Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The insulation market attained a value of USD 65.62 Billion in 2025. The industry is expected to grow at a CAGR of 4.30% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 99.97 Billion.

Rising global energy costs and environmental awareness are pushing governments and businesses to prioritize energy-efficient building solutions. Insulation plays a central role in minimizing heat transfer, reducing HVAC loads, and cutting utility bills. Mandatory energy efficiency codes, such as the IECC and EU Energy Performance of Buildings Directive, drive adoption. Building owners seek solutions that deliver long-term savings, prompting demand for high-R-value insulation materials.

Rapid urbanization, especially in Asia-Pacific and Africa, is fuelling insulation market expansion due to robust construction of residential, commercial, and industrial infrastructure. According to the Asian Development Bank, over 55% of Asia’s population will be urban by 2030. As cities expand, the demand for energy-efficient and noise-reducing insulation materials surges. Infrastructure megaprojects in China, India, and Southeast Asia include insulation as a critical component in reducing long-term operational costs.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

4.3%

Value in USD Billion

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

| Global Insulation Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 65.62 |

| Market Size 2035 | USD Billion | 99.97 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 4.30% |

| CAGR 2026-2035 - Market by Region | Latin America | 4.6% |

| CAGR 2026-2035 - Market by Country | India | 4.9% |

| CAGR 2026-2035 - Market by Country | China | 4.7% |

| CAGR 2026-2035 - Market by Product | Aerogel | 5.0% |

| CAGR 2026-2035 - Market by Application | Infrastructure | 5.4% |

| Market Share by Country 2025 | Japan | 4.1% |

Sustainability is a key trend influencing choices in the insulation industry. Builders and developers are choosing materials with low embodied carbon, high recycled content, and minimal environmental impact. Insulation products made from natural fibres, bio-based foams, and recyclable materials are gaining popularity. For instance, in December 2024, Knauf Insulation partnered with Carters to replace EcoInsulation with Knauf-branded glasswool, maintaining quality and sustainability.

Ongoing research & development is driving innovation in insulation technologies. In January 2024, Whirlpool Corporation introduced its SlimTech™ insulation technology, marking a significant advancement in refrigeration. Aerogels, vacuum insulation panels (VIPs), and phase-change materials (PCMs) are being explored for their superior thermal properties and space efficiency. These innovations cater to both residential and industrial applications, offering customized performance.

Global tightening of energy codes and building performance standards has become a powerful driver for the growth of the insulation market. Regulations, such as the U.S. ASHRAE standards, EU EPBD, and national green codes mandate minimum insulation levels in building envelopes. These rules require higher thermal resistance and airtightness, encouraging the use of high-performance insulation. Compliance is further tied to financial incentives or penalties, accelerating demand.

Digital tools are reshaping how insulation is specified, modelled, and installed. In September 2022, Kingspan Insulated Panels North America launched “BIM Bundle” and “BIM Configure,” offering downloadable Revit-format products and customizable panels with AR preview options for architects and engineers. Sensors and smart materials are also embedded to monitor moisture, temperature, and insulation integrity over time. These technologies reduce construction errors and support predictive maintenance.

Labor shortages and tighter construction schedules are driving insulation demand to offer lightweight, easy to handle, and quick to install benefits. Blown-in fiberglass, pre-cut panels, and spray foam offer efficient installation with minimal labour. Lightweight materials also reduce structural load and transportation costs. In May 2024, Huntsman Building Solutions unveiled its Icynene Series spray polyurethane foam insulation line at SprayFoam 2024 and IBS 2024 events. This trend supports faster project completion and cost savings for contractors.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Insulation Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

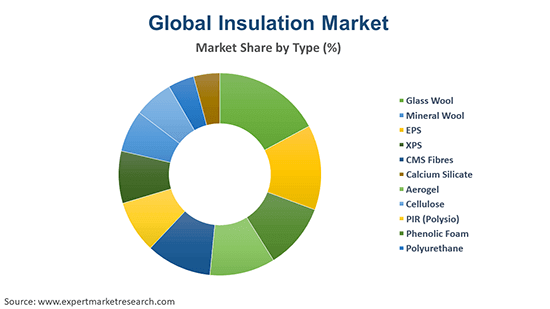

Market Breakup by Product

Key Insight: Glass wool is the most dominant insulation product globally due to its affordability, fire resistance, and thermal performance. Major players continuously invest in product improvements. In March 2022, Saint Gobain’s insulation subsidiary ISOVER invested EUR 120 million in France to expand glass wool capacity and decarbonize production. Its lightweight, easy-to-install properties and widespread availability make glass wool a preferred choice in North America and Europe, securing its top position in the insulation market.

