Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global ocular implants market size was valued at USD 17.05 Billion in 2025. The market is projected to grow at a compound annual growth rate (CAGR) of 5.90% during the forecast period from 2026 to 2035, with values likely to reach USD 30.25 Billion by 2035. Key growth drivers include the rising prevalence of ophthalmic disorders, the aging global population, and technological advancements in implants. Additionally, increasing awareness of corrective eye surgeries, rising healthcare expenditures, and a surge in cases of diabetic retinopathy are contributing factors. Conditions such as cataracts, glaucoma, and vision impairment—both near and distance are also fostering demand.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

5.9%

Value in USD Billion

2026-2035

*this image is indicative*

The ocular implants market is a critical segment of ophthalmology, addressing various eye diseases through advanced surgical solutions. These implants play a vital role in restoring vision and improving the quality of life for individuals with distance vision impairment and uncorrected near vision impairment. Factors such as population aging, urbanization, and increasing healthcare access in low- and middle-income countries (LMICs) contribute to the market’s significance. As technology advances, ocular implants continue to evolve, offering innovative treatments for vision-related conditions worldwide.

The key driver of the ocular implants market is the rising prevalence of eye conditions. Around 2.2 billion people worldwide experience vision impairment, with over 1 billion cases being preventable or unaddressed. Conditions such as cataracts, glaucoma, and age-related macular degeneration (AMD) significantly contribute to this burden. The global prevalence of glaucoma among individuals aged 40-80 years is approximately 3.54%, while in 2020, an estimated 3.7 million people were blind. Advanced ocular implants to restore vision are important in addressing these challenges. The aging population is a major factor driving demand, as age-related eye conditions become more common. These implants restore vision and improve the quality of life for affected individuals.

The ocular implants market is further driven by the increasing aging population and rising prevalence of age-related eye conditions. As the incidence of cataracts, glaucoma, and macular degeneration increase, the demand for effective vision correction grows. Cataracts alone affect millions worldwide, making them a significant contributor to vision impairment. With age-related macular degeneration rising, advanced ocular health solutions are essential to meet growing needs. The increasing burden of these conditions emphasizes the need for innovative ocular implants to address vision loss. The market is poised for growth as technological advancements continue to enhance the efficacy of ocular implants and provide better vision correction options, improving ocular health solutions globally.

The ocular implants market is moderately concentrated, with a mix of established medical technology firms and emerging innovators driving advancements. This market includes a variety of implants such as intraocular lenses (IOLs), glaucoma implants, and retinal implants, addressing a broad range of ocular conditions. The landscape is characterized by the presence of global medical device manufacturers and specialized ophthalmology companies. The industry’s concentration reflects a balance between a few dominant players with extensive resources and smaller firms contributing to niche innovations. Companies in this sector focus on improving surgical outcomes, enhancing patient comfort, and developing advanced delivery mechanisms for sustained drug release. Ongoing research and development efforts are shaping the market, with increasing collaboration and strategic partnerships to expand product offerings and geographical reach. Market growth is fueled by the rising prevalence of age-related vision disorders and adoption of minimally invasive procedures.

The degree of innovation in the ocular implants market is high, driven by rapid technological advancements and the increasing demand for improved patient outcomes. Companies are investing in cutting-edge technologies like biocompatible materials, tailored drug delivery systems, and advanced intraocular lens designs. Innovations focus on providing long-term solutions that reduce the need for repeated surgical interventions and improving visual acuity. The development of refillable ocular implants and devices with sustained-release capabilities is transforming treatment patterns. Furthermore, the integration of digital workflows enhances surgical precision and post-operative monitoring. The market is observing continuous improvements in implant designs, addressing both therapeutic and cosmetic needs, with an emphasis on patient safety, durability, and ease of use.

Mergers and acquisitions play a pivotal role in shaping the ocular implants market by enabling companies to expand product portfolios and strengthen market presence. For instance, in April 2024, Carl Zeiss Meditec AG completed the acquisition of Dutch Ophthalmic Research Center (D.O.R.C.) after securing all required regulatory approvals. This acquisition enhances ZEISS Medical Technology’s ophthalmic portfolio and integrates advanced surgical solutions for retinal and corneal conditions. This integration aims to deliver breakthrough innovations and provide comprehensive solutions for ophthalmologists globally. The acquisition also supports ZEISS’s strategy to become a leading player in ophthalmology by leveraging enhanced workflows and expanding their market presence in anterior and posterior surgery segments.

