Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The huber needle market was valued at USD 76.53 Million in 2025 and is expected to grow at a CAGR of 6.15%, reaching USD 139.01 Million by 2035. The market growth is driven by rising chemotherapy and parenteral nutrition therapies, advancements in needle design, and increasing cancer patient population.

Base Year

Historical Period

Forecast Period

The increasing prevalence of chronic diseases such as cancer, diabetes, and kidney disorders, along with the growing aging population are driving the demand for Huber needles.

One of the major market trends is the rising advancements in the design and manufacturing of Huber needles. This reduces the risk of coring and other complications, boosting market growth.

The rise in the number of surgical procedures and the increasing adoption of safety-engineered needles are likely to impact the market value.

Compound Annual Growth Rate

6.15%

Value in USD Million

2026-2035

*this image is indicative*

A Huber needle is a hollow needle specifically designed for chemotherapies and transfusions. It contains a septum (silicon membrane) through which drugs can be injected. Straight Huber needles are preferred for short-term procedures, whereas curved Huber needles are more convenient for repetitive vascular access procedures. These needles are also used in treatments of various chronic diseases and for nutritional fluid delivery. The market is driven by the increasing prevalence of chronic diseases such as cancer, diabetes, and kidney disorders, which propels the demand for Huber needles.

The rising advancements in the design and manufacturing of Huber needles further contribute to the market expansion by improving their safety and efficacy. The increasing healthcare expenditure, the growing trend of home healthcare services, and the rising need for long-term intravenous therapies in the oncology sector are some of the factors influencing the market landscape.

Rising Burden of Chronic Diseases Drives Market Growth

The market is being driven by a significant rise in the cases of chronic diseases as chemotherapy, blood sampling, and transfusion require a Huber needle. Hence, the increasing occurrences of such diseases are adding to the demand for Huber needles. The growing adoption of these needles in the treatment of hepatitis and HIV is expected to bolster the market value in the coming years. Increasing investments in healthcare infrastructure are also predicted to influence the market positively in the forecast period. The market is likely to be impacted by government regulations on needle stick injuries to ensure patient safety. Furthermore, the usage of a curved huber needle for nutritional fluid delivery is expected to propel the market growth over the forecast period.

The market is witnessing several trends and developments to improve the current global scenario. Some of the notable trends are as follows:

"Huber Needle Market Report and Forecast 2026-2035" offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type

Market Breakup by Application

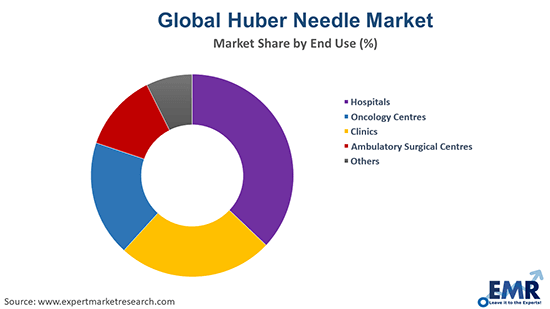

Market Breakup by End User

Market Breakup by Region

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The Product Type Segment Holds a Significant Market Share

Based on the product type, the market is segmented into straight Huber needles and curved Huber needles, among others. Out of these, straight Huber needles cover a major market share and are widely used for various medical procedures, including chemotherapy, intravenous therapy, and blood product administration. The design of these needles ensures easy access to implanted ports. The increasing prevalence of cancer and the growing demand for chemotherapy are significantly boosting the demand for straight Huber needles. On the other hand, curved Huber needles allow a comfortable approach to access difficult-to-reach implanted ports.

Regionally, the market report is divided into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. North America has been a major market for Huber needles in the past years and is expected to retain its position in the forecast period as well. The growth of the North American market can be attributed to the rising burden of chronic diseases and the presence of an advanced healthcare system. Huber needles are widely used in chemotherapy, transfusion, and blood sampling due to their easy accessibility. It is finding increasing usage in intravascular cancer treatments, thus, further aiding the huber needle market growth in North America.

Apart from North America, Europe and Asia Pacific regions are witnessing significant growth owing to the technological advancements in needle design and the adoption of safety-engineered needles. Within the Asia Pacific, countries like India, Japan, Australia and China are expected to experience rapid market growth due to the increasing investment in healthcare infrastructure and the rising health awareness among the public.

The key features of the market report comprise patent analysis, funding and investment analysis and strategic initiatives by the leading key players including mergers, collaborations and new product launches. The major companies in the market are as follows:

Nipro Europe Group Companies, a leading global healthcare company, is a part of Nipro Corporation Japan. It manufactures a wide range of medical supplies, including Huber needles. Nipro is ranked as one of the world's largest needle manufacturers, boasting a production of more than 11 billion units annually.

VYGON is one of the leading players in the market, known for manufacturing and marketing technologically advanced single-use medical devices. The company's Huber needles are integrated with innovative features to ensure safety and efficacy in vascular access procedures.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include Kindly (KDL) Group, BD, VIOMED, Shanghai Mekon, and Tegra Medical.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Application |

|

| Breakup by End User |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Supplier Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 3,299

USD 2,969

tax inclusive*

Single User License

One User

USD 5,499

USD 4,949

tax inclusive*

Five User License

Five User

USD 6,999

USD 5,949

tax inclusive*

Corporate License

Unlimited Users

USD 8,199

USD 6,969

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share