Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global moulded pulp packaging market reached a value of approximately USD 4.14 Billion in 2025. The market is projected to grow at a CAGR of 4.00% between 2026 and 2035, reaching a value of around USD 6.13 Billion by 2035.

Base Year

Historical Period

Forecast Period

China's consumer electronics market achieved total retail sales of USD 305 billion in 2023.

In FY23, India's domestic electronics production was valued at $101 billion.

Data from the UK Government indicates 2,400 hospitals across the UK, driving growth in the international healthcare distribution sector.

Compound Annual Growth Rate

4%

Value in USD Billion

2026-2035

*this image is indicative*

Moulded pulp packaging, crafted from recycled paperboard or similar fibrous materials, is frequently employed to protect delicate items like electronics, glassware, and various consumer goods due to its ability to absorb shocks. It is also used for packaging medical devices, pharmaceuticals, and laboratory supplies due to its sterile and protective properties. Additionally, Continuous advancements in design and technology within the moulded pulp packaging sector propel its growth by improving functionality and aesthetic appeal. Moulded pulp packaging offers superior protection and cushioning for electronic components during transit and storage, effectively shielding them against impact, vibration, and static electricity.

According to Invest India, India's domestic electronics production has grown at a CAGR of 13%, rising from USD 49 billion in FY17 to USD 101 billion in FY23, this indicates the rise in the demand for moulded pulp packaging within the nation.

Consumer and regulatory emphasis, cost-effectiveness, customisation and design flexibility, and circular economy initiatives are the major trends impacting global moulded pulp packaging market growth.

Increasing consumer demand for eco-friendly packaging and stricter environmental regulations from governments are driving companies to adopt sustainable options like moulded pulp packaging.

Improved manufacturing processes and economies of scale are reducing the cost of moulded pulp packaging, making it more competitive with traditional materials like plastic and foam.

Advances in moulding technology allow for more customised and intricate designs, catering to specific product needs and enhancing brand differentiation.

Companies are integrating moulded pulp packaging into their circular economy strategies, focusing on reducing waste and promoting the reuse and recycling of materials.

The increasing demand for moulded pulp packaging stems from its expanding use within the food and beverage industry. Its compliance with food safety standards renders it a favoured option for packaging food and beverages.

Ongoing research and development are leading to moulded pulp products with better strength, water resistance, and thermal insulation properties. Advances in material science are resulting in the development of new types of pulp that offer enhanced performance for various applications.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Moulded Pulp Packaging Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

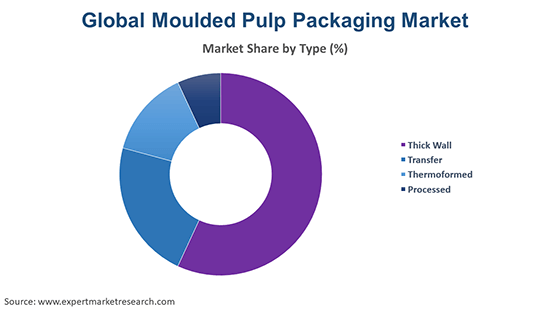

Market Breakup by Type

Market Breakup by Source

Market Breakup by Product Type

Market Breakup by End Use

Market Breakup by Region

Thermoformed type enhances the moulded pulp packaging market by offering a premium aesthetic appeal, enhancing brand perception and consumer appeal.

Thermoformed moulded pulp packaging provides excellent protection for delicate or fragile items. Its ability to cushion and safeguard products during transit ensures their integrity, making it a preferred choice for manufacturers seeking reliable packaging solutions.

Processed moulded pulp packaging can be engineered to possess specific functional properties, such as moisture resistance, insulation, and barrier properties.

Wood pulp sources contribute to the moulded pulp packaging market growth by specialising in supplying high-quality fibres with consistent characteristics, ensuring reliable and high-performance moulded pulp packaging products that meet diverse industry standards and needs.

Wood pulp is a cost-effective raw material for moulded pulp packaging production, especially when sourced from regions with favourable market conditions and efficient supply chains.

Incorporating non-wood pulp sources, such as agricultural residues (e.g., bagasse, straw), bamboo, and various plant fibres, diversifies the raw material base for moulded pulp packaging production.

The healthcare sector enhances the moulded pulp packaging market by providing specialized packaging solutions tailored to medical and pharmaceutical needs, ensuring product integrity, safety, and compliance with regulatory standards.

The healthcare industry's increasing focus on sustainability and environmental responsibility aligns with the eco-friendly attributes of moulded pulp packaging.

Customisable moulded pulp packaging provides opportunities for branding and marketing, allowing electronics manufacturers to showcase their brand identity and communicate product features and benefits to consumers effectively.

The Asia-Pacific region is driving the growth of the Global Moulded Pulp Packaging Market due to several key factors. These include its large consumer base, increasing focus on sustainability, government regulations favouring eco-friendly options, thriving manufacturing industry, and the cost-effectiveness of moulded pulp compared to traditional materials.

In 2022, the National Health Expenditure Account (NHEA) reported a 4.1% increase in US healthcare spending, reaching $4.5 trillion. This growth underscores the demand for moulded pulp packaging in healthcare, which safeguards medical devices, pharmaceuticals, specimens, and supplies while offering eco-friendly solutions for hospitals and clinics.

The packaging industry has emerged as one of the most rapidly growing sectors worldwide, establishing itself across all countries. In 2019, the industry surpassed $917 billion and is forecasted to grow at a CAGR of 2.8%, reaching $1.05 trillion by 2024, this suggests an increase in demand for moulded pulp packaging within the country.

The companies are a provider of sustainable packaging solutions, medical devices, sterile packaging, and PET containers, including bottles, jars, lids, and others.

Huhtamaki OYJ was established in 1920 and based in Kokkola, Finland. The company is a key global provider of sustainable packaging solutions for consumers around the world. It operates in 37 countries.

UFP Technologies, Inc. was founded in 1963 and based in Newburyport, MA. UFP Technologies specialises in designing and manufacturing customised solutions for medical devices, sterile packaging, and various highly engineered products.

Pro-Pac Packaging Limited was established in and based in Reservoir, Victoria. The company provides a combination of product and service solutions for primary, secondary, and tertiary packaging.

Gepack was founded in 2002 and is headquartered in Aveiras de Cima, Lisboa. The company delivers innovative PET containers, including bottles, jars, lids, caps, and decorative options.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other global moulded pulp packaging market key players are Thermoformed Engineered Quality LLC among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The moulded pulp packaging market was valued at USD 4.14 Billion in 2025.

The market is projected to grow at a CAGR of 4.00% between 2026 and 2035.

The revenue generated from the moulded pulp packaging market is expected to reach USD 6.13 Billion in 2035.

The major drivers of the market are rising disposable incomes, growing urbanisation, increase in the middle-class population, and the rise in demand from sectors like food packaging, electronics, and healthcare.

Rising preference for compact and sustainable packaging are the key trends guiding the growth of the market.

The market is broken down into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa.

The market is categorised according to the type, which includes thick wall, transfer, thermoformed, and processed.

The market is categorised according to the source, which includes wood pulp and non-wood pulp.

Based on the product type, the market is divided into trays, cups, clamshells, plates, bowls, and others.

Based on the end use, the market is divided into food service disposables, food packaging, healthcare, electronics, and others.

The market key players are Huhtamaki OYJ, UFP Technologies, Inc., Thermoformed Engineered Quality LLC, Gepack, and Pro-Pac Packaging Limited among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Source |

|

| Breakup by Product Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share