Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global milk protein concentrate market is aided by the global milk market, which is likely to grow at a CAGR of 2.50% in the forecast period of 2026-2035.

Base Year

Historical Period

Forecast Period

In 2022, around 930 million tonnes of milk were produced across the world, which offered ample opportunities for milk protein concentrates (MPC).

India is the largest producer of milk in the world, offering a positive market for the MPC market players.

Milk protein concentrates are high in protein and low in lactose, which makes them suitable for use in protein-fortified foods and beverages.

Compound Annual Growth Rate

2.5%

2026-2035

*this image is indicative*

The rising demand for protein is aided by the rising demand from consumers, especially sports enthusiasts. The growing population of lactose intolerant consumers has been boosting the growth of the industry and is likely to continue driving the market growth in the coming years as well. The growth in the health-conscious population all over the world is contributing to an increase in the adoption of healthier lifestyles and further aiding the growth of the milk protein concentrate market.

As a result, the purchasing of sports nutritional goods, protein-rich foods and beverages including dietary supplements and ready-to-eat foods is propelled further. The increase in the intake of these food items would increase the demand for these concentrates as these are used in the preparation of dietary supplements and sports supplement products.

Innovations in Dairy Processing Technology

Dairy processing techniques such as ultra-filtration have made it easier to extract higher concentrations of protein from milk. In this technique, separation is done based on molecule size and chemical interaction, which makes it easy for the market players to separate MPC of different protein concentrations. For instance, Fonterra announced that it has been driving innovations in its milk protein technology to develop higher protein content products such as MPC products without any change in taste or texture.

As per the milk protein concentrate industry analysis, Milk production in the world is projected to increase by 177 million tonnes by 2025, which is also expected to increase dairy-based products such as milk protein concentrates and allow market players to invest in innovative processing technologies for producing MPC with unique protein content as per their requirements.

High Demand for Protein-Fortified Food Products

The growing health consciousness has boosted the demand for protein-enriched foods and beverages. There is a rise in gym culture and demand for weight management and weight loss that can contribute to the milk protein concentrate market value. For instance, the fitness sector is expected to generate a revenue of around 434.74 billion by 2028, with the gym sector expected to account for around 30% of its total share by 2028. The digital fitness content reached a value of 10.7 billion by the end of 2021, amid the pandemic as several people decided to dedicate their free time to improving their health.

These factors led to the increased usage of MPCs in sports nutrition and functional foods as they aid muscle recovery and can sustain energy after rigorous workout sessions. Moreover, it is recommended that an athlete’s diet should have around 15 to 25% of protein content, which boosts demand for protein-fortified food products.

June 2024

Steadfast Nutrition, a leader in performance and wellness nutrition, announced the launch of three new supplements, Whey Protein, LIV Raw, and a vegetarian Multivitamin mega pack of 180 tablets, to its lineup.

April 2024

Z Natural Foods, a provider of natural and organic foods, announced the launch of Chocolate Caramel Cappuccino Whey Protein Concentrate, which is sourced from grass-fed cows.

There has been an increased demand for minimally processed MPC products due to the trend of sustainability and clean labelling, which increases the milk protein concentrate market revenue. For instance, Fonterra announced that it aims to reduce its on-farm emissions by 30% by 2030 as part of its sustainable initiatives in dairy production. Moreover, the Dairy Sustainability Framework (DSF) monitors the environmental, social, and economic progress of the dairy sector to ensure it follows the socio-economic and sustainability goals.

A survey conducted by the Daily Reporter on over 100,00 consumers from 3 global markets revealed that 78% of the consumers are willing to pay more for food and beverages which claim to be all-natural. There was also a 40% rise in the purchase of natural packaged food and drinks in 2023 compared to 2020, which indicates a flourishing market for clean-labelled and natural dairy products, including MPC.

The production of milk protein concentrate, especially with higher protein levels involves the use of high-end processes such as ultra-filtration and spray drying which are costly and energy-intensive, eventually leading to high prices of the MPC products. The complexity of the protein extraction process may also drive up the price of production as well as the end-product, affecting the overall milk protein concentrate demand forecast.

Any fluctuations in raw milk prices also have a direct impact on the price of MPCs. Climate change and supply chain disruptions are leading to volatility in dairy prices. For instance, as per the Food and Agriculture Organisation of the United Nations, the international price quotations for all dairy products witnessed an increase in August 2024, with the price of whole milk powder rising the most due to a surge in import demand. The price of dairy inputs such as fertiliser and feed were also volatile in 2021-2022, eventually affecting the price of MPCs.

Lactose-free MPC products have gained prominence in recent years due to the rise of lactose intolerance among consumers. Lactose intolerance is a very common condition with around 65 percent of the people having a reduced ability to digest lactose after infancy. This condition is most common in people of East Asian descent, with around 70 to 100 per cent of people affected in these regions, which boosts the demand for lactose-free MPC products.

