Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The instant coffee market attained a value of USD 13.79 Billion in 2025. The industry is expected to grow at a CAGR of 4.90% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 22.25 Billion.

The instant coffee market is positively driven by the surging consumer preference for quick as well as easy-to-prepare beverages. With fast-paced lifestyles, instant coffee is offering a hassle-free alternative to traditional brewing. The increasing demand for single-serve packets and ready-to-drink options is further boosting this trend, especially in urban markets with the dominance of time-saving products. Tapping into this expanding coffee market, in February 2025, Nestlé disclosed plans of launching its Starbucks ready-to-drink coffee in India.

In Brazil, the world's second-largest coffee consumer, demand continues to rise steadily. According to industry data, the country recorded a 1.1% increase in domestic coffee consumption between November 2023 and October 2024, reaching 21.9 million 60-kg bags. This growth is reflective of broader changes in consumption habits, with instant and specialty coffee varieties gaining popularity across both metropolitan and semi-urban regions. The adoption of Western lifestyles increased international travel, and social media influence are accelerating the popularity of coffee culture in markets like India and China, where tea traditionally dominated. The emergence of coffee chains, cafes, and ready-to-drink coffee offerings has contributed to a cultural shift, making coffee a more socially embedded beverage.

The influx of supportive agricultural policies and trade agreements is impacting coffee production and pricing, further adding to the market growth. Several countries are benefitting from government initiatives promoting coffee exports and quality improvements. In July 2024, Brazil's Ministry of Agriculture allocated R$6.8 billion to support coffee growers through financing, commercialization, and acquisition of coffee beans. Favourable trade terms are also enabling producers in reaching global consumers with diverse instant coffee offerings.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

4.9%

Value in USD Billion

2026-2035

*this image is indicative*

The growing focus of manufacturers on introducing new flavours as well as functional blends with added vitamins and adaptogens for attracting diverse consumer tastes is boosting the instant coffee industry. For instance, in May 2025, NesilCoffee expanded its product range with three new instant coffee flavours, such as hazelnut, pistachio and pumpkin to meet the surging popularity in the Middle East. Additionally, spray-dried powders, freeze-dried granules and sachets are evolving to improve solubility and taste.

The surging consumer willingness to pay for premium products that emphasize origin, roasting methods, and sustainability is increasing the instant coffee market share. Supporting this trend, in January 2022, leading DTC coffee brand Sleepy Owl launched its premium instant coffee for expanding its product portfolio. The third wave coffee movement is also influencing the product popularity, with brands including Starbucks VIA and Blue Bottle offering high-quality instant blends. This trend is further tapping into the surging interest of consumers in gourmet experiences in instant form.

Environmental concerns are pushing manufacturers in the instant coffee industry to adopt sustainable sourcing practices and transparent supply chains. For instance, in March 2023, Volcafe launched its Responsible Sourcing programme with Verified and Excellence labels for promoting sustainability and accountability in global coffee sourcing. Certifications are also becoming standard in attracting eco-conscious consumers. Major companies are focusing on sustainability commitments, further investing in farmer welfare while reducing the carbon footprints in production.

Advancements in freeze-drying and spray-drying for improving aroma and flavour retention while enhancing consumer acceptance is impacting the instant coffee market outlook. Innovations in packaging and the higher usage of resealable containers are also helping to extend shelf life and maintain freshness. In March 2025, India’s Coffee Board unveiled premium GI-tagged single-serve coffee drip bags for strengthening the domestic consumption of pure coffee across the country, adding to the market growth.

The surge in online sales due to greater internet penetration and changing buying behaviours is propelling the instant coffee market value. As per industry reports, the number of internet users across the world stood at 5.44 billion in 2024, highlighting the vast potential customer base engaging in digital commerce. Online marketplaces are also offering an extensive range of instant coffee brands, from premium to budget-friendly options. Digital marketing, influencer campaigns, and social media are also playing a crucial role in increasing awareness and trial of instant coffee products.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Instant Coffee Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

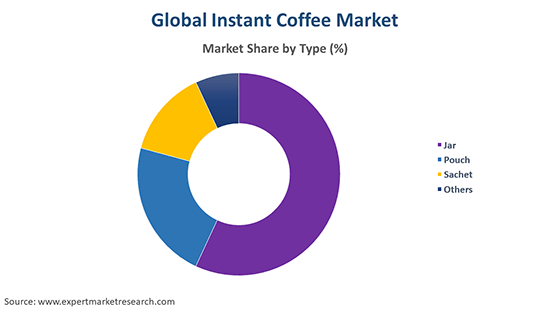

Market Breakup by Packaging

Key Insight: The jar segment leads the instant coffee market due to its widespread acceptance, value-for-money appeal, and household suitability. Typically sold in glass or plastic jars, this format allows consumers to scoop desired quantities while preserving aroma with air-tight seals. These jars offer cost efficiency and convenience, especially for families or offices with frequent consumption. The premium look of glass jars further enhances shelf appeal, reinforcing brand perception. In May 2025, Continental Coffee expanded its premium brand, Continental Spéciale, with four new flavoured instant variants in 50g jars, available online and offline across India, further driving the segment growth.

