Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global natural fragrance market attained a value of USD 3.93 Billion in 2025. The market is expected to grow at a CAGR of 9.80% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 10.01 Billion.

There is now a stronger drive for clean label products, which defined as removing synthetic chemicals, allergens, or artificial additives, and reflecting a desire for awareness and health conscious. Natural fragrances derived directly from plants fulfill this desire and have greater acceptance. As consumers continue to consider ingredient labels, focusing primarily on personal care and home products, brands are reformulating to clean standards.

Advancements in extraction technologies are adding to the natural fragrance market development. Techniques like supercritical CO₂ extraction, molecular distillation, and green solvents allow companies to obtain high-purity natural essences with reduced environmental impact. In November 2023, L’Oréal and Cosmo International Fragrances launched a Green Sciences‑based extraction process that is water‑free, low energy, and slow, using only air to extract volatile fragrance molecules. These methods preserve the integrity and aromatic complexity of raw botanicals while minimizing waste and energy consumption.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

9.8%

Value in USD Billion

2026-2035

*this image is indicative*

The growing link between scent and well-being is a major driver for the natural fragrance market expansion. Consumers increasingly seek fragrances that not only smell good but also support emotional and physical wellness. Natural ingredients like lavender, eucalyptus, and sandalwood are popular for their calming, energizing, or healing properties. Brands are also integrating aromatherapy principles into fragrance formulations for stress relief, sleep enhancement, and mood elevation.

Environmental concerns are pushing both consumers and companies toward more sustainable options. Sourcing ingredients responsibly, using biodegradable formulations, and reducing carbon footprints are now vital components of fragrance development. In September 2025, Seth Rogen’s brand Houseplant collaborated with Ripple Home to launch a sustainable incense collection. Brands are responding by investing in sustainable farming, ethical harvesting, and traceable supply chains. Eco-friendly packaging like recyclable bottles and refillable containers further supports this shift.

Biotechnology is revolutionizing the natural fragrance market dynamics by making rare or threatened scent molecules available through sustainable production. Debut introduced a biotechnology platform in July 2025 that manufactures fragrance ingredients without growing them, beginning with orris, perhaps the costliest perfume ingredient. It allows businesses to duplicate plant-derived materials through fermentation and biosynthesis without taxing natural resources beyond their capacity. The innovation is supporting biodiversity while providing consistency and scalability.

Regulatory authorities and governments are starting to restrict ingredients in synthetic fragrances based on possible health and environmental concerns. Phthalates, parabens, and some preservatives are being questioned or prohibited. The regulatory burden prompts brands to reformulate with natural substitutes. As regulations continue to change, businesses are actively looking for compliant, natural scent ingredients. The regulatory change benefits consumers as well as innovation in natural perfumery.

The natural fragrance industry has seen significant growth from niche and artisan brands that focus on craftsmanship, storytelling, and ingredient authenticity. Launched September 2025 in India, Al Abbadi delivers artisan crafted perfumes made to European standards, each limited to 1,500 units per SKU, sold via monthly drops. These smaller players often use locally sourced botanicals, small-batch production methods, and personalized scent profiles to attract consumers seeking uniqueness and authenticity.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Natural Fragrance Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

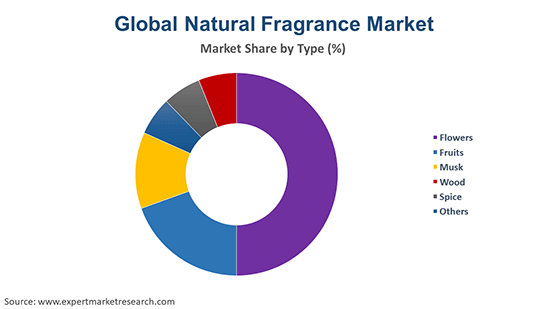

Market Breakup by Type

Key Insight: Flowers are the most dominant segment, prized for their familiarity, versatility, and emotional resonance. Iconic ingredients like rose, jasmine, neroli, and tuberose are used across luxury and mass-market products. Brands focus on sourcing authentic Indian florals, elevating flower-based perfumery with ethical and sustainable narratives. In March 2025, Coty’s Nautica launched Rose Island and Jasmine Coast, two fragrance mists for women. The timeless appeal of florals, paired with their strong olfactive identities, ensures their leading position in both feminine and unisex compositions.

