Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global industrial automation market size attained USD 209.32 Billion in 2025. The market is expected to grow at a CAGR of 8.60% during the forecast period of 2026-2035 to attain USD 477.65 Billion by 2035. Growing demand for smarter solutions to manage industrial plants is driving market growth, particularly in the Asia Pacific region.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

8.6%

Value in USD Billion

2026-2035

*this image is indicative*

The expansion of Industrial Internet of Things (IIoT) is driving industrial automation industry share by enabling seamless communication between machines, sensors, and control systems. IIoT facilitates remote monitoring, real-time analytics, and automation of complex processes. In March 2024, IoT Community introduced GenAIoT that merges Generative AI with AIoT to operationalize Industrial & Enterprise IoT for enabling smarter digital twins and real-time AI-driven insights. This growing adoption of IIoT solutions accelerates digital transformation in industrial automation, driving market growth globally.

The surging sustainability concerns and the rising energy costs push industries to adopt automation solutions that improve energy management and reduce waste. In August 2024, Delta introduced its AI-powered Digital Green Factory platform and smart warehouse logistics systems, achieving 1.676 billion kWh energy savings in 2023, equivalent to cutting CO₂ emissions by millions of tonnes. This focus on green manufacturing enhances corporate social responsibility and regulatory adherence, positioning energy-efficient automation as a critical market growth driver.

Smart factories are leveraging digital twins to simulate, monitor, and optimize production processes in real time, boosting the industrial automation industry. This trend enables predictive maintenance, process optimization, and reduced downtime. Subsequently, companies are investing in integrating automation with IoT, AI, and analytics to build intelligent manufacturing environments. Supporting with an instance, in October 2023, Advantech acquired BitFlow to integrate high-speed AI-powered image acquisition into its industrial IoT portfolio, enhancing automated defect detection and precision in smart factories.

Governments worldwide are promoting automation through subsidies, tax incentives, and smart manufacturing initiatives to enhance industrial competitiveness. In June 2025, The United Kingdom government reduced green levies and eased energy costs for >7,000 manufacturers, boosting automation investments in advanced manufacturing and clean energy sectors. Public-private partnerships also facilitate knowledge sharing and innovation. Such policies are accelerating technology deployment, infrastructure development, and research & development investments in the market.

Wireless communication and 5G networks are gaining traction in the industrial automation market to enable faster, more reliable data transmission in industrial environments. 5G offers ultra-low latency and high bandwidth, supporting applications, such as autonomous robots and AR-assisted maintenance. In September 2024, Nokia partnered with Rockwell Automation to deploy private 5G standalone networks for enhancing industrial connectivity. The rollout of 5G infrastructure globally accelerates wireless automation adoption, making it a significant market driver, especially for smart factories and geographically dispersed industrial operations.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Industrial Automation Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

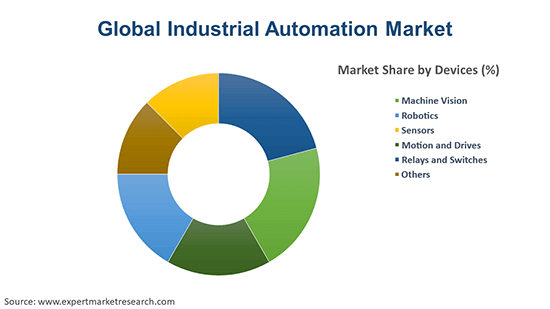

Breakup by Devices

Key Insight: Robotics is the most dominant segment in the industrial automation market, revolutionizing manufacturing processes across sectors. Major players are expanding their offerings of robots to support smart factories. In June 2025, ABB Robotics unveiled its expanded portfolio by introducing the IRB 6730S, IRB 6750S, and IRB 6760 industrial robots to enhance productivity and flexibility in manufacturing environments. Robotics continues to lead due to increasing labor shortages, rising demand for consistent quality, and the evolution of AI-integrated robots capable of learning and adapting.

Breakup by Control System

Key Insight: Programmable logic controller (PLC) segment is favoring the industrial automation industry revenue due to their central role in controlling and automating machinery. These systems are reliable, flexible, and widely used across automotive, manufacturing, and food processing. In February 2024, WEG launched PLC410, its new versatile controller used for industrial automation in pulp, metallurgy, and pharmaceuticals. PLCs are easily programmable and adapt to real-time changes, making them ideal for fast-paced environments. As smart factories evolve, the segment continues to integrate with IoT and cloud platforms, boosting both visibility and responsiveness.

