Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The India gift cards market attained a value of USD 13.98 Billion in 2025. The market is expected to grow at a CAGR of 18.20% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 74.42 Billion.

A niche driver of the India gift-cards market is the integration of AI-driven personalization combined with regional-language and culturally themed designs. For example, in 2024 the LazyPay app launched a gift-card platform offering vouchers from 150+ popular brands, across categories like shopping, travel, food and electronics. The platform includes customised messaging and themes catering to regional festivities and users beyond urban centres. By enabling culturally relevant digital gifts in vernacular contexts, this innovation increases appeal among Tier-2 and Tier-3 city consumers and drives higher adoption in the digital gifting segment.

The expanding reach of affordable smartphones and internet connectivity, especially in tier 2 and tier 3 cities, is boosting the gift card demand in India. According to DataReportal, there were 751.5 million internet users across India in January 2024. More users can access digital gift card platforms, participate in online shopping, and engage with mobile wallets. This democratization of technology enables real-time gifting, personalized offers, and enhanced user engagement. This technology-driven trend is crucial in converting traditional gifting habits into modern, digital gift card usage, accelerating market growth countrywide.

Advancements in payment technologies such as QR codes, NFC, and blockchain enhance security and usability in the India gift card industry. Platforms offer real-time balance updates, multi-channel access, and digital wallets linked with gift cards. In May 2024, Google Wallet launched in India with first-of-its-kind gift card integration, powered by Pine Labs, enabling seamless storage and redemption. Fintech partnerships enable seamless issuance and management of corporate and consumer cards. These technological innovations improve user convenience, transparency, and control, fostering confidence and broader acceptance of gift cards across India’s diverse retail and service sectors.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

18.2%

Value in USD Billion

2026-2035

*this image is indicative*

The rapid growth of e-commerce platforms is driving the gift cards market in India. Consumers prefer digital gifting options for convenience and instant delivery. As per IBEF, India’s e-commerce industry is projected to grow to Rs. 29,88,735 crore by FY30. The ability to use gift cards seamlessly across online stores enhances shopping flexibility, encouraging higher adoption. E-commerce marketplaces often promote gift cards during festive seasons and sales events, further boosting market growth. This trend is amplified by growing internet penetration and smartphone usage, enabling a broad demographic to access gift cards digitally.

India’s robust digital payment ecosystem, propelled by UPI, mobile wallets, and prepaid cards, supports the widespread adoption of gift cards. Improved payment gateways and secure transactions make digital gift cards accessible and trustworthy. In March 2025, Tata Neu and HDFC Bank's co-branded credit card crossed 2 million issuances, highlighting strong adoption in loyalty platforms. The interoperability between various payment platforms facilitates smooth redemption across multiple merchants, driving the market’s growth trajectory significantly.

The India gift cards industry value is increasing with integration with loyalty programs, allowing customers to earn and redeem points via gift card purchases. Companies bundle gift cards with reward points, cashback offers, and exclusive deals to increase attractiveness. In February 2025, PayU integrated AdvantageClub.ai’s rewards into its checkout, letting users redeem loyalty points directly for digital purchases. This driver enhances cross-selling opportunities, strengthens brand-consumer relationships, and boosts gift card usage as a preferred reward mechanism in India’s competitive retail and corporate sectors.

Festivals, such as Diwali, Christmas, and regional celebrations spur gift card sales in India. Retailers and e-commerce platforms launch special offers, discount coupons, and exclusive bundles during these periods. Gift cards become a preferred gifting option for their convenience and variety. For instance, Christmas gifting in India reached around ₹25,500 crore in 2024, with gift cards and vouchers accounting for ~₹6,120 crore. Seasonal marketing campaigns and corporate incentives also align with festive trends, increasing volume and value of gift card transactions.

Growing disposable incomes and digital literacy in smaller cities is driving the gift card demand in India beyond metros. According to Goldman Sachs, nearly 100 million people in India are expected to earn more than USD 10000 in annual income by 2027. Consumers in tier 2 and tier 3 cities seek convenient gifting and shopping solutions compatible with digital wallets and apps. Brands target these emerging markets with localized offers and accessible denominations. Mobile penetration and affordable internet facilitate adoption. This geographic expansion further diversifies the customer base and boosts overall market volume.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

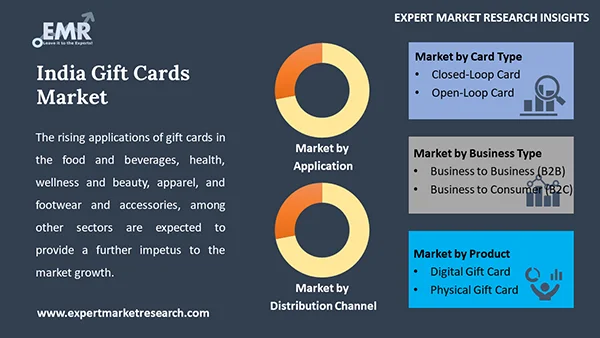

The EMR’s report titled “India Gift Cards Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Card Type

Key Insight: Closed-loop gift cards are restricted for use at a specific retailer or a defined group of stores, making them highly popular in India’s retail and e-commerce sectors. These cards offer controlled spending, allowing customers to redeem value only within a particular brand ecosystem. In September 2023, ONDC introduced the ONDC Network Gift Card ahead of the 2023 festive season, enabling corporate and consumer gifting across all ONDC-enabled apps. They are also simpler to manage for merchants and often come with fewer regulatory hurdles. Closed-loop cards further dominate the India gift card market due to their targeted appeal and ease of use, especially among large retailers and niche service providers.

