Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The India animal health market attained a value of USD 1144.68 Million in 2025. The market is estimated to grow at a CAGR of 13.24% during 2026-2035 to reach a value of USD 3969.01 Million by 2035.

Base Year

Historical Period

Forecast Period

As per the Department of Animal Husbandry and Dairying, the total number of animals vaccinated for FMD during April 2023 to January 2024 was 238 million, which covered 80.4% of the total targeted population.

The age group of 25-34 years are found to be adopting the pets most. Millennials and Gen Z are driving the new wave of pet parenting.

India is the 3rd largest producer in egg production. In 2021-22, the country produced a total of 129,600 million eggs.

Compound Annual Growth Rate

13.24%

Value in USD Million

2026-2035

*this image is indicative*

As per industry reports, population of pets in India reached more than 38 million, from 22.1 million in 2022. Dogs were estimated to account for 90% of the total pet population, followed by cat.

Ruminant is crucial to India’s economy, supporting the livelihoods of around 20.5 million people and contributing 16% to the income of small farm households. It sustains two-thirds of the rural population. The country also boasts extensive ruminant resources.

Ruminant care is closely linked to animal health, which is vital due to the rising occurrences of zoonotic diseases and the increasing demand for animal-derived products like eggs, dairy, and meat.

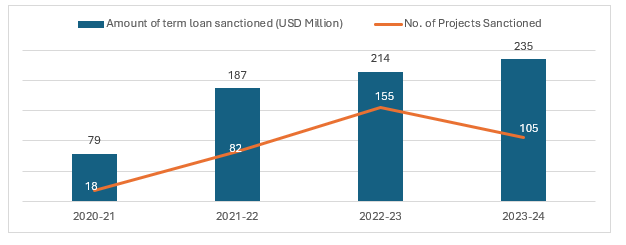

Under the AtmaNirbhar Bharat Abhiyan stimulus package, the Animal Husbandry Infrastructure Development Fund (AHIDF) was established with a corpus of USD 1,800 million.

AHIDF aims to incentivize investments by entrepreneurs, private companies, MSMEs, Farmers Producers Organizations (FPOs), and Section 8 companies in the following areas: dairy processing and value addition infrastructure, meat processing and value addition infrastructure, animal feed plants, and breed improvement technology and farms for cattle, buffalo, sheep, goat, pig, and technologically assisted poultry farms.

Figure: Projects Sanctioned under AHIDF

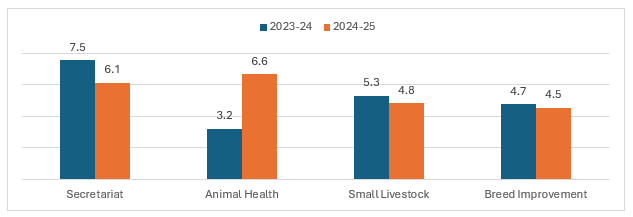

Budget Allocation for Animal Husbandry and Dairying

Figure: Establishment Expenditure of the Centre (USD Million)

Rising ownership of pets in India; increasing preventive care of animals; presence of favourable government initiatives; and rising digitalisation are the key trends impacting the India animal health market growth

India’s pet industry is rapidly emerging as a significant market in the global space, experiencing a rapid surge in pet ownership. This growth in pet adoption is driven by changing lifestyles, rbanization, rising disposable incomes, and the need for emotional support among nuclear families. The industry has seen a rise in organized pet retail and greater awareness of pet care and nutrition, driving the demand for a variety of pet-related products and services, including pet food, accessories, healthcare, and insurance.

Preventive care is on the rise, with more focus on regular vet check-ups, vaccinations, and dental care. Consequently, the market for pet healthcare products like multivitamins, supplements, and dental care items is expanding.

Pet owners in India are becoming increasingly digitally savvy and well-educated, leading to the emergence of start-ups bringing their own innovations, with some utilizing Internet of Things (IoT) technology. The internet has significantly reduced barriers to brand building, democratizing sales channels. This new landscape has led to the emergence of digitally native vertical brands that are established online, leading to the India animal health market development.

Improvement in genetics, animal health and feeding practices provides ample opportunities for the market to gain potential. As per government data, the expenditure of animal husbandry and dairying reached USD 39.73 million in October 2023. The need for effective vaccination programs highlights the importance of maintaining robust animal health standards in India, leading to increased government investments in animal healthcare.

Surge in pet adoption due to growing urbanisation, changing lifestyle, and rising popularity of the nuclear family trend coupled with their awareness regarding healthy animal practices is expected to drive the market. Dogs are the most popular pets in India with their population increasing to approximately 20 million in 2022.

Young pet owners are increasingly focused on the quality and quantity of their pets' food, spending more on premium options that meet specific nutritional needs. In response, pet nutrition companies are introducing innovative products tailored to the diverse dietary requirements of various pets.

Spaying and neutering pets have seen increased numbers as it can increase their lifespan, reduce serious health issues, and make them more manageable. These procedures also help combat canine overpopulation and homelessness. They are considered essential aspects of responsible pet ownership.

