Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The North America waterproofing market size reached nearly USD 21.35 Billion in 2025. The market is projected to grow at a CAGR of 4.80% between 2026 and 2035 to reach around USD 34.12 Billion by 2035.

Base Year

Historical Period

Forecast Period

Green roofs are gaining popularity across North America as awareness of climate change rises, which can reduce the need for air conditioning in buildings by around 75%.

BASF SE, DuPont de Nemours, Inc., and Wacker Chemie AG are a few of the major companies in the market.

With rising innovation in waterproofing technologies, companies are exploring areas like nanotechnology in waterproofing to enhance the structural integrity of buildings.

Compound Annual Growth Rate

4.8%

Value in USD Billion

2026-2035

*this image is indicative*

| North America Waterproofing Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 21.35 |

| Market Size 2035 | USD Billion | 34.12 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 4.80% |

| CAGR 2026-2035 - Market by Country | Canada | 5.4% |

| CAGR 2026-2035 - Market by Country | USA | XX% |

| CAGR 2026-2035 - Market by Type | Bituminous Membrane | 5.1% |

| CAGR 2026-2035 - Market by Application | Roofs and Balconies | 5.1% |

| Market Share by Country 2025 | Canada | 10.1% |

To prevent moisture buildup and ensure that water cannot enter through surfaces like floors, walls, and ceilings, waterproofing materials are applied. The extreme cold weather in North America creates opportunities for waterproofing solutions.

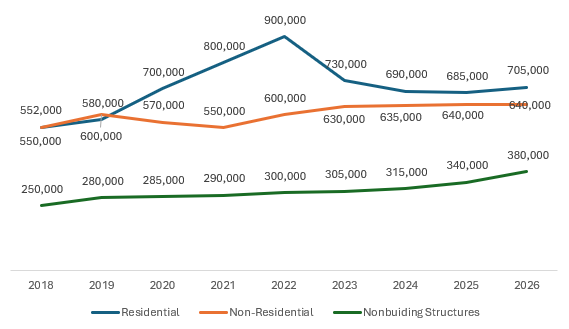

Figure: Total Construction Spending in the United States (2018-2026)

One of the major factors driving the North America waterproofing market growth is the growing construction activities in the USA and Canada. Growing demand for urban centres and high urbanisation fuel construction activities in the region. Consequently, it increases the demand for waterproofing to safeguard buildings from extreme climatic conditions. Additionally, a rise in immigration and a growing working population in Canada aid the demand for residential and commercial construction.

Growth in construction sector; government investments promoting infrastructural development; rise in the working population; the growing popularity of green roofing; and innovations in waterproofing solutions aid the North America waterproofing market expansion

| Date | Company | Details |

| April 2023 | Sika AG | Introduced Sikaflex®-591, a versatile and mould-resistant hybrid sealant, which is UV-stable, weather-resistant, and free of harmful components, suitable for various sealing applications at the IBEX Conference and Exhibition. |

| March 2023 | U.S. Waterproofing LLC | Acquired Crawl Space Brothers, a prominent provider of crawl space encapsulation, repair, and basement waterproofing services in the Southeastern U.S. |

| March 2023 | MAPEI | introduced Mapeguard Board, a versatile and waterproof backer-board panel designed for use in ceramic tile and stone installations. It features an extruded polystyrene core and a waterproof membrane on both sides for water and vapour protection. |

| March 2023 | SOPREMA | Partnered to distribute the CN2000® cementitious capillary crystalline waterproofing system for concrete infrastructure. |

| Trends | Impact |

| Growing construction activities | The USA contributes around 11.1% to the global construction market. Hence, growing construction activities in the USA and Canada surge the demand for optimal waterproofing solutions. |

| Government investments in infrastructure development | The U.S. Department of Transportation (DOT) allotted USD 26.5 billion in January 2022 to repair, replace, and construct approximately 15,000 highway bridges, aiding the requirement for waterproofing systems. |

| Rise in immigration and a growing working population | In 2022, Canada witnessed the entry of 437,180 immigrants. A rise in immigration and a growing working population aid the demand for residential and commercial waterproofing systems in the region. |

| Demand for sustainable waterproofing solutions for green building initiatives | Green building initiatives promote the use of waterproofing solutions that reduce energy consumption and have a lower environmental impact. |

| Innovation in waterproofing technologies | Manufacturers are exploring areas like nanotechnology in waterproofing, crystalline waterproofing, waterproofing membranes, self-healing, water-repellent and spray-on coating to enhance the sustainability and structural integrity of buildings. |

The North America construction market continues to grow, driven by factors such as urbanisation, population growth, and infrastructure renewal projects. Additionally, high-growth segments for the USA’s construction sector in 2022 included multifamily and residential improvements, manufacturing, commercial, sewage and waste disposal, water supply, and others. These sectors grew with an annual growth rate of over 10%.

The increasing construction of green buildings amid the growing environmental consciousness is also supporting the North America waterproofing market expansion. Manufacturers, such as MAPEI S.p.A. (Italy) and W.R. Meadows (USA), provide contractors with VOC-compliant liquid waterproofing membranes. These membranes can contribute to LEED points and enhance the structural life of buildings.

