Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global interventional radiology market size reached around USD 25.82 Billion in 2025. The market is projected to grow at a CAGR of 6.70% between 2026 and 2035 to reach nearly USD 49.39 Billion by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

6.7%

Value in USD Billion

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Interventional radiology (IR) refers to a collection of methods that direct medical imaging like x-ray fluoroscopy, magnetic resonance imaging, computed tomography, or ultrasound to guide medical therapies via very small incisions specifically towards the internal structure of the body. The interventional radiology market growth is driven by several factors including its expanded application across different domains like cardiology, musculoskeletal interventions, oncology, and neurology. The rising prevalence for minimally invasive procedures, along with patient centric approaches, personalized treatment plans and integration of artificial intelligence and robotics, also contribute to the rising market value.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

New Product Launches to Meet the Rising Interventional Radiology Market Demand

In May 2023, United Imaging launched an entire range of products imaging and digital solutions, enabled with artificial intelligence capacity across multiple modalities. Some of the notable inventions include the uRT-linac 506c, a LINAC device that combines a diagnostic CT imager and a linear accelerator to offer continuous treatment simulation. Other cutting-edge solutions include PET/CT uEXPLORER®, the uMR® Jupiter 5.0T, uMI Panorama™, and the ultra-high-field preclinical 9.4T MR.

The interventional radiology market share is poised to grow further with multiple companies stepping up to unveil innovative and technology driven equipment. In September 2023, Canon Medical Systems Corporation introduced Alphenix Sky 12 HD interventional system that offers twice as much better resolution than the conventional flat panel detectors. With the new 12” × 12” high-definition (Hi-Def) detector, the system aims at offering improved interventional imaging efficiency for multiple domains, including neurology, cardiology, oncology, and pediatric care.

Surge in Investments to Offer Improved Solutions

In June 2023, Flow Medical , a University of Chicago startup, received a USD 1 million investment to develop and commercialize their latest multi-function catheter to help diagnose and treat venous thromboembolic disease. The funds are expected to expediate the device development and testing process so as to facilitate the submission for FDA 510(k) approval by the first quarter of 2025. The growth in investments for enhanced research activities in poised to boost the interventional radiology market growth in the forecast period.

Increasing Integration of Artificial Intelligence Based and Smart Solutions

The healthcare landscape is witnessing rising integration of smart and artificial intelligence run solutions. To offer improved patient and staff experience and drive operational efficiency at a lower cost of care, leading healthcare companies such as Royal Philips have started developing and applying smart connected imaging systems into relevant treatment plans. For instance, MR 5300 is an artificial intelligence run technology that automates several compound clinical and operational tasks to enhance clinical decision-making and speed up the imaging process. The rising application of latest technologies in the radiology scenario is likely to drive a significant upswing in the interventional radiology market size.

In addition, the advent of Phillips MR 7700 in 3.0T imaging is a breakthrough as it facilitates an enhanced gradient system for better imaging results. Along with an improved image quality, it has reduced the scan time by 35% enabling and allows imaging six different nuclei at the same time, which has been a major help for radiologists.

Market Breakup by Products

Market Breakup by Technology

Market Breakup by Procedure

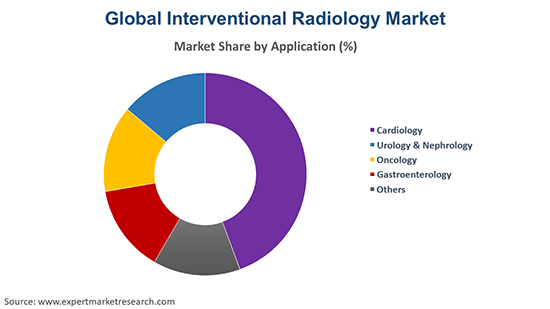

Market Breakup by Application

Market Breakup by End User

Market Breakup by Region

The United States is anticipated to lead the global market owing to the presence of prominent healthcare companies. The presence of a robust healthcare infrastructure aids the market share as well. The region is witnessing continuous infrastructure related developments. In October 2023, Children’s Hospital Los Angeles opened a new interventional radiology suite with latest technology aimed at improving patient care. This hospital is likely to contribute significantly to the rising interventional radiology market share in the coming years.

The new diagnostic facility for children includes state-of-the-art machinery that combines fluoroscopy and CT scanning. It also includes a biplane angiography machine to allow radiologists to make videos during X-ray procedures. The opening of such facilities is expected to improve the accessibility for advanced imaging alternatives, ensuring quality care and patient safety.

In January 2023, GE Healthcare acquired Imactis, a French CT interventional guidance technology to strengthen their imaging technology portfolio by leveraging the IMACTIS CT-Navigation system. An ergonomic universal solution, CT-Navigation™ offers stereotactic needle guidance for continuous and pre-planned control across several diagnostics to treatments. With this acquisition, GE has showed the intent of expanding their technologies into image guided therapies business to maximize growth.

The key features of the interventional radiology market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market attained a value of about USD 25.82 Billion in 2025, driven by the rising incidence of geriatric population across the globe.

The market is anticipated to grow at a CAGR of 6.70% during the forecast period of 2026-2035, likely to reach a market value of USD 49.39 Billion by 2035.

The rising convergence of artificial intelligence and robotics into the healthcare sector is a major market trend. In March 2023, Phillips launched several artificial intelligence run imaging systems like MR 5300 and MR 7700 to offer improved and accurate solutions to the patients.

The products in the market include MRI systems, CT scanners, ultrasound imaging systems, angiography systems, biopsy devices, and fluoroscopy systems, among others.

The technologies in the market include catheters, stents, inferior vena cava (IVC) filters, hemodynamic flow alteration (HFA) devices, angioplasty balloons, thrombectomy systems, embolization devices, biopsy needles, and accessories, among others.

The procedures can be divided into angioplasty, angiography, embolization, thrombolysis, biopsy and drainage, vertebroplasty, and nephrostomy, among other procedures.

Radiology finds wide applications in cardiology, urology and nephrology, oncology, gastroenterology, and obstetrics, among others.

The end-users in the market include hospitals, clinics, and ambulatory surgical centres, among others.

The major regions of the market include North America, Europe, Asia Pacific, Latin America, Middle East, and Africa. North America is currently leading the global market.

Key players involved in the market are General Electric, Koninklijke Philips N.V., Carestream Health, Hitachi, Ltd., Hologic, Inc., Shimadzu Corporation, Siemens Healthcare GmbH, Canon Medical Systems Corporation, Samsung Medison Co., Ltd., Medtronic Plc, Agfa-Gevaert Group, Teleflex Incorporated, Analogic Corporation, Shenzhen Mindray Bio-Medical, Electronics Co., Ltd., Trivitron Healthcare, Stryker Corporation, Olympus Corporation, and Toshiba Medical Systems.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Products |

|

| Breakup by Technology |

|

| Breakup by Procedure |

|

| Breakup by Application |

|

| Breakup by End User |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Single User License

One User

USD 5,499

USD 4,949

tax inclusive*

Datasheet

One User

USD 3,299

USD 2,969

tax inclusive*

Five User License

Five User

USD 6,999

USD 5,949

tax inclusive*

Corporate License

Unlimited Users

USD 8,199

USD 6,969

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share