“India Animal Health Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Species

Market Breakup by Product Type

Market Breakup by Distribution Channel

Market Breakup by Region

Based on animal type, ruminants are a major contributor to the India animal health market revenue

Increase in intake of milk products in routine diet due to the rising awareness of health benefits has increased its consumption in the country. During 2022-2023, milk production in India reached 230.58 million tons, introducing new products in the market. In fact, the total number of drugs/vaccines approved for cattle constituted 10% of the total approvals in India between January and September 2022. As per the DOAHD, in 2023, a total of 8.99 crore cattle have been vaccinated by Goat Pox vaccine.

As per the latest census of DOAHAD (Ministry of fisheries, animal husbandry and dairying), poultry population witnessed an increase of 16.81%, reaching 851.81 million in 2019, from 729.21 million in 2012. Further, the growing demand for protein is expected to promote the poultry sector development, with increasing emphasis being put on poultry health.

Based on product type, parasiticides contribute significantly to the India animal health market revenue

Endoparasiticides drugs are intended to be used in animals for the treatment of infestation with gastrointestinal nematodes, lungworms, and tapeworms. Whereas Ectoparasites cause itching, irritation, dermatitis, baldness, scaling, and subsequent pyoderma. Severe ectoparasitic infections may cause anaemia, hypoproteinemia, decreased weight increase, and poor output results.

The ruminant segment, particularly cattle, represents the largest market for nutraceuticals. Leading the way in this space is Virbac, a key company known for its innovative solutions. The market dynamics have been significantly influenced by regulatory changes, particularly the ban on antibiotic growth promoters. This, coupled with growing concerns over antimicrobial resistance, has driven breeders to seek drug-free, high-quality food solutions. Studies show significant benefits of nutraceuticals for ruminant health, particularly in improving gut health and overall productivity.

The market players are focusing on providing high quality products at competitive prices, with improved customer services.

It is a subsidiary of Virbac Group from France, intending to provide veterinary pharmaceuticals in India. The company offers unique industry insights nationwide by offering high-quality, effective medicines, and feed supplements for ruminant, poultry, and other segments.

Founded in 2021, Zenex Animal Health India Private Limited is one of the home-grown animal healthcare firms in India. With almost 200 brands, Zenex is well-known for catering to therapeutic areas.

Elanco Animal Health Inc., a corporation with a global presence in animal health founded in 1954, has an Indian subsidiary - Elanco India Private Limited. The company supplies a comprehensive range of over 200 animal healthcare products to farmers, veterinarians, and pet owners worldwide. Their portfolio includes products such as Posilac, Keto-Test, Larvadex, Conban, Interprity, and Maxiban.

MSD Animal Health which is a subsidiary of Merck & Co., Inc. has established Intervet India Pvt. Ltd. (MAH-India) as its animal health division in India. It provides technologies, services, and health products for the prevention, diagnosis, and treatment of illnesses in companion and farm animal species.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other notable players operating in the India animal health market are Zoetis India Limited, Cargill India Pvt. Ltd., Boehringer Ingelheim India Pvt. Ltd., Ceva Polchem Private Limited, SeQuent Scientific Ltd., and Hester Biosciences Limited among others.

During 2022-2023, Tamil Nadu, West Bengal, Telangana, Jammu and Kashmir and Jharkhand stood as the top producers of milk in the country, with production of 10,317 thousand tonnes, 6,969 thousand tonnes, 5,855 thousand tonnes, 2,817 thousand tonnes, and 2,774 thousand tonnes respectively.

The total five major meat producing States in the country are Maharashtra (12.25%), Uttar Pradesh (12.14%), West Bengal (11.63%), Andhra Pradesh (11.04%), and Telangana (10.82%) in 2021-2022. Additionally, the major wool producing states include Rajasthan (45.91%), Jammu and Kashmir (23.19%), Gujarat (6.12%), Maharashtra (4.78%) and Himachal Pradesh (4.33%).

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market attained a value of USD 1144.68 Million in 2025.

The market is estimated to grow at a CAGR of 13.24% during 2026-2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a value of USD 3969.01 Million by 2035.

The factors driving the market growth are increasing pet adoption, rising importance of preventive care, presence of favourable government initiatives, increasing awareness of animal diseases, and stringent regulations.

The animal types are ruminant, poultry, companion, and others.

Ceftriaxone, Enrofloxacin, Oxytetracycline, and Penicilline are the leading antibiotics prescribed by veterinarians in the country to treat cattle.

Nutrition, parasiticides, antibiotics, biologicals, and medicated feed additives are the various product types in the market.

The key players in the market include Virbac Animal Health India Pvt Ltd, Zenex Animal Health Pvt Ltd, Elanco India Private Limited, MSD Animal Health India(Merck & Co.), Zoetis India Limited, Ceva Polchem Private Limited, Cargill India Private Limited, Boehringer Ingelheim India Pvt. Ltd., SeQuent Scientific Ltd., and Hester Biosciences Limited, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Species |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,999

USD 2,699

tax inclusive*

Single User License

One User

USD 4,839

USD 4,355

tax inclusive*

Five User License

Five User

USD 5,999

USD 5,099

tax inclusive*

Corporate License

Unlimited Users

USD 7,259

USD 6,170

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share