Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The North America online gambling market size attained a value of USD 14.26 Billion in 2025. The market is expected to grow at a CAGR of 9.07% between 2026 and 2035, reaching almost USD 33.98 Billion by 2035.

Base Year

Historical Period

Forecast Period

According to 2022 data from Statistics Canada, around 64.5% of Canadians aged 15+ (about 18.9 million people) participated in gambling in 2018.

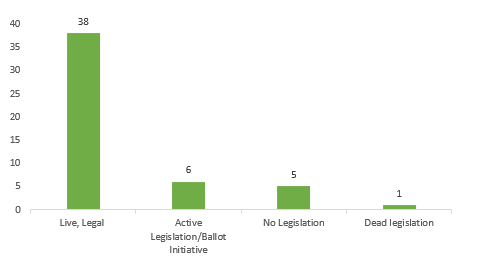

The American Gaming Association reports that by January 2024, sports betting is legally regulated in 38 US states, thus, fuelling the North America online gambling market growth.

The Super Bowl is expected to become the most significant sports betting occasion ever witnessed in the history of the United States.

Compound Annual Growth Rate

9.07%

Value in USD Billion

2026-2035

*this image is indicative*

The North America online gambling market comprises diverse digital platforms and services catering to gambling activities throughout the region. It encompasses a broad spectrum of online gambling types, including sports betting, casino games, poker, lotteries, and various other betting options, all accessible via digital platforms.

Licensed operators and platforms provide these online gambling services, enabling individuals to engage in remote gambling and betting using devices such as computers, smartphones, or other internet-enabled devices. The market reflects a rising inclination towards online gambling, driven by technological advancements like mobile apps, virtual reality, and blockchain, which enhance the overall gambling experience.

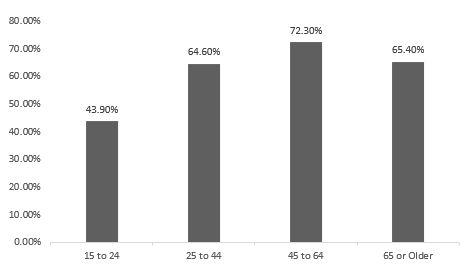

Based on Statistics Canada's 2022 statistics, approximately 64.5% of Canadians aged 15 or older, equivalent to 18.9 million individuals, engaged in gambling activities in 2018. This significant participation contributed to the North America online gambling market growth.

PREVALENCE OF GAMBLING BY HOUSEHOLD POPULATION AGE

The North America online gambling market is growing in technological progress, accessibility and convenience, legalisation and regulatory shifts and passion for sports.

The swift technological progress propels the North America online gambling market development, with advancements like mobile platforms, advanced software, and heightened security bolstering user experience. Integration of VR and AR creates immersive gaming, while blockchain ensures secure transactions, fostering trust and market expansion.

Online gambling platforms provide unmatched convenience, enabling users to enjoy a vast selection of games anytime, anywhere. This accessibility, made possible by widespread internet access and the prevalence of smart devices, has attracted a diverse clientele, driving market expansion.

Legalisation and regulation of online gambling drive market growth. Governments acknowledge economic benefits, including job creation and tax revenues, leading to legal amendments. Clear legal frameworks ensure safety and fairness, attracting participants and curbing illegal activities, fuelling expansion.

Sports betting is immensely popular due to the widespread appeal of sports globally. Major events like the Super Bowl and FIFA tournaments attract both legal and illicit betting across the world, appealing to a wide range of gamblers.

As per the North America online gambling market report, the transition of players from traditional to digital gambling presents lucrative growth opportunities for online casino operators. Many seasoned players favour live casinos for their ability to monitor gameplay and offer real-time interaction with live dealers. Additionally, these platforms provide flexibility with 24/7 access.

Furthermore, online gaming platforms embrace secure online payment methods, enhancing consumer trust and fuelling market expansion. Many online sports betting firms employ strategic partnerships, including acquisitions or mergers, to sponsor teams and expand their reach as part of their marketing endeavours.