Market Breakup by Product

Key Insight: Digital gift cards dominate the India gift card market due to their convenience, instant delivery, and seamless integration with e-commerce platforms. These cards are delivered via email, SMS, or apps, making them ideal for last-minute gifting and corporate rewards. The growing smartphone penetration and digital payment adoption further boost this segment. As per PIB, UPI leads India's digital payment revolution with 16.73 billion transactions in December 2024. Digital cards also include features, such as multi-use balances, easy redemption, and mobile wallet compatibility, making them the preferred choice for retailers and consumers in India.

Market Breakup by Business Type

Key Insight: The business to consumer (B2C) segment is largely driving the India gift card industry value, driven by growing online shopping, digital payments, and consumer preference for convenient gifting solutions. E-commerce giants offer digital gift cards widely used for birthdays, festivals, and personal occasions. In December 2024, Valuedesign partnered with Flipkart to expand Flipkart Gift Cards availability via Adivaha Shop, increasing accessibility for gift-givers across India’s e-commerce market. Retailers and restaurants also promote gift cards as a versatile gifting option. Consumers enjoy flexibility, instant redemption, and multi-brand options, making B2C the largest segment by volume and value in India’s gift card ecosystem.

Market Breakup by Application

Key Insight: The food and beverages segment is fostering the India gift card market development, driven by rising demand for convenient gifting and dining experiences. Food delivery platforms offer gift cards that are popular for personal and corporate gifting. In May 2025, Swiggy teamed up with TWID to enable users across India to pay using reward points seamlessly. These cards cater to growing urban populations who prefer quick access to meals and treats. Cafes, bakeries, and grocery chains also issue gift cards, enhancing customer loyalty. The convenience of digital redemption and festive promotions make this segment a significant contributor to overall gift card sales.

Market Breakup by Distribution Channel

Key Insight: The retail segment is adding to the India gift cards market value, driven by extensive consumer demand in e-commerce platforms, supermarkets, and specialty stores. Retailers issue gift cards widely used for personal gifting during festivals, birthdays, and special occasions to provide consumers flexibility to choose products and services, enhancing shopping convenience. In December 2024, Amazon Pay recorded a 40% increase in gift card purchases in 2024 during the Amazon Great Indian Festival. Retailers also bundle gift cards with discounts or loyalty rewards, further driving adoption and making retail the largest contributor to the gift card market in India.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Open-Loop Gift Cards to Gain Popularity in India

Open-loop gift cards, such as Visa or Mastercard prepaid cards, are attaining traction in the India gift cards industry as they can be used across multiple merchants and platforms for offering flexibility and wider acceptance. In March 2024, Patanjali Ayurved partnered with digital payments firm Ongo to launch a co-branded open-loop prepaid card that also supports transit services, such as metro, buses, tolls, and parking nationwide. Open-loop cards cater to customers seeking versatility but involve complex regulatory compliance and higher transaction fees. The segment growth is also credited to India’s expanding digital payments infrastructure.

Prevailing Interest in Physical Gift Cards in India

Physical gift cards represent a significant share of the India gift card market. These plastic or paper cards are commonly used in retail stores, restaurants, and malls where customers prefer tangible gifts. Examples include Big Bazaar’s physical gift cards and prepaid cards issued by banks. In December 2022, Fortum India launched a RuPay prepaid card with Pine Labs, enabling flexible payments at Fortum EV charging stations nationwide. Physical cards remain popular in tier 2 and tier 3 cities where digital infrastructure is less pervasive. Their appeal lies in gifting traditions and ease of use without the need for internet connectivity.

Business to Business Gift Cards to Accrue Huge Preference in India

The business to business (B2B) gift card segment is rapidly growing in the India gift card market as companies increasingly use gift cards for employee rewards, incentives, and client gifting. In April 2025, Indian fintech firm NKPAYS Private Limited launched exchange.nkpays.in, an AI-driven B2B platform for mobile recharges and digital gift card distribution. Corporates prefer gift cards for bulk issuance, tax benefits, and simplifying expense management. Platforms specializing in B2B solutions offer customized cards across sectors. This segment is also critical for corporate engagement, loyalty programs, and festive gifting drives.

Rising Gift Card Application in Health, Wellness, and Beauty & Apparel, Footwear, and Accessories in India

The health, wellness, and beauty segment is rapidly growing in the India gift cards industry, fuelled by increasing consumer focus on self-care. Brands offer gift cards redeemable for cosmetics, skincare, spa, and wellness services. The surge in awareness around health and beauty routines has expanded demand for gift cards as personal or corporate gifts. The availability of both physical and digital cards enhances accessibility. This segment benefits from premium gifting occasions and rising disposable incomes, positioning it as an important and fast-growing category in India’s gift card ecosystem.