Breakup by Application

Key Insight: The discrete industry segment of the industrial automation market focuses on manufacturing distinct items. In automotive, companies use robotics and vision systems for precision assembly and inspection. For instance, in May 2025, Comau deployed its SmartCell vision-guided robotic system on Li Auto’s electric vehicle production line in China. Packaging lines increasingly deploy PLCs and motion control to ensure speed and accuracy. Food processing firms utilize SCADA and sensor networks for hygiene compliance and efficiency. In textiles, automation supports digital weaving and dyeing processes, improving customization and productivity. These industries benefit significantly from automation in terms of speed, quality, and scalability.

Breakup by Region

Key Insight: Asia Pacific is leading the industrial automation market, driven by rapid industrialization, urbanization, and strong manufacturing hubs. China is aggressively investing in smart factories, robotics, and AI-integrated systems. As of February 2025, China established more than 30,000 basic-level smart factories as part of a nationwide initiative to fast-track industrial digitalization and intelligent transformation. Japan’s leadership in robotics and South Korea’s automation in electronics manufacturing further boost the region. India's push for digital manufacturing is also transforming its industrial base. This growing demand for automation makes Asia Pacific the fastest-growing regional segment.

Machine Vision & Sensors to Boost Industrial Automation

Machine vision is contributing to the industrial automation market for providing crucial quality control and inspection capabilities. Industries, such as electronics, pharmaceuticals, and food processing rely heavily on vision systems for accuracy. In June 2025, Cognex launched a cloud-based platform OneVision™ to help manufacturers easily build, train, and scale AI-powered machine vision applications to streamline inspection processes. Machine vision systems also reduce human error, boost efficiency, and support autonomous systems, making them an essential part of smart manufacturing environments.

Sensors play a vital role in industrial automation as they enable real-time data acquisition, monitoring, and control of machines and processes. Widely used in oil & gas, chemicals, and automotive, sensors detect temperature, pressure, motion, and proximity. The rise of IIoT has increased demand for wireless and smart sensors, which are integral to automation networks and safety systems. Sensors are also foundational for enabling communication, responsiveness, and adaptability in automated environments.

SCADA & DCS to Boost Industrial Automation Adoption

The supervisory control and data acquisition (SCADA) segment is contributing to the industrial automation industry as they are essential for monitoring and controlling the processes. Widely used in utilities, oil & gas, and water treatment facilities, SCADA enables centralized data collection, visualization, and control. With the rise of remote monitoring and IoT integration, modern SCADA systems offer greater mobility, cybersecurity, and predictive analytics, making them indispensable for large-scale operations where continuous monitoring and system-wide control are critical.

Distributed control system (DCS) holds a strong position, especially in chemicals, refining, and pharmaceuticals. This system allows operators to manage processes from centralized control rooms for continuous operations. In June 2024, Valmet introduced the DNAe system to streamline process control with unified OT/IT integration in industries. With the shift towards digitalization, DCS platforms are becoming more integrated with analytics and digital twins for improving operational insight and process optimization in the entire production lifecycle.

Rising Industrial Automation Application in Process Industry

The process industry segment of the industrial automation market includes chemical, power, oil & gas, healthcare and pharmaceuticals, and plastics. These industries rely on continuous and highly controlled processes, making automation essential for safety, efficiency, and consistency. In June 2025, Baker Hughes and Repsol deployed next-gen digital tools using the Leucipa™ automated field production solution, featuring a generative AI-powered virtual assistant for energy operations. Automation improves productivity, ensures regulatory compliance, reduces human error, and enables predictive maintenance. Rising need to enhance control, reduces downtime, and supports digital transformation is also adding to the segment growth.

Higher Industrial Automation Deployment in North America & Europe

North America industrial automation market share is expanding with the United States and Canada at the forefront of innovation and adoption. The region benefits from a strong presence of leading automation companies, coupled with high demand for smart manufacturing in automotive, aerospace, and oil & gas sectors. Government support for reshoring manufacturing and advancing Industry 4.0 technologies also plays a key role. The integration of AI, IoT, and data analytics in factory systems is widely embraced, while growing investments in cybersecurity and predictive maintenance solutions ensure North America maintains a competitive edge.