Regulatory frameworks significantly impact the ocular implants market by ensuring product safety and efficacy while shaping innovation timelines. For example, in July 2024, Genentech, part of the Roche group, received FDA approval to relaunch Susvimo, a refillable ocular implant for treating wet age-related macular degeneration (AMD). This approval followed a voluntary recall in October 2022 due to issues with the implant’s seal performance. The relaunch of Susvimo addresses these concerns and provides patients with a long-term drug delivery option, reducing the frequency of injections. Regulatory approvals like these are critical in restoring market confidence and ensuring patient safety. Companies face stringent regulatory scrutiny, particularly for novel implants, which impacts development timelines and encourages the adoption of advanced, compliant technologies.

The ocular implants market faces limited product substitutes due to the specialized nature of these devices. However, alternative treatment methods such as topical medications, laser therapies, and systemic drugs provide non-invasive options for managing eye conditions. For instance, anti-VEGF injections are commonly used to treat retinal diseases like AMD, competing with implant-based drug delivery. Laser trabeculoplasty is an alternative to glaucoma drainage implants for reducing intraocular pressure. While these substitutes offer less invasive options, they often require frequent treatments, whereas ocular implants provide sustained therapeutic effects and improve patient adherence. Despite the availability of substitutes, implants remain crucial for patients requiring long-term or advanced treatment solutions, particularly in cases where other therapies are insufficient.

Regional expansion is a key strategy for market growth, with companies focusing on emerging markets and regulatory approvals in new territories. For instance, in January 2024, Rayner, a leading manufacturer of cataract surgery products, announced the first RayOne Galaxy IOL implantations in the United States under an FDA-approved Investigational Device Exemption (IDE) study. This study aimed to secure pre-market approval (PMA), allowing broader U.S. market entry. It marked a significant milestone for Rayner’s expansion into the United States, complementing their successful European launch. By entering new regions, companies can access larger patient populations, address unmet medical needs, and strengthen their competitive position. North America, Europe, and Asia-Pacific are primary focus areas due to advanced healthcare infrastructure and rising demand for innovative ophthalmic solutions.

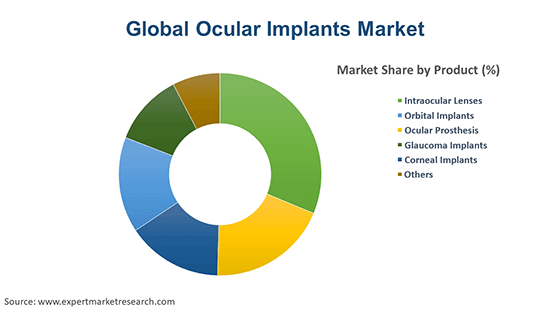

Based on the products, the ocular implants market is segmented into intraocular lenses, orbital implants, ocular prosthesis, glaucoma implants, corneal implants, and others. Among these, intraocular lenses (IOLs) hold a substantial market share due to their critical role in cataract surgery and vision correction. The increasing number of cataract cases worldwide drives the demand for intraocular lenses. Glaucoma implants are another key segment, fueled by the rising prevalence of glaucoma and the need for effective long-term pressure management. In 2022, approximately 4.22 million people in the United States were living with glaucoma, affecting 1.62% of adults aged 18 years or older and 2.56% of those aged 40 years or older. Of these, 1.49 million people had vision-affecting glaucoma, with prevalence rates of 0.57% and 0.91% in the same age groups, respectively. As the aging population grows and awareness of ocular diseases increases, the market for advanced ocular implants continues to expand.

The intraocular lenses (IOLs) segment is expected to experience significant growth due to the rising prevalence of cataracts and advancements in surgical techniques. Globally, cataracts are the leading cause of blindness and the second-leading cause of moderate and severe visual impairment. Over 100 million people worldwide are affected by cataracts, with approximately 17 million cases resulting in blindness. The growing aging population and technological innovations, such as multifocal and toric lenses, are increasing the demand for IOLs. These advanced lenses improve post-surgery vision quality and patient outcomes. As cataract surgeries become more accessible, the need for high-performance intraocular lenses is expected to rise, driving substantial market growth in the coming years.

