Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global offshore oil and gas pipeline market was valued at USD 15.73 Billion in 2025. The market is expected to grow at a CAGR of 7.00% during the forecast period of 2026-2035 to reach a value of USD 30.94 Billion by 2035. Increasing LNG trade volumes across Asia and Europe continue to accelerate offshore gas pipeline demand, as nations diversify supplies and invest heavily in new cross-border and subsea transmission networks.

One of the major factors shaping the market is the rapid acceleration of offshore exploration projects in deepwater and ultra-deepwater zones. According to the offshore oil and gas pipeline market analysis, offshore fields nearly account for 30% of the total crude oil production output, globally. At the same time, the United States Department of the Interior approved offshore energy investments for Gulf of Mexico in three leases in April 2024, reinforcing how government support continues to push offshore infrastructure forward.

Another critical motivator of the offshore oil and gas pipeline market growth is the increasing need to modernize aging subsea infrastructure, especially in regions such as the North Sea and Middle East. In May 2024, the United Kingdom’s North Sea Transition Authority allocated new licenses specifically tied to subsea upgrades, as part of its climate-compatible energy roadmap. Similarly, in July 2024, Saudi Energy Minister Prince Abdulaziz bin Salman indicated that gas production will grow by 63% by 2030, reaching 21.3 billion ft3, pointing to the role of modernization and expansion in boosting demand for next-generation offshore pipelines.

Beyond energy security, digital transformation is becoming a structural trend noticed in the offshore oil and gas pipeline market. Operators are embedding AI-powered predictive maintenance and fiber-optic monitoring systems into subsea networks, reducing downtime and operational costs. These developments are no longer optional add-ons but mission-critical tools for extending the lifespan of billion-dollar offshore assets.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

7%

Value in USD Billion

2026-2035

*this image is indicative*

The move toward deeper reserves is driving significant pipeline investments. According to the offshore oil and gas pipeline market analysis, Brazil produced 3.5 million barrels per day in 2024, relying heavily on extensive subsea pipeline networks. Meanwhile, India’s ONGC’s USD 5 billion for deepwater projects in the Krishna-Godavari basin, has created demand for advanced steel-grade and flexible pipeline solutions. Ultra-deepwater projects, requiring specialized coatings and high-pressure systems, are reinforcing the need for engineering innovations. The expansion of deepwater assets in Latin America, West Africa, and the Gulf of Mexico underscores why offshore pipelines remain indispensable for global energy security and transport efficiency.

As LNG imports surge, pipelines form the critical link between offshore terminals and onshore processing. Europe increased LNG imports by 60 bcm in 2023, partly supported by subsea gas pipeline connections to regasification plants. In Asia, China’s PipeChina initiative is expanding subsea connectivity to support record LNG inflows from Qatar and Australia. Japan and South Korea are also boosting their offshore grid to secure diversified energy flows, reshaping the offshore oil and gas pipeline market dynamics. These projects are not only capacity expansions but strategic geopolitical assets, ensuring energy diversification while enhancing subsea infrastructure resilience.

Governments across regions are pumping billions into offshore pipeline infrastructure as part of energy security measures. The United States Infrastructure Investment and Jobs Act earmarked funds for subsea pipeline safety and resilience upgrades. The European Commission also funded the Baltic Pipe Project with EUR 267 million, since 2013, to strengthen regional supply post-Ukraine war disruptions, widening the scope for offshore oil and gas pipeline market expansion. Meanwhile, the UAE’s Ministry of Energy is scaling offshore gas pipelines to meet industrial demand for petrochemicals and power generation. These programs highlight how offshore pipeline investments are closely tied to national strategic security agendas and long-term resilience planning.

Digital transformation is redefining pipeline operations. Fiber-optic sensing, AI-driven monitoring, and predictive maintenance tools are becoming mainstream in offshore projects. For example, Norway’s Equinor deployed real-time leak detection systems across its subsea network in August 2023, while Petrobras adopted digital twins for monitoring deepwater pipelines in Brazil in October 2024. These technologies reduce unplanned shutdowns, enhance worker safety, and extend asset lifecycles, boosting the offshore oil and gas pipeline market growth.

As global energy transition goals intensify, pipelines are being re-purposed to transport low-carbon fuels. The Northern Lights project in Norway, part of Europe’s first cross-border carbon capture and storage (CCS) initiative, involves offshore pipelines for CO₂ transport. Similarly, hydrogen-ready pipeline infrastructure is being tested in the North Sea under the United Kingdom government’s Hydrogen Backbone initiative. These developments show that offshore pipelines are not fading but evolving to serve future energy systems. Repurposing oil and gas assets into hydrogen and CO₂ transport channels ensures long-term utility for existing infrastructure.

The EMR’s report titled “Global Offshore Oil and Gas Pipeline Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Diameter

Key Insight: Both large-diameter and small-diameter pipelines play pivotal roles in driving demand in the offshore oil and gas pipeline market. While greater than 24” pipelines remain the core motivators of high-capacity offshore transport, below 24” pipelines are capturing momentum from modular, short-distance applications and renewable energy pilots. Both diameters represent the dual growth axis of scale and flexibility in offshore pipeline infrastructure.