As per the milk protein concentrate market dynamics and trends, several market players such as Valio are readily offering lactose-free MPCs that can be used for making high-protein products which offer better digestive comfort and all the benefits of milk’s natural whey and casein proteins and amino acids, standing out amongst their competitors.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

"Milk Protein Concentrate Market Report and Forecast 2026-2035" offers a detailed analysis of the market based on the following segments: Milk Protein Concentrate (MPC) is any form of concentrated milk product containing about 40–90% milk protein. MPC contains micellar casein, whey proteins and bioactive proteins in the same milk ratio. As the protein content of MPC grows, the lactose level decreases. This high-protein low-lactose ratio makes MPC an ideal ingredient for protein fortified drinks and snacks and low-carbohydrate foods.

Based on nature, the industry can be divided into:

The form of the product can be divided into the following:

The type of the product can be segmented as follows:

Based on preparation method, the industry can be categorised into:

It finds wide applications in the following:

The distribution channels can be divided into:

The regional markets for milk protein concentrate can be divided into:

By Nature Insights

The powder form holds the largest milk protein concentrate market share in the industry owing to its long shelf life, ease of transportation, and versatility which makes it popular in several food and beverage applications. For instance, the powder can be widely used in the production of dairy products, nutritional supplements, and processed foods.

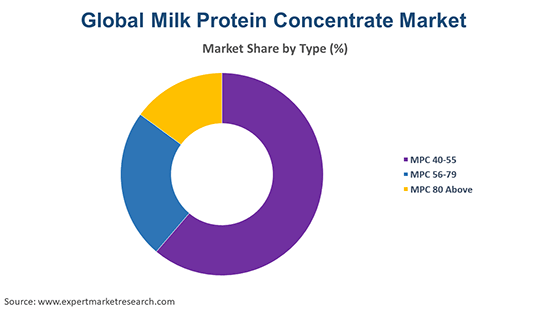

By Type Insights

The MPC 80 above segment holds the largest market share and boosts the milk protein concentrate demand owing to the rising demand for MPC with 80% or more protein in applications which require a concentrated protein source such as sports nutrition products, protein supplements, and formulations aimed at high-protein foods.

By Preparation Method Insights

Ultra-filtration accounts for a major share and boosts milk protein concentrate demand growth when compared to co-precipitation and other methods as this preparation method allows for a more efficient and selective separation of proteins from other components of milk, such as lactose and minerals while maintaining the nutritional integrity of the proteins.

By Application Insights

Dairy products account for a substantial share of the market and increase the milk protein concentrate industry revenue as Milk protein concentrate (MPC) is widely used in the dairy sector because it enhances the protein content of products such as cheese, yoghurt, and milk-based drinks, among others, while maintaining their original flavour and texture. It is also favoured for enhancing the nutritional value of several dairy items.

By Distribution Channel Insights

Hypermarkets and supermarkets are gaining prominence in the market due to factors such as wide availability, variety of product choices, and convenience. These retail formats offer a wide range of protein-enriched dairy items, dietary supplements, and sports nutrition products that contain milk protein concentrate.

North America Milk Protein Concentrate Market Trends

North America is currently leading the global industry for milk protein concentrate. It is likely to dominate the global market in the forecast period as well. The growth can be attributed to the rising population in the region which is leading to increased consumption. With the growth of the sports industry in the region, the rising demand for demand for sports and nutritional supplements is likely to boost the growth of the industry.

The rising trend for fitness and health consciousness among consumers is propelling the milk protein concentrate market opportunities in the region. For instance, as per the Move To Be Well: The Global Economy of Physical Activity report, US consumers spend more on physical activity than any other country in the world.

Asia Pacific Milk Protein Concentrate Market Outlook

The growth in the population of working women, the growth in birth rates in the region, and the rising recognition among parents of the nutritional benefits of infant formula are leading to the increased demand for infant formula. For instance, more than half of births across the world take place in Asia with 25 million births in India and 16 million births in China every year, creating a lucrative demand of milk protein concentrate market. These concentrates are used as additives in baby formula for the proper growth of children by fulfilling their nutritional needs. The rise of the infant formula market is one of the main factors that will boost the market growth of milk protein concentrates in the coming years.

Europe Milk Protein Concentrate Market Growth

The market growth in Europe is driven by a growing demand for high-protein functional foods and beverages such as nutritional supplements, sports nutrition, and dairy-based foods, among others. The regulatory environment in Europe further supports high-quality production standards in sectors such as MPC and affects the milk protein concentrate market expansion.

For instance, under the General Food Law Regulation (EC) No. 178/2002, the market players ensure that their products meet stringent safety and hygiene standards. Regulation (EC) No. 852/2004 on Food Hygiene further ensures that best hygiene practices are followed in MPC production throughout their life cycle to offer the best quality of food products to consumers.

