Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global passenger and commercial vehicle leasing market size is projected to grow at a CAGR of 7.60% between 2026 and 2035, reaching a value of USD 163.56 Billion by 2035.

Base Year

Historical Period

Forecast Period

Vehicle leasing demand is increasing due to the boosting tourism sector, growing income, and changing ways of traveling.

India's Ministry of Statistics reported a growth of 16.49% between 2020/21 and 2022/23 in disposable income, thus, making it an attractive option for the vehicle leasing players.

E-vehicle renting is a growing avenue for the industry, with growing investments recently. For instance, Electrifi Mobility, a business specializing in electric vehicle leasing and asset management, received $3.02 million in initial funding, led by ADB Ventures and AdvantEdge Founders.

Compound Annual Growth Rate

7.6%

2026-2035

*this image is indicative*

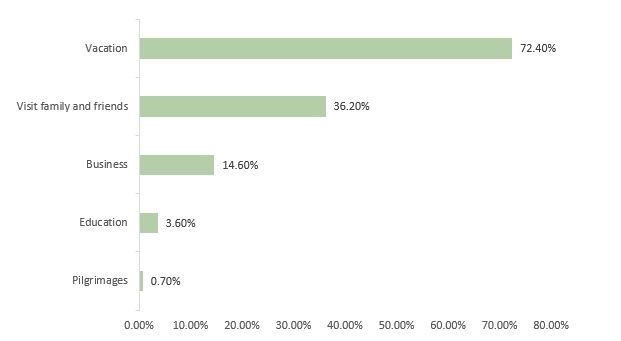

A vehicle lease allows individuals to utilise a desired vehicle for a specific period. Throughout this duration, a leasing firm provides the user with the car, maintaining complete ownership. In return, the user makes monthly payments as specified by the leasing company. By opting for a vehicle lease, the user is relieved of obligations like road tax, maintenance costs, and other ongoing expenditures. As per the 2021 report from the National Travel and Tourism Office, U.S. Department of Commerce, a predominant purpose for owning a car was primarily related to vacation and holiday activities.

Car leasing operates on a payment structure where fees are accrued exclusively for the duration the vehicle is utilised. The agreed-upon period of usage is predetermined by both the lessor and lessee. After this designated usage period concludes, the user has the option to return the vehicle to the owner and cease making payments.

The global passenger and commercial vehicle leasing market growth is boosted by growing tourism, availability of electric vehicles, rapid digitisation and increasing disposable income.

Vehicle leasing is vital to tourism, offering value for various purposes like exploration, airport travel, events, and business. Their significance lies in providing convenience, enabling individuals to be self-reliant while navigating unfamiliar destinations, and enhancing the overall travel experience.

The passenger and commercial vehicle leasing market is growing due to the increasing popularity of electric vehicles. EVs require cost-efficient maintenance, as they have fewer moving components compared to traditional internal combustion vehicles. The decreased requirement for servicing enhances the economic viability and environmental friendliness of electric vehicles, addressing concerns related to depreciation and consequently driving up leasing rates.

The utilisation of mobile applications, QR codes, and digital forms enables renters to electronically access their vehicles and complete required paperwork, minimising the necessity for face-to-face interactions and physical documentation. The safety of vehicle leasing has increased with the availability of live tracking, accident notifications, and verification of traffic fines.

The passenger and commercial vehicle leasing market at a global scale has been experiencing significant expansion in recent times, largely attributed to the rise in consumers' disposable income. Individuals with elevated living standards are inclined to allocate more of their resources toward luxury vehicle leasing rather than relying on public transportation. For instance, according to the Ministry of Statistics and Programme Implementation, the gross national disposable income (GNDI) of India has increased at a CAGR of 16.49% between 2020/21 and 2022/23.

GROSS NATIONAL DISPOSABLE INCOME OF INDIA, IN RUPEES

Leasing vehicles play a crucial role in the tourism sector, providing economic value for various purposes such as exploration, airport commuting, attending events, and business trips. The safety aspect of car leasing has improved with the introduction of features like live tracking, accident notifications, and the ability to verify traffic fines.

As per the passenger and commercial vehicle leasing market analysis, leasing a fresh vehicle involves consistently using a newer and more fuel-efficient model, which is advantageous for the environment. New cars generate fewer emissions compared to older models. Therefore, by opting for a lease, the individual is contributing to minimizing pollution and actively participating in safeguarding the planet.

Global Passenger and Commercial Vehicle Leasing Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Vehicle Type

Market Breakup by Lease Type

Market Breakup by Providers

Market Breakup by Tenure

Market Breakup by Region

Based on vehicle type, passenger vehicle dominates the global passenger and commercial vehicle leasing market share due to increasing tourism and travel

The surge in passenger vehicle leasing is driven by its cost-effectiveness, offering flexibility in model choices, and providing convenience for those averse to ownership responsibilities. Travelers favor car renting for independent exploration, and environmental consciousness contributes to the trend. Additionally, the seamless online booking process propels the global vehicle leasing industry's growth.

