Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global kitchen faucets market attained a value of USD 32.58 Billion in 2025 and is projected to expand at a CAGR of 6.80% through 2035. The market is further expected to achieve USD 62.90 Billion by 2035. The growing number of institutional kitchen renovations in the healthcare, education, and cloud kitchen sectors is driving the demand for standardized and sensor-enabled faucets that provide assurance of compliance, faster installation cycles, and lower exposure to maintenance risks.

The water efficiency regulations and labor optimization demands are driving the kitchen faucets market growth. Certified faucets help in meeting regulations, and touchless and pre-rinse faucets help in reducing labor. At the same time, the growth in cloud kitchens is fueling the demand for strong faucet systems with quick replacement parts. These factors are encouraging operators to invest in standardized high-durability faucet platforms.

The kitchen faucets market is experiencing a fresh surge in momentum due to sensor-driven product enhancements targeting commercial kitchens and institutional customers. For example, Kohler Co. offers an enhanced Sensate line of touchless faucets with adaptive sensor calibration designed for high-traffic commercial kitchen applications. This innovation is specifically appealing for the hospitality industry and shared kitchen facilities that require a steady water supply even in challenging conditions. Moreover, sensor-driven commercial faucets can cut water usage by nearly 30% compared to manual faucets, as indicated by the findings of the United States Environmental Protection Agency WaterSense program.

Product positioning in the kitchen faucets market dynamics is driven more by durability, performance, and life cycle efficiency than design. Companies such as Moen and Delta Faucet Company are focusing on longer-lasting cartridges, corrosion-resistant materials, and more standardized internal components to target multi-property owners. In March 2025, Prayag Polymers unveiled an exquisite collection of brass faucets, designed for durability and a superior aesthetic. Commercial kitchen renovations continue to be a significant part of the non-residential plumbing market. This is compelling companies to position their products according to ADA standards and institutional purchasing requirements, making it easier for facilities managers to obtain approvals for mixed-use projects.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

6.8%

Value in USD Billion

2026-2035

*this image is indicative*

Sensor-equipped kitchen faucets are moving from high-end product placement to standardized procurement for institutional kitchens. Companies are developing adaptable sensors that will be able to operate effectively in the presence of steam, grease, and varying lighting conditions. In February 2024, Moen Commercial improved its M-Power line of products to accommodate continuous use applications such as airports and healthcare facilities, leveraging this trend in the kitchen faucets market. Federal water conservation initiatives are shaping government procurement specifications, leading to a faster replacement cycle of manual fixtures. Purchasers are now preferring vendors who can provide performance reliability and alignment with certifications.

Innovation in materials is also coming to the forefront as a key differentiator considering the tightening regulations on lead content. Companies that produce kitchen faucets are now working on in-house brass alloys and composite materials that can meet the NSF/ANSI 61 standards while also being durable. Companies such as American Standard are now highlighting the importance of lead-free materials in contracts, creating new kitchen faucets market opportunities. In September 2025, Lenova announced the release of the K250 kitchen faucet line from its Design Edition Collection, made from type 304 stainless steel with zero lead content.

The growing need for modular kitchen faucet systems with interchangeable parts is being fueled by multi-location foodservice operators. Companies are standardizing valves, spouts, and cartridges to make inventory and maintenance easier. In February 2025, Delta Faucet extended its modular commercial product line to minimize downtime, with the launch of Delta Clarifi Filtration Systems. Government-backed school kitchen renovation initiatives are increasingly requiring standardized parts to simplify maintenance, accelerating the overall kitchen faucets market value. This will help minimize life cycle costs and maximize uptime. Modular system providers are becoming the preferred choice for service contracts and RFPs for foodservice operators.

High-arc and pre-rinse faucets with strengthened springs are being increasingly specified in QSR and institutional kitchens. In January 2023, Gerber expanded its Parma kitchen lineup with a professional-style pre-rinse single-handle spring pull-down faucet offering enhanced spray control and ergonomic reach for heavy kitchen tasks. Workplace safety and efficiency programs have an indirect positive effect on these improvements. Labor efficiency is becoming a measurable parameter, and faucets are being increasingly associated with operational key performance indicators, reshaping the overall kitchen faucets market dynamics.

