Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The North America recycled plastics market is expected to grow at a CAGR of 5.20% during the period 2026-2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

5.2%

2026-2035

*this image is indicative*

Government regulations and rising consumer pressure to adopt sustainable business activities is forcing firms to take up environmentally friendly alternatives. Consumers are increasingly displaying sensitivity towards how plastic products negatively affect the environment, and taking into consideration plastic recyclability and the possibility of the plastic item ending up in a landfill.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Packaging, in particular, has come to become a significant factor affecting purchase decisions of socially aware consumers. Indeed, companies neglecting consumer sentiment towards eco-friendly packaging might see a negative effect on their margins. The government also is making efforts to encourage plastic recycling. In 2020, the U.S. Department of Energy (DOE) announced to fund twelve projects to support the advancement advanced plastics recycling technologies. The expenditure towards funding amounted to over UDS $27 million. Thus, a combination of consumer pressure and government regulations is likely to drive the North America recycled plastics market during the period 2026-2035. PET (polyethylene terephthalate) is extensively used in the manufacture of soft drink plastic bottles, and food and liquid containers. PET is also used for extrusion of sutures, implantable textiles and tubing for angioplasty balloons. Thus, the PET segment is expected to lead the North America recycled plastics market.

In 2021, the Consortium of Carbios, L’Oréal, Nestlé Waters, PepsiCo and Suntory Beverage & Food Europe, announced the successful manufacture of the world’s first food-grade PET plastic bottles made completely from enzymatically recycled plastic. Each Consortium firm has produced, successfully, sample bottles on the basis of Carbios’ enzymatic PET recycling technology for a few of their key products including Biotherm, Perrier, Pepsi Max and Orangina. Carbios created a new process using an enzyme that naturally occurs in compost heaps and normally breaks down leaf membranes of dead plants. Carbios optimized this enzyme through technology, and made possible the breaking down of any type of PET plastic into its components, which can be refashioned into like-new virgin-quality plastic.

In 2016, a group of trade associations and non-profits announced the formation of the North American Plastics Recycling Alliance (NAPRA) to significantly grow plastics recycling in the United States and Canada.

In recent years, several leading companies have displayed commitment towards adoption of recycled plastics. For example, Coca-Cola claims that nearly 88% of its packaging products were made of recycled plastics in 2019, and aims to take the figure to100% by 2025.

Walmart has also increased the PCR (post-consumer resin) percentage employed in its private label packaging in North America from nearly 7% in 2019 to almost 9% in 2020 (Walmart includes Canada, the U.S. and Mexico in its North America calculations), and aims to achieve 20% PCR in North America and 17% globally by 2025.

In 2021, Coca-Cola Trademark brands (Coke, Diet Coke, Coke Zero Sugar, Coca-Cola Flavors) announced the introduction of a 13.2-oz. bottle made of 100% recycled PET (rPET) plastic in USA to encourage recycling and the creation of a circular economy. More than 94% of the company’s North American packaging is currently recyclable.

Clearly, major companies are striving towards increased use of recycled plastic.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

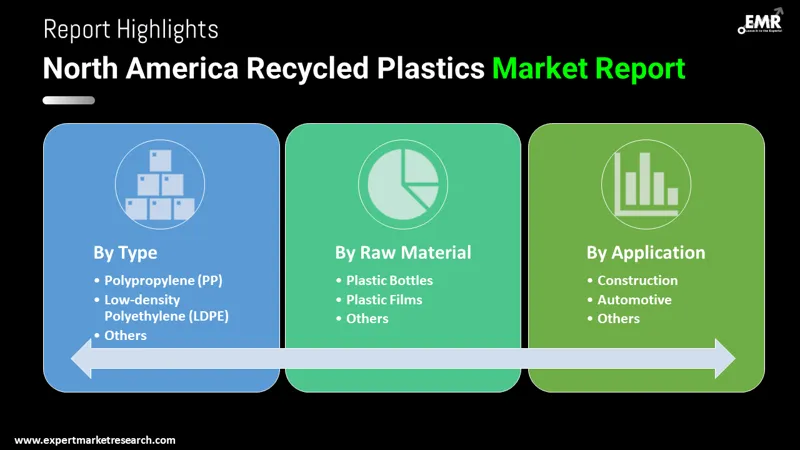

North America Recycled Plastics Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

By type, the market is segmented into:

By raw-material, the market is classified into:

By application, the market is segmented into:

By region, the market is classified into:

The report presents a detailed analysis of the following key players in the market, looking into their capacity, and latest developments like capacity expansions, plant turnarounds, and mergers and acquisitions:

The EMR report gives an in-depth insight into the industry by providing a SWOT analysis as well as an analysis of Porter’s Five Forces model.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Raw Material |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share