Gift cards for apparel, footwear, and accessories are highly popular, as consumers value the flexibility to choose fashion products. Leading retail brands provide both digital and physical gift cards. The fashion segment’s strong seasonal trends and new collection launches stimulate gift card sales. In September 2024, Tata Neu launched its “Gift Card Store” for offering customers a diverse selection of over 100 brands across more than 15 categories, including fashion. Growing online shopping and omni-channel retail models also support this category. Apparel and footwear remain one of the top segments due to their universal appeal and gifting versatility.

Corporate Gift Cards to Attain High Demand in India

The corporate segment is a significant part of the India gift cards market. Corporations utilize gift cards for employee rewards, client appreciation, and incentive programs. Companies prefer gift cards for ease of bulk distribution, tax efficiency, and simplifying payroll-related gifting. In December 2023, foodpanda partnered with Pine Labs’ Qwikcilver to introduce gift cards for its corporate users via the foodpanda for Business portal. the corporate segment is growing steadily, fueled by expanding workplaces and increasing focus on digital rewards and recognition, making it a key growth driver after retail.

Key players in the India gift cards market are leveraging digital innovation, strategic partnerships, and consumer-centric approaches to drive growth. A primary strategy is digitization, with a strong shift from physical to e-gift cards, supported by QR codes, NFC, and mobile wallet integrations. This aligns with India’s booming digital payments ecosystem. E-commerce and fintech partnerships are enabling seamless gift card purchases and redemptions across various platforms. Brands are also collaborating with corporates to offer employee rewards, customer loyalty programs, and festive gifting solutions, expanding B2B adoption.

Players use data analytics to offer customized gifting experiences, targeting tech-savvy Millennials and Gen Z. This includes theme-based cards, brand-specific options, and occasion-driven campaigns. To enhance distribution, companies are investing in omnichannel strategies, combining offline retail networks with digital channels. They are also focusing on security and compliance, ensuring RBI regulations on prepaid instruments are met, which builds trust. Finally, market players are innovating with subscription-based gifting models, gamification, and seasonal promotions to boost engagement and repeat usage, ensuring sustained market penetration and revenue growth.

Headquartered in India, Plasto Cards Private Limited offers a wide range of loyalty and eco-friendly PVC card solutions, such as magnetic stripe, smart-chip, recycled–material variants. Known for blending durability with customization and sustainability, the company emphasizes integrated branding and secure chip-based loyalty programs.

Founded in 2004 in Mumbai, Creative Cards & Solutions is a small proprietary firm specializing in magnetic-stripe, RFID, and access-control PVC cards. The firm operates a 400 sq ft facility producing up to 100K cards monthly with its strengths in R&D-led customization, software integration, and exporting corporate ID and loyalty solutions.

Established 1998 and based in New Delhi, Creation Technics India Private Limited is a full-service PVC card innovator of magnetic, barcode, RFID, smart chip, hotel-key, loyalty/gift cards. Noted for state-of-the-art thermal/digital printing R&D, international-standard capacity, and bespoke card tech solutions across sectors.

Headquartered in Noida, India, Arahan Infotech specializes in biometrics, access control, Aadhaar-enabled payments, Android POS terminals and B2C e commerce services. The firm is also renowned for integrating multifunctional self service kiosks and securing identity based transaction systems.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the India gift cards market are Plastic Loyalty Cards, among others.

Unlock key insights into the evolving India gift cards market trends 2026. Download a free sample report today and stay ahead with expert forecasts, growth opportunities, and competitive analysis. Empower your business with data-backed strategies from one of the most trusted research providers in India’s digital payments landscape.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 18.20% between 2026 and 2035.

Key strategies driving the market include digital transformation, with e-gift cards and contactless solutions gaining popularity. E-commerce integration and mobile-first strategies enhance accessibility. Corporates increasingly use gift cards for incentives and rewards. Personalization appeals to younger demographics, while strategic partnerships and a regulatory push for transparency ensure sustained market growth.

The key industry trends include the rising demand for convenient gifting options in the corporate sector and rising applications of gift cards in the food and beverages, health, wellness and beauty, apparel, and footwear and accessories.

Closed-loop card and open-loop card are the major card types of the product.

Digital gift card and physical gift card are the different products in the market.

Business to business (B2B) and business to consumer (B2C) are the business types in the market.

Food and beverages, health, wellness and beauty, apparel, footwear and accessories, books and media products, consumer electronics, restaurant and bars, and kids’ products, among others are the significant applications of the product.

Retail and corporate, among others are the distribution channels of the product.

The key players in the market report include Plasto Cards Private Limited, Creative Cards & Solutions, Creation Technics India Private Limited, Plastic Loyalty Cards, and Arahan Infotech, among others.

In 2025, the market reached an approximate value of USD 13.98 Billion.

Digital gift cards dominate the market due to their convenience, instant delivery, and seamless integration with e-commerce platforms.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Card Type |

|

| Breakup by Product |

|

| Breakup by Business Type |

|

| Breakup by Application |

|

| Breakup by Distribution Channel |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share