North America Waterproofing Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Application

Market Breakup by Region

| CAGR 2026-2035 - Market by | Type |

| Bituminous Membrane | 5.1% |

| Thermoplastic Membrane | 4.7% |

| Liquid Membrane | XX% |

| Cementitious Membrane | XX% |

| Others | XX% |

| CAGR 2026-2035 - Market by | Application |

| Roofs and Balconies | 5.1% |

| Bridges and Highways | 4.7% |

| Parking Deck | XX% |

| Tunnel Liners | XX% |

| Others | XX% |

Liquid membrane is further divided based on type into bituminous coating, polyurethane membrane, epoxy, and acrylic.

Bituminous membrane is expected to dominate the North America waterproofing market share as it acts as a solid and reliable barrier against water penetration.

Bituminous waterproofing systems are ideal for cold climates owing to their high flexibility at low temperatures. In countries like the USA and Canada, producers of bitumen rolling roofs need to comply with standards, such as ASTM C981-05 and CSA A123.23-15 laid down by the American Society for Testing Materials and Canadian Standard Association. Leading market players such as Sika AG and MAPEI S.p.A. offer customers customisable bituminous membranes to meet evolving customer demands.

| CAGR 2026-2035 - Market by | Country |

| Canada | 5.4% |

| USA | XX% |

Meanwhile, the demand for thermoplastic membranes is substantially rising as they reduce repair and maintenance costs, offer enhanced durability and strength, can withstand normal building movement, and are resistant to bacteria and mould. In addition, the North America waterproofing market growth is being fuelled by the increasing launches of innovative and sustainable thermoplastic membranes in the coming years.

The use of waterproofing solutions in roofs and balconies is significantly rising due to diverse environmental conditions in the region

Waterproofing solutions are widely used on roofs and balconies to withstand diverse climatic situations. With over 83% of the population living in urban areas, coupled with changing climate and global warming, the requirement for optimal waterproofing solutions for roofs and balconies is increasing. The demand for green roof waterproofing surged with mandatory regulations for waterproofing for green roofs.

Besides, increasing renovation and repair activities of bridges, tunnels, and highways by governments are expected to favour the North America waterproofing market expansion in the forecast period.

Major players in the North America waterproofing market are increasing their collaboration, partnership, and research and development activities to gain a competitive edge

| Company | Year Founded | Headquarters | Products/Services |

| BASF SE | 1865 | Germany | Offers binders and additives for application in polymer-modified asphaltic waterproofing and cementitious waterproof coatings. |

| DuPont de Nemours, Inc. | 1802 | United States | offers a diverse range of waterproofing, and water barrier products under the brand names Weathermate™, Tyvek®, Styrofoam™ Brand, LiquidArmor™, DuPont™ Sill Pan etc. |

| Wacker Chemie AG | 1914 | Germany | Provides waterproofing membranes under the VINNAPAS® brand. |

| Sika AG | 1910 | Switzerland | provides a wide array of waterproofing systems for various applications, including below-grade, tunnel, bridge deck, water tank, wet room, and pond waterproofing. |

Other key players in the North America waterproofing market include GCP Applied Technologies Inc., GAF Materials LLC, Arkema SA, and Evonik Industries AG.

The United States accounts for a major market share due to the growing construction activities and infrastructure development in the country

The United States holds a dominant position in the North America waterproofing market. In August 2023, total construction spending for the residential sector in the United States increased to USD 872.0 billion. Increased disposable incomes have fuelled a surge in residential improvement and renovation projects, leading to a rise in the demand for residential waterproofing solutions.

Meanwhile, the market in Canada is being driven by the rise in immigration and a growing working-age population. In Canada, individuals dealing with basement leaks are increasingly turning to basement waterproofing services, especially during the rainy season. In August 2023, the Quebec region recorded a 10.6% monthly increase in investment of USD 95.0 million, the largest since March 2022 for single-family home construction.

| 2025 Market Share by | Country |

| Canada | 10.1% |

| USA | XX% |

Table: Overview of Tunnel Projects in North America

| Project | Investment | Completion Year | Description |

| Hudson Tunnel Project (USA) | USD 17.2 billion | 2035 | Underwater rail tunnel between New York City and New Jersey. |

| Potomac River Tunnel (USA) | USD 819 million | 2030 | 5.5-mile-long tunnel will control combined sewer overflows to the Potomac River. |

| Eglinton Crosstown West Extension (Canada) | USD 729 million | 2025 | The underway with 9.2 kilometres from the future Mount Dennis LRT station to Renforth Drive. |

Global Waterproofing Market

Global Below Grade Waterproofing Market

Latin America Waterproofing Market

Brazil Waterproofing Market

Chile Waterproofing Market

Indonesia Waterproofing Market

Malaysia Waterproofing Market

United States Waterproofing Market

Mexico Waterproofing Market

Colombia Waterproofing Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market value was approximately USD 21.35 Billion.

The market is projected to grow at a CAGR of 4.80% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach around USD 34.12 Billion by 2035.

The market drivers include growing construction activities, government investment in infrastructure development, and innovations in waterproofing technologies.

The key trends include demand for sustainable waterproofing solutions for green building initiatives and increasing repair and renovation activities.

The different types of waterproofing include liquid membrane, cementitious membrane, bituminous membrane, and thermoplastic membrane (PVC, Others).

The major applications of waterproofing include roofs and balconies, parking deck, tunnel liners, and bridges and highways, among others.

The major players in the market include BASF SE, GCP Applied Technologies Inc., DuPont de Nemours, Inc., Wacker Chemie AG, Sika AG, GAF Materials LLC, Arkema SA, Evonik Industries AG.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share