Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The North America legal cannabis market size was nearly USD 33.69 Billion in 2025. The industry is further expected to grow at a CAGR of 26.80% over the forecast period of 2026-2035 to attain USD 361.99 Billion by 2035.

Base Year

Historical Period

Forecast Period

States and territories in the United States are increasingly legalising recreational cannabis to reduce law enforcement costs, generate revenue, and regulate the market for safety and quality control. As of January 2025, 24 states, along with Washington D.C., in the United States have legalised recreational use of cannabis for adults 21 years and older. As more states legalise recreational cannabis, key players in the legal cannabis market are investing in cannabis cultivation, distribution, production, and retail while diversifying their product offerings to cater to evolving customer demands.

In countries like the United States and Canada, cannabis is emerging as a mainstream product due to the evolving regulatory landscape, shifting public perceptions, and rising awareness regarding its recreational and medicinal benefits. In 2021, approximately 52.5 million people or nearly 19% of Americans used cannabis at least once. With an increasing number of individuals turning to legal cannabis, there is likely to be an influx of cannabis-related businesses and retail outlets.

Consumers are increasingly shifting from smoking to edible-based cannabis products due to their convenience and the growing awareness regarding respiratory risks associated with smoking cannabis. In Canada, while smoking cannabis decreased from 89% in 2018 to 69% in 2024, eating/drinking cannabis surged from 43% in 2018 to 57% in 2024. This rising popularity of cannabis-infused food and beverages is expected to drive investments in the development of innovative cannabis drinks, edibles, baked goods, gummies, and chocolates, among others.

Compound Annual Growth Rate

26.8%

Value in USD Billion

2026-2035

*this image is indicative*

The legal cannabis industry in North America is being driven by the growing medical applications of the product in the region and the implementation of favourable government policies. Within North America, the United States legal cannabis market is supported by the thriving medical cannabis industry. The United States medical cannabis industry accounts for a majority of the regional market share and is further expected to continue its dominance over the forecast period. It is estimated that 33% of the United States consumers utilise cannabis for both recreational and medical reasons. As CBD derived from hemp is legal to import and purchase in all 50 US states, it is expected to create an increased demand for industrial hemp, which in turn, will aid the overall industry growth in the region.

Surging product diversification; increasing focus on sustainability; rising demand for medical cannabis; and the growing use of cannabis as a wellness product are favouring the North America legal cannabis market.

Evolving customer demand and growing concerns regarding respiratory issues caused by inhalation products are driving product diversification of cannabis and leading to the development of cannabis beverages, edibles, chocolate, creams, tinctures, and oils, among others.

With the growing trend of sustainability, cannabis producers are optimising energy and water usage, adopting advanced LED lighting, integrating renewable energy, and embracing regenerative and organic farming practices. They are also adopting recyclable and biodegradable packaging solutions to appeal to environmentally conscious consumers.

With the growing body of medical research highlighting the benefits of cannabis in alleviating chronic pain, reducing symptoms of depression, anxiety, and PTSD, and providing relief for conditions like multiple sclerosis and epilepsy, the demand for medical cannabis is significantly increasing.

The rising trend of health and wellness is shaping the North America legal cannabis market trends and dynamics. Wellness brands, especially in the beauty, fitness, and skincare sectors, are increasingly incorporating cannabis-based ingredients into their offerings due to their skin-soothing effects, pain relief, and anti-inflammatory properties.

Cannabis, commonly called marijuana, is an annual flowering plant belonging to the Cannabaceae family, which is native to Central Asia and the Indian subcontinent. The plant is used for industrial, recreational, as well as medical purposes, owing to its psychoactive properties.

On the basis of derived products, the industry can be divided into:

While marijuana finds applications in medical (migraine, arthritis, and cancer, among others) and recreational purposes, industrial hemp finds application in sectors like personal care, hemp CBD, consumer textiles, and food, among others.