Middle East and Africa Milk Protein Concentrate Market Drivers

The growth of the milk protein concentrate industry in the region is driven by increasing awareness of nutrition and wellness and a rise in disposable incomes. Countries such as Saudi Arabia and South Africa are witnessing a rise in demand for high-protein functional food products. For instance, the milk production in Saudi Arabia reached around 2,849,957 thousand tonnes in 2022.

Furthermore, the General Authority for Statistics (GASTAT) stats stated that the percentage of adults who practice physical activity increased by at least 150 minutes per week during the year 2021, which can fuel the demand for functional food products including MPC.

Latin America Milk Protein Concentrate Market Dynamics

Rapid urbanisation and the rise of the middle class are boosting the demand for packaged goods and protein-enriched products such as MPC products in the region. Brazil and Mexico have emerged as the prominent countries in the region with growing consumer awareness of health and nutrition which boosts the milk protein concentrate market development.

For instance, in 2021, the South and Southeast regions of Brazil produced about 67% of the country's milk, offering lucrative opportunities for the production of dairy-based products. The milk production in the country was also expected to grow by 3.6 per cent to reach 24.5 MMT.

Startups are increasingly exploring the growing demand for plant-based protein alternatives to stand out in the market. Although these companies do not directly compete with traditional companies in the market, many are producing plant-based concentrates that mimic the protein content and functional characteristics of milk protein. This effort in the milk protein concentrate market aligns with consumer trends favouring plant-based diets and sustainability. A number of startups are also focusing on specific niches within the market, such as high-protein products designed for athletes or medical nutrition.

Perfect Day

Perfect Day is a biotechnology startup that offers animal-free dairy proteins such as milk protein concentrate, through precision fermentation technology. This method mimics the proteins present in cow's milk without taking them from cows, positioning their company as a compelling choice for environmentally-conscious consumers and businesses aiming to minimise their carbon emissions.

TurtleTree Labs

TurtleTree Labs is a cell-based food technology startup focused on creating lactose-free and animal-free milk proteins, including milk protein concentrates, by use of cell cultivation methods. Their advanced technology enables the production of milk components that offer the same nutritional advantages as conventional dairy while addressing both environmental and ethical issues.

The report gives a detailed analysis of the following key players in the global milk protein concentrate market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds. Major dairy companies are focusing on expanding their range of milk protein concentrates to meet the increasing demand for high-protein products. They are producing MPC with varying protein concentrations, typically between 40% and 90%, for use in sports nutrition, infant formula, and functional food products, among others.

Fonterra, a global dairy company based in New Zealand, is owned by around 10,000 farmers. It is one of the world's leading dairy exporters, providing a wide range of products such as milk powders, butter, and cheese.

Located in Leppersdorf, it is a German dairy company that is part of the Müller Group. It is known as one of the largest and most technologically advanced dairy facilities in Europe.

The LACTALIS Group, a French multinational corporation, is the largest dairy products provider in the world. It produces a wide variety of dairy goods such as cheese, milk, butter, and cream, among others.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other market players are Glanbia PLC and Kerry Group, among others.

The comprehensive EMR report provides an in-depth assessment of the milk protein concentrate market based on the Porter's five forces model along with giving a SWOT analysis.

November 2023

Valio, a Finnish dairy company, announced the launch of Eila MPC 65, a new milk protein concentrate (MPC), which offers its applications in ice-cream and other desserts.

November 2023

FrieslandCampina Ingredients announced the launch of Nutri Whey ProHeat, a heat-stable whey protein, which can be used for patient recovery after treatment.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The global milk protein concentrate market is aided by the global milk market, which is likely to grow at a CAGR of 2.50% in the forecast period of 2026-2035.

The major industry drivers are rising health awareness, growing population, and the rising demand from the application sectors, especially the sports enthusiasts.

The key trends in the market are growing population of lactose intolerant consumers and purchasing of sports nutritional goods, protein-rich foods and beverages including dietary supplements and ready-to-eat foods.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific, with North America accounting for the largest share in the market.

Based on nature, the industry can be divided into powder and liquid.

MPC 40-55 is the dominant type in the industry.

The production methods include co-precipitation and ultra-filtration, among others.

The application sectors include dietary supplements, dairy products, infant formula, emulsifier, sports nutrition, and bakery and confectionary, among others.

The distribution channels can be divided into hypermarket and supermarket, convenience store, special store, and online, among others.

The major players in the industry are Fonterra Co-Operative Group Limited, Sachsenmilch Leppersdorf GmbH, LACTALIS Group, Glanbia PLC, and Kerry Group, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Nature |

|

| Breakup by Form |

|

| Breakup by Type |

|

| Breakup by Preparation Method |

|

| Breakup by Application |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share