Supply chain assurance is emerging as a key growth factor as powerful as innovation in purchasing decisions. Kitchen faucet producers are increasing regional manufacturing to shorten lead times and minimize the impact of tariffs. In September 2023, Aparna Enterprises partnered with Italian faucet maker Paffoni, bringing its extensive, high-quality faucet portfolio to Indian customers through Aparna Unispace showrooms. Moreover, public infrastructure upgrade initiatives have improved the predictability of demand in the kitchen faucets market. Purchasers increasingly prefer suppliers who can provide regional assembly, quick delivery, and reliable access to replacement parts.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Kitchen Faucets Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

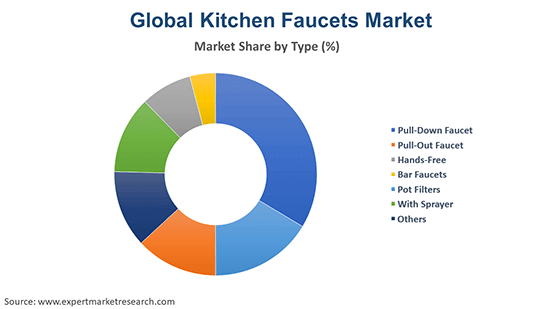

Market Breakup by Type

Key Insight: Every faucet model, considered in the kitchen faucets market report has its own set of operational needs to fulfill. Pull-out and pull-down faucets are designed for flexibility and ergonomic functionality. For example, KOHLER’s Malleco Touchless Pull Down Kitchen Faucet boasts response technology, sweep spray, and DockNetik magnetic docking system. Hands-free faucets focus on hygiene and compliance, while bar faucets are designed for smaller service areas. Pot fillers help to eliminate the need for heavy lifting in cooking areas. Faucets with sprayers are designed for improved cleaning efficiency, and other specialty faucets are designed for specific installation needs. The buyer's choice is based on workflow design, maintenance needs, and compliance requirements, not on design trends. Suppliers with well-defined product lines are better equipped to fulfill different commercial procurement needs.

Market Breakup by Installation Type

Key Insight: Deck-mounted faucets provide users with a familiar and easy method of installation and service, while wall-mounted designs promote cleanliness and save space. Customers consider accessibility for maintenance, compatibility of wall structure, and sink layout when deciding on the installation types. Buying decisions are increasingly based on the practical aspects of operations rather than appearance. Companies that make products for both configurations with the same internals are gaining acceptance in mixed-use kitchen environments, broadening the kitchen faucets market scope.

Market Breakup by Faucet Holes

Key Insight: One-hole designs emphasize simplicity and efficiency, while two-hole systems balance control and compactness. Three-hole configurations offer precision and redundancy and four-hole setups accommodate additional accessories where required. Buyers choose configurations based on maintenance strategy, operator skill levels, and sink design, thus opening up new kitchen faucets market opportunities. Manufacturers aligning products with standardized hole spacing, gain procurement advantage.

Market Breakup by Material Type

Key Insight: As per the kitchen faucets market report, chrome leads through reliability and standardization. Stainless steel grows popular due to hygiene alignment, and bronze supports premium positioning. Plastic serves cost-sensitive applications, while other materials address niche requirements. Material choice reflects durability expectations, cleaning protocols, and procurement budgets rather than visual differentiation alone.

Market Breakup by Region

Key Insight: North America emphasizes compliance and reliability. Europe prioritizes sustainability alignment. Asia Pacific focuses on scale and efficiency. Latin America supports replacement-driven demand. Middle East and Africa emphasize durability under demanding conditions. Regional strategies reflect infrastructure maturity and procurement structures, accelerating the overall kitchen faucets market penetration.

By type, hands-free faucets dominate the market due to compliance needs and operational hygiene priorities

Hands-free faucets dominate the kitchen faucets industry mainly because of the demand for hygiene, compliance, and operational efficiency from institutional buyers. These faucets are turning into standard requirements in healthcare kitchens, airports, schools, and cloud kitchen operations to minimize touchpoints. To keep up with such demands, manufacturers are working on features such as deepening sensor recognition, better flow control, and power backup options so that no false activation or power failure can be experienced. In such hectic places, buyers put reliability and consistency before aesthetic emanation. In May 2024, GRAFF expanded its portfolio with new faucets featuring leading-edge sensor technology.