Market Breakup by Product Type

Key Insight: Spray-dried instant coffee market value is growing due to its cost-effectiveness and wide availability. This process is economical and suitable for mass production, making it ideal for budget-conscious consumers and institutional use. Several brands are predominantly offering spray-dried products for catering to daily coffee drinkers across the rural markets. In June 2025, Vintage Coffee Private Limited launched its new Natural Liquid Coffee to expand current offerings of spray-dried solutions. Furthermore, spray-dried variants dominate due to their affordability, extended shelf life, and appeal in price-sensitive regions.

Market Breakup by Distribution Channel

Key Insight: Supermarkets and hypermarkets are major distribution channels of the instant coffee market as they offer a wide range of brands and packaging formats under one roof. With extensive shelf space, discounts, and visibility, these stores are the go-to option for consumers buying in bulk or for household use. In May 2024, premium coffee pioneer NESPRESSO entered in Indian supermarkets to serve domestic and professional consumers. The organized retail structure enables strategic product placements and in-store promotions, driving volume sales. These outlets also serve urban and suburban customers while ensuring convenience, competitive pricing, and consistent product availability across demographic segments.

Market Breakup by Region

Key Insight: Asia Pacific instant coffee market size is driven by rising urbanization, changing lifestyles, and the growing middle-class population. According to industry reports, Asia's total urban population is likely to surpass 2.6 billion in 2030. India, China, Japan, and South Korea are witnessing increased demand for convenient, ready-to-drink coffee products. The region also records strong e-commerce growth, making instant coffee widely accessible. Local and global brands are also continuing to invest heavily in new flavours, packaging, and retail strategies to expand their market share.

Rising Demand for Instant Coffee Pouch & Sachets

The pouch segment occupies a significant share in the instant coffee industry as it balances affordability and portability. Leading brands are offering pouch refills for targeting budget-conscious and brand-loyal consumers. Supporting this trend, in March 2023, Nescafé introduced refill pouches for its instant coffee products. Furthermore, pouch packaging has grown especially popular in price-sensitive markets, such as India and Southeast Asia, contributing steadily to overall market share.

Sachets represent another leading segment of the instant coffee market given their convenience and accessibility. Ideal for single-use and on-the-go consumption, sachets cater to travellers, students, and office goers. This packaging is strategically important for penetrating rural areas and first-time users due to low unit prices. Additionally, sachets enable trial purchases, helping brands build loyalty over time. The utility and portability of sachets also make them a critical component of market outreach and brand expansion strategies.

Freeze-dried Instant Coffee to Record High Preference

The freeze-dried segment of the instant coffee market is expanding rapidly for offering superior aroma and flavour retention. Though expensive, freeze-dried coffee appeals to discerning consumers seeking café-like quality at home, driving innovations and expansion. For instance, in March 2025, NesilCoffee launched a major freeze-dried coffee facility in Turkmenistan for offering premium coffee products and beverages across online and offline retail channels. The segment is further gaining traction among urban and health-conscious buyers looking for high-end coffee experiences.

Thriving Instant Coffee Sales through Online & Independent Retailers

The online segment of the instant coffee market has emerged as a powerful and fast-growing channel for sales, especially in urban centres and among tech-savvy consumers seeking convenience, variety, and curated shopping experiences. Leading platforms are offering vast product selections, doorstep delivery, and user reviews to guide purchases, favouring the segment growth. Driving this trend, in January 2025, Swiggy partnered with Blue Tokai to deliver freshly brewed coffee in 15 minutes via SNACC, its quick-commerce platform.

Independent retailers, such as local grocery shops and convenience stores, are playing a key role in the instant coffee market, particularly in semi-urban and rural areas. These stores primarily stock cost-effective, high-turnover brands for catering to daily consumption needs. Independent retailers are also deeply embedded in community networks and rely on strong distributor relationships. Accessibility, familiarity, and credit-based purchasing options are also making the segment indispensable in emerging markets, such as India and Southeast Asia.

Magnifying Instant Coffee Consumption in Europe & North America

Europe holds a massive share of the instant coffee market, driven by high per capita coffee consumption and the strong preference for quick yet quality brews, mainly in the United Kingdom, Germany, and Russia. As per industry reports, Europe recorded 30.4% of the worldwide coffee consumption, amounting to 3.2 million tonnes, in 2023/2024. This rise is urging regional consumers to favour sustainability, prompting companies to launch ethically sourced and eco-packaged products. Instant coffee is especially popular for at-home and office use due to its speed and convenience.

