Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global LED downlight market attained a value of USD 26.15 Billion in 2025. The market is projected to expand at a CAGR of 8.60% through 2035 to achieve USD 59.67 Billion by 2035. Integration of IoT-enabled controls and wireless lighting networks is fueling demand for smart LED downlights across commercial buildings and retail environments, transforming energy management into a digital, data-driven process.

The market is inclining toward personalization and automation trends, where lighting systems are evolving to adapt to human behavior and environmental conditions. In January 2025, Philips Hue introduced its first generative AI assistant in the Hue app, delivering personalized lighting scenes based on mood, occasion or style. This features embedded sensors and AI-based luminance control that automatically adjust brightness and color temperature according to real-time room occupancy and daylight intensity. Such an innovation, introduced across commercial and smart residential markets, reflects the company’s vision of merging energy efficiency with human-centric lighting.

Moreover, according to the latest 2022 United States Department of Energy report, approximately 56% of commercial buildings have not upgraded to LED Lighting, which further indicates ample opportunities for growth. Government initiatives such as the EU Green Deal and India’s UJALA program, which collectively distributed billions of LEDs, have significantly enhanced affordability and consumer trust in the technology, boosting the LED downlight market value.

Companies like Acuity Brands, Osram, and Cree Lighting are focusing on modular designs and connected ecosystems that enable remote configuration and predictive maintenance. For example, Acuity Brands offers nLight AIR SmartSense, a cloud-enabled downlight system that utilizes Bluetooth mesh networking to simplify installation and optimize lighting performance across multi-site facilities.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

8.6%

Value in USD Billion

2026-2035

*this image is indicative*

Governments and corporates are aggressively adopting intelligent lighting systems to improve operational efficiency. The United States Infrastructure Investment and Jobs Act allocates nearly USD 550 billion for smart city projects, including lighting modernization. Smart LED downlights with embedded sensors and connectivity are becoming foundational to these initiatives. As a response, in September 2022, Signify introduced a new app, called SpaceSense, that features and products for its WiZ smart lighting system to enhance users’ daily convenience. Moreover, the demand in the LED downlight market is shifting toward integrated ecosystems where downlights link with HVAC, occupancy, and daylight sensors, signaling a paradigm shift in building automation and real-time facility management for both public and private infrastructure projects.

Strict energy codes across the world are mandating the transition from fluorescent to LED-based luminaires. The EU’s Ecodesign Directive and California’s Title 24 building standards enforce minimum efficiency levels and lifecycle performance. These regulations have triggered accelerated retrofitting projects across commercial spaces, schools, and government buildings, surging the LED downlight market value. Manufacturers are focusing on producing Energy Star-certified downlights with extended lifespans and lower total cost of ownership. For example, in August 2023, GREEN CREATIVE introduced NYX, a series of downlights providing all the adaptability required for any new construction or renovation applications. Countries like South Korea are providing tax rebates for switching to LED downlights in industrial plants, further pushing adoption growth.

The aesthetic and spatial benefits of LED downlights have made them an ideal choice in commercial and residential settings. Architectural projects in Dubai, London, and New York are incorporating trimless, recessed, and micro-downlight solutions for seamless interior integration. Designers now collaborate directly with manufacturers to customize lumen output and color rendering for mood-based lighting. The LED downlight market trend toward biophilic and human-centric design is creating demand for downlights that mimic natural daylight cycles.

Innovations in thermal management are extending LED lifespan and performance stability. Manufacturers are introducing graphene-coated heat sinks and liquid cooling systems for high-output commercial downlights. These solutions enable compact fixtures with better heat dissipation, ensuring consistent illumination and color quality over time. For instance, Samsung’s thermal ceramic modules improved lumen maintenance significantly. Such advancements are vital for installations in high-ceiling environments like airports and convention centers, where maintenance is costly.

