Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The North America 2-wheeler replacement tire market size is projected to grow at a CAGR of 4.60% between 2026 and 2035.

Base Year

Historical Period

Forecast Period

Based on the World Integrated Trade Solutions (WITS)statistics, U.S. imports of bicycle inner tubes from 2019 to 2022 increased by 19.72%.

In 2021, the US registered approx. 8.5 million two-wheelers, as reported by the Bureau of Transportation Statistics, which boosted the 2-wheeler replacement tire market in North America.

Canada, with a local automotive production worth about USD 74,598 million, offers a substantial potential for generating revenues.

Compound Annual Growth Rate

4.6%

2026-2035

*this image is indicative*

Due to the advancement of technology and an increase in the number of individuals owning personal 2-wheelers, there is a constant demand for 2-wheeler tires and their replacement. According to the Bureau of Transportation Statistics, motorcycle registrations in the United States have increased as governments and consumers emphasise on carbon emission reduction, thus driving tire manufacturers to create eco-friendly replacements, supporting global sustainability goals and propelling the North America 2-wheeler replacement tire market growth.

Another major aspect is original equipment manufacturers (OEMs) implementing state-of-the-art manufacturing techniques. To set their products apart from the competition, manufacturers focus on utilising cost, durability, and sustainability. For instance, retreading tires are becoming increasingly popular as it's an affordable aftermarket solution that lowers operational expenses by preventing total tire replacements.

Advancements in sustainable transportation, urbanization, the e-bike market, and government initiatives are boosting the North America 2-wheeler replacement tire market development.

Heightened environmental concerns have significantly impacted the automotive industry, particularly two-wheelers, as governments and consumers prioritize reducing carbon emissions. Tire manufacturers are developing eco-friendly tire replacements techniques to align with global sustainability goals, contributing to the market's growth.

The North America 2-wheeler replacement tire market is driven by urbanisation, with growing demand for efficient transportation solutions like two-wheelers. In congested urban areas, their maneuverability provides advantages, addressing challenges in commuting and fostering increased demand for tire replacements.

In 2022, the Office of Energy Efficiency and Renewable Energy reported that e-bike sales in the United States surpassed one million. The growing number of e-bikes in use is driving increased demand for tire replacements, creating new prospects within the market.

Government initiatives that are promoting two-wheeler usage drives the North America 2-wheeler replacement tire market growth. Advocacy campaigns highlighting their role in reducing congestion and pollution, coupled with infrastructure projects like dedicated bike lanes, incentivising adoption, and creating a favorable environment are driving the demand for replacement tires in North America.

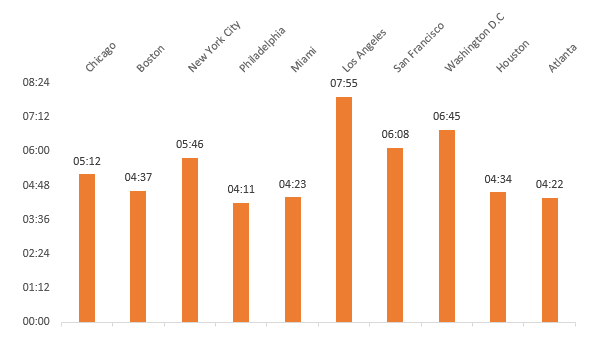

ESTIMATED CONGESTED HOURS BY STATE IN THE UNITED STATES, 2019, HOURS

In the North America 2-wheeler replacement tire market, sustainable transport, urbanisation, e-bikes, and government efforts drive market growth. Some North American companies provide full refunds or replacements for compatibility issues, while robots in the U.S. perform tire changes twice as fast as humans.

"North America 2-Wheeler Replacement Tire Market Report and Forecast 2026-2035" offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Vehicle Type

Market Breakup by Country

Scooters/Mopeds are relatively fuel-efficient and emit fewer greenhouse gases, thus pushing their attractiveness in the market

As per the North America 2-wheeler replacement tire market report, two-wheeler tires include products tailored for larger and more potent motorcycles, appealing to both sports and leisure riders. Scooter tires are designed for smaller urban commuting vehicles, providing excellent traction and maneuvering capabilities.

