Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The North America compound feed market size attained a value of USD 116.51 Billion in 2025. The market is expected to grow at a CAGR of 4.50% between 2026 and 2035, reaching almost USD 180.94 Billion by 2035.

Base Year

Historical Period

Forecast Period

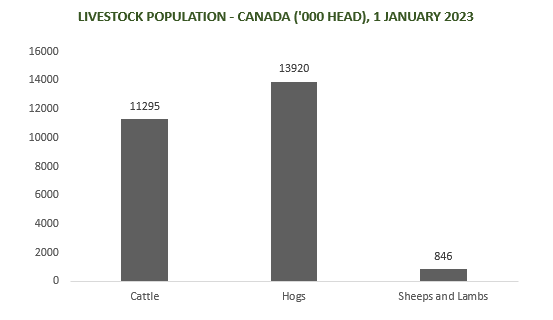

As per Statistics Canada's report, Canadian farmers owned 11.3 million cattle and calves in January 2023.

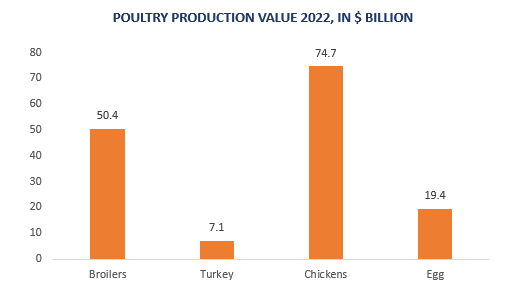

According to the USDA, American poultry products dominate global and domestic meat markets due to competitive production, advanced genetics, and consumer preference.

According to the U.S. Department of Agriculture, in 2021, Americans had access to 68.1 pounds of chicken per capita, exceeding beef availability at 56.2 pounds thus boosting the compound feed market in North America.

Compound Annual Growth Rate

4.5%

Value in USD Billion

2026-2035

*this image is indicative*

Compound feed is a meticulously blended combination of grains, cereals, oilseeds, minerals, vitamins, and supplements, aimed at providing comprehensive and balanced nutrition for livestock. It functions as a convenient and efficient method to ensure animals receive essential nutrients necessary for their growth, reproduction, and overall health.

As per the North America compound feed market report, feeds are utilised extensively across various sectors of the livestock industry, including poultry, swine, cattle, and aquaculture. Compound feed plays a pivotal role in improving feed efficiency, enhancing animal welfare, and maximising production yields. The demand for compound feed is driven by increasing needs for animal protein products and the necessity to enhance agricultural productivity to meet global food demands sustainably.

On 1 January 2023, Canadian farmers were reported by Statistics Canada to have possessed 11.3 million cattle and calves on their farms, thereby impacting the North America compound feed market outlook.

The North America compound feed market is growing with increasing population, regulations and standards, and increasing health awareness.

Rapid population growth heightens the need for livestock products, emphasising the importance of animal nutrition. This fuels the North America compound feed market growth, as countries focus on sustaining their populations. Enhancing feed formulations to optimise livestock health and growth while controlling costs reflects the industry's crucial role.

Regulatory frameworks are pivotal in shaping the compound feed market, governing formulation, production, and distribution to ensure safety and quality. These standards cover sourcing, labelling, and production processes, safeguarding animal health and food safety. Compliance fosters consumer trust, influencing innovation and promoting responsible practices throughout the market.

The rising demand for meat and dairy products is driven by diverse diets, nutrition demand and convenient products catering to on-the-go consumption. As per the U.S. Department of Agriculture, in 2021, individuals in the United States had access to 68.1 pounds of chicken per capita for human consumption (on a boneless, edible basis), surpassing the availability of beef at 56.2 pounds.

Increasing awareness about health is transforming the compound feed sector. Consumers prioritise their health and food nutrition, influencing choices in poultry and livestock feed. They favour organic, antibiotic-free, or free-range options, demonstrating a readiness to invest more in perceived quality. This trend stimulates broader conversations on food safety.

Advancements in animal nutrition science have led to tailored feeds for different species and growth stages, aiming to boost growth rates, improve feed efficiency, and enhance animal welfare. Concerns over sustainability have prompted the creation of eco-friendly feeds, while strict food safety regulations drive demand for high-quality products, ensuring animal and consumer well-being. Further, globalisation has expanded trade, facilitating the distribution of feed ingredients and products across borders, and bolstering market growth.

