Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global interior car accessories market size was valued at USD 267.83 Billion in 2025. The industry is expected to grow at a CAGR of 4.45% during the forecast period of 2026-2035 to reach a value of USD 413.95 Billion by 2035. The market is increasingly propelled by strategic collaborations between suppliers, technology providers, and automotive OEMs, aimed at developing advanced, connected, and user-centric cabin solutions.

The global interior car accessories industry development is influenced by the increasing trend of vehicle personalization, along with the rising smart cabin technology integration. Additionally, consumers are looking for tailored interiors that maximize comfort and also décor. OEMs are introducing linked features like adaptive lighting and intelligent displays. As a result, innovative interior accessories are becoming increasingly popular in both OEM and aftermarket channels.

Moreover, passengers now demand comfort, personalization, seamless connectivity, and intuitive controls from their car interiors. Companies in the global interior car accessories market are taking advantage of partnerships to innovate at an accelerated pace by incorporating advanced electronics, smart textiles, software, and sensor technologies into modular interior systems. This co-development strategy reduces time to market while allowing suppliers and OEMs to test, tweak, and scale features. By combining their skills, they can design automotive interiors with adaptable seats, ambient lighting, and sophisticated monitoring, improving comfort, safety, and technology. For instance, Yanfeng joined forces with Loomia in October 2024 to incorporate e-textile circuits in car interiors, thus facilitating advanced cabin functionality. Similarly, in December 2024, Hyundai Mobis revealed working together on human-centric lighting and advanced interior systems developments before CES 2025.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

4.45%

Value in USD Billion

2026-2035

*this image is indicative*

| Interior Car Accessories Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 267.83 |

| Market Size 2035 | USD Billion | 413.95 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 4.45% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 5.9% |

| CAGR 2026-2035 - Market by Country | India | 6.8% |

| CAGR 2026-2035 - Market by Country | UK | 6.3% |

| CAGR 2026-2035 - Market by Vehicle Type | SUV/MUV | 5.4% |

| CAGR 2026-2035 - Market by Distribution Channel | Aftermarket | 5.8% |

| Market Share by Country 2025 | France | 3.6% |

The global interior car accessories market is benefiting from a robust demand for personalized comfort systems. Modern thermal and ergonomic features, as well as modern seating technology, are continually being made available to passengers to enhance their experience. To fulfill increased consumer demand for comfort and convenience, providers are focusing on research and development of modular, configurable solutions. For example, in February 2025, Lear Corporation integrated its ComfortMax Seat engineering technology with General Motors cars, putting thermal seating solutions at the forefront of passenger comfort.

Advanced digital displays and human-machine interfaces are dramatically changing the trends in car interior accessories. Consumer demand is now focused on seamless infotainment, navigation, and smart cabin features, which necessarily means innovative accessory solutions. A number of suppliers are launching state-of-the-art display tech and AR-equipped systems aimed at improving the experience of both driver and passenger. For example, Hyundai Mobis, in association with ZEISS, revealed a holographic full windshield display projecting infotainment and driving data directly on the windshield in January 2025.

Consumer concerns about the environment, together with government regulations, are the primary driving elements behind the surge in sustainable development in the interior car accessories market. Producers and OEMs are turning their focus to recycled or plant-based resources, as well as implementing circular production methods. As a result, partnerships aimed at greener seats and cabin components have been formed. Adient, in collaboration with Jaguar Land Rover and Dow, manufactured the first entirely recyclable polyurethane foam seats in December 2024, marking a significant breakthrough toward sustainable interior manufacturing.

Major manufacturers operating in the global interior car accessories industry are participating in fairs and product exhibitions, which are powerful tools to showcase their new technology and secure OEM collaborations. These events provide insights into supplier developments in seats, electronics, and modular systems, which are then implemented in a variety of domains. For example, during CES 2024 in December 2023, Yanfeng exhibited its most recent advancements in seating, interiors, and safety, including modular steering and high-tech dashboard concepts.

The aftermarket interior car accessories market is witnessing significant growth, fueled by consumer demand for vehicle personalization and affordable upgrades. Manufacturers are expanding their product range, thus offering a wider variety of comfort, aesthetic, and functionality solutions. These expansions not only broaden the market but also make international distribution easier. For instance, PPAPCO added over 1,200 SKUs to its interior accessories catalog during FY 2024–25, which, in turn, boosted its export potential and allowed for a more extensive distribution network.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Interior Car Accessories Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type

Key Insights: The interior car accessories market scope comprises products such as covers, electronic accessories (displays, mobile chargers, cigarette lighters, music systems, and others), consoles and organizers, knobs, dash kits, car cushions and pillows, fragrances, sunshades, communication systems, central locking systems, car mats, interior lighting, and others. Valeo and other manufacturers are developing innovative interior lighting systems using structural electronics, which will improve ambient and dynamic cabin lighting experiences for both OEMs and customers.