Mopeds, characterised by their lightweight and lower engine power, have distinct tire needs emphasising fuel efficiency and durability. The "other" category encompasses tires for electric bikes, off-road motorcycles, and specialised vehicles, serving a niche market with unique performance requirements.

Based on type, North America 2-wheeler replacement tire market share is considerably held by tubeless as it offers distinct benefits in terms of velocity, comfort, traction, and safeguarding against punctures

Tubeless tires minimise friction between the tire and tube, reducing rolling resistance below that of folding tires or tubular. They support lower inflation pressure for enhanced comfort, control in critical situations, and improved puncture protection, reducing the risk of blowouts.

A tubed tire comprises an inner tube filled with air, positioned between the rim and the tire. The tube's valve connects to the rim hole for tire inflation. Additionally, it helps preserve the tire's form and, crucially, provides support for the vehicle's weight, ensuring its stability. According to the World Integrated Trade Solutions (WITS) a 19.72% CAGR for U.S. imports of bicycle inner tubes was observed from 2019 to 2022.

The United States of America stands out as a significant country, primarily due of its large base of consumers in the region

According to the Insurance Institute for Highway Safety, in 2021, on-road motorcycles registered in the United States of America were 8,575,569. Further, the growing sales of e-bikes have also added additional revenue prospects for the manufacturers, boosting the North America 2-wheeler replacement tire market size.

Further, as per the International Trade Administration, Canada boasts a local production valued at around USD74,598 million. This significant production also contributes to the expansion of the 2-wheeler replacement tire market in North America.

The companies are focusing on improving the time-to-market and enhancing customer experience, while also treading into new avenues to boost its position in the 2-wheeler replacement tire market in North America.

Bridgestone Corporation was founded in 1931 and is headquartered in Japan. The company provides a diverse selection of tires globally, including those for motorcycles, cars, trucks, buses, aircraft, construction, and mining vehicles, along with various non-tires like hydraulic hoses, conveyor belts, and seismic isolators. These products contribute to everyday applications, enhancing multiple industries and consumer lifestyles.

Michelin Group was founded in 1889 and is headquartered in France. Committed to advancing sustainable transportation, Michelin creates, produces, and markets tires for a wide range of vehicles, encompassing airplanes, cars, bicycles, earthmovers, farm machinery, heavy-duty trucks, and motorcycles.

Pirelli & C. S.p.A was founded in 1872 and is headquartered in Italy. Centered on consumer tire manufacturing for cars, motorcycles, and bicycles, this sustainable tire brand prioritizes eco-friendly practices, utilizing sustainable rubber and actively working towards minimizing its climate impact.

Continental AG was founded in 1871 and is headquartered in Germany. Continental is backed by three robust, equally important, and autonomous sectors: Tires, ContiTech, and Automotive. Its emphasis lies on advanced technologies that prioritize safety, autonomy, connectivity, and sustainability.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the North America 2-wheeler replacement tire market report are Shinko Group, Kenda Rubber Industrial Company, LTD., Sumitomo Rubber Industries, Ltd, Coker Tire, Maxxis International, and others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is expected to grow at a CAGR of 4.60% between 2026 and 2035.

Key trends aiding market expansion include sustainable transportation, urbanization, the growing E-bike market, government initiatives, innovations, and increasing research and development (R&D) activities by key players.

The tires prevalent in the market are- Tube tires and Tubeless tires.

The sales channels are OEMs and Aftermarket.

Key players in the industry are Bridgeton Corporation, Michelin Group, Shinko Group, Kenda Rubber Industrial Company, LTD., Sumitomo Rubber Industries, Ltd, Maxxis International, Pirelli & C. S.p.A., Continental AG, among others.

The United States holds a majority share in the tire market.

It is advisable to change tires when the tread wears down below the suggested depth of 2/32nds of an inch or if they exceed six years of age.

While certain tire manufacturers specify 6 years, others suggest a maximum service life of 10 years. This information is often indicated by the Tire Identification Number (TIN).

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Vehicle Type |

|

| Breakup by Sales Channel |

|

| Breakup by Country |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share