Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The North America COVID-19 diagnostics market was valued at USD 18.68 Billion in 2025 and is expected to grow at a CAGR of 2.30%, reaching USD 23.45 Billion by 2035. The market growth is driven by large-scale testing initiatives and rapid adoption of advanced diagnostic platforms.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

2.3%

Value in USD Billion

2026-2035

*this image is indicative*

Ever since the outbreak of the COVID-19 pandemic, the demand for COVID-19 diagnostic kits has exponentially risen in North America because of the widespread need for testing within the region. The demand for the diagnostic kits have, especially, witnessed a substantial rise in the United States of America due to the significant and rising number of active cases in the country. The highest number of cases in the world have been registered in the United States of America as of March 2021, and there has been a great need for testing and vaccination in the country. To prevent the spread of the virus further, the country has also implemented measures to test travellers entering the country and those travelling within the country, thus, further contributing to the growth of the COVID-19 diagnostics industry in North America.

In the short term, the demand for COVID-19 diagnostics is expected to rise rapidly in the North America region, but in the long term, the market is expected to shrink as vaccines for COVID-19 enter the market and people develop antibodies.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

COVID-19 diagnostics are used to detect if a person is COVID-19 positive, their infection level, or if they have developed COVID-19 antibodies. They may involve tests of different types, such as RT PCR test, rapid antigen test, and others.

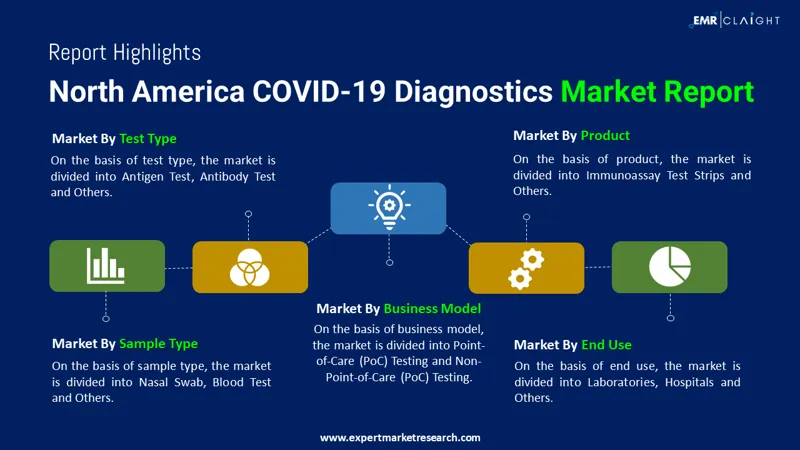

Market Breakup by Test Type

Market Breakup by Product

Market Breakup by Sample Type

Market Breakup by Business Model

Market Breakup by End Use

Market Breakup by Region

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The rising number of novel coronavirus cases in the North America region, especially in the United States of America, has led to a massive demand for testing kits. The portability of these testing kits has allowed more people to be tested in a large number, and it is expected that the demand for these will continue to grow, at least in the short term.

Since there have been multiple waves observed in the prevalence of the transmission of COVID-19, along with mutations of the virus into different variants, the same population has been tested multiple times, causing a consistent demand for the diagnostic tools. Governments in the North America region have relaxed regulations for these diagnostic kits in view of the emergency. Such measures have catalysed the growth of the COVID-19 diagnostics market. There has also been continuous research and development sponsored by both the government and private players, which has helped to create more effective testing kits, with fewer occurrences of false positive reports, further propelling the market ahead.

The report gives a detailed analysis of the following key players in the North America COVID-19 diagnostics market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

The comprehensive EMR report provides an in-depth assessment of the market based on the Porter's five forces model along with giving a SWOT analysis.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The North America COVID-19 diagnostics market is being aided by the growing cases of COVID-19 infections in the United States of America, which had performed nearly 390 million tests for COVID-19 as of March 2021.

The major drivers of the industry include the rising occurrence of COVID-19 cases, increasing mutations and variants of the virus, growing investments, and the large population base.

The growing technological improvements in the diagnostic kits and the increasing R&D activities are expected to be the key trends guiding the growth of the industry.

The major regions in the industry are the United States of America and Canada.

The major test types available in the industry are PCR test, antigen test, and antibody test, among others.

The significant products available in the industry are RT-PCR assay kits and immunoassay test strips, among others.

The leading sample types available in the market are nasopharyngeal swab, oropharyngeal (OP) swab, nasal swab, and blood test, among others.

The major business models in the industry are point-of-care (PoC) testing and non-point-of-care (PoC) testing.

The significant end use sectors in the industry are hospitals, and diagnostic centres and clinics, laboratories, among others.

The leading players in this market are Abbott Laboratories, Becton, Dickinson and Company, LuminUltra Technologies Ltd., Co-Diagnostics, Inc, CTK Biotech, Inc., and Thermo Fisher Scientific, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Test Type |

|

| Breakup by Product |

|

| Breakup by Sample Type |

|

| Breakup by Business Model |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Supplier Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,699

USD 2,429

tax inclusive*

Single User License

One User

USD 4,299

USD 3,869

tax inclusive*

Five User License

Five User

USD 5,799

USD 4,949

tax inclusive*

Corporate License

Unlimited Users

USD 6,999

USD 5,949

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share