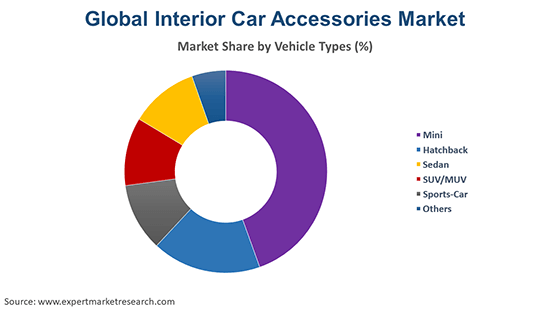

Market Breakup by Vehicle Type

Key Insights: Based on vehicle types, the interior car accessories market caters to mini, hatchback, sedan, SUV/MUV, sports car, and others. SUVs and MUVs are boosting the demand for ergonomic accessories and advanced displays, while hatchbacks and sedans are the main markets for mats, cushions, and fragrances. Sports cars require premium electronic and audio accessories. OEM and aftermarket suppliers are modifying products such as custom consoles and performance-grade music systems to meet each segment's style and functionality, which is supporting the market growth.

Market Breakup by Distribution Channel

Key Insights: The interior car accessories market sales are divided between the aftermarket and OEM channels of distribution. The aftermarket is thriving as buyers want to personalize their vehicles with coverings, bespoke organizers, and mobile chargers, as well as the backing of online retail. OEM channels are focused on factory-installed solutions such as central locking, integrated music systems, and display modules. Valeo, AMS OSRAM, and other companies are working together to develop dynamic ambient lighting solutions that will change OEM cabin environments.

Market Breakup by Region

Key Insights: Regionally, the global interior car accessories market landscape includes North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific region is at the forefront of growth due to increased manufacturing, higher incomes, and the quick adoption of smart home solutions. North America and Europe continue to have a strong demand for high-tech electronic accessories and personalized mats. Latin America and the Middle East & Africa are emerging markets owing to the increasing car ownership and the trend of using personalization and comfort-enhancing accessories.

| CAGR 2026-2035 - Market by | Region |

| Asia Pacific | 5.9% |

| Europe | 5.3% |

| North America | XX% |

| Latin America | XX% |

| Middle East and Africa | XX% |

By products, electronic accessories witness high demand for rising demand for smart safety & connectivity systems

The electronic accessories category contributes substantially to the interior car accessories market revenue, as customers look for smart safety and recording solutions that go beyond the basic infotainment systems. Dash cams featuring a wider field of view, AI capabilities, and higher resolution are becoming a standard upgrade in both OEM and aftermarket outlets, thus promoting insurance, security, and connectivity trends. For instance, in October 2025, Uno Minda introduced 2-way and 3-way dash cams equipped with comprehensive video capture and connectivity features, thereby enhancing its range of smart safety accessories.

Besides this, premium audio and ambient lighting systems are driving demand in the interior car accessories market, as they rebuild the cabin and allow for mood customization. These integrated systems blend high-fidelity audio with visual ambience to provide immersive in-car experiences that appeal to tech-savvy customers. Audi India launched the My Auras feature platform in February 2026, which combines music, lighting, climate, and seat settings to create a mood-based atmosphere, hence spurring product innovation in electronic accessories.

By vehicle types, SUV/MUV show notable product adoption owing to growing interior tech uptake

SUVs and MUVs are the major contributors to the growing interior vehicle accessories market trend of accessory adoption, since they have larger cabin spaces and may be used in a variety of ways. The owners want to make the vehicle comfortable for the family, especially while traveling long distances, so they equip it with larger infotainment screens, better seating, and ambient lighting systems. The 2025 Infiniti QX80 SUV interior exemplifies premium technology use in large sport utility vehicles. It includes two 14.3-inch monitors and 64-color ambient lighting, among other advanced features.

| CAGR 2026-2035 - Market by | Vehicle Type |

| SUV/MUV | 5.4% |

| Sedan | 5.0% |

| Mini | XX% |

| Hatchback | XX% |

| Sports-Car | XX% |

| Others | XX% |

On the other hand, sedans are increasingly being outfitted with next-generation multimedia and comfort technologies in response to passenger demand for connected and engaging trips. High-resolution touchscreen systems and surround audio significantly improve user experience, increasing the interior's perceived value at the time of purchase. The all-new 2025 Lexus ES debuted a 14-inch LexusConnect infotainment system and ambient lighting components, considerably increasing the sedan segment's interior accessory appeal.

By distribution channel, OEM amass significant product sales driven by rising demand for multimedia integration

The OEM distribution channel continues to generate significant interior car accessories market sales, owing to the growing trend of enhancing the value of built-in interior accessories by incorporating next-generation infotainment and connection systems into new vehicles. Factory-installed multimedia platforms now provide highly advanced features such as personalized media zones, intuitive controls, and seamless connectivity, which improve car interior comfort and eliminate the need for aftermarket upgrades. For example, Harman unveiled new OEM infotainment systems with tailored media zones and ultra-low latency features to improve in-vehicle experiences, making them more appealing to automakers looking for digitally unique cabins.

| CAGR 2026-2035 - Market by | Distribution Channel |

| Aftermarket | 5.8% |

| OEM | XX% |

Aftermarket accounts for a large share of the interior car accessories market because it is aided by customized electronic equipment that can be retrofitted into vehicles, allowing owners to increase comfort, entertainment, and convenience at their leisure. Products such as ambient lighting kits, wireless display adapters, and high-level audio systems transform the vehicle's individuality and create the ideal interior without the requirement for factory installation. As customer demand for smart cabins grows, these tech-heavy add-ons are becoming more popular among car owners seeking flexible, plug-and-play improvement choices.