On the other hand, pull-down faucets are gaining rapid popularity, powered by the needs of commercial kitchens as well as high-end residential projects that require flexibility without the use of sensors. They are capable of handling different sink depths and heavy-duty cleaning, which makes them ideal for hospitality and housing operations. Manufacturers are opting for more robust hoses, reinforced swivels, and more reliable locking systems for spray heads that can withstand frequent yet intensive use.

Deck-mounted faucets lead installations due to compatibility with standardized countertops

Deck-mounted faucets continue to be the most relevant installation type because they are easy to replace and compatible with standard kitchen countertops. When it comes to new installations and replacement projects, deck-mounted faucets are the first choice as they need less wall penetrations. Moreover, facility managers consider deck-mounted faucets more convenient for maintenance and less prone to leaking. Dealers are making efforts to improve the mounting hardware and sealing capability of deck and mounted faucets.

Wall-mounted faucets are currently the fastest growing segment, contributing to the kitchen faucets market growth due to space-saving and hygiene benefits. A wall-mounted faucet provides an uncluttered sink area thus allowing for better cleaning and less chance of contamination. Commercial kitchens that are small in size are increasingly opting for wall-mounted faucets in order to have more working area. Manufacturers are upgrading the fixing parts and the adjustable spouts of wall-mounted faucets to fit various sink depths. In February 2025, Wasserwerk entered the United States and Canadian markets with its premium German-engineered kitchen faucets, offering diverse finishes and installation designs.

By faucet holes, single-hole faucets account for a major share of the market value due to simplified installation and reduced leak points

One-hole faucets are the most popular faucet hole type as consumers demand easier installation and a cleaner sink appearance. One-hole faucets minimize leak locations and installation time, which is essential in renovation-intensive commercial settings. Suppliers are combining faucet controls and accessories into smaller components without sacrificing durability. Facility managers find one-hole faucets more convenient to replace and maintain. Compatibility with contemporary sinks and countertops further enhances acceptance.

Three-hole faucets are also expanding their share in the kitchen faucets market as commercial facilities begin to use separate control systems for temperature and flow control. Three-hole faucets are gaining acceptance in heavily used kitchens where precise control enhances safety and workflow efficiency. Suppliers are standardizing hole spacing and enhancing gasket seals to overcome past maintenance issues. For example, Olympia's i3 Collection of faucets, launched in February 2025, combines smooth beveled edges with stunning gradients to create an engaging, minimalist style. Consumers view three-hole faucet systems as durable solutions for demanding applications rather than aesthetic enhancements. Their popularity is supported by kitchens requiring redundancy and clear control separation, particularly in training facilities and regulated food preparation spaces.

By material type, chrome faucets register the largest share of the market due to durability, finish consistency, and cost stability

Chrome continues to be the most common material in the kitchen faucets market mainly because of its longevity, resistance to corrosion, and upscale finish quality. Commercial buyers appreciate chrome because it can be washed frequently. Manufacturers are constantly looking for new plating methods that they can use to make the surface last longer, while maintaining an aesthetic appeal. Chrome taps also blend well with standard kitchen designs which bring less visual variation to different facilities. Procurement departments favor chrome for its predictable performance and the fact that it can be sourced from many suppliers. For example, the KOHLER Billet Kitchen Faucet Collection, launched in December 2025, offers Polished Chrome, Vibrant Stainless, Matte Black, Vibrant Brushed Moderne Brass and so on.

Stainless steel emerges to be the fastest-growing material type within the kitchen faucets market dynamics as it offers hygiene and durability over time. Buyers link stainless steel with the ability to withstand germs, meanwhile manufacturers are working on developing new alloy compositions and surface finishes that help stainless steel to be less prone to fingerprints and discoloration. The use of this material is picking up pace in the health sector and top-tier foodservice operations where the integrity of the material has a significant impact on the scores obtained in audits.