Europe, while technologically advanced, holds a considerable share in the industrial automation market. Germany, France, and Italy are key players, with Germany's Industry 4.0 initiative being a global benchmark for automation and smart manufacturing. Europe excels in high-precision manufacturing, especially in automotive and engineering sectors, and boasts strong industrial robotics and control system development. In 2024, Europe’s automotive sector installed around 23,000 industrial robots, reinforcing its status as a global automation leader. The region further remains a hub of automation innovation, with a strong focus on sustainability and energy-efficient manufacturing solutions.

Key players operating in the industrial automation market are employing several strategies to maintain competitiveness and drive growth. One major strategy is continuous innovation and investment in advanced technologies, such as AI, IoT, and machine learning to enhance the efficiency and intelligence of automation systems. Companies also focus on strategic partnerships and collaborations to expand their technological capabilities and global reach. Mergers and acquisitions are commonly used to gain access to new markets, enhance product portfolios, and strengthen supply chains.

Customization and scalability of solutions are prioritized to cater to the diverse needs of industries such as automotive, manufacturing, and energy. Additionally, many firms emphasize sustainability by developing energy-efficient and eco-friendly automation solutions. Digital transformation and smart factory initiatives are gaining momentum, prompting players to integrate cloud computing, big data analytics, and cybersecurity features into their offerings. After-sales services, including remote monitoring and predictive maintenance, also play a crucial role in customer retention.

Founded in 1847, Siemens AG is headquartered in Munich, Germany and is a global leader in industrial automation and digitalization. Siemens has pioneered technologies like the Digital Twin and MindSphere, its cloud-based IoT platform. The firm’s innovations drive smart manufacturing, energy efficiency, and seamless integration of hardware and software solutions.

Established in 1890 and based in St. Louis, the United States, Emerson Electric Co. excels in automation solutions and commercial technologies. Emerson is recognized for its Plantweb digital ecosystem and DeltaV distributed control systems, enabling real-time analytics, process optimization, and enhanced operational reliability in industries worldwide.

ABB Ltd., formed in 1988 via the merger of ASEA and BBC, is headquartered in Zurich, Switzerland and is renowned for its advances in robotics, electrification, and industrial automation. ABB's innovative offerings include ABB Ability™, a suite of digital solutions supporting predictive maintenance, energy monitoring, and performance improvement.

Rockwell Automation, Inc., founded in 1903 and based in Milwaukee, the United States, is a prominent player in industrial automation and information technology. Known for its Allen-Bradley and FactoryTalk brands, Rockwell delivers smart manufacturing systems, IIoT solutions, and integrated control systems to drive industrial productivity and digital transformation.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the industrial automation market include Mitsubishi Electric Corporation, Schneider Electric, and Texas Instruments Incorporated, among others.

Discover the latest industrial automation market trends 2026 with our comprehensive report. Download your free sample now to access detailed forecasts, competitive analysis, and emerging technology insights. Stay ahead in the rapidly evolving automation landscape by leveraging trusted data and expert perspectives. Don’t miss out on crucial market opportunities—get your report today!

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 209.32 Billion.

The market is projected to grow at a CAGR of 8.60% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach USD 477.65 Billion by 2035.

The key strategies driving the market include investing in AI and IoT innovations, forming strategic partnerships, and pursuing mergers to expand capabilities. Companies focus on customizable, energy-efficient solutions, digital transformation with cloud and analytics, and strong after-sales services. Geographic expansion into emerging markets also drives growth and competitiveness.

The trends in the market include the rising demand for precise production and high-quality automation control system and the emerging technologies like AR and VR.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Machine vision, robotics, sensors, motion and drives, and relays and switches, among others are the leading devices in the market.

Supervisory Control and Data Acquisition (SCADA), Distributed Control System (DCS), Programmable Logic Controller (PLC), Manufacturing Execution System (MES), Product Lifecycle Management (PLM), Enterprise Resource Planning (ERP), and Human Machine Interface (HMI), among others are the significant control systems in the market.

Discrete industry and process industry are the two major applications. Discrete industry can be further divided into automotive, packaging, food processing, and textile, among others. Process industry is further categorised into chemical, power, oil and gas, healthcare and pharma, and plastic, among others.

The key players in the market report include Siemens AG, Emerson Electric Co., ABB Ltd., Rockwell Automation, Inc., Mitsubishi Electric Corporation, Schneider Electric, and Texas Instruments Incorporated, among others.

Robotics is the most dominant segment in the market, revolutionizing manufacturing processes across sectors.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Devices |

|

| Breakup by Control System |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share