Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global over the top (OTT) market size was valued at USD 143.43 Billion in 2025. The industry is expected to grow at a CAGR of 15.00% during the forecast period of 2026-2035 to reach a value of USD 580.25 Billion by 2035. The increasing preference for on-demand entertainment platforms is significantly contributing to the market growth.

Consumer viewing behavior has changed significantly to the point that it is a departure from traditional linear TV to more flexible, on-demand platforms. The change in behavior goes hand in hand with the increased demand for live, sports, and interactive content. Today, audiences expect entertainment of any kind at any time and from any place, even over multiple devices, which has caused OTT providers to go far beyond just offering pre-recorded series and movies, contributing to the over the top (OTT) market development.

Such a change in behavior has also been a major factor in the growth of live-streaming, sports events, concerts, and interactive programming, which, in turn, has led to the creation of new ways of engagement and monetization. For instance, in July 2025, the Monumental Sports & Entertainment collaborated with ViewLift to establish a unified broadcast and streaming sports platform in the United States, thus uniting the live matches, original content, alternate camera views, and monetization tools.

In fact, by merging on-demand flexibility with the live interactive experiences, OTT platforms are not only winning the game of changing content consumption patterns but are also deepening user engagement, and thus, they are expanding the global over the top (OTT) market scope.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

15%

Value in USD Billion

2026-2035

*this image is indicative*

OTT players in the global over the top (OTT) market, with their minds continuously sharpened by the needs of mobile-first streaming are rapidly adapting their platforms for the same as the use of smartphones and broadband in terms of capacity is increasing practically in every corner of the earth. Companies are aiming at digital economies with rapid growth where low-cost devices and 4G/5G coverage are raising content consumption in video format. This trend is also visible in the MarkNtel Advisors report from August 2025, which sees the OTT market grow to USD 595 billion by 2030 due to the expanding internet infrastructure and device accessibility.

Major companies in the global over the top (OTT) market are heavily channeling their funds into the production of local content, focusing on local stories, local languages, and culturally based narratives for the purpose of deepening the audience engagement in non-English speaking markets. The players are increasing the scale of the original productions that are not only for local consumption but also that are made with local people and local tastes. To support this trend, Balaji Telefilms in March 2024 unveiled a Rs 795 crore plan to pour money into ALT Balaji to both solidify its subscription business and roll out India-focused original content. This is a prime example of how regionalization has become a key competitive lever.

The OTT network players, who also happen to be the top-tier companies, have already started overhauling their technology stacks with modern-day cloud-native tools, revamped UI designs, AI-fueled personalization, and low-latency features to keep churn at bay and user trust high. To make the job easier, tech vendors are giving content owners a quicker way to get into the over the top (OTT) market. A good example of that is the launch in November 2024 by ICARO Media Group of its ICARO OTTO enterprise OTT SaaS platform that is targeted towards media companies wanting to deliver streaming solutions that are scalable and have a wealth of features.

Deepening their partnerships with telcos and pay-TV operators, OTT platforms are employing various strategies to expand their reach by offering bundles at a discounted price and hence increasing the subscriber retention rate, mainly in competitive and price-sensitive markets. Besides making bundled billing easier, it also facilitates the consumers' multi-screen usage as they can seamlessly switch from one device to another. On the other hand, a significant instance is the cooperation between PCCW and CANAL+ in June 2023, which besides the partnership, included a USD 300 million investment to accelerate Viu’s international expansion across Asia, the Middle East, and South Africa.

In the competitive landscape of the market, top OTT companies and technology providers are focused on acquiring niche firms with the right expertise, which can support them to not only improve their skills but also spur the over the top (OTT) market expansion by offering customers a one-stop streaming ecosystem solution. These consolidations give the freedom to the players to bring in the most advanced technologies, to upgrade the delivery infrastructure and to have quicker access to new markets. Citing an instance, in March 2024, Planetcast Media Services took over Switch Media, which is based in Australia, to broaden its white-label OTT offering and deepen its international presence.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Over the Top (OTT) Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