North America, particularly the United States and Canada, contribute to the instant coffee industry due to the rising interest in fresh-brewed and specialty coffees. Brands including Starbucks VIA and Blue Bottle NOLA Craft Instant are targeting premium niches by offering high-quality, specialty-style instant options. Additionally, single-serve sachets and on-the-go formats are gaining popularity among busy consumers. Innovation and premiumization efforts are further helping instant coffee in carving a more defined space in the North American beverage landscape.

Key players in the instant coffee market are employing strategies that focus on innovation, branding, and market expansion. Product innovation is assisting companies in developing premium blends, single-origin options, and flavoured variants to attract discerning consumers. Sustainability has grown increasingly important as leading brands are adopting eco-friendly packaging and ethical sourcing of coffee beans to appeal to environmentally conscious buyers. Market players are investing heavily in branding and marketing by leveraging social media and influencer partnerships to build customer loyalty.

Convenience remains a critical selling point, with companies introducing ready-to-drink formats and single-serve sachets catering to on-the-go lifestyles. Geographic expansion is another major strategy, particularly in emerging markets like Asia-Pacific and Latin America, where coffee consumption is rising. Strategic partnerships with local distributors and e-commerce platforms help strengthen distribution channels and enhance accessibility. Additionally, companies are emphasising pricing strategies to cater to a broad consumer base for offering both budget and premium product lines. Some players are further exploring digital transformation via data analytics to tailor offerings and predict demand.

Founded in 1866, Nestlé is headquartered in Vevey, Switzerland and offers a wide range of food and beverage products, including its well-known Nescafé line of instant coffees. Nestlé focuses on nutrition, health, and wellness, and it maintains a strong global presence with operations in over 180 countries.

Founded in 1971, Starbucks Corporation is headquartered in Seattle, the United States. Best known for its specialty coffeehouses, Starbucks offers instant coffee options under its VIA brand. The company provides a broad portfolio, including brewed beverages, teas, snacks, and retail coffee products available in grocery and online channels worldwide.

Kraft Foods, originally founded in 1903, became part of the Kraft Heinz Company in 2015, with joint headquarters in Chicago and Pittsburgh, the United States. The company offers a diverse selection of food and beverage items, including instant coffee under the Maxwell House brand, targeting both convenience and affordability for mass-market consumers.

Tata Consumer Products Limited, headquartered in Mumbai, India, was founded in 1962. The company operates in the beverages and food sectors for offering popular instant coffee products under the Tata Coffee Grand label whilst combining local insights with global reach as a part of the larger Tata Group conglomerate.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the instant coffee market are Tchibo Coffee International Ltd, Strauss Group, Jacobs Douwe Egberts, Matthew Algie & Company Ltd, and Kraft Foods Inc., among others.

Stay ahead of industry shifts with in-depth insights into instant coffee market trends 2026. Download your free sample report now to explore growth forecasts, competitive strategies, and consumer behaviour insights. Whether you're an investor, supplier, or retailer, this report will guide your decisions in the expanding instant coffee market. Don't miss out—get your sample today!

United Kingdom Coffee Creamer Market

Coffee Beauty Products Market

North America Coffee Market

Foodservice Coffee Market

Coffee Concentrate Market

Cold Brew Coffee Market

Coffee Machines Market

Coffee Creamer Market

Organic Coffee Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 13.79 Billion.

The market is projected to grow at a CAGR of 4.90% between 2026 and 2035.

The market is estimated to reach a value of about USD 22.25 Billion by 2035.

Key strategies driving the market include product innovation, such as flavored and premium blends, expansion in emerging markets, strong e-commerce presence, and sustainable sourcing. Companies are also investing in advanced processing technologies, targeted marketing, and strategic partnerships to meet evolving consumer preferences and boost global market penetration.

The premiumisation and affordability of instant coffee, growing demand for single-serve packaging, and introduction of new flavours, are expected to be the key trends guiding the growth of the market.

Regionally, the market is divided into Europe, Asia Pacific, North America, Latin America, and the Middle East and Africa, with Europe currently leading the global market.

The global instant coffee market can be divided into two segments based on product type: spray-dried and freeze-dried. At present, spray-dried instant coffee holds a dominant position in the market.

The global instant coffee market has been categorised based on packaging into jars, pouches, sachets, and others. Of these, pouches account for the largest share of the market.

The global instant coffee market can be classified by distribution channel into business-to-business, supermarkets and hypermarkets, convenience stores, online, and others. At present, supermarkets and hypermarkets hold the largest share of the market.

The key players in the market report include Nestlé, Starbucks Corporation, KRAFT Foods, Tata Consumer Products Limited, Tchibo Coffee International Ltd, Strauss Group, Jacobs Douwe Egberts, Matthew Algie & Company Ltd, and Kraft Foods Inc., among others.

The unexpected onset of the COVID-19 pandemic has resulted in a shift in consumer preferences, moving away from traditional brick-and-mortar stores towards online retail platforms for purchasing instant coffee.

Asia Pacific dominates the market driven by rising urbanization, changing lifestyles, and the growing middle-class population.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Packaging |

|

| Breakup by Product Type |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share