Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The North America air barrier market attained a value of USD 1.81 Billion in 2025 and is projected to expand at a CAGR of 4.40% through 2035. The market is further expected to achieve USD 2.78 Billion by 2035. Expansion of data center construction across North America is accelerating demand for high-performance air barriers that stabilize internal pressure, limit moisture ingress, and support long-term energy efficiency targets.

Public infrastructure projects are requiring continuous air barrier systems to be eligible for funding. Secondly, insurers are pushing developers to lower moisture risks in buildings. Air leakage is one of the main causes of long-term insurance claims, boosting the North America air barrier market growth. Hence, the manufacturers that provide sealed, guaranteed assemblies rather than just the individual components are most benefited by such market pressures. Consequently, choosing an air barrier system is now a matter of the initial design phase rather than being a last-stage specification review.

The North America air barrier market is experiencing a major shift as manufacturers make new product lines to be compliant with the stricter energy performance continuance being enforced. One of the significant changes was made in June 2024 when Henry, a Carlisle Company announced the launch of Blueskin VPTech, an innovative new product for residential construction that delivers energy efficiency and labor savings in one integrated solution.

According to the North America air barrier market analysis, uncontrolled air leakage can be responsible for up to 30% of the energy loss in buildings which, consequently, specifiers have been choosing tested continuous air barrier systems, over fragmented solutions, to work with institutional and commercial constructions. At the same time, behavior regarding procurement is changing in healthcare, education, and logistics facilities. Developers are emphasizing the importance of air barriers requiring them to be a part of full envelope assemblies. This method reduces coordination risks and makes it easier to get inspection approvals.

In Canada, changes in the National Energy Code for Buildings have cut down the air leakage limits allowed which is one of the reasons why fluid-applied and spray-based air barriers are gaining momentum. Contractors often notice the improvement in the steadiness of the work, less failure of the envelope, and fewer occasions of rework. All these factors lead to preference for manufacturers who offer documented system-level performance as opposed to those who only give product certifications.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

4.4%

Value in USD Billion

2026-2035

*this image is indicative*

| North America Air Barrier Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 1.81 |

| Market Size 2035 | USD Billion | 2.78 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 4.40% |

| CAGR 2026-2035 - Market by Region | Canada | 4.8% |

| CAGR 2026-2035 - Market by Application | Masonry | 4.6% |

| CAGR 2026-2035 - Market by End Use | Residential | 4.5% |

| Market Share by Country 2025 | Canada | 13.1% |

Air barriers are being increasingly specified as components of overall building envelope systems rather than separate materials. Large-scale manufacturers are combining air barriers with insulation, flashing, and moisture control layers to make ordering easier, accelerating demand in the North America air barrier market. A number of publicly funded healthcare and education facilities in the United States now require that the building envelope be the responsibility of a single source. For example, Aeroseal offers AeroBarrier Select, the latest advancement in its proven building envelope air sealing solution. This movement benefits suppliers with extensive portfolios and in-house testing capabilities.

The enforcement of energy codes in the United States and Canada is driving a change in the composition of air barrier products. Energy regulations are moving towards an assessment of the airtightness of the building rather than prescribing installation methods. Fluid-applied air barriers with higher elasticity and crack-bridging capacity are becoming more popular. In February 2026, AkzoNobel Aerospace Coatings introduced a new single-coat Aerobase basecoat solution designed to help MRO paint facilities improve performance, efficiency and operational throughput. Moreover, the North America air barrier market observes a shift in products that can hold their adhesion even when the material undergoes thermal movement. Manufacturers are tweaking polymer chemistry and also giving longer performance warranties as a response to the surging demand.

Data centers represent a continuously growing segment of air barrier systems that are advanced. These buildings need to maintain stable internal pressure and have strict moisture control in order to protect sensitive equipment, reshaping the entire North America air barrier market trends and dynamics. Developers are progressively specifying fully adhered air barriers to minimize the risk of infiltration. North America is still experiencing a continuous expansion of cloud and colocation infrastructure. Manufacturers who are concentrating on mission-critical facilities are highlighting durability testing and long-term warranties. In September 2025, Fourier introduced a portfolio of prefabricated, containerized data center solutions.