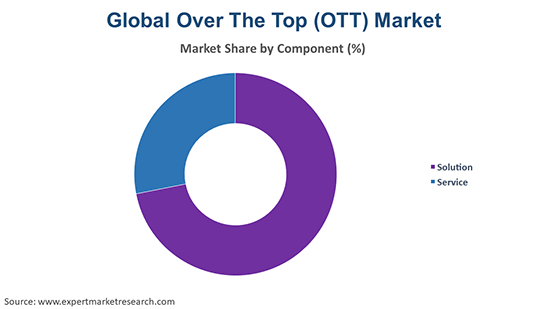

Market Breakup by Component

Key Insights: The OTT solutions are gaining traction as platforms adopt cloud-based encoding, DRM, and content-management systems, while the service segment expands with rising demand for managed operations, integration, analytics, and UX optimisation. Players such as Brightcove, Amagi, and Accedo are streamlining workflows to help providers scale efficiently. Reflecting this shift, MediaKind and Accedo launched a joint D2C streaming solution in September 2025 to simplify and accelerate OTT deployments.

Market Breakup by Device

Key Insights: The over the top (OTT) market is diversifying across devices as smartphones lead mobile-first viewing, smart TVs register notable growth owing to the increasing availability of built-in apps, and desktops/tablets support multitasking audiences. Gaming consoles and cloud-enabled TVs add new viewing pathways, while set-top boxes evolve into hybrid OTT gateways. To meet this shift, device makers are enhancing connectivity and app ecosystems. For instance, in April 2025, LG enabled Xbox Cloud Gaming on select WebOS TVs, expanding OTT-ready, console-free entertainment.

Market Breakup by Content Type

Key Insights: Companies are actively expanding across content types to capture rising digital demand. Video platforms are strengthening regional libraries and personalisation tools, while audio and VoIP players enhance premium catalogues and telecom bundles. Gaming firms push cloud-based access and cross-device play, and communication apps upgrade encryption and collaboration features. These efforts align with ongoing efforts in the over the top (OTT) industry, such as Spotify’s February 2024 rollout of audiobook access in the United States.

Market Breakup by Revenue Model

Key Insights: Streaming platforms are diversifying monetization strategies to match evolving consumer demand. Companies are expanding subscription tiers, scaling ad-supported offerings, and rolling out hybrid models to balance reach and revenue in price-sensitive markets. FAST and pay-per-view options provide added flexibility. Reflecting these trends, Roku launched its USD 2.99/month Howdy subscription service in October 2024 to attract budget-conscious users, highlighting the over the top (OTT) market trend towards low-cost, consumer-friendly streaming plans.

Market Breakup by Application

Key Insights: OTT platforms are tailoring offerings to personal and commercial applications. In the Personal segment, companies are enhancing entertainment experiences through AI-powered recommendations, regional content, and mobile-optimized interfaces to increase engagement. For commercial use, firms are developing enterprise streaming solutions, interactive learning platforms, and branded content services for marketing, training, and communication purposes. Providers like Brightcove, Amagi, and IBM Cloud Video are actively supporting businesses in the over the top (OTT) market with turnkey streaming solutions to scale content delivery efficiently.

Market Breakup by End Use

Key Insights: OTT providers are customizing offerings to suit diverse end-use sectors. In media & entertainment, companies are investing in originals, regional content, and multi-platform delivery to capture audience attention. Education & training platforms are leveraging interactive video, AI, and analytics to enhance remote learning and corporate upskilling. In health & fitness, firms offer live workouts, teleconsultation integration, and wellness content. IT & telecom, e-commerce, BFSI, and government sectors contribute substantially to the over the top (OTT) market revenue owing to the increasing adoption for internal communication, digital marketing, employee training, and citizen engagement, with companies developing secure, scalable, and interactive solutions to meet specific industry needs.

Market Breakup by Region

Key Insights: OTT providers are tailoring strategies to regional dynamics. In North America and Europe, companies focus on original content, premium UX, and high-quality streaming infrastructure. In Asia Pacific, providers are investing in mobile-first platforms, regional content, and language localization to capture emerging audiences. Reflecting this trend, in October 2025, 504 telco-OTT partnerships were formed across 19 APAC markets to expand distribution and monetization. Latin America and the Middle East & Africa are seeing telco bundling and cloud-based platform adoption to reach broader markets efficiently.

By component, OTT solutions continue to witness strong market interest

OTT solution providers are aggressively refactoring their cloud-native architectures to make them more scalable, multi-device delivery, and quicker app deployment. A notable instance was in June 2024, when Brightcove enhanced its OTT solution through a partnership with Applicaster to facilitate no-code front-end app development and easy media companies’ workflows. It shows that the industry-wide movement toward modular, launch-ready solutions that cut down operational complexity and accelerate go-to-market for OTT platforms is reflected by this.