Market Breakup by Industry

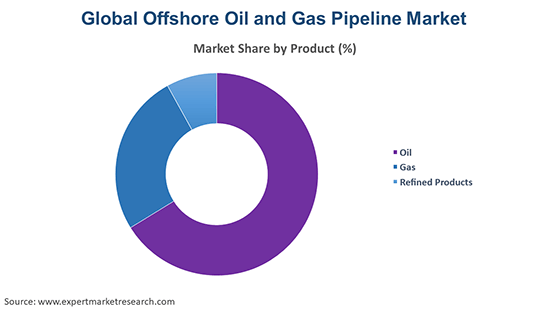

Key Insight: Oil pipelines remain the core pillar of offshore hydrocarbon transport, securing dominance due to sheer demand scale, while gas pipelines are experiencing accelerated growth in the offshore oil and gas pipeline market share due to LNG trade expansion and clean energy positioning. Refined product pipelines, while smaller in share, contribute niche value by connecting offshore storage with industrial hubs.

Market Breakup by Line Type

Key Insight: Transport, export, and other line types collectively shape the market economics, with each category guided by distinct commercial driving factors and engineering choices. Transport lines focus on reliability, pigging, and future-proofing for high-volume hubs, attracting long-term O&M and EPC involvement, thereby propelling growth in the offshore oil and gas pipeline market. Export lines emphasize geostrategic resilience, reversible flows, and export finance structures to serve international buyers. Other lines enable field tie-ins, service connections, and repurposing options for hydrogen or CO2.

Market Breakup by Region

Key Insight: According to the offshore oil and gas pipeline market report, North America emphasizes capital depth, safety standards, and complex engineering execution. Europe focuses on regulatory alignment, repurposing infrastructure, and integration with energy transition projects. Asia Pacific is defined by rapid deployment, modular fabrication, and LNG-driven export connectivity. Latin America prioritizes deepwater project scalability and localized supply chains, while the Middle East and Africa are leveraging vast reserves to expand export and processing linkages.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

By diameter, greater than 24” pipelines secure the largest market share due to high-volume offshore transport

Pipelines above 24 inches dominate the industry due to their ability to handle massive offshore oil and gas volumes. Large-scale projects in the Gulf of Mexico and Brazil’s pre-salt basin rely heavily on high-diameter pipelines to transport hydrocarbons to onshore facilities efficiently. Their importance is magnified in LNG export hubs, where bulk movement requires large-diameter steel networks. Furthermore, Middle Eastern projects connecting massive offshore reserves to refining centers are increasing reliance on pipelines above 24 inches, ensuring they remain key for offshore transport infrastructure.

Smaller-diameter pipelines are recording the fastest growth in the offshore oil and gas pipeline market, particularly for offshore gas distribution and regional connectivity. With the rise of floating LNG terminals and modular energy hubs in Southeast Asia, below 24-inch pipelines offer flexibility and cost-effectiveness for shorter transmission. Their ability to connect smaller offshore fields to local demand centers makes them vital in countries such as Indonesia and Malaysia. Additionally, these pipelines play an important role in renewable-linked offshore projects, including hydrogen blending pilots and subsea CCS, where high volume is less critical than adaptability.

By industry, oil pipelines dominate the market due to expansive offshore crude transport

Oil pipelines continue to dominate offshore investments due to massive global reliance on crude production. Projects such as Brazil’s pre-salt and Saudi Aramco’s expansion in the Arabian Gulf highlight the criticality of oil transport networks. Offshore oil remains vital to energy security, and subsea pipelines ensure efficient movement from high-output fields to refineries and storage terminals.

As per the offshore oil and gas pipeline market report, gas pipelines are expanding their shares at record pace, largely driven by Europe’s shift from Russian supply and Asia’s surging LNG imports. Offshore gas connectivity projects, like Norway’s Johan Sverdrup extension and India’s subsea gas distribution in the Arabian Sea, are key examples in this regard. Additionally, gas pipelines are increasingly aligned with transition strategies, enabling cleaner fuels to penetrate industrial and residential demand. Their role in supporting LNG regasification terminals ensures gas pipelines’ accelerated growth trajectory, particularly in Asia Pacific and Europe where diversification of energy supply is a priority.

By line type, transport Lines secure the largest share due to continuous high-volume output

Transport lines are the dominant offshore pipeline type, handling continuous, high-volume flows from fields to onshore processing facilities. Engineered for reliability, these lines integrate pigging, dual-layer corrosion barriers, and fiber-optic sensing for leak detection and flow assurance, stabilizing the offshore oil and gas pipeline demand forecast. Operators prioritize redundancy and maintainability, deploying subsea manifolds and tie-ins that minimize downtime during maintenance or field expansion.

