Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global IV tubing sets and accessories market was valued at USD 1.26 Billion in 2025, driven by the rising chronic disease burden and growing demand for advanced IV tubing sets across the globe. The market is expected to grow at a CAGR of 4.60% during the forecast period of 2026-2035, with the values likely to reach USD 1.98 Billion by 2035.

Base Year

Historical Period

Forecast Period

The rising prevalence of chronic diseases and the growing aging population are significant growth drivers of the market.

One of the major market trends is the rising introduction of innovative IV tubing sets with advanced features such as needleless connectors, anti-kinking properties, and precision flow control.

The market value is impacted by the growing demand for IV tubing sets with antimicrobial properties and the rising advancements in materials and design of IV tubing sets.

Compound Annual Growth Rate

4.6%

Value in USD Billion

2026-2035

*this image is indicative*

IV tubing sets are medical equipment designed to deliver fluids like nutrients and medications into a patient’s body in controlled amounts. They serve as an effective way to administer fluids and medication to patients over a longer period of time. These sets are a complete tubing system and include all the accessories required to connect the bag of medication to the patient.

The increasing prevalence of cardiovascular diseases coupled with the rising risk of malnutrition across different parts of the world is driving the demand for IV tubing sets and accessories. Increased government initiatives to combat malnutrition, which can be cured by providing essential nutrients to the targeted patient pool, are significantly contributing to the growth of the IV tubing sets and accessories market. These tubing systems facilitate precise and accurate drug delivery at a faster rate.

Other factors like the growing geriatric population, developing healthcare infrastructure, and favorable reimbursement policies are further propelling the market demand. Moreover, the increased product utilization for peripheral intravenous catheter insertion, which is an invasive procedure that allows the introduction of medications directly into the cardiovascular system, is also elevating the market value. The increase in demand for branded and patented smart IV infusion pump systems and associated IV tubing sets is expected to have a positive effect on the expansion of the market in the forecast period.

Increasing Prevalence of Chronic Diseases to Drive Market Growth

According to the World Health Organization (WHO ), noncommunicable diseases or chronic diseases are responsible for the death of 41 million people annually, contributing to 74% of all deaths worldwide. Further, it is estimated that 129 million individuals in the United States are affected by at least one major chronic disease like hypertension, cancer, heart disease, or diabetes. These conditions often require long-term intravenous treatments which increases the demand for IV tubing sets and accessories to deliver medications and fluids to the patients. Thus, the rising prevalence of chronic diseases is expected to fuel the market growth.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The market is witnessing several trends and developments to improve the current global scenario. Some of the notable trends are as follows:

The EMR’s report titled “Global IV Tubing Sets and Accessories Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type

Market Breakup by Application

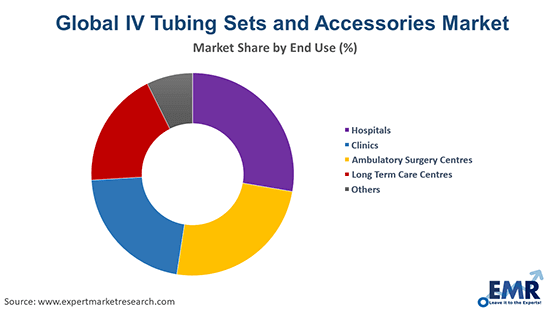

Market Breakup by End User

Market Breakup by Region

The Product Type Holds a Significant Market Share

The market segmentation by product type includes primary IV tubing sets, IV extension sets, secondary IV tubing sets, filtered IV tubing sets, and others. Primary IV tubing sets are further divided into macro-drip IV tubing sets and micro-drip IV tubing sets. The primary IV tubing sets account for a significant share of the total market value. The segment growth can be attributed to the growing product utilization for the infusion of intermittent medication or fluids to the patients. They are an effective medium to provide medications and can be used in several cases like dehydration, and specialised medication delivery, among others.

In the forecast period, the extension IV tubing sets are expected to witness robust growth in the IV tubing sets and accessories market. It can be attributed to their ability to increase the length of the primary infusion set. They are connected to IV catheters and are introduced into the patient’s body to allow rapid fluid administration when the distance is large. Thus, the wide applicability of these tubing sets over large distances is expected to drive the demand for the segment in the coming years.

Regionally, North America represents a major share of the market for IV tubing sets and accessories which can be attributed to the rising burden of chronic diseases and the high healthcare spending. The increasing adoption of innovative IV technologies, such as smart pumps and safety features like needleless connectors, also aids the market growth. Moreover, the increasing aging population in the region also propels the demand for IV therapy for age-related conditions.

The key features of the market report comprise the patent analysis, grants analysis, funding and investment analysis, and strategic initiatives by the leading key players. The major companies in the market are as follows:

Headquartered in Pennsylvania, United States, B. Braun Medical Inc. is a significant player in the market known for its high-quality IV products and infusion therapy solutions. The company has a robust portfolio of extension sets and specialized IV administration sets with needleless connectors and back-check valves.

Baxter International Inc., an American multinational healthcare company based in Deerfield, Illinois, is a prominent player in the market. The company provides a wide range of IV tubing sets, including primary, secondary, and extension sets, designed for various medical applications.

Becton, Dickinson and Company (BD) is a global medical technology company that manufactures and markets instruments, medical devices, and reagents. Some of its key products include Extension Sets with Needle-Free Connectors and Total Intravenous Anaesthesia (TIVA) Administration Sets.

New Jersey-based Blickman is a leading medical equipment manufacturer that is known for its significant contributions to the IV tubing sets and accessories market. Blickman provides IV poles and stands needed to support IV tubing sets in healthcare facilities.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include BQ PLUS MEDICAL CO. LTD., Cardinal Health, EQUASHIELD, ICU MEDICAL Inc., KB MEDICAL (GROUP) INC, LARS MEDICARE Pvt Ltd., and Vygon Group.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Application |

|

| Breakup by End User |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Supplier Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 3,299

USD 2,969

tax inclusive*

Single User License

One User

USD 5,499

USD 4,949

tax inclusive*

Five User License

Five User

USD 6,999

USD 5,949

tax inclusive*

Corporate License

Unlimited Users

USD 8,199

USD 6,969

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share