In the services ecosystem, the growth in the over the top (OTT) market is mianly because providers are compelling to delegate their monetization, ad operations, analytics, and channel management functions to specialized vendors as CTV and FAST extend their reach globally. An important announcement was made In August 2025 when Amagi was chosen as the exclusive monetization partner for OTT Studio’s CTV inventory; thus, targeting and yield optimisation were enhanced. These kinds of moves highlight that service providers have become enablers of content owners to improve revenue efficiency while concentrating on programming and audience growth.

By device, Smartphones show significant uptake

Smartphones stay the leading OTT access device as users increasingly stream, play, and browse while on the move. Providers are fine-tuning OS features and AI experiences to raise mobile viewing levels. A good example of this is Samsung’s initiative to advance the Galaxy AI ecosystem and reveal new foldable devices at the Unpacked event in July 2024.

Smart TVs are emerging as significate device category owing to the rising trend in the global over the top (OTT) market, where consumers are turning their living room streaming hubs due to big screens, smart home integration, and pre-installed OTT apps. Producers are upgrading display tech and modernizing platforms to allow smooth app delivery. For instance, LG debuted its new OLED evo line with advanced AI processors and upgraded webOS smart platform at CES in January 2024.

By content type, Audio/VoIP registers notable traction

Audio and VoIP platforms are going beyond just music to create full voice-first ecosystems. They do this by collaborating with publishers and adding features like audiobooks and live chat. In line with this, in November 2024, Spotify and Bloomsbury partnered to offer more than 1,000 new audiobook titles in Spotify's Premium catalogue that mainly aims at deepening content and subscribers' value. In addition, companies apply AI-powered voice processing and telecom bundling to ignite engagement and monetisation activities.

On the other hand, the gaming content is witnessing high demand in the over the top (OTT) market, as service providers are taking measures to ensure that users can access games from any device without worrying about the hardware they have while also partnering with content providers to get more content and expand their reach. For example, in June 2024, Amazon Luna announced a collaboration with GOG.com to add more than 40 games and expand into new territories, enabling subscribers to stream titles across Fire TV, smart TVs, mobile, and desktop. So, game platforms are using such strategies to transform their business models hybrid-entertainment-wise and as strategic OTT equivalents.

By application, personal category is picking up momentum

The personal application category is driving significant growth in the global over the top (OTT) market, as OTT platforms ramp up their work to deliver extremely immersive, tailored streaming experiences. Providers are employing AI-powered recommendation engines, adaptive streaming, and localized content to make users' stays longer. Besides, they upgrade mobile and connected device user experiences to facilitate on-the-go consumption. Brightcove, for example, in October 2024, broadened its AI Suite by launching an AI Text-to-Video pilot that allows creators to turn text content into attractive videos quickly; thus, OTT experiences personalization and scalability are getting enhanced.

For commercial applications, OTT providers are developing enterprise-focused solutions that can be utilized for employee training, internal communication, and the promotion of marketing campaigns. Firms are providing the means for decentralized video production, recording, and content management through which organizations can improve their customer base and return on investment. One of the most significant innovations in the over the top (OTT) market is the introduction of Brightcove's Marketing Studio for Sales in November 2024 that made it possible for broadly spread teams to not only generate on-brand, personalized video content but also keep track of the engagement metrics. This clearly indicates how OTT technology is transitioning into an agent for business uplift by delivering video solutions that are both scalable and measurable to commercial clients.

By end-use, media & entertainment amass substantial revenue

OTT providers are leveraging AI to optimize content production, personalization, and distribution across different geographies. By way of illustration, generative AI was employed by Netflix in July 2025 to accomplish a highly complex VFX scene for the show El Eternauta production in a time which was one-tenth of the traditional one. More and more platforms are shifting their production onto the cloud with AI pipelines to be able to upscale their production, cut down on the expenditure and increase the audience engagement by delivering more immersive experiences in the over the top (OTT) market.

In the fields of education and corporate training, video platform companies are taking advantage of features such as smart search, interactive analytics, and AI-enhanced accessibility. An illustration is Panopto which provides AI-powered video indexing that allows employees’ training content to be searched through speech transcripts, thereby making the learning process faster. Enterprises are increasingly turning to these solutions, thereby facilitating just-in-time learning, onboarding at scale, and training programs that are driven by data; thus, OTT infrastructure is becoming a critical business capability.