By region, North America leads market growth, driven by premium audio & connected cabin demand

North America contributes considerably to the interior car accessories market revenue owing to the consumer demand for immersive in-car audio and connectivity, which is becoming a key factor in shaping the demand for interior accessories. The integration of native streaming apps and spatial audio not only increases the entertainment quality but also touches upon the suppliers' push to innovate even in the standard trims. For instance, GM equipped some of its 2025 models with Apple Music and Dolby Atmos, thus highlighting the focus of the region on high-quality audio integrations.

Meanwhile, the Asia Pacific interior car accessories market is expanding rapidly as vehicle ownership spreads, generating circumstances for a significant increase in demand for modern SUV interior accessories. These characteristics are driving consumers to prefer items like immersive sound systems, larger screens, and adaptable ambient lighting, which not only improve interior design but also increase comfort and connectedness throughout daily use and long trips. For instance, a BYD Tang L SUV stands out from the crowd with a 15.6-inch rotatable touchscreen entertainment system and ambient lighting, representing the regional trend of technology-oriented, highly valued interior amenities.

| CAGR 2026-2035 - Market by | Country |

| India | 6.8% |

| UK | 6.3% |

| China | 5.7% |

| Germany | 5.1% |

| France | 4.8% |

| USA | XX% |

| Canada | XX% |

| Italy | XX% |

| Japan | 3.5% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

Major global interior car accessories market players are vigorously focused on research and development to come up with smart, comfortable, focused interior accessories such as connected infotainment systems, advanced seating, and ambient cabin solutions. Besides, firms are deepening their collaborations with OEMs and technology providers to speed up the commercial launch of products, which in turn makes it possible to integrate new interior features in vehicle models and aftermarket offerings much more quickly.

Top-tier interior car accessories companies are taking initiatives to increase their presence worldwide by means of building new plants, entering into regional distribution partnerships, and offering a wider range of products. Meanwhile, suppliers are not only making sustainable materials and modular interior designs their utmost priorities to comply with the regulations and changing consumer preferences, but they are also using digital platforms to bolster customer engagement and improve aftermarket sales performance, thereby impacting the interior car accessories market growth trajectory.

Covercraft Industries LLC, a company established in 1965 and located in California, US, is the major player in the manufacturing of vehicle interior and exterior protection products. The firm is engaged in supplying custom-fit seat covers, dashboards, and vehicle protection accessories to both OEM and aftermarket segments.

Pecca Group Berhad, a company established in 1999 and located in Selangor, Malaysia, is a leading automotive upholstery manufacturer producing high-grade seat covers and interior trim solutions. The firm mainly supplies global OEMs but is developing its presence in Asia, Europe, and other parts of the global interior car accessories market.

Established in 1950 and based in Burgos, Spain, Grupo Antolin is a worldwide automotive interior supplier of dashboards, door panels, lighting, and overhead systems. The company is a major automaker worldwide with its manufacturing and innovation network.

Established in 1871 and with its headquarters in Hanover, Germany, Continental AG is a leading automotive technology company offering advanced interior electronics, display systems, and connected vehicle solutions. Its interior segment is mainly focused on intelligent cockpit technologies that improve drive safety, comfort, and user experience.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the market include Harman International Industries, Incorporated, among others.

Explore the latest trends shaping the Global Interior Car Accessories Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on the global interior car accessories market trends 2026.

Argentina Interior Car Accessories Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 4.45% between 2026 and 2035.

Key strategies driving the market include product innovation in smart and comfort-focused interiors, strategic partnerships with OEMs and technology providers, expansion of aftermarket distribution channels, adoption of sustainable materials, and investments in research and development to improve connected and personalized cabin solutions.

The key trends guiding the market include the growing demand for vehicle customisation and surging sales of passenger cars.

The major regions in the global interior car accessories market include North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The different product types are covers, electronic accessories, consoles and organisers, knobs, dash kits, car cushions and pillow, fragrance, sunshades, communication, central locking system, car mats, and interior lighting, among others.

The major distribution channels in the market are aftermarket and OEM.

The significant vehicle types in the market are mini, hatchback, sedan, SUV/MUV, and sports-car, among others.

The key players in the market include Covercraft Industries LLC, Pecca Group Berhad, Grupo Antolin, Continental AG, and Harman International Industries, Incorporated, among others.

In 2025, the global interior car accessories market reached an approximate value of USD 267.83 Billion.

The major challenges that market players face includes fluctuating raw material prices, high development costs for advanced interior technologies, supply chain disruptions, intense competition from low-cost aftermarket suppliers, and the need to comply with evolving safety and environmental regulations.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Distribution Channel |

|

| Breakup by Vehicle Type |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share