North America registers the leading market position due to compliance-driven upgrades and standardized procurement

North America remains the dominant regional kitchen faucets market due to consistent renovation activity and strict plumbing compliance standards. Institutional buyers emphasize certified products, warranty assurance, and supplier reliability. Manufacturers focus on modular designs and lead-free compliance to meet regional procurement expectations. Centralized purchasing among hospitality and healthcare operators supports stable demand. Supplier selection prioritizes service coverage and spare availability. These factors collectively sustain regional dominance. BLANCO, the premium kitchen solutions brand backed by industry-leading German engineering, offers two new metal faucet finishes including bold Matte Black and luxurious Satin Gold, since March 2022.

Growth of the Asia Pacific kitchen faucets market is supported by rapid expansion of commercial kitchens and infrastructure modernization. To handle large-scale foodservice operations, buyers are increasingly specifying durable, standardized faucet systems. Manufacturers expand their regional production and adapt their designs for different installation conditions. Operational scalability, rather than premium positioning, is the main driving factor of increased adoption. As regulatory frameworks become more established, the demand for faucet systems that are compliant and easy to service keeps increasing.

Prominent kitchen faucets market players are developing features such as sensor accuracy, modular internal designs, and material traceability to increase the number of long-term institutional orders. The development of standardized faucet platforms that facilitate maintenance in multi-site kitchens, thus mainly benefiting the hospitality, healthcare and education sectors, presents lucrative opportunities. In order to be able to provide shorter delivery times and more support services, manufacturers are equally creating region-specific manufacturing and service infrastructure.

Being focused on regulatory compliance, especially lead-free and water efficiency standards, is another significant point of attention, as these standards have a direct impact on procurement eligibility. As buyers are focused on lifecycle value analysis, kitchen faucet companies who can provide serviceable designs, upgradeable components, and reliable quality assurance are the ones who are gaining a competitive advantage.

Jaquar Group, a company founded in 1960 and located in India, is a major player in the kitchen faucets industry through its vertically integrated manufacturing and in-house component management. They focus on sensor-equipped faucets, high-precision cartridges, and modular platforms that can be easily scaled for residential and commercial projects.

LIXIL Corporation, established in 1949 and based in Tokyo, Japan, is a leading global company offering environmentally friendly and modular kitchen faucet systems. LIXIL Corporation innovates lead-free materials and localizes production to meet institutional buying requirements.

Founded in 1873, and with headquarters in Wisconsin, United States, Kohler Co. serves the kitchen faucet industry through the use of cutting-edge sensor calibration, digital control interfaces, and high-quality material development. The company emphasizes standardized internal components, easy servicing, and long product life.

Established in 1901 and based in Schiltach, Germany, Hansgrohe SE identifies with the kitchen faucets market through engineering-driven precision and ergonomic design. Hansgrohe SE emphasizes flow control precision, strongly built spray nozzles, and durable materials.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include Delta Faucet Company, Dornbracht GmbH & Co.KG, and Roca Sanitario, S.A., among others.

Unlock the latest insights with our kitchen faucets market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 6.80% between 2026 and 2035.

Stakeholders are investing in modular designs, strengthening compliance readiness, expanding regional manufacturing, improving service networks, and aligning product roadmaps with institutional procurement standards and lifecycle efficiency.

The increasing application of faucets in modernised kitchens and the growing customer preference toward modular kitchens are the key trends of the market.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Pull-down faucet, pull-out faucet, hands-free, bar faucets, pot filters, and with sprayer, among others are the types of faucets in the market.

The various installation types include deck mount and wall mount.

The major faucet holes in the market include one, two, three, and four.

The significant material types in the market are chrome, stainless steel, bronze, and plastic, among others.

The key players in the market include Jaquar Group, LIXIL Corporation, Kohler Co., Hansgrohe SE, Delta Faucet Company, Dornbracht GmbH & Co.KG, and Roca Sanitario, S.A., among others.

In 2025, the market reached an approximate value of USD 32.58 Billion.

Companies face challenges from tightening material regulations, sensor reliability expectations, skilled installer shortages, and buyer pressure for standardized products with lower maintenance risk across large kitchen networks.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Installation Type |

|

| Breakup by Faucet Holes |

|

| Breakup by Material Type |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share