Public infrastructure programs are facilitating the air barrier demand in North America. Transportation terminals, government buildings, and civic facilities are now undergoing envelope performance standards that are stricter than before. In April 2025, Avery Dennison launched tapes portfolio for building envelope flashing and seaming. Funding frameworks are increasingly referring to operational efficiency and long-term maintenance outcomes. Air barriers are one of the means by which these standards can be met. Manufacturers who are supplying public projects have to provide third-party testing and documented assemblies.

Labor constraints are influencing air barrier selection decisions. Contractors favor systems that reduce installation time and reliance on specialized crews. Spray-applied and liquid air barriers are gaining preference because they conform to complex geometries and reduce detailing labor. Manufacturers are introducing faster curing formulations and simplified surface preparation requirements, accelerating North America air barrier market penetration. For example, WR Meadows offers Dual Action Acrylic Curing Compound combining curing and sealing performance suited for concrete and air barrier interface control. Product innovation increasingly targets application speed alongside performance, reshaping competitive priorities within the market.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “North America Air Barrier Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Membrane Type

Key Insight: Sheet-applied and fluid-applied membranes both cater to different demands in North America. Sheets dominate because of speed, installer familiarity, and cost control. Fluid-applied systems, on the other hand, increase their North America air barrier market share quicker since they offer continuous seamlessness and are capable of complex geometries. The decision depends on the nature of the project, the complexity of the substrate, and the performance requirements. In order to cater to both approaches, manufacturers are upgrading their adhesives, low VOC chemistries, and training programs.

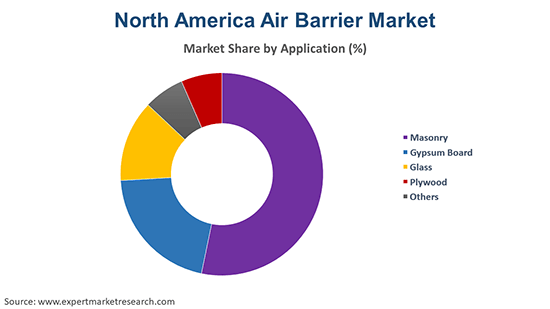

Market Breakup by Application

Key Insight: Application demand in the North America air barrier market spans masonry, gypsum board, glass, plywood, and others. Masonry leads because it anchors commercial retrofits and institutional envelopes. Gypsum board expands its share in the market faster as interior air sealing gains acceptance. In September 2025, Saint-Gobain Canada inaugurated the first Zero-Carbon Gypsum Wallboard plant in North America. Glass assemblies require precision-compatible air barriers to manage movement and condensation. Plywood remains relevant in light commercial and wood-frame transitions. Other substrates include metal panels and hybrid systems.

Market Breakup by End Use

Key Insight: As per the North America air barrier market report, commercial buildings drive volume through renovation cycles and tenant turnover. Residential buildings adopt air barriers to improve comfort and moisture control. Public infrastructure grows at the fastest pace due to performance-linked funding requirements. Each segment values different attributes. Commercial buyers prioritize speed and warranty coverage.

Market Breakup by Region

Key Insight: Regional demand reflects regulatory intensity and climate exposure. The United States leads due to enforcement scale and retrofit activity. Canada grows faster as airtightness standards tighten. Both regions value tested systems and contractor support. Climate variability shapes product selection. The North America air barrier market penetration strategies evolve based on code interpretation and construction practice and enforcement consistency across jurisdictions over time within the construction markets overall.

| CAGR 2026-2035 - Market by | Country |

| Canada | 4.8% |

| United States of America | XX% |

Sheet-applied membranes dominate North America air barrier market through installation speed and proven compliance

Sheet-applied membranes still account for the majority of the market in North America. This is mainly because they make it easy to achieve predictable performance and enable fast installation even on the most common wall assemblies. Contractors like using premanufactured sheets mostly because the sheets are of standard thickness and that the air leakage performance of the sheets is well documented. These types of products make it easy to control the quality of a big project, especially when the project needs to be completed quickly. Manufacturers have been working to improve the adhesive systems and edge, sealing details so they can lower the field variability.

