Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The India onion powder market was at about 15717.89 Tons in the year 2025. The Indian onion powder market is further expected to grow at a CAGR of 6.00% between 2026 and 2035 to reach a volume of almost 28148.35 Tons by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

6%

Value in Tons

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

| India Onion Powder Market Report Summary | Description | Value |

| Base Year | Tons | 2025 |

| Historical Period | Tons | 2019-2025 |

| Forecast Period | Tons | 2026-2035 |

| Market Size 2025 | Tons | 15717.89 |

| Market Size 2035 | Tons | 28148.35 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 6.00% |

| CAGR 2026-2035 - Market by Region | Gujarat | 7.8% |

| CAGR 2026-2035 - Market by Application | Food Processing | 6.7% |

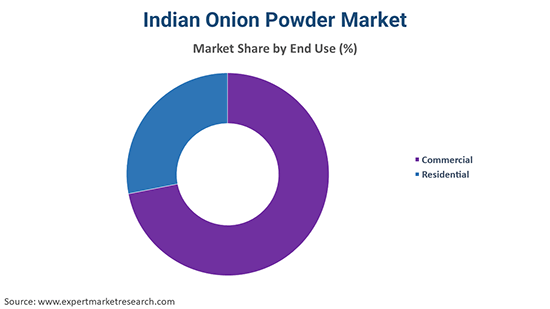

| CAGR 2026-2035 - Market by End Use | Commercial | 6.8% |

The onion powder industry in India is contributing to the growth of the India onion powder market. The industry is led by Gujarat, which holds the largest market share in India. The state has the largest number of onion powder production plants in India. The product is extensively used in India for its numerous culinary purposes due to its several benefits, such as easy transportation, long-shelf life, insignificant calorie count, and wide availability.

The Indian onion powder market is driven by its extensive use in the production of ready-to-cook food products like noodles, oats, pasta, instant mixes, and frozen food items. These products are further being driven by the rapid urbanisation, increasing working population, and hectic work schedules. Moreover, onion powder is used in dry rubs, seasonings, marinades, and condiments for preparing seafood, appetisers, and meat. There is an increasing preference for the use of this product, as it helps save time, and the consumers are spared from the difficult task of chopping onions for cooking requirements, further aiding the industry growth.

As per the India onion powder market dynamics and trends, manufacturers within the food industry are undergoing changes to meet the standards of processed goods in India, further propelling the industry growth. The Ministry of Food Processing Industries (MoFPI) is encouraging the growth of this sector by increasing investments, thereby providing further impetus for the market growth of onion powder in India.

A key trend of India onion powder market is the growing consumer preference for organic and non-GMO onion powder, which appeals to health-conscious buyers. This shift is prompting producers to adapt production processes to meet the demand for cleaner labels. Government initiatives supporting food processing and agricultural exports, along with subsidies for technological upgrades, are also playing a role in boosting this market's growth.

India’s onion powder industry is influenced by ongoing export policies, which are critical in stabilising prices and supply amid fluctuating production volumes, affecting India onion powder demand forecast. Due to erratic weather affecting onion harvests, prices of raw onions surged, impacting the production and pricing of onion powder. Manufacturers are increasingly investing in storage solutions to handle supply fluctuations more effectively.

Prominent Onion Producing States in India and A Growing Food Processing Sector

As per the India onion powder industry analysis, Maharashtra leads India's onion production with 13,301.7 thousand tonnes in 2021-2022, making it the top producer by a significant margin. Madhya Pradesh follows as the second-largest producer with 4,740.6 thousand tonnes, reflecting its strong agricultural capacity. Karnataka ranks third with 2,779.5 thousand tonnes, contributing significantly to the overall production. Gujarat produced 2,554.7 thousand tonnes, while Rajasthan and Bihar produced 1,447.9 and 1,375 thousand tonnes respectively. West Bengal followed Bihar with 861.35 tonnes of onions produced during 2021-2022. Further, Andhra Pradesh, Tamil Nadu, and Haryana produced 722.9, 555.7, and 514 thousand tonnes of onions, respectively, boosting the India onion powder industry revenue.

According to the India Brand Equity Foundation (IBEF), India's food processing sector is projected to grow from USD 866 billion in 2022 to USD 1,274 billion by 2027. This significant growth is driven by urbanisation, changing consumption patterns, and increasing consumer awareness. The sector's expansion aligns with rising disposable incomes and evolving lifestyles, which favor ready-to-eat (RTE) and ready-to-cook (RTC) foods. The food and grocery market, contributing 32% to the overall food market, underscores the robust demand for processed food products. As the food processing sector expands, the demand for value-added products like onion powder increases, fuelling the growth of the India onion powder industry. The growth in food processing provides opportunities for farmers and producers in top onion-producing states such as Maharashtra, Madhya Pradesh, and Karnataka to process surplus onions into powder, reducing wastage and stabilizing prices. With increasing urbanization and demand for convenience foods, the demand for onion powder is likely to grow.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Onion powder is the processed form of dehydrated onions, which tastes less pungent comparatively. The product is extensively used in the preparation of several food products, such as snacks, salads, soups, and gravies, to enrich their flavour. Onion powder contains several nutrients, including iron, protein, calcium, carbohydrate, folate, cholesterol, potassium, manganese, magnesium, phosphorus, and vitamin B-6 and C. Other benefits associated with onion powder are longer shelf-life, insignificant calorie count, and easy storage and transportation.

