Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Indian solar electric system and inverter markets are expected to reach volume of almost 43.20 Gigawatt by the year 2035, growing at a CAGR of 13.10% between 2026 and 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

13.1%

2026-2035

*this image is indicative*

The Indian solar electric system and inverter market is driven by the rising awareness regarding renewable power resources. The market is further aided by the maintenance cost related to solar electric systems, which is comparatively low, helping it gain traction, especially in an emerging economy such as India. Telangana is the leading regional market in India.

A solar panel is referred to as a collection of cells which is utilised to produce electricity using sunlight as the energy source, whereas a solar inverter is referred to as a device which helps in the conversion of the direct current produced by the panels into alternating current. This current is then distributed to either power grids, storage batteries, or houses for operating various appliances.

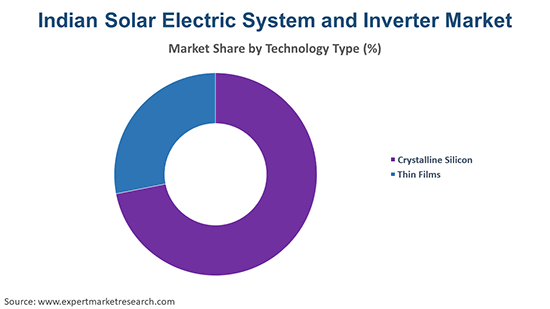

The Indian solar electric system market is bifurcated on the basis of technology type into:

Out of these, crystalline silicon represents the most preferred segment.

On the basis of installation type, the Indian solar electric system market is segmented into:

Amongst these, the ground mounted segment hold the largest market share.

The Indian solar inverter market is segmented on the basis of inverter type into:

On the basis of the inverter type, central inverters represent the leading type in the industry.

The Indian solar inverter market is segmented on the basis of region into:

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The Indian solar electric system and inverter market is driven by the constant shortage in the electricity supply across the country. The market is further aided by the rising population, in conjunction with rising adoption rates of electronic appliances and heating, ventilating, and air conditioning (HVAC) systems, and electronic appliances, which has resulted in the escalating use and consequent deficit in the supply of electricity. In addition to this, the market is witnessing a reduction of the prices of equipment used in the production process of such electric systems, thereby reducing their average selling price and boosting the Indian solar electric system and inverter market growth.

The market is aided by the rising awareness of the risks associated with the use of conventional energy sources, leading to a significant shift in the preference of consumers toward cleaner power sources. Moreover, several government initiatives are encouraging the use of these systems and, consequently, impacting their sales positively. For example, the Government of India offers incentives and subsidies for the installation of rooftop systems. The government has taken many initiatives under its wings, which aim to achieve a national solar rooftop target of 40 GW till 2021-2022.

The report gives a detailed analysis of the following key players in the Indian solar electric system and inverter market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

The comprehensive EMR report provides an in-depth assessment of the market based on the Porter's five forces model along with giving a SWOT analysis.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is expected to grow at a CAGR of 13.10% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach around 43.20 Gigawatt by 2035.

The major drivers of the market are rising disposable incomes, increasing population, rising adoption of electronic and HVAC systems, inadequate electricity supply, and lowering of costs of equipment.

The rising shift from non-renewable to renewable energy sources and government incentives are the major trends driving the growth of the market.

The major states for solar electric systems and inverters are Telangana, Tamil Nadu, Rajasthan, Andhra Pradesh, Gujarat, and Karnataka, among others.

The various technology types of solar electric system in the market are thin films and crystalline silicon.

The leading installation types of solar electric systems in the market are ground mounted and rooftop.

The inverter types of solar inverters in the market are central inverter, and string inverter, among others.

The key players in the market for solar inverters are Fimer S.p.A., Toshiba Mitsubishi-Electric Industrial Systems Corporation, SMA Solar Technology AG, and Hitachi Hi-Rel Power Electronics Private Limited, among others. In the market for solar panels, the key players are Vikram Solar Limited, Waaree Energies Ltd., Adani Group, Goldi Solar Pvt Ltd, Tata Power Solar Systems Ltd, Moser Baer Solar Limited, and XL Energy Ltd., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment

|

| Indian Solar Electric System Market Breakup by Technology Type |

|

| Indian Solar Electric System Market Breakup by Installation Type |

|

| Indian Solar Inverter Market Breakup by Inverter Type |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share