Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global machine tools market size reached a value of almost USD 142.20 Billion in the year 2025. The industry is further expected to grow at a CAGR of 5.40% between 2026 and 2035 to reach a value of almost USD 240.61 Billion by 2035.

Base Year

Historical Period

Forecast Period

Machine tools are widely used in the automotive industry to manufacture high-precision components like transmissions, engines, and chassis. Hence, the growing automotive production is boosting the machine tools market revenue. In 2022, automotive production reached 85.4 million around the world. As the sector shifts towards more diverse vehicle offerings, the demand for machine tools that can switch between different production types without long setup times is increasing.

The production of medical devices such as surgical instruments, implants, and diagnostic tools requires high-precision machine tools to ensure their safety, reliability, and optimal functioning. With governments and organisations increasingly boosting the production of medical devices amid the rising prevalence of health issues, the demand for machine tools is rising. For instance, in March 2024, the Indian government inaugurated 27 new Bulk Drug Park projects and 13 Manufacturing Plants for medical devices under the PLI Scheme.

With manufacturers increasingly implementing smart manufacturing to reduce costs and improve efficiency, there is a growing demand for machine tools equipped with advanced capabilities such as sensors, IoT connectivity, AI, and automation. Reportedly, around 24% of manufacturers worldwide had implemented smart manufacturing by 2020. The increasing shift towards smart manufacturing is expected to prompt key players to develop flexible machine tools that can handle a wide range of products with minimal changeover times.

Compound Annual Growth Rate

5.4%

Value in USD Billion

2026-2035

*this image is indicative*

The global machine tools market is driven by automated and high-precision equipment. The Asia Pacific region is the leading regional market in the industry globally. A major trend driving the industry includes the growing automation of tasks varying from material handling to tool changing. The emphasis has also shifted toward the creation of interconnected systems and user-friendly software that facilitate users to include additional characteristics and specifications in the final product.

Growing demand for high-precision machine tools; advancements in CNC software; rising trend of automation; and increasing emphasis on sustainability are favouring the machine tools market expansion.

Evolving manufacturing technologies and the rising demand for precise and complex components across different sectors, ranging from automotive to consumer goods, are driving the demand for high-precision machine tools. Such tools boast enhanced accuracy, reduce operational costs and material waste, facilitate shorter production times, and optimise workflow.

Advancements in CNC software aimed at enabling better tolerance and higher precision in machining processes, minimising deviations in part dimensions, and minimising the risk of human errors are fuelling the market. Moreover, advanced CNC software incorporates tool management systems to enable manufacturers to monitor wear, track tool usage, and predict the maintenance needs of tools.

Amid the growing demand for mass production of components with complex geometries and fine lines, manufacturers are integrating technologies such as the Internet of things (IoT) and artificial intelligence (AI) in machine tools to automate repetitive tasks and enable faster production times. Automation of machine tools also ensures consistent product quality, lowers labour costs, and facilitates predictive maintenance.

The growing focus on sustainability is shaping the machine tools market trends and dynamics. Energy-efficient machine tools that minimise material waste during production processes are gaining significant popularity. Besides, manufacturers are increasingly utilising eco-friendly materials, including bio-based lubricants and recyclable components, in machine tools to reduce their carbon footprints.

Machine tools are the stationary, power-driven equipment used for cutting or forming metals or any other hard materials. They usually shape the workpiece by eliminating the extra material and help in performing operations like drilling, abrading, grinding, and nibbling. The advanced and modern machine tools are numerically, or computer-controlled, which improves the product uniformity and decreases the human interaction required in the process. At present, an extensive range of the product are present in the market, extending from small workbench mounted instruments to large devices.

Market Breakup by Tool Type

Market Breakup by Technology Type

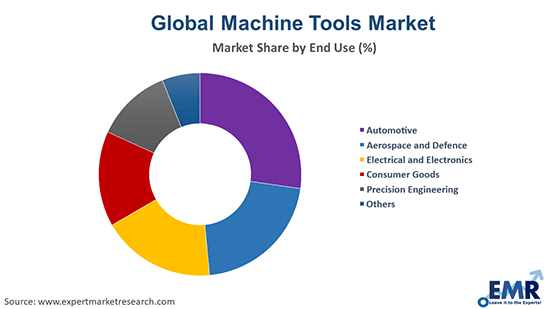

Market Breakup by End Use

Market Breakup by Region

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The global machine tools market is driven by the extensive applications of the product within industries such as automotive, electronics, aerospace, and precision engineering. This can be ascribed to the fact that machine tools are used in the manufacturing of durable goods and other machines. The market is further aided by the rapid development in these industries. Further, the initiation of advanced processes such as ultrasonics, high-pressure water jets, lasers, and plasma streams in machine tool applications has helped in increasing the speed and precision of the machining process. In addition to this, consumers are shifting toward automated higher-end technologies with improved performance, accuracy, and stability. These factors are expected to influence the market growth positively.

Key machine tools market players are leveraging Industry 4.0 technologies to enhance the connectivity and automation of machine tools. Machine tools companies are also continuously innovating to develop advanced machine tools that can easily adapt to multiple environments.

Allied Machine & Engineering Corp., headquartered in Ohio, United States, and established in 1941, is a prominent manufacturer of finishing and holemaking cutting tool systems. The company leverages advanced manufacturing and engineering technologies to develop innovative value-added tooling solutions for use in metal-cutting industries.

TRUMPF, founded in 1923 and headquartered in Ditzingen, Germany, is a company that offers production solutions in the laser, machine tools, as well as electronics sectors. Its machine tools are used in industrial lasers and flexible sheet metal processing. Boasting 19,018 employees, the company generated a revenue of EUR 5,172.5 million in FY 2023/24.

Falcon Machine Tools Co., Ltd., established in 1978 and headquartered in Kaohsiung City, Taiwan, is an innovative CNC machine manufacturer. Its product portfolio includes Production CNC Grinder, Linear Motor Drive Grinder, Double Column Grinding Machine, Surface and Profile CNC Grinder, and Fully Auto Surface Grinder, among others. The company is publicly traded on the Taiwan Stock Exchange.

Okuma America Corporation, founded in 1898 and headquartered in North Carolina, United States, is a sales and service affiliate of Okuma Corporation, a prominent manufacturer of CNC machine tools as well as automation and control systems. The company designs its CNC controls that can seamlessly integrate with each machine tool's functionality.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the machine tools market include General Technology Group Dalian Machine Tool Corporation, DMG MORI, AMADA Co., Ltd., Mazak Corporation, and Doosan Machine Tools, Co. Ltd., among others.

United States Machine Tools Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global machine tools market attained a value of nearly USD 142.20 Billion.

The market is projected to grow at a CAGR of 5.40% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 240.61 Billion by 2035.

The major drivers of the market are the growing demand for high-precision and automated equipment, rapid urbanisation and industrialisation, and growing technological advancements.

The key trends guiding the growth of the market include the development of interconnected systems and the growing shift towards automation.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Metal cutting, metal forming, and accessories are the different tool types in the market.

The various end uses of the product are automotive, aerospace and defence, electrical and electronics, consumer goods, and precision engineering, among others.

The major players in the global machine tools market are Allied Machine & Engineering Corp., General Technology Group Dalian Machine Tool Corporation, DMG MORI, Falcon Machine Tools Co., Ltd., AMADA Co., Ltd., Mazak Corporation, TRUMPF, Doosan Machine Tools, Co. Ltd., and Okuma America Corporation, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Tool Type |

|

| Breakup by Technology Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share