Market Breakup by Application

Key Insight: Soap and detergents lead the natural fragrance market due to its frequent usage and high volume sales. Consumers increasingly prefer laundry and body care products scented with essential oils and free from synthetic chemicals. Brands are using ingredients and naturally derived aromas that are gentle on skin and the environment. In February 2024, Dr. Bronner’s launched a 32 oz refill carton for its Pure Castile liquid soap in multiple scents including lavender, peppermint, rose, citrus, and eucalyptus.

Market Breakup by Region

Key Insight: North America is the most dominant region in the natural fragrance industry, driven by high consumer awareness, regulatory support for clean-label claims, and strong market presence of eco-conscious brands. Brands like Dr. Bronner’s, Seventh Generation, and Mrs. Meyer’s lead with formulations free from synthetic chemicals, using essential oils such as lavender, citrus, and eucalyptus. Consumer demand for sustainable, cruelty-free, and biodegradable personal and home care products continues to fuel innovation and growth in this region, especially in the United States and Canada.

Surging preference for Fruits and Wood-based Fragrances

The popularity of fruity fragrances is driven by demand for fresh, youthful, and energetic scents. Ingredients like fig, pear, bergamot, and blackcurrant are widely used in modern natural fragrance formulations. These ingredients resonate especially with younger demographics, contributing to rising integration of fruity notes in natural body sprays, wellness mists, and clean beauty fragrances. This trend continues to inspire innovative launches that blend fruity freshness with sustainable, eco-friendly ingredients.

The wood segment of the natural fragrance market provides structure, depth, and longevity, emerging popular in both men’s and unisex fragrances. In January 2025, Korean brand Longtake released three gender-neutral solid perfumes formulated from upcycled oak sawdust. Sandalwood, cedarwood, and vetiver are ethically sourced or lab-grown to avoid environmental degradation. Artisan brands have also incorporated sustainable woods to add a grounding, natural character to their creations.

Rising Application in Cosmetics and Toiletries & Fine Fragrances

The cosmetics and toiletries segment is adding to the industry value, as natural fragrances enhance consumer trust and appeal in skincare, body care, and haircare. Brands incorporate florals like jasmine, rose, and neroli in lotions, creams, and oils. Claire’s launched a new fragrance and body care line in November 2024, featuring unique scents like Cherry Bliss and Watermelon Kiss. These natural scent profiles are often tied to traditional wellness systems like Ayurveda, appealing to users seeking holistic, clean beauty products.

The fine fragrance segment is rapidly growing within the natural category. Luxury and niche brands like LilaNur Parfums, Ffern, and Abel focus on storytelling, rare botanicals, and sustainable sourcing. Natural ingredients like orris, sandalwood, and rose are used to create high-end perfumes that resonate with conscious consumers looking for authenticity and artisanal quality. This trend is driving innovation in eco-friendly packaging and transparency throughout the supply chain.

Europe & Asia Pacific to Drive Natural Fragrance Demand

Europe holds a large natural fragrance market share, backed by strict environmental regulations and a deeply rooted culture of sustainability. France, Germany, and the United Kingdom have seen strong growth in botanical-based fine fragrances and personal care items. Leading brands such as Weleda, L’Occitane, and Neal’s Yard Remedies promote transparency, natural sourcing, and eco-friendly packaging. The region is also home to Grasse, France, which is the historical heart of perfume making, where many niche brands now blend tradition with green innovation.