The retrofit market is seeing accelerated growth as global governments push for carbon-neutral building operations. Older halogen and CFL-based fixtures are being systematically replaced with LED downlights compatible with existing fittings. Simultaneously, a circular economy approach is gaining momentum, creating new LED downlight market opportunities. Companies are designing modular LED fixtures with replaceable optics and drivers, reducing electronic waste. European manufacturers like Signify and Zumtobel offer “lighting-as-a-service” contracts, allowing customers to pay per lumen.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global LED Downlight Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type

Key Insight: The LED downlight market scope spans across fixtures, modules, and lamps, each serving distinct consumer needs. Fixtures dominate with their blend of form and efficiency, while modules lead innovation through miniaturization and connectivity. LED lamps continue to serve retrofit markets seeking immediate energy savings. These product categories form a versatile ecosystem balancing performance, design adaptability, and integration potential.

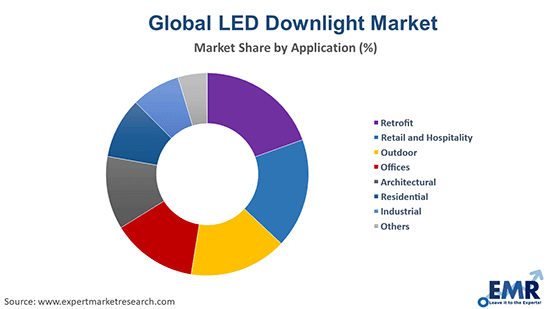

Market Breakup by Application

Key Insight: The LED downlight market caters to diverse applications, from commercial retrofits and residential projects to hospitality, industrial, and outdoor environments. Commercial retrofits dominate due to infrastructure modernization and corporate ESG commitments, while residential growth stems from the smart home revolution. Industrial and outdoor markets benefit from durable, high-lumen fixtures built for performance and safety. Meanwhile, hospitality and architectural projects prioritize aesthetic lighting control.

Market Breakup by Region

Key Insight: The Asia Pacific LED downlight industry leads in production and large-scale deployment, while North America dominates innovation in intelligent control systems. Europe emphasizes sustainability standards under its Green Deal, and Latin America shows steady retrofit adoption. The Middle East and Africa are emerging through large urban and hospitality projects.

By product type, fixtures dominate the market due to design flexibility and longevity

LED fixtures dominate due to their design adaptability, integrated optics, and enhanced efficiency. Advanced fixture designs are enabling architectural customization, combining aesthetic value with functionality in modern interiors. In August 2025, Access Fixtures, a leader in commercial and industrial lighting solutions, announced the launch of the LECI 28 LED Dock Light. These systems often feature adjustable beam angles and smart dimming capabilities, aligning with the rising demand for ambient, task, and accent lighting in both commercial and high-end residential projects.

LED modules, on the other hand, are swiftly expanding their LED downlight industry revenue share due to their compactness and easy integration with IoT systems. These modular components allow manufacturers to customize light output, shape, and performance for varied applications. They are increasingly being used in smart lighting grids and retrofitting projects, particularly where space or heat constraints are present. The flexibility to integrate Bluetooth Mesh or Zigbee technology directly within modules has boosted their adoption across next-gen commercial installations.

By application, commercial retrofit leads the market due to infrastructure modernization

Retrofit applications lead the market’s growth curve as offices, retail stores, and public buildings increasingly replace legacy lighting systems. Retrofits minimize installation costs while enhancing energy performance, aligning with government efficiency mandates. The United States General Services Administration’s ongoing modernization of federal facilities includes replacing fixtures with LED downlights. Building owners also view LED retrofits as an immediate method to meet carbon disclosure and ESG targets.

The residential sector is witnessing the fastest growth as smart home adoption accelerates. Consumers prefer LED downlights for their aesthetics, low heat emission, and compatibility with home automation systems like Alexa or Google Home. According to the LED downlight market analysis, the installed base of smart street lights amounted to 23.0 million globally at the end of 2022. This showcases strong penetration. Homebuilders now integrate energy-efficient LEDs into new constructions to meet green certification standards such as LEED.