North America Compound Feed Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Livestock

Market Breakup by Ingredient

Market Breakup by Source

Market Breakup by Form

Market Breakup by Country

North America compound feed market development is led by poultry sector, driven by increasing consumer demand for lean and cost-effective protein sources

Poultry, like chicken and eggs, offers an economical and adaptable protein source for a varied consumer base. Growing health consciousness fuels demand for lean meats, favouring poultry. Technological advancements in poultry farming also enhance efficiency, productivity, and profitability.

Swine, rich in protein, aids muscle upkeep and growth, crucial for children's bone health. It contains zinc, selenium, and vitamins B12 and B6, vital for immune function, making it favourable in North America. Aquatic species, providing omega-3 and other nutrients, also boost demand.

In terms of ingredients, the North America compound feed market share is dominated by cereals as it provides essential carbohydrates that support optimal animal growth and performance

As sustainable agriculture gains prominence and environmental concerns grow, cereals emerge as a crucial renewable and resource-efficient feed source, meeting consumer demands for responsible production practices.

Utilising oilseed by-products in animal nutrition offers a cost-effective and environmentally sustainable feed option. Cakes and meals, abundant post-oil extraction, serve as viable protein alternatives in animal diets.

Pellets are the prevalent choice in the North America compound feed market, driven by increasing demand for feed options that are convenient and simple to manage

The compressed and consistent feed formats provide convenience in storage, transportation, and feeding procedures, appealing to producers and consumers alike. Furthermore, the increased nutritional density and minimised wastage of pellets add to their appeal.

Crumble, a feed type made by pelleting mixed ingredients and crushing them slightly coarser than mash, gained popularity in broiler production in the poultry market.

In the USA, geopolitical dynamics such as trade agreements and policies affect market access and regional trade patterns. Additionally, increasing awareness of environmental sustainability drives the adoption of eco-conscious practices and boosts demand for sustainable feed options.

As per the U.S. Department of Agriculture, American poultry products excel in global and domestic meat markets due to competitive production, advanced genetics, ample feed resources, and consumer preference.

In Canada, the compound feed market is stimulated by urbanisation, a growing population desiring protein-rich diets, economic growth, and higher disposable incomes. Innovations in feed production and distribution amplify supply chain efficiency.

Market players are driving the North America compound feed market growth by producing natural ingredients used in personal care, pet food, animal feed, and bio-industrial applications.

Cargill Inc., established in 1865, and headquartered in the United States, engages in marketing, processing, and distributing grains, oilseeds, sugar, meat, and various food products, including cotton. Additionally, it produces natural ingredients for personal care, pet food, animal feed, and bio-industrial purposes.

Archer-Daniels-Midland Co., founded in 1902 and headquartered in the United States, handles agricultural commodities like oilseeds, corn, wheat, oats, barley, and their derivatives worldwide through its extensive grain elevator and transportation system.

Alltech Inc., established in 1980 and headquartered in the United States, develops agricultural solutions for livestock and crop farming, alongside food industry products. The company operates in three core divisions: animal nutrition and health, crop science, and food and beverage.

Smithfield Foods, Inc., founded in the USA in 1936, specializes in pork, beef, and poultry. It has gained acclaim for its unwavering commitment to high-quality standards, innovative methods, and environmentally conscious efforts.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other North America compound feed market key players are Roquette Freres S.A., SHV Holdings N.V. (Nutreco N.V.), Hueber Feed, LLC, Land O’Lakes, Inc. (Purina), Kent Corp., Perdue AgriBusiness LLC and Others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The compound feed market size attained a value of USD 116.51 Billion in 2025.

The market is projected to grow at a CAGR of 4.50% between 2026 and 2035.

The revenue generated from the market is expected to reach USD 180.94 Billion in 2035.

The expansion of the compound feed market is fueled by factors such as population growth, regulatory requirements, rising demand for meat and dairy products, and growing health consciousness.

The compound feed market is segmented into poultry, ruminants, aquatic animals, swine, and other categories.

Key players in the industry are Cargill Inc., Archer-Daniels-Midland Co., Alltech Inc. Smithfield Foods, Inc., Roquette Freres S.A., SHV Holdings N.V. (Nutreco N.V.), Hueber Feed, LLC, Land O’Lakes, Inc. (Purina), Kent Corp., Penrdue AgriBusiness LLC, and others.

Based on the source, the market is divided into plant-based and animal-based.

The market is broken down into the United States of America and Canada.

Based on the form, the compound feed market is divided into pellets, mash, crumbles, and others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Livestock |

|

| Breakup by Ingredient |

|

| Breakup by Source |

|

| Breakup by Form |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share