"North America Online Gambling Market Report and Forecast 2026-2035" offers a detailed analysis of the market based on the following segments:

Market Breakup by Game Type

Market Breakup by Device

Market Breakup by Country

Sports betting dominates the North America online gambling market, largely due to the widespread enthusiasm for sports

The segment's growth is powered by major sports events like the FIFA World Cup and the Olympics. Online platforms offer live betting, event coverage, and competitive odds, with features like live streaming and real-time analytics enhancing the betting experience amid regulatory shifts favouring legalisation.

Online casinos offer diverse games like slots, poker, blackjack, roulette, and baccarat, catering to both serious and casual players with a variety of options ranging from simple slots to strategic games like poker.

Based on device, the North America online gambling market share is led by mobiles and tablets

Mobile gambling is swiftly expanding and poised to exceed desktop usage in the online gambling market, propelled by smartphone and tablet prevalence, improved technology, and user-friendly interfaces.

Desktop platforms provide superior screen size and stable internet connectivity, enhancing immersion, particularly in intricate games such as poker and virtual casinos. Companies prioritise advanced graphics, reliable software, and extensive game selections to entice users.

The North America online gambling market competitiveness is characterised by the technological advancements, ease of access, and regulatory changes.

888 Holdings was established in 1997 as Virtual Holdings Limited, is a global gambling and sports betting corporation. It possesses renowned brands including 888casino, 888poker, 888sport, Mr Green, and William Hill.

MGM Resorts International was established in 1986 and headquartered in the United States, is a worldwide hospitality enterprise. It manages both casino and non-casino resort ventures globally, with key business activities spanning gaming, hospitality, and entertainment.

Flutter Entertainment Plc was founded in Ireland in 2016, previously known as Paddy Power Betfair plc, and operates as a global sports betting and gambling corporation. It engages in various activities such as on-course bookmaking, daily fantasy sports, broadcasting, editorial services, sportsbooks, exchanges, and business-to-business services.

Caesars Entertainment Inc. was established in 1973 and is headquartered in the United States and operates a network of resorts. The company provides various gaming amenities including casinos, poker, and roulette, along with food and beverage services.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other North America online gambling market key players are PENN Entertainment Inc., Churchill Downs, Inc., Entain Plc, SGHC Ltd. (Betway), DraftKings Inc., and Cherry Gold Casino, among others.

The United States is experiencing a rising embrace of online gambling, which is evident by the ongoing process of legalising and regulating online sports betting and casinos. This trend is accompanied by technological advancements, heightened investment in mobile platforms, and collaborative ventures between local and international gambling entities.

As reported by the American Gaming Association, as of 2024, sports betting is permitted and regulated in 38 states across the US, driving the demand for online gambling in North America.

SPORTS BETTING LEGISLATION IN THE US STATES, 2024

In Canada, gambling stands as a significant facet of the entertainment sector, bolstered by widespread familiarity with gambling practices and the growing accessibility of legal gambling opportunities, aiding the North America online gambling market development.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is estimated to be valued at USD 14.26 Billion in 2025.

The online gambling market is projected to grow at a CAGR of 9.07% between 2026 and 2035.

The market is expected to witness significant growth to reach a value of about USD 33.98 Billion in 2035.

The market is growing due to technological progress, accessibility and convenience, legalisation and regulatory shifts, and passion for sports.

Based on the game type, the online gambling market is divided into sports betting, casino, lottery, and bingo.

Key players in the industry are 888 Holdings, MGM Resorts International, Flutter Entertainment Plc, Caesars Entertainment Inc., PENN Entertainment Inc., Churchill Downs, Inc., Entain Plc, SGHC Ltd. (Betway), DraftKings Inc., Cherry Gold Casino and others.

Based on the device, the online gambling market is divided into desktop and laptops and mobile and tablets

The market is broken down into United States of America and Canada.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Game Type |

|

| Breakup by Device |

|

| Breakup by Country |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share