Commercial vehicle leasing offers a cost-effective alternative for businesses by eliminating upfront and ongoing ownership expenses. It provides flexibility to scale fleets based on demand, accommodating seasonal variations. Leasing shields businesses from long-term depreciation concerns and eases the burden of regulatory compliance, while technological integration enhances tracking and fleet management, making it a sophisticated choice.

Close-ended lease is one of the prominent methods that is deployed in the industry currently

A closed-end lease is a rental arrangement where the lessee (the individual making regular lease payments) is not obligated to buy the leased asset once the agreement concludes. As per the passenger and commercial vehicle leasing market study, most consumer leases are closed-end leases, offering a consistent and predictable monthly payment structure throughout the lease duration. Adherence to specified terms, like mileage limits in the case of a vehicle lease, ensures this predictability.

A subvented lease is a lease arrangement where the leasing entity lowers the cost by providing a subsidy. In the vehicle leasing sector, it is a common marketing strategy to attract new customers. In an option-to-buy lease, the lessor may permit the lessee to acquire the vehicle at the current market price when the leasing period concludes, with the specifics of this condition varying in the market.

In terms of providers, the global passenger and commercial vehicle leasing market development is controlled by original equipment manufacturers (OEMs) as leasing firms are more closely connected to them

OEMs are presenting innovative offerings directly to end customers, focusing on retail clients seeking to buy a vehicle. They provide the choice of leasing, offering a more affordable monthly payment compared to a standard loan EMI, with the option to upgrade every three to four years. This is aiding the passenger and commercial vehicle leasing market growth.

Nonbank financial companies (NBFCs) engage in hire purchase financing and vehicle leasing. Bank-affiliated vehicle leasing serves to finance capital equipment. The contractual agreement involves the bank and the customer hiring a chosen vehicle tailored to meet specific requirements from a preferred manufacturer or supplier.

The competitive landscape in the global passenger and commercial vehicle market is characterized by the growing number of electric vehicles, rapid digitisation, tourism, and a focus on improving customer satisfaction.

Arval BNP Paribas Group was established in 1989 and is based in France. The company focuses on comprehensive vehicle leasing and innovative mobility solutions. With a presence in 29 countries, it boasts a workforce of over 8,300 employees. As of December 2023, the company had successfully leased 1,701,540 vehicles.

Wheels Inc. was established in 1939 and is based in the United States, offering a range of services catering to various business needs. These services encompass fleet leasing, maintenance, fuel management, telematics, pool management, and mileage reimbursement. Wheels' comprehensive fleet services are designed to meet all aspects of business requirements.

ORIX Corporation was established in 1964 and is based in Japan, is a global corporate group engaged in various sectors worldwide. Its diverse portfolio includes activities in financing and investment, life insurance, banking, asset management, real estate, concession, environment and energy, automobile-related services, industrial/ICT equipment, as well as ships and aircraft.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other global passenger and commercial vehicle leasing market key players are Merchants Fleet, Donlen Corporation, Emkay, Sumitomo Mitsui Auto Service, and Elements Fleet Management Corporation among others.

North America occupies a significant passenger and commercial vehicle leasing market share, primarily owing to its significant consumer base. The U.S. Government Rental Car Program provides discounted rates and exclusive advantages for renting cars, passenger vans, or small pick-up trucks through approved rental car companies.

The passenger and commercial vehicle leasing market in the Asia Pacific region is anticipated to claim a substantial market share in the coming forecast period. This upswing is linked to the rising need for commercial vehicle leasing, propelled by increased infrastructure development, a surge in tourism and population, and evolving lifestyles accompanied by rising incomes.

Similarly, Europe, Latin America, the Middle East, and Africa are experiencing a rising demand for leased vehicles, driven by the expanding travel and tourism sector, a growing adoption of electric vehicles for sustainable practices, and increasing infrastructure development supported by government initiatives.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is expected to grow at a CAGR of 7.60% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach USD 163.56 Billion by 2035.

Key trends aiding market expansion are growing tourism, availability of electric vehicles, rapid digitisation, and increasing disposable income government initiatives and innovations, and increasing research and development (R&D) activities by key players.

Key players in the industry are Arval BNP Paribas Group, Wheels Inc., ORIX Corporation, Mercedez-Benz Group AG, Merchants Fleet, LeasePlan (ALD Automotive), Donlen Corporation, Emkay, Sumitomo Mitsui Auto Service, and Elements Fleet Management Corporation among others.

The market report focuses on notable vehicle categories, encompassing passenger vehicles and commercial vehicles.

The major lease categories comprise a closed-end lease, lease purchase option, sub-vented lease, and various other options.

The market report considers various providers, including Original Equipment Manufacturers (OEMs), bank-affiliated entities, and Non-Bank Financial Companies (NBFCs).

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Vehicle Type |

|

| Breakup by Lease Type |

|

| Breakup by Providers |

|

| Breakup by Tenure |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share