Fluid-applied membranes constitute the rapidly developing segment of the North America air barrier market, fueled by the need for flawless continuity and complicated architectural assemblies. Such systems create monolithic films which do not only remove laps and fasteners but also improve airtightness even in the most difficult details. Architects choose to use fluid membranes for curved walls, window penetrations, and refurbishment projects where sheet application is the most difficult. Owing to the advancements in polymer chemistry, cure times and substrate adhesion are getting better, which consequently lessens the impacts on the project schedule. For example, GCP offers innovative liquid-applied, impermeable air barrier membrane products.

By application, masonry remains dominant due to compatibility, durability, and installation familiarity

Masonry applications represent the dominant application that is boosting demand in the North America air barrier market. Concrete and concrete masonry units demand continuous air sealing to control moisture migration and pressure differentials. Manufacturers design fluid-applied and self-adhered membranes that tolerate surface irregularities and high alkalinity. Contractors favor these systems because detailing around penetrations is simpler. Product development in this category is focused on higher elongation and crack-bridging performance which matters on large wall assemblies exposed to thermal cycling. In April 2025, MAPEI Canada introduced MSVS line enhancing installation efficiency and aesthetic quality for stone veneer applications.

| CAGR 2026-2035 - Market by | Application |

| Masonry | 4.6% |

| Glass | 4.2% |

| Plywood | 4.1% |

| Gypsum Board | XX% |

| Others | XX% |

Gypsum board is the fastest-growing application for air barriers. Interior wall assemblies in commercial buildings increasingly rely on gypsum substrates. Manufacturers are launching vapor-permeable air barriers optimized for smooth surfaces. These products allow rapid installation and consistent thickness control. That appeals to contractors under schedule pressure. Gypsum-compatible air barriers also support interior air sealing strategies in mixed-use developments. Design teams are specifying them earlier to reduce coordination conflicts.

By end use, commercial buildings lead adoption by compliance enforcement and lifecycle focus

Commercial buildings represent the dominant end-use, largely contributing to the North America air barrier market revenue. Offices, healthcare facilities, and logistics assets demand predictable envelope performance. Owners focus on operating cost stability and moisture risk control. Air barriers are specified to support energy compliance and interior comfort. Manufacturers target this segment with high-durability systems and extended warranties. Commercial demand remains steady because these buildings undergo frequent interior renovations. In December 2025, Carrier launched commercial field trials of next generation rooftop heat pump technology under the United States DOE Commercial Building HVAC Challenge.

| CAGR 2026-2035 - Market by | End Use |

| Residential | 4.5% |

| Commercial | XX% |

| Public Infrastructure | XX% |

Public infrastructure is also gaining momentum across the North America air barrier market dynamics. Transportation hubs, civic buildings, and educational facilities face strict performance oversight. Funding approvals increasingly link to lifecycle efficiency outcomes. Air barriers support these goals by controlling infiltration and moisture. Agencies demand tested assemblies and clear documentation. Manufacturers serving this segment invest in compliance support and field training. Long procurement timelines reward experienced manufacturers with regulatory familiarity and stable production planning across multiple regions over extended project horizons.