The market is segmented based on application into oculoplasty, glaucoma surgery, drug delivery, age-related macular degeneration (AMD), aesthetic purposes, and others. Among these, the glaucoma surgery segment holds a significant market share due to the rising prevalence of glaucoma worldwide and the increasing adoption of minimally invasive glaucoma surgeries (MIGS). Ocular implants play a crucial role in reducing intraocular pressure and preventing vision loss, making them essential for managing glaucoma cases. Additionally, age-related macular degeneration (AMD) is another significant segment driven by the aging population and the increasing incidence of retinal disorders. The demand for intraocular implants for AMD treatment is rising as advanced implantable devices enhance patient outcomes and provide targeted drug delivery. Oculoplasty procedures, including orbital implants and prosthetics, also contribute to the market, driven by the growing need for reconstructive surgeries and cosmetic enhancements.

The drug delivery segment is projected to experience substantial growth due to advancements in sustained-release ocular implants and increasing demand for targeted therapies. Innovations such as biodegradable implants and micro-implants enable controlled, long-term drug release, improving patient compliance and treatment efficacy. This growth is supported by rising cases of chronic eye diseases like diabetic retinopathy and AMD, where sustained drug delivery reduces the frequency of intraocular injections. Additionally, the aesthetic purpose segment is gaining traction, driven by increasing consumer interest in cosmetic eye procedures and prosthetic eye implants for improved appearance. As technology advances, the demand for personalized and biocompatible ocular implants is expected to drive growth across multiple applications, expanding treatment options and improving patient outcomes.

Based on end user, the ocular implants market includes hospitals, clinics, specialty eye institutes, and others. Hospitals hold the largest market share due to their advanced medical infrastructure, access to specialized ophthalmic equipment, and the presence of highly trained healthcare professionals. They handle a high volume of complex ocular implant procedures, including cataract surgeries, glaucoma implants, and retinal implants. The rising prevalence of age-related eye conditions, such as cataracts and macular degeneration, increases patient demand for surgical interventions. Additionally, hospitals offer comprehensive care, including preoperative assessments and postoperative management, ensuring better patient outcomes. The growing adoption of advanced ocular implants, such as intraocular lenses (IOLs) and corneal implants, further drives market growth in this segment. The availability of government funding and insurance coverage for ocular surgeries also supports hospitals' dominant position in the ocular implants market.

Clinics and specialty eye institutes are projected to experience significant growth in the ocular implants market. This growth is driven by the increasing number of outpatient procedures and patient preference for faster, specialized care. Specialty eye institutes focus on advanced ophthalmic treatments and offer tailored solutions for conditions such as glaucoma, retinal disorders, and corneal diseases. Clinics provide more accessible and personalized care, with shorter waiting times compared to hospitals, making them a preferred option for non-emergency ocular procedures. The rising adoption of minimally invasive ocular surgeries and technological advancements in implant design further boost growth in these segments. Additionally, the expansion of ambulatory care services and the increasing availability of specialized surgical techniques contribute to the growing demand for ocular implants in clinics and specialty eye institutes. These factors position these segments to capture a larger share of the market in the coming years.

The ocular implants market includes regions such as North America, Europe, Asia-Pacific, Latin America, and the Middle East, and Africa. North America holds a significant market share due to advanced healthcare infrastructure, increased adoption of innovative ocular technologies, and a growing aging population prone to eye disorders. The United States drives market growth with rising cases of cataracts, glaucoma, and macular degeneration, leading to increased demand for ocular implants. Favorable reimbursement policies and ongoing research and development further support market expansion. Additionally, the presence of major industry players enhances technological advancements and product availability. Increasing awareness about eye health and early diagnosis also contributes to the region’s growth. Moreover, supportive government initiatives and high healthcare expenditure foster the adoption of advanced ocular solutions. The region’s focus on improving patient outcomes and access to cutting-edge treatments positions North America as a key player in the global ocular implants market.

The U.S. ocular implants market is experiencing significant growth, driven by technological advancements and the increasing prevalence of ocular conditions like diabetic macular edema (DMO). Innovations such as refillable implants for continuous drug delivery are improving the patient outcomes while reducing the burden of frequent treatments. The market is also witnessing a rise in demand for minimally invasive procedures and patient-centric care solutions, with increasing FDA approvals and robust research investments further enhancing market expansion. For instance, in February 2025, the United States FDA approved Susvimo, a continuous delivery ranibizumab treatment for diabetic macular edema. This refillable ocular implant, formerly known as port delivery system, offers a less invasive alternative to monthly eye injections, with efficacy supported by the Phase III Pagoda study. Companies are focusing on developing advanced ocular implants to address rising cases of age-related macular degeneration and other chronic eye diseases.