Asia Pacific dominates the market due to urban construction surge

Asia Pacific dominates the LED downlight market, backed by rapid urbanization and large-scale infrastructure spending. China and India account for a major share, with public housing and smart city initiatives driving installations. The region’s manufacturers are integrating local production advantages and exporting cost-efficient smart fixtures. Urban infrastructure projects, such as India’s Smart Cities Mission and China’s green building policies, emphasize energy-efficient lighting standards.

The LED downlight market in North America is witnessing fast-paced growth driven by digitalization in building management systems. The United States and Canada are integrating IoT-enabled LED downlights within smart office and retail networks to optimize energy consumption. For example, in August 2025, Fluxwerx launched Speak, a latest addition to their collection of LED luminaires for commercial, institutional, retail, hospitality and residential environments. With sustainability mandates and carbon-neutrality goals, companies are actively upgrading lighting infrastructure. Technological maturity and strong R&D capabilities among firms like Cree Lighting and Acuity Brands further foster rapid product innovation.

Majority of the LED downlight companies are competing on smart-control ecosystems, end-to-end lighting-as-a-service contracts and low-waste modular designs that extend fixture life. Unique opportunities are arising from partnerships with utilities for demand-response programs, and with architects for specification-grade tunable-white solutions in healthcare and education. Manufacturers are investing in advanced phosphors, micro-optics, and novel thermal substrates like graphene to improve efficacy while shrinking form factors.

Mid-tier LED downlight market players are differentiating through regional service networks and quick-replacement modules that lower maintenance costs for stadiums and airports. Private equity is consolidating fragmented regional suppliers to build national fulfillment capabilities. Firms focusing on circularity, IoT integration, and spec-grade partnerships are best positioned to capture growing retrofit and smart-buildings spend.

ELCO Lighting was established in 1991 and is headquartered in Los Angeles, California. It is supplying architectural-grade downlights and integrated systems focusing on performance and ease of installation. ELCO is innovating with magnetic trim retrofit kits and quick-connect modular drivers to reduce onsite labor. The firm serves electrical distributors, contractors and specifiers by offering extended warranty programs and BIM-compatible product libraries.

Nora Lighting was founded in 1989 and is headquartered in the United States. Nora is focusing on specification-grade downlights and specialty trims for hospitality and retail. It provides rapid prototyping services and custom color-rendering solutions for high-end projects. The company is deploying micro-optic lens arrays and tunable white modules to meet designer specifications.

JESCO Lighting Group LLC was established in 1998 and is headquartered in New York, United States. JESCO specializes in commercial downlight fixtures, linear solutions and integrated lighting systems for large projects. The group is advancing with proprietary micro-LED modules and high-efficiency drivers optimized for continuous-dimming. It supports contractors with distribution, technical specification teams, and on-site commissioning services.

DMF Lighting was founded in 1988 and is headquartered in the United States. DMF supports lighting designers and contractors with rapid sample programs and detailed photometric data packages. Currently they are focusing on architectural downlights, track modules and spec-grade retrofit solutions. The company is innovating with ultra-thin form factors, field-replaceable optics and wireless driver integration.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Unlock the latest insights with our global LED downlight market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

Connected LED Lighting And IoT Demand

Architectural And Hospitality LED Downlighting

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 26.15 Billion.

The market is projected to grow at a CAGR of 8.60% between 2026 and 2035.

The market is estimated to reach a value of about USD 59.67 Billion by 2035.

Manufacturers are investing in modular designs, integrating IoT and analytics, forming utility partnerships, offering lighting-as-a-service, and piloting circular warranty and replacement programs nationwide, and training installers.

Smart lighting integration, energy-efficient retrofits, modular designs, human-centric illumination, and IoT-enabled controls are transforming the global LED downlight market landscape.

North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa are the leading regions in the market.

The significant applications of LED downlight are retrofit, retail and hospitality, outdoor, offices, architectural, residential, and industrial.

The key players in the market include ELCO Lighting, Nora Lighting, JESCO Lighting Group LLC, DMF Lighting, and others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share