United States registers the bigger market share due to code enforcement and retrofit intensity

The United States represents the dominant regional market for air barriers. Strict enforcement of energy codes drives consistent adoption. Commercial retrofits and new institutional construction sustain demand. Manufacturers prioritize the United States for product launches and contractor training. Climate diversity increases the need for adaptable air barrier systems. Products must perform across hot, cold, and mixed zones. The North America air barrier market rewards companies offering tested systems with reliable field performance histories. In November 2025, Sealed Air Corp. announced that the company has reached an agreement to be acquired by Clayton, Dubilier and Rice (CD&R), a private investment firm with extensive experience in the industrial and packaging industries.

| 2025 Market Share by | Country |

| USA | 75.6% |

| Canada | XX% |

Canada is the fastest-growing regional market for air barriers. National and provincial codes emphasize airtightness performance. Cold climate exposure increases moisture management risk. Air barriers are critical for durability. Manufacturers adapt products for low-temperature application. Contractors favor systems with predictable curing. Public buildings and multi-family housing drive adoption. Canadian projects often specify continuous air barrier testing which encourages higher quality installations. Suppliers invest in bilingual documentation and compliance support.

The competitive landscape of the market is shaped by system-level competition. Leading North America air barrier companies focus on integrated envelope solutions rather than standalone materials. Investment priorities include formulation chemistry, installation efficiency, and compliance documentation. Companies are expanding contractor training programs to reduce field failures. Differentiation increasingly depends on how products perform across varied substrates and climates.

North America air barrier companies also compete on technical support responsiveness. Faster problem resolution influences repeat specifications. Regional distribution strength remains critical. Small-scale players resort to either niche positioning or partnerships. The market favors firms synchronize the product development with the regulatory enforcement realities. Innovation is functional rather than decorative. A competitive advantage arises from a product being trusted under real construction situations. The market is more geared towards strict adherence and incremental improvements rather than disruptive experimentation.

RPM International Inc. was established in 1947 and is headquartered in Medina, Ohio, United States. The company serves the air barrier market through specialized building materials brands focused on sealants and coatings. RPM targets commercial and infrastructure projects requiring durable envelope performance.

BASF SE was founded in 1865 and is headquartered in Ludwigshafen, Germany. The company participates in the air barrier market through advanced polymer chemistries. BASF supports manufacturers with raw materials that improve elasticity and adhesion. Its focus is on formulation science rather than finished systems.

DuPont de Nemours, Inc. was established in 1802 and is headquartered in Wilmington, Delaware, United States. The company supplies air barrier materials used in high-performance building envelopes. DuPont emphasizes material science and long-term durability.

WR Meadows, Inc. was founded in 1926 and is headquartered in Hampshire, Illinois, United States. The company manufactures air barrier and waterproofing products for commercial construction. WR Meadows focuses on fluid-applied systems compatible with masonry and concrete.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include Carlisle Companies Inc., Mark Beamish Waterproofing, SOPREMA, Group, Dryspace, Inc, and 3M Company, among others.

Unlock the latest insights with our North America air barrier market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 1.81 Billion.

The market is projected to grow at a CAGR of 4.40% between 2026 and 2035.

The market is expected to reach a value of about USD 2.78 Billion by 2035.

Stakeholders are prioritizing integrated system offerings, expanding contractor training, investing in compliant formulations, strengthening regional distribution, and targeting infrastructure and mission-critical projects.

The growing trend of sustainability and the increasing attempts to reduce the use of natural resources for power generation are the key trends guiding the market growth.

The United States of America and Canada are the major countries for air barrier in North America.

The major membrane types of air barrier in the market are sheet applied and fluid applied.

The significant applications of air barrier include masonry, gypsum board, glass, and plywood, among others.

The major end-use segments of air barrier in the market are residential, commercial, and public infrastructure.

The key players in the market include RPM International Inc., BASF SE, DuPont de Nemours, Inc., WR Meadows, Inc., Carlisle Companies Inc., Mark Beamish Waterproofing, SOPREMA, Group, Dryspace, Inc, and 3M Company, among others.

Manufacturers face challenges from inconsistent code enforcement, labor shortages affecting installation quality, rising material costs, and the need to educate contractors on evolving air barrier system requirements across regional markets.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Membrane Type |

|

| Breakup by Application |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,999

USD 2,699

tax inclusive*

Single User License

One User

USD 4,399

USD 3,959

tax inclusive*

Five User License

Five User

USD 5,599

USD 4,759

tax inclusive*

Corporate License

Unlimited Users

USD 6,659

USD 5,660

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share