Export lines are emerging to be the fastest-growing subcategory driven by rising cross-border energy trade and LNG export hub developments. These pipelines connect offshore production zones to distant export terminals and floating production storage and offloading units, requiring high-pressure designs and export-grade coatings, accelerating the offshore oil and gas pipeline market opportunities. Export routes emphasize geostrategic resilience, regulatory harmonization, and capacity flexibility to handle variable cargoes for global markets. Developers are prioritizing modular construction, reversible flow capability, and enhanced cathodic protection to meet export demand while lowering life-cycle costs.

North America leads the market due to deep-capital markets and strict-standards

North America remains the dominant regional market, anchored by deep capital markets, strict safety regulations, and advanced offshore engineering capabilities. Operators prioritize long-term reliability and sovereign-security considerations, favoring large-diameter transport pipelines with hybrid onshore-offshore interfaces. Project sponsors often layer in multi-year service contracts, insurance structures, and digital monitoring suites to secure financing and meet lender covenants.

The offshore oil and gas pipeline market in the Asia Pacific region is driven by surging energy demand, rapid offshore discovery activity, and expanding LNG export ambitions. Markets across Southeast Asia and Australasia are prioritizing modular pipeline systems and shorter lead-time fabrication yards to accelerate commissioning. Regional operators favor flexible routing and smaller-diameter networks to connect numerous marginal fields and floating production hubs efficiently. Local content rules and growing service-sector capabilities are reshaping procurement, creating opportunities for regional yards and technology providers.

Global offshore oil and gas pipeline market players are focusing on engineering innovation, modular project delivery, and integration of digital monitoring to extend pipeline life cycles. Companies are prioritizing AI-driven predictive maintenance, remote-operated inspection systems, and hybrid material solutions to improve safety and efficiency.

Opportunities for offshore oil and gas pipeline companies are emerging in repurposing pipelines for hydrogen transport and CO₂ sequestration, aligning with global decarbonization strategies. EPC firms are also collaborating with technology startups to enhance subsea robotics and fiber-optic sensing, enabling real-time integrity management. The focus is shifting toward partnerships, scalable contracting, and low-carbon solutions that reduce operating costs while unlocking new revenue streams in cross-border energy projects.

Saipem S.p.A., established in 1957 and headquartered in Milan, Italy, is a leader in engineering and construction for energy and infrastructure. The company caters to the offshore pipeline market through integrated EPCI services, specializing in deepwater installations and subsea tiebacks. Saipem leverages advanced vessels, autonomous robotic systems, and sustainable materials to deliver cost-efficient projects.

Subsea 7, founded in 2002 and headquartered in London, United Kingdom, is a global provider of seabed-to-surface engineering solutions. The company supports offshore pipeline markets with subsea construction, inspection, and repair services. Subsea 7 emphasizes collaboration with energy companies on integrated SURF projects, enabling faster and safer installations.

McDermott International, Ltd, established in 1923 and headquartered in Texas, United States, delivers engineering and construction solutions across the energy value chain. In the offshore pipeline sector, McDermott provides design-to-installation services with a strong focus on deepwater infrastructure. The company operates advanced marine vessels and subsea equipment, incorporating AI-based monitoring systems to enhance pipeline integrity.

TechnipFMC plc, formed in 2016 and headquartered in London, United Kingdom, is a global leader in subsea engineering and project delivery. The company supports offshore pipelines with integrated subsea production systems, flexible pipe technologies, and advanced robotics. TechnipFMC leverages digital twins, AI-enabled predictive analytics, and subsea automation to improve lifecycle performance.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market are Sapura Energy Berhad, John Wood Group PLC, and Fugro, among others.

Explore the latest trends shaping the global offshore oil and gas pipeline market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on offshore oil and gas pipeline market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the offshore oil and gas pipeline market reached an approximate value of USD 15.73 Billion.

The market is projected to grow at a CAGR of 7.00% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 30.94 Billion by 2035.

Companies are investing in modular designs, enhancing digital monitoring, forming technology partnerships, and repurposing infrastructure for hydrogen and CO₂ while aligning with stricter global sustainability and safety standards.

The key trends guiding the market growth include increasing investments in oil and gas exploration activities by governments, the rising demand for reliable and safe connectivity in the oil and gas sector, and the growing demand for refined oil products.

The major regions in the market are North America, Latin America, Europe, the Middle East, and Africa, and the Asia Pacific.

The major diameters of oil and gas pipeline considered in the market report are greater than 24” and below 24”.

The various products of oil and gas pipeline in the market are oil, gas, and refined products.

The significant line types considered in the market report are transport line and export line, among others.

The key players in the market include Saipem S.p.A., Subsea 7, McDermott International, Ltd, TechnipFMC plc, Sapura Energy Berhad, John Wood Group PLC, and Fugro,TechnipFMC plc, among others.

Companies face challenges in cost overruns, regulatory compliance, supply chain disruptions, and integrating low-carbon solutions into existing offshore pipeline infrastructure under volatile energy markets.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Diameter |

|

| Breakup by Product |

|

| Breakup by Line Type |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share