The Europe ocular implants market is expanding due to rising cases of cataracts, glaucoma, and dry eye disease (DED), coupled with advancements in implant technologies. Increased research and development investments, a growing aging population, and improved regulatory support drive market growth. The demand for minimally invasive procedures and personalized implants is increasing as patients seek better post-surgical outcomes. In October 2024, Novaliq and Laboratoires Théa received European Commission approval for Ciclosporin 0.1% eye drops solution (Vevizye) to treat dry eye disease. This product, already approved by the U.S. FDA, will be commercialized across Europe and select regions of the Middle East and North Africa. Clinical trials confirmed its efficacy in improving corneal health in patients with moderate to severe DED. Continuous innovation, strategic partnerships, and increasing public awareness about advanced ocular treatments further contribute to the region’s market growth.

The UK ocular implants market is growing due to increasing demand for vision correction solutions and the adoption of advanced surgical techniques. Rising incidences of refractive errors, including myopia and presbyopia, are accelerating market development. For instance, in June 2024, EuroEyes expanded its presence by opening a flagship laser eye clinic in London, offering treatments for myopia, presbyopia, and cataracts. The clinic emphasizes cutting-edge technologies and patient-centered care, reflecting the rising preference for minimally invasive procedures. With an experienced clinical team, the UK market continues to attract investments and innovations in ocular implants. Increasing public and private collaborations and the availability of advanced surgical infrastructure further enhance market growth.

The market in France is driven by technological innovations and government support for ophthalmic treatments. Increasing cataract surgeries and demand for premium intraocular lenses fuel market growth. The focus on minimally invasive techniques and the customization of implants enhances patient outcomes. Reimbursement policies and a well-established healthcare system further support market expansion. Ongoing research in advanced implants and collaborations between public and private sectors play a significant role in shaping the market landscape.

The ocular implants market in Germany is expanding due to high adoption rates of advanced implantable devices and increasing age-related eye conditions. Strong R&D investments, a robust regulatory environment, and collaborations between medical institutions and industry leaders drive innovation. The demand for personalized implants and state-of-the-art surgical solutions continues to rise. Increasing patient awareness, improved access to advanced treatments, and a growing focus on precision medicine further strengthen the market's position.

Asia Pacific’s ocular implants market is experiencing notable growth driven by technological innovations and expanding healthcare infrastructure. Rising demand for advanced eye care solutions and increasing investments in research and development are propelling market expansion. Emerging economies in the region are adopting state-of-the-art surgical techniques and high-quality implant materials, contributing to improved clinical outcomes. Government initiatives and public‑private collaborations further support market growth. Overall, the region is witnessing a surge in both domestic and international partnerships, which are instrumental in enhancing accessibility and affordability of ocular implant solutions across Asia Pacific.

Japan’s ocular implants market remains extremely dynamic, driven by robust healthcare infrastructure and significant investments in innovation and research. Demand for advanced implants is rising, fueled by an aging population and improved surgical techniques. In November 2024, Atsena Therapeutics and Nippon Shinyaku signed an exclusive license for ATSN‑101, a gene therapy for Leber congenital amaurosis (LCA1). Under the agreement, Nippon Shinyaku intended to commercialize ATSN‑101 in the United States and Japan, while Atsena retains global rights. These strategic moves are bolstering market growth.

China's ocular implants market is experiencing robust growth, driven by rising healthcare investments and a growing focus on advanced surgical technologies. Manufacturers are investing in innovative implant materials and precision techniques to improve vision outcomes. The regulatory environment supports both local innovations and international collaborations, further fueling market expansion. In January 2025, Clearside Biomedical’s Asia‑Pacific partner, Arctic Vision, received approval for its suprachoroidal treatment for uveitic macular edema in Australia and Singapore. ARCATUS, using the SCS Microinjector for targeted drug delivery, minimizes toxicity. These advancements are strengthening market competitiveness and broadening treatment options.

India's ocular implants market is witnessing steady growth due to increased healthcare awareness and enhanced access to advanced eye care solutions. Government initiatives and rising investments in medical technology are driving market expansion. Local manufacturers are focusing on affordable, high‑quality implants to address a diverse patient base. Collaborative research and educational programs further bolster market potential. In November 2024, Sightsavers India and AbbVie India launched a campaign to prevent visual impairment from glaucoma. The fourth state‑level consultation was held at the NIMHANS Convention Centre in Bengaluru, Karnataka, emphasizing early diagnosis and collaborative care.