Breakup by Packaging

Breakup by Application

Breakup by End Use

Breakup by Region

| CAGR 2026-2035 - Market by | Region |

| Gujarat | 7.8% |

| Maharashtra | 6.5% |

| Madhya Pradesh | XX% |

| Rajasthan | XX% |

| Others | XX% |

The commercial sector is expected to grow at a CAGR of 6.8% between 2026 and 2035 owing to the rising demand for packaged food products. Onion powder is widely used in processed foods like sauces, snacks, and seasonings, fuelling the India onion powder market revenue. The Indian food processing sector, backed by government initiatives and incentives, is scaling up, thus increasing demand for dehydrated products like onion powder. In the commercial sector, bulk packaging has become dominant, allowing manufacturers to cater to large-scale buyers efficiently. Bulk packaging options reduce per-unit costs, making it cost-effective for high-volume usage.

The report gives a detailed analysis of the following key players in the Indian onion powder market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

Gujarat and Maharashtra hold significant onion powder market share in India and are expected to grow at CAGRs of 7.8% and 6.5% in the forecast period. Gujarat, particularly the regions of Bhavnagar and Mahuva, has extensive onion cultivation and processing facilities. The state is known for producing a variety of onions suitable for dehydration, making it a key player in the powdered and dehydrated onion market. Maharashtra is one of India’s largest onion-producing states, with districts like Nashik being well-known for onion farming. This production base provides a steady supply of raw onions, essential for producing onion powder.

Raw Onion Prices:

Fluctuations in the prices of raw onions, influenced by supply conditions and weather conditions, directly impact the cost of onion powder production.

Processing Costs:

Costs associated with dehydration, packaging, and storage of onion powder affect the final product price as well as reduce India onion powder market opportunities.

Energy Costs:

Energy prices for operating dehydration and processing equipment influence production costs and pricing strategies.

Labour Costs:

Labour costs for harvesting, processing, and packaging impact the overall production expenses and pricing.

Transportation and Logistics:

Costs related to transportation and logistics, including fuel prices and infrastructure efficiency, affect the final pricing of onion powder in the onion powder industry.

Market Demand:

High market demand, both domestically and internationally, can drive up prices, especially during periods of supply shortages.

Growth of Processed Food Industry:

Expansion of the processed food industry, which uses onion powder as a key ingredient, drives demand.

Changing Dietary Patterns:

Shift towards convenience foods and ready-to-eat meals boosts the use of onion powder in various culinary applications, enhancing India onion powder market expansion.

Health Consciousness:

Rising health awareness leads consumers to prefer natural and additive-free ingredients like onion powder.

Foodservice Industry Expansion:

Growth in the foodservice industry, including restaurants and fast-food chains, increases the use of onion powder in meal preparation.

Export Demand:

Increasing international demand for Indian onion powder due to its quality and competitive pricing enhances overall market demand.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the Indian onion powder market reached a volume of 15717.89 Tons.

In the forecast period of 2026-2035, the market is projected to grow at a CAGR of 6.00%.

By 2035, the market is estimated to attain a volume of nearly 28148.35 Tons by 2035.

The major drivers of the market are rising disposable incomes, increasing population, and increasing adoption of onion powder due to its longer shelf life and ease of use.

Investments into the market by government entities like the Ministry of Food Processing Industries (MoFPI), increasing implementation of standards of processed goods in India, and rising consumption of processed foods are the key trends of the market.

Gujarat, Maharashtra, Madhya Pradesh, and Rajasthan, among others, are the major states in the market in India.

The various packaging in the onion powder market in India are bulk packaging and pouches.

The leading end uses in the onion powder market in India are commercial and residential.

The primary applications of onion powder in the market are food processing and healthcare.

The major players in the Indian onion powder market are Natural Dehydrated Vegetables Private Limited, Vakil Foods, Balkrishna Agro, Vinayak Ingredients (Indian) Pvt. Ltd., and Saipro Biotech Private Limited, among others.

India exports onion powder to a wide range of countries across the globe, with notable importers including the United States, Brazil, South Africa, Germany, and Russia.

One of the largest onion exporters in India is Sarah Exim, known for its extensive infrastructure that includes India's first fully automated packhouse for onions and potatoes.

Tajikistan leads the world in per capita onion consumption, with an impressive average of about 56-60 kg (110 pounds) per person annually. This high consumption is followed closely by Libya, with around 31 kg.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Packaging |

|

| Breakup by Application |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share