By region, North America holds a significant market share

To fight for the attention of the highly- ompetitive market, OTT platforms in North America are improving content libraries, user experience, and cross-device streaming to keep subscribers. Apart from that, companies are bundling streaming with telecom services and spending money on personalization tech. For instance, Ooredoo Group was demonstrating how operators are actively innovating to maintain market share by launching its “Go Play Market” OTT service in numerous regions with MediaKind and Microsoft Azure in March 2024. Such developments are boosting the over the top (OTT) market growth in the region.

In the MEA region, telecom operators and local OTT providers are collaborating to meet the increasing demand for streaming anytime anywhere on mobile devices by launching streaming solutions which are cloud-based. As a matter of fact, in April 2025, the MTN Group entered into a partnership with Synamedia to create an entirely new streaming service across the 16 African countries that combined live TV and VOD content, and this was the integration of it. These kinds of projects illustrate how regional players are evolving to become digital entertainment providers of the full-scale kind.

The leading over the top (OTT) market players are actively expanding content libraries and improving user engagement through platform innovation. Netflix, Hulu, and Apple are spending a lot of money on original and regional content while they use AI-driven recommendations and multi-device support for personalization. These tactics give the companies the chance to attract and keep subscribers, increase monetization, and reinforce their position in saturated and emerging markets globally.

Technology and telecom companies such as Amazon Web Services, Google, and Telstra are concentrating on infrastructure, cloud solutions, and partnerships to provide a seamless OTT experience. By allowing low-latency streaming, scalable cloud platforms, and bundled service offerings, these players are facilitating the global OTT transition. Investments in platform security, analytics, and cross-platform accessibility are consolidating their position in the expanding digital entertainment ecosystem and the global over the top (OTT) market.

AWS (Amazon Web Services, Inc.) launched its operations in 2006 and is located in Seattle, USA. It is a major cloud computing provider that offers project-based and server-based services with flexible infrastructure to any customer. Furthermore, the company is the technology partner of a broad range of over-the-top and digital media companies, thus it facilitates quick, safe, and stable delivery of content all over the world.

Netflix, Inc. is a worldwide streaming platform that was established in 1997 and is still based in Los Gatos, California. The company is recognized for the massive library of movies, series, and its own content, which it continually expands by going into foreign markets and by producing local originals to attract new subscribers.

Hulu, LLC is a Santa Monica, California-based company which was established in 2007 and is engaged in the provision of subscription streaming services as well as the support of streaming services by advertising. The service is mainly focused on the distribution of next-day TV, exclusive originals, and live streaming to serve customer segments that have different preferences.

Telstra Corporation Limited (Telstra) is an Australian telecommunications and media company that was born in 1901 and is still located in Melbourne. By bundling OTT services with broadband and mobile offers, Telstra not only empowers consumers with easier access to digital content but also makes the packages more attractive and affordable for them.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the market include Apple Inc., Google LLC, Rakuten Group, Inc., and others.

Explore the latest trends shaping the Global Over the Top (OTT) Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on global over the top (OTT) market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global over the top (OTT) market reached an approximate value of USD 143.43 Billion.

The market is projected to grow at a CAGR of 15.00% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 580.25 Billion by 2035.

Key strategies driving the market include technology innovation, regional content production, telco partnerships, acquisitions, and diversified monetization models.

The key trends guiding the growth of the market includes the availability of various OTT providers and higher per capita incomes.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The leading components of over the top (OTT) in the market are solution and service.

The various devices of over the top (OTT) include smartphones, smart TVs, desktops and tablets, gaming consoles, and set-top box, among others.

The significant content types of over the top (OTT) in the market are video, audio/VoIP, games, and communication, among others.

The leading revenue models of over the top (OTT) in the market are subscription, advertisement, and hybrid, among others.

The major applications of over the top (OTT) are personal and commercial.

The significant end uses of over the top (OTT) are media and entertainment, education and training, health and fitness, IT and telecom, e-commerce, BFSI, and government, among others.

The key players in the market include Amazon Web Services, Inc., Netflix, Inc., Hulu, LLC, Telstra Corporation Limited, Apple Inc., Google LLC, Rakuten Group, Inc., and others.

The over the top (OTT) market faces challenges such as intense competition, high content costs, licensing complexities, multi-device integration, and regulatory compliance.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Component |

|

| Breakup by Device |

|

| Breakup by Content Type |

|

| Breakup by Revenue Model |

|

| Breakup by Application |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share