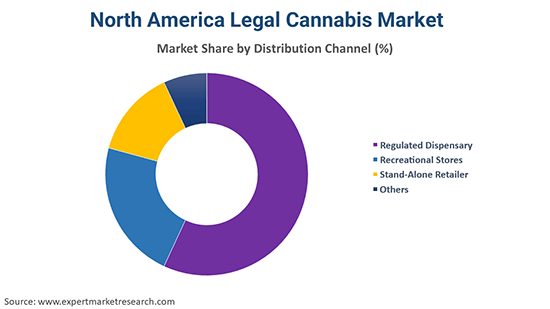

On the basis of distribution channel, the industry is segmented into:

On the basis of Region, the industry can be divided into:

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The legal cannabis market in North America is being driven by the growing demand for cannabis for medical as well as recreational purposes, supported by favourable government policies. In the region, the cannabinoid is treated as a supplement, which is aiding the industry growth. The growing geriatric population and significant patient pool in the region are driving the product demand for medicinal purposes.

Within the United States, more states are moving towards the legalisation of cannabis and, thus, its applications are expected to increase significantly, especially in the medical industry. Different research studies have demonstrated the potential benefits of cannabis in cancer treatment, thus, increasing its demand for cancer therapy. Further, over 100 million Americans suffering from chronic pain rely on opioid painkillers such as Vicodin. Medical cannabis is found to have the potential to fight this opioid epidemic in the United States. As the FDA called for a ban on Opana ER, an opioid painkiller, due to public health reasons in April 2018, cannabis-derived drugs are increasingly being considered a substitute to opioids as they possess no risk of overdose and are less-addictive.

The growing cannabis-related research and development activities and new product launch by manufacturers and leading companies will further aid the legal cannabis industry growth in the future. The growing public support for the legalisation of marijuana and the shift towards hemp-based products are contributing to the industry growth. The growing popularity of CBD hemp oil, which is emerging as an essential part of a healthy lifestyle, is expected to aid the industry growth over the forecast period.

Key North America legal cannabis market players are expanding their product portfolios to include CBD-infused beauty and wellness products, topicals, edibles, vapes, and beverages for both medicinal and recreational use. Legal cannabis companies in North America are also actively investing in research activities to develop innovative cannabis formulations and delivery methods.

Tilray, founded in 2013 and headquartered in New York, United States, is a prominent lifestyle and consumer packaged goods company. The company is a pioneer in the production, development and research of medicinal cannabis. It supplies medical cannabis to patients in 18 countries across the world.

Marijuana Company of America, Inc., headquartered in California, United States, is an operator and owner of licensed cannabis processing, cultivation, and dispensary facilities. Its wholly owned subsidiary cDistro, Inc. offers CBD brands and smoke and vape shop-related products to speciality retailers, wholesalers, and consumers in North America.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

The comprehensive EMR report provides an in-depth assessment of the industry, providing an insight into the various trends in the market, based on the Porter's five forces model along with giving a SWOT analysis.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the North America legal cannabis market attained a value of nearly USD 33.69 Billion.

The market is projected to grow at a CAGR of 26.80% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 361.99 Billion by 2035.

The major drivers of the market are the increasing awareness regarding the health benefits of cannabis, growing utilisation of product for recreational purposes, increasing geriatric population, rising demand for cannabis in the medical sector, and favourable government policies.

The key trends guiding the growth of the legal cannabis market include the launch of enhanced cannabis-based products and the growing investment by the government and private organisations in the research and development activities.

The major regional markets are the United States of America and Canada.

Marijuana and industrial hemp represent the major type of products derived in the market.

The regulated dispensary, recreational stores, and stand-alone retailers are the most significant distribution channels of legal cannabis in the market.

The major players in the North America legal cannabis market are Tilray, and Marijuana Company of America, Inc, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

|

Breakup by Products Derived |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,699

USD 2,429

tax inclusive*

Single User License

One User

USD 4,299

USD 3,869

tax inclusive*

Five User License

Five User

USD 5,799

USD 4,949

tax inclusive*

Corporate License

Unlimited Users

USD 6,999

USD 5,949

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share