Recent trends in the Latin America ocular implants market reveal a growing demand for advanced vision restoration technologies. In Brazil, over 2 million individuals suffer from cataract-induced blindness, with most affected patients being over 60 years old. These seniors depend on the Public Health System (SUS) for essential cataract surgeries, significantly bolstering market growth. Recent technological advancements and increased awareness about ocular health have created a favourable investment environment, encouraging regional stakeholders to adopt innovative implant solutions and enhanced surgical techniques to meet the rising demand for effective eye care.

Emerging developments in the Middle East and Africa ocular implants market underscore a significant focus on combating cataract-related vision impairment. In southwest Saudi Arabia, about 0.7% of the population is blind, while 10.9% experience some form of vision impairment. Cataracts contribute to more than half of blindness cases and roughly one-fifth of visual impairments. Consequently, these statistics have driven robust regional investments in cutting-edge implant technologies and refined surgical techniques to significantly improve overall eye care outcomes.

Leading market players drive innovation by leveraging cutting-edge technology, exceptional product quality, and strategic partnerships. Their commitment to vision care excellence continually sets new global industry standards. Some of these players include:

Bausch + Lomb Corporation, headquartered in Vaughan, Ontario, Canada, is a global leader established decades ago in eye health. In January 2025, the company launched enVista Aspire™ Intermediate Optimized Monofocal and Toric Intraocular Lenses in the European Union. Their innovative approach addresses modern vision challenges.

STAAR Surgical Company, headquartered in Monrovia, California, United States, was founded in 2000. In May 2024, it announced a milestone strategic agreement with IQ Laser Vision, marking its commitment to EVO Implantable Collamer® Lenses in the United States. This collaboration underscores its innovation in refractive surgery.

Glaukos Corporation is headquartered in San Clemente, California, United States. It is an innovative company established in 2005 dedicated to advancing ocular treatments. In February 2024, Glaukos launched iDose TR, an implantable glaucoma treatment designed to reduce intraocular pressure. This product offers patients long-term, sustained drug delivery and further enhances patient outcomes.

Alcon Vision Limited Liability Company, headquartered in Fort Worth, Texas, United States, is a renowned leader in ocular implants since its establishment in 1945. In March 2024, Alcon launched the Clareon Family of Intraocular Lenses in India, featuring advanced presbyopia-correcting technologies to deliver exceptional, long-lasting vision clarity and reinforce their innovative legacy.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other notable market players include Novartis AG, Carl Zeiss AG, Johnson & Johnson Services, Inc., MORCHER GmbH, HOYA CORPORATION, AbbVie Inc., and FCI.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Ocular Implants Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Product Insights

Application Insights

End Use Insights

Regional Insights

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the ocular implants market was valued at approximately USD 17.05 Billion and it is expected to grow at a compound annual growth rate (CAGR) of 5.90% during the forecast period from 2026 to 2035.

The ocular implants market is likely to reach a value of USD 30.25 Billion by 2035, driven by demand for advanced vision restoration, technological innovations, and rising ocular disorder prevalence across the globe.

Glaucoma implants accounted for the largest ocular implants market share.

Key players in the market are Novartis AG, Bausch + Lomb, Carl Zeiss AG, Johnson & Johnson Services, Inc., STAAR SURGICAL, MORCHER GmbH, Glaukos Corporation, HOYA CORPORATION, AbbVie Inc., and FCI.

Factors driving the ocular implants market include technological advancements, increasing prevalence of ocular diseases, rising demand for minimally invasive procedures, favorable reimbursement policies, and significant research investments fostering innovation.

The major application segments in the ocular implants market include oculoplasty, glaucoma surgery, drug delivery, age-related macular degeneration treatment, aesthetic procedures, and other specialized applications.

Significant end-use sectors in the ocular implants market include hospitals, clinics, and specialty eye institutes, which drive demand for advanced ocular implant procedures.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Application |

|

| Breakup by End User |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 3,299

USD 2,969

tax inclusive*

Single User License

One User

USD 5,499

USD 4,949

tax inclusive*

Five User License

Five User

USD 6,999

USD 5,949

tax inclusive*

Corporate License

Unlimited Users

USD 8,199

USD 6,969

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share