Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global minimally invasive surgery market was valued at USD 88.90 Billion in 2025, driven by the growing incidences of cardiovascular and other diseases coupled with the rising demand for surgical procedures allowing faster recovery across the globe. The market is anticipated to grow at a CAGR of 12.10% during the forecast period of 2026-2035 to achieve a value of USD 278.59 Billion by 2035.

Base Year

Historical Period

Forecast Period

The market is expected to expand significantly due to growing demand for quicker recovery times, reduced risk of complications, and improved patient outcomes, driving its widespread adoption.

Advancements in robotic surgery, augmented reality, and 3D imaging technologies are transforming MIS, enabling greater precision, enhanced outcomes, and expanding the range of surgeries suitable for minimally invasive procedures.

Increasing healthcare awareness, coupled with the rising prevalence of chronic conditions, is fueling the demand for MIS procedures, contributing to the market’s growth by offering less painful, cost-effective treatment alternatives.

Compound Annual Growth Rate

12.1%

Value in USD Billion

2026-2035

*this image is indicative*

Minimally invasive surgery (MIS) involves surgical procedures that use small incisions, specialised instruments, and advanced technology such as cameras and robotic systems, reducing the need for large cuts. This approach aims to minimise patient discomfort, reduce recovery time, and lower the risk of infection. Commonly used for procedures like laparoscopy, arthroscopy, and endoscopy, MIS is employed in various medical fields including orthopaedics, urology, and gynaecology. The primary benefits include quicker healing, less scarring, and shorter hospital stays, improving overall patient outcomes and satisfaction.

Innovations in Embolization Systems to Drive Market Growth

In March 2024, CERENOVUS Inc. launched the TRUFILL n-BCA Liquid Embolic System Procedural Set, a new addition to its hemorrhagic stroke portfolio. This procedural set includes two configurations and the necessary accessories to prepare and deliver the n-BCA liquid embolic system, all sterilised within one set, streamlining the preparation process for physicians. This embolization system is used for pre-surgical devascularisation, reducing bleeding risks in surgery, and making inoperable arteriovenous malformations (AVMs) operable. The TRUFILL system offers lower fluoroscopy times and potential procedural cost reductions compared to competitors, with customisable solutions for individual patients. The system also boasts a lower incidence of microcatheter retention. These improvements in both safety and cost-efficiency will further fuel the adoption of embolization techniques in minimally invasive surgeries, significantly contributing to market growth during the forecast period.

Miniaturized Robotic Surgery Systems to Boost Minimally Invasive Surgery Market Demand

In February 2024, Virtual Incision Corporation received FDA marketing authorisation for its MIRA Surgical System, the first miniaturised robotic-assisted surgery (miniRAS) device designed for adults undergoing colectomy procedures. MIRA was approved through the FDA’s De Novo Classification process, intended for devices that have no legally marketed predicate. The FDA approval was based on results from the company’s U.S. Investigational Device Exemption (IDE) clinical study, which showed the system’s efficacy. MIRA is designed to assist with minimally invasive surgeries by enabling smaller incisions, reduced recovery times, and improved precision. This development in robotic surgery technology will enhance the overall performance and efficiency of minimally invasive surgeries, marking a significant advancement that is expected to drive continued growth in the market, particularly in colorectal surgeries, during the forecast period.

The market is witnessing several trends and developments to improve the current scenario. Some of the notable trends are as follows:

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Minimally Invasive Surgery Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Product

Market Breakup by Application

Market Breakup by End User

Market Breakup by Region

Endoscopy Devices to Lead the Product Segment

Endoscopy devices are poised to hold a substantial market share based on product. As per the analysis by Expert Market Research, the global endoscopy devices market is expected to grow at a CAGR of 6.2% during the forecast period of 2025-2034. The growing preference for minimally invasive procedures, driven by factors such as reduced recovery times and lower risk of complications, has significantly boosted demand for endoscopy devices. The continuous advancements in technology, such as high-definition imaging and 3D visualization systems, are enhancing their efficacy and precision. As healthcare providers increasingly adopt minimally invasive techniques in various surgeries, the endoscopy devices segment is expected to dominate, with continued growth in both diagnostic and therapeutic applications driving the market in the forecast period.

Cardiovascular Surgery to Hold a Significant Minimally Invasive Surgery Market Value for the Application Segment

Cardiovascular surgery is projected to hold the largest market share within the application segment. The increasing prevalence of cardiovascular diseases (CVDs), coupled with the rising demand for less invasive procedures, positions cardiovascular surgeries as a significant growth driver. As per the analysis by Expert Market Research, the global cardiovascular stents market is expected to grow at a CAGR of 4.80% during the forecast period 2025-2034. Minimally invasive techniques in cardiac surgery, such as catheter-based interventions and endovascular procedures, offer reduced recovery time, lower risk of infection, and improved patient outcomes. As technological advancements in imaging and surgical tools continue, the cardiovascular surgery segment is set to experience substantial growth, contributing significantly to the overall market expansion.