Market Breakup by Application

Key Insight: The infrastructure segment, comprising residential construction and on-residential and commercial construction, drives the market due to extensive renovation of buildings, bridges, tunnels, and public utilities. Insulation materials, such as mineral wool, glass wool, and spray foam are widely used to improve energy efficiency, fire resistance, and soundproofing in commercial and residential projects. In September 2024, Knauf Insulation launched Performance+™ line to offer formaldehyde-free, asthma-friendly fiberglass products for healthier indoor air. The sector’s large-scale projects and long service life ensure steady demand, making infrastructure the largest market driver for insulation globally.

Market Breakup by Region

Key Insight: North America is the most dominant region in the global insulation market, driven by stringent energy efficiency regulations, high demand for sustainable construction, and advanced research & development. Major companies are actively launching innovations to meet evolving building codes and consumer demand. For instance, Natural Resources Canada (NRCan) has been actively supporting the development of next-generation bio-based foam insulation products. Government incentives for retrofitting and green building certifications further support insulation growth.

| CAGR 2026-2035 - Market by | Country |

| India | 4.9% |

| China | 4.7% |

| Saudi Arabia | 4.6% |

| Mexico | 4.5% |

| Canada | 4.4% |

| USA | XX% |

| UK | 4.2% |

| Germany | XX% |

| Italy | XX% |

| Japan | XX% |

| Australia | XX% |

| Brazil | XX% |

| France | 3.9% |

Mineral Wool & EPS Insulation to Gain Traction

Mineral wool is a significant segment due to its excellent fire, acoustic, and thermal resistance. It is commonly used in industrial, commercial, and high-rise residential projects. Leading manufacturers like Rockwool and Saint-Gobain have capitalized on its popularity. Mineral wool is especially preferred in Europe due to its fire safety standards and recyclability. Although heavier and more expensive than glass wool, its durability and performance in harsh environments keep it competitive in insulation markets globally.

EPS (expanded polystyrene) holds a strong position in the insulation market, particularly in packaging and lightweight construction applications. EPS is widely used in regions with developing infrastructure. Manufacturers are developing fire-retardant and recycled EPS variants to remain relevant. In December 2024, HIRSCH Isolation launched EPS insulation products made entirely from recycled materials, eliminating the use of virgin material. EPS further remains highly favoured in emerging markets due to its affordability and easy handling.

Thriving Insulation Adoption in Industrial & HVAC and OEM Applications

Industrial insulation is a major segment focused on thermal management, fire protection, and energy conservation in manufacturing plants, refineries, and power generation facilities. In February 2024, Owens Corning launched its EcoTouch® PIR (polyisocyanurate) insulation line to enhance energy efficiency and sustainability in industrial applications. The segment is also critical for reducing operational costs and emissions in oil and gas, chemical processing, and heavy manufacturing, securing its position as a leading market segment.

HVAC and OEM applications are vital for the insulation industry revenue for improving system efficiency and reducing noise in heating, ventilation, air conditioning, and original equipment manufacturing. Foam insulations, flexible fiberglass, and reflective barriers are widely used to insulate ducts, pipes, and machinery components. Companies like Johns Manville and Owens Corning supply insulation tailored for HVAC systems that enhance thermal performance and reduce energy consumption. This segment benefits from growing demand for energy-efficient HVAC solutions in residential and commercial buildings, making it a significant but somewhat smaller part of the overall insulation market compared to industrial and infrastructure.

Europe & Asia Pacific to Drive Insulation Industry Expansion

Europe is a strong and mature insulation market, driven by aggressive carbon reduction goals and strict building energy codes under the European Union Green Deal. Germany, France, and the United Kingdom emphasize retrofitting old housing stock with mineral wool, stone wool, and cellulose insulation. Europe also invests heavily in digital tools for insulation specification and promotes natural fibre solutions to reduce environmental impact, making it a progressive yet saturated market.