Asia Pacific is the fastest-growing region, with increasing interest in traditional, plant-based aromas. The market in India, Japan, and South Korea is expanding rapidly. Indian brands emphasize authentic, natural florals like jasmine, tuberose, and sandalwood. In October 2023, India’s Praan Naturals launched a range of Plant-Based Fragrance Oils crafted from pure essential oils, absolutes, extracts, and aromatic isolates derived from natural, raw botanical sources. Rising disposable income, interest in wellness, and a return to heritage beauty rituals are helping drive growth in this region.

Leading players in the natural fragrance market are employing several key strategies to meet growing consumer demand for clean, sustainable, and ethically produced products. One core strategy is clean-label positioning, highlighting the use of plant-based, non-toxic, and allergen-free ingredients. Brands often obtain certifications such as Ecocert, COSMOS, or USDA Organic to build trust and validate their natural claims. Sustainable sourcing is another major focus, with companies partnering with ethical suppliers to ensure traceability and reduce environmental impacts.

Many players invest in green chemistry to innovate extraction techniques that maintain ingredient purity while minimizing ecological footprints. Transparent communication is essential as brands disclose ingredient origins, production methods, and sustainability efforts to meet rising consumer expectations. In marketing, they emphasize eco-conscious values, often supported by minimalist and recyclable packaging. To expand market share, companies pursue strategic collaborations with natural ingredient producers, invest in research & development for unique scent profiles, and explore niche segments.

Founded in 1895, Givaudan SA is headquartered in Vernier, Switzerland. It is a global leader in the fragrance and flavor industry. The company is recognized for sustainable innovation, pioneering biotech fragrance ingredients, and its commitment to carbon neutrality. Givaudan also champions ethical sourcing and transparency in natural fragrance development.

Established in 1895, Firmenich SA is based in Geneva, Switzerland. Known for its scientific innovation, Firmenich has developed biodegradable fragrance molecules and advanced encapsulation technologies. The company is celebrated for sustainability leadership and was among the first to offer 100% renewable fragrance ingredients, supporting biodiversity and ethical supply chain practices.

International Flavors & Fragrances (IFF)., founded in 1958 and headquartered in New York, the United States, is a prominent player in the scent and nutrition industries. IFF is known for integrating biotechnology and green chemistry into its fragrance innovation, and for advancing responsible ingredient sourcing through industry-leading sustainability initiatives.

Symrise AG, founded in 2003 and headquartered in Holzminden, Germany, is recognized for its expertise in natural raw materials and cutting-edge fragrance technologies with emphasis on circular economy practices, and sustainable innovation. Symrise has developed eco-friendly extraction processes and invests heavily in green chemistry for natural fragrance creation.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the natural fragrance market include Wild Flavors, Inc., Takasago International Corp, and Mane SA, among others.

Unlock key insights into the evolving natural fragrance market trends 2026 with our expert-curated report. Whether you're a brand, investor, or strategist, gain valuable data on market size, segmentation, and regional growth. Stay ahead of your competition, download your free sample report now to explore the full potential of the natural fragrance industry.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 3.93 Billion.

The market is projected to grow at a CAGR of 9.80% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 10.01 Billion by 2035.

Key strategies driving the market include clean-label branding, sustainability initiatives, sourcing transparency, and plant-based ingredient innovation. Brands emphasize eco-friendly packaging, cruelty-free claims, and certifications like COSMOS or Ecocert. Strategic partnerships with ethical suppliers and investment in green chemistry also enhance product appeal and consumer trust in natural fragrances.

Increasing growth of the personal care industry and the rising demand for natural and organic goods are the key market trends.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Flowers, fruits, musk, wood, and spice, among others, are the various types of natural fragrance in the market.

The applications of natural fragrances in the market include soap and detergents, cosmetics and toiletries, fine fragrances, and household cleaners and air fresheners, among others.

The key players in the market report include Givaudan SA, Firmenich SA, International Flavors & Fragrances, Inc., Symrise AG, Wild Flavors, Inc., Takasago International Corp, and Mane SA, among others.

Flowers fragrances are the most dominant segment, prized for their familiarity, versatility, and emotional resonance.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share