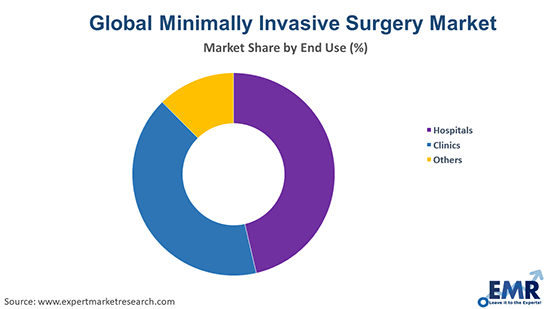

Hospitals and Clinics to Lead the Minimally Invasive Surgery Market by End User Segment

Hospitals and clinics are set to hold the largest market share by end user. These healthcare facilities continue to adopt minimally invasive procedures due to their benefits of quicker recovery times and reduced complications. The increasing demand for minimally invasive surgeries in hospitals and clinics is driven by advancements in surgical technology, better patient outcomes, and the growing burden of chronic diseases. As more procedures move from traditional to minimally invasive methods, this segment will remain dominant, further propelling the market’s growth in the forecast period, particularly as surgical capacities expand globally.

North America is poised to hold the largest share of the market, driven by advanced healthcare infrastructure, high adoption of robotic-assisted procedures, and increasing demand for outpatient surgeries. The region benefits from strong reimbursement policies and continuous innovations in laparoscopic and robotic technologies, making MIS more accessible. Meanwhile, Europe is experiencing growth due to rising geriatric populations and technological advancements. The Asia Pacific market is expanding rapidly with increasing medical tourism and healthcare investments. Latin America and the Middle East & Africa show steady growth, primarily driven by improving healthcare facilities and rising awareness of minimally invasive techniques. North America’s leadership is expected to persist due to sustained technological advancements and strong market investments.

The key features of the market report comprise patent analysis, grants analysis, funding and investment analysis, and strategic initiatives by the leading players. The major companies in the market are as follows:

Founded in 1941 and headquartered in Michigan, USA, Stryker Corporation is a global leader in medical technology, specialising in minimally invasive surgery (MIS). The company offers advanced surgical instruments, endoscopic systems, and robotic-assisted technologies, including the MAKO robotic-arm-assisted platform for orthopaedic procedures. For instance, In August 2024, Stryker announced a definitive agreement to acquire Vertos Medical Inc., a provider of minimally invasive solutions for chronic lower back pain caused by lumbar spinal stenosis. This acquisition strengthens Stryker’s MIS portfolio, enhancing patient outcomes by offering innovative, less invasive treatments that improve mobility, reduce recovery times, and address the growing demand for advanced spinal care solutions.

Conmed Corporation, established in 1970 and headquartered in New York, USA, specialises in medical devices for minimally invasive surgery. The company provides a comprehensive range of products, including arthroscopy, electrosurgery, endoscopic instruments, and surgical visualisation technologies. Conmed’s advanced solutions cater to orthopaedics, gastroenterology, and general surgery, supporting surgeons with precise and efficient tools. With a strong emphasis on innovation and surgeon-centric designs, the company continuously develops new technologies to enhance procedural outcomes and patient recovery, strengthening its position in the global minimally invasive surgery market.

Intuitive Surgical Operations, Inc., founded in 1995 and headquartered in California, USA, is a leader in robotic-assisted minimally invasive surgery. Renowned for its da Vinci Surgical System, the company enhances precision in urology, gynaecology, and general surgery, improving patient outcomes through reduced invasiveness and faster recovery. In June 2024, Intuitive (NASDAQ: ISRG) announced FDA clearance for a labelling revision on da Vinci X and Xi for radical prostatectomy. This approval was based on real-world evidence (2007–2014) showing comparable five- to 10-year survival rates between robotic-assisted and non-robotic radical prostatectomy, reinforcing Intuitive’s role in advancing surgical innovation.

Founded in 1997 and headquartered in California, USA, NuVasive, Inc. is a leading medical device company specialising in minimally invasive spine surgery. The company is renowned for its advanced spinal implants, neuromonitoring systems, and robotic-assisted surgical solutions, particularly in lateral access spine procedures. In November 2022, NuVasive expanded its portfolio with the launch of the NuVasive Tube System (NTS) and Excavation Micro, enhancing minimally invasive solutions for TLIF and decompression. Its flagship XLIF® procedure has revolutionised spinal surgery by reducing tissue disruption and recovery times. Committed to innovation, NuVasive continues advancing spinal alignment technologies, improving patient outcomes, and transforming spine surgery globally.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include Fortimedix Surgical B.V., Microline Surgical Inc., Arthrex, Inc., Eximis Surgical, Inc., and Cirtec Medical Corporation.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Application |

|

| Breakup by End User |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 3,299

USD 2,969

tax inclusive*

Single User License

One User

USD 5,499

USD 4,949

tax inclusive*

Five User License

Five User

USD 6,999

USD 5,949

tax inclusive*

Corporate License

Unlimited Users

USD 8,199

USD 6,969

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share