Asia Pacific is the fastest growing market due to lower baseline adoption and regional disparities. Rapid urbanization in China, India, and Southeast Asia fuels demand for thermal and acoustic insulation in residential and commercial projects. Government programs to improve building efficiency are boosting adoption. Japan and South Korea are mature markets with high-tech insulation materials, while India is seeing increased activity. In October 2023, ALP Aeroflex launched 'Aerocell Rail,' a rubber-based thermal insulation material designed for modern rail and metro coaches in India.

Key players in the insulation market are adopting a range of key strategies to strengthen their market position, drive innovation, and meet evolving sustainability and regulatory demands. Product innovation is a central focus, with companies investing in advanced materials like aerogels, vacuum insulation panels, and bio-based insulations to enhance thermal performance and environmental friendliness. Sustainability and decarbonization have become core to strategic growth, as firms develop low-carbon or recyclable products and invest in cleaner production technologies.

Geographic expansion is also prevalent, particularly into emerging markets, where construction and industrial activity is rising. To support this, companies are building local manufacturing plants to reduce logistics costs and emissions. Strategic partnerships and acquisitions help expand product portfolios, enter new sectors, or gain technological expertise. Additionally, digitalization is being used to streamline operations, improve energy modelling, and enable smarter installation techniques.

Founded in 1886, GAF is headquartered in Parsippany, the United States. As North America's largest roofing manufacturer, it has pioneered innovations like advanced roofing membranes and reflective technologies. GAF has significantly contributed to sustainable roofing with its energy-efficient systems and recycling initiatives, helping reduce landfill waste and promote green building practices.

Established in 1970 and based in Texas, the United States, Huntsman is a global leader in specialty chemicals. It has advanced the development of high-performance polyurethane insulation, enabling energy-efficient construction. Huntsman is known for its innovation in MDI-based foam systems, which enhance thermal resistance and reduce emissions across residential and industrial applications.

Founded in 1858 and headquartered in Denver, Johns Manville is a Berkshire Hathaway company specializing in insulation, roofing, and engineered products. It is recognized for developing formaldehyde-free fiberglass insulation and advanced vapor barrier systems. The company prioritizes sustainability and performance, supplying energy-efficient solutions for building, industrial, and transportation sectors globally.

Cellofoam North America Inc., founded in 1965 and headquartered in Conyers, the United States, specializes in EPS products. Known for innovation in lightweight, moisture-resistant insulation, the company serves construction, packaging, and marine markets. Its advanced EPS manufacturing methods contribute to cost-effective, energy-efficient building insulation with reduced environmental impacts.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the insulation market are ROCKWOOL International A/S, DuPont de Nemours, Inc., and Owens Corning, among others.

Download your free sample of the Insulation Market Trends 2026 report today to explore in-depth industry analysis, market forecasts, and growth opportunities. Stay ahead in the competitive insulation sector with trusted insights, emerging trends, and strategic guidance from Expert Market Research. Don’t miss out—access your comprehensive market overview now!

Sustainable Insulation Market

HVAC Insulation Market

North America Building Thermal Insulation Market

Cryogenic Insulation Market

Microporous Insulation Market

North America Marine Insulation Market

Aerogel Insulation Market

Industrial Insulation Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 65.62 Billion.

The market is projected to grow at a CAGR of 4.30% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 99.97 Billion by 2035.

Key strategies driving the market include innovation in eco-friendly materials, expanding production capacity, strategic partnerships, and mergers. Companies focus on digital tools for specification and installation, regional market penetration, and compliance with environmental regulations to boost energy efficiency and sustainability, enhancing competitiveness and meeting growing demand globally.

The rising demand for consumers for energy conservation and the growing demand for residential and industrial insulation are the key trends propelling the market growth.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Glass wool, mineral wool, EPS, XPS, CMS fibres, calcium silicate, aerogel, cellulose, PIR (polysio), phenolic foam, and polyurethane, are the major products in the market.

The significant applications of insulation are infrastructure, industrial, HVAC and OEM, transportation, appliances, furniture, and packaging.

The key players in the market report include GAF, Huntsman International LLC, Johns Manville, Cellofoam North America Inc., ROCKWOOL International A/S, DuPont de Nemours, Inc., and Owens Corning, among others.

Glass wool is the most dominant insulation product globally due to its affordability, fire resistance, and thermal performance.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share