Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global physical security services market attained a value of USD 378.74 Billion in 2025. The industry is expected to grow at a CAGR of 6.00% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 678.27 Billion.

The demand of physical security services market is driven by the increase in crime rates, social unrest within countries, and rising terrorism. The rising social insecurity is prompting the buyers to be more proactive in securing their premises, further augmenting the global market. Moreover, to curb these rising problems, there has been massive innovation in the security services lately. Smart technology is currently being used for monitoring and managing security workforces. Real-time incident reporting and GPS tracking have led to significant advances in employee accountability while integrating apps with employee’s smartphones have led to improved communication and efficiency.

Improvements have also been made to security devices like access control and CCTVs, which now come with features like Bluetooth-enabled access control and 360-degree view. These technological advancements are expected to increase the physical security services market value in the coming years.

The increasing digital transformation to effectively predict and mitigate threats is propelling the physical security services market development. Physical security service providers are increasingly leveraging various technologies to enhance their operational efficiency and reduce operating costs. With the growing adoption of the Internet of things (IoT) and cloud connectivity, physical security services can process data to deliver meaningful insights and enhance operational decision-making.

Base Year

Historical Period

Forecast Period

For physical security, 40% of businesses installed security cameras and other monitoring systems in 2023.

As per security services market statistics, 70% of residential properties installed physical security in 2020.

Currently, 25% of businesses have adopted physical security solutions like gates, barriers, and security fencing.

Compound Annual Growth Rate

6%

Value in USD Billion

2026-2035

*this image is indicative*

Cloud-based security solutions offer remote access, scalability, and cost-efficiency for customers and service providers, which can boost physical security services market growth and competitiveness. Cloud-based security solutions reduce the need for extensive on-premises infrastructure, leading to lower capital expenditures and operational costs for businesses. Cloud-based systems allow security personnel and managers to monitor and manage security operations remotely, providing flexibility and responsiveness.

IoT and smart devices generate more data sources and endpoints for security monitoring, which can enhance the situational awareness and responsiveness of security services. These technologies facilitate data analysis and decision-making processes, enhancing overall security effectiveness. Companies like Motorola Solutions are enhancing their security offerings by acquiring smart sensor companies. As per the physical security services market report, in December 2023, Motorola acquired IPVideo, a New York-based smart sensor company known for its HALO Smart Sensor, which monitors air quality and detects anomalies such as gunshots and motion.

AI and machine learning (ML) can improve the capabilities and efficiency of security systems and services by enabling automated detection, classification, and prediction of security events and anomalies. AI and ML are enabling video management systems to offer sophisticated analytics, such as facial recognition, anomaly detection, and behavioral analysis, which significantly improve security effectiveness. Thereby supporting the physical security services market development. Advanced algorithms and machine learning techniques are being incorporated into biometric solutions, allowing them to continuously evolve and adapt to the ever-changing security landscape.

Biometric authentication and identification can improve the accuracy of security verification and access control by using unique and hard-to-forge physical or behavioural characteristics of employees. According to HID Global's 2024 State of Physical Access Control Report, the adoption of biometrics for physical access control has risen from 30% to 39% over the past two years. Additionally, 23% of surveyed organizations identified biometrics as a top technology trend influencing the access control industry. Companies like Precise Biometrics are expanding their offerings to include biometric visitor management systems, integrating fingerprint, facial, and palm recognition technologies to streamline access and enhance security protocols.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Physical Security Services Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

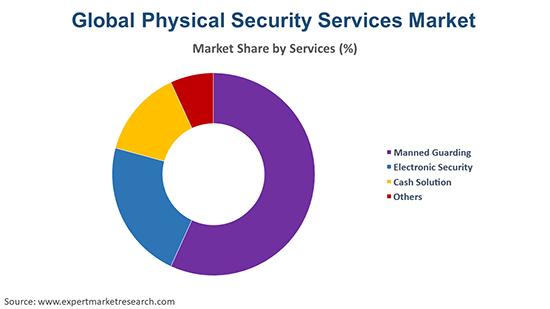

Market Breakup by Services

Key Insight: Manned guarding remains a cornerstone of the physical security services market. It involves deploying security personnel to monitor premises, control access, and respond to incidents. This service is particularly relevant for high-risk environments like retail stores, government buildings, and industrial sites, where human judgment and intervention are crucial. With the increasing demand for a personal touch in security services, manned guarding continues to be essential in both urban and remote locations.

Market Breakup by End Use

Key Insight: Commercial segment encompasses the office buildings, business parks, convention centres, and other commercial spaces that require physical security services to protect their premises, employees, customers, and information from unauthorised access, burglary, fraud, or violence. The commercial segment is anticipated to hold a large physical security services market share due to the rapid expansion of the service sector and the rising adoption of smart and connected technologies in the commercial settings.

Market Breakup by Region

Key Insight: North American region is expected to dominate the global physical security services market due to the high adoption of advanced technologies, such as IoT, cloud, and artificial intelligence in context of security by the corporate and residential sector. The presence of major players, such as ADT, Allied Universal, and Securitas also helps in increasing the market size in this region. Moreover, the increasing demand for security services from various industries, such as banking and finance, healthcare, and retail, in this region is driving the market expansion.

Growth of Electronic Security and Cash Solutions in the Physical Security Services Market

Electronic security services, which include surveillance cameras, alarm systems, and access control systems, are rapidly gaining importance due to advancements in technology. Businesses and residential complexes increasingly rely on these systems to provide continuous monitoring and real-time threat alerts. As the demand for smart buildings and integrated security systems rises, electronic security is expected to see significant expansion, especially with innovations like AI-powered surveillance and automated response systems.

Cash solutions, such as cash-in-transit and cash management services, remain a vital segment in the physical security services market, for industries handling large volumes of cash, like banking, retail, and casinos. With the increasing security concerns around transporting and storing cash, businesses are seeking more secure and efficient solutions. The market for cash solutions continues to evolve as companies adopt secure digital alternatives, though traditional services remain critical for sectors reliant on physical cash handling.

Rising Demand for Physical Security Services in Retail and Industrial Sectors

Retail segment includes the shopping malls, supermarkets, department stores, and other retail outlets that need physical security services to prevent shoplifting, robbery, inventory shrinkage, and employee theft. The physical security services market estimates that the retail segment is likely to use a varied security services due to the increasing consumer spending, the proliferation of online and offline retail channels, and the growing competition among the retailers.

Industrial segment includes manufacturing, mining, construction, and other industrial sectors that require physical security services to protect their assets, equipment, personnel, and data from theft, vandalism, sabotage, or natural disasters. The industrial segment is expected to witness a high demand for physical security services due to the increasing automation and digitisation of the industrial processes. Moreover, the rising awareness of the social impacts of industrial activities is also driving the need for physical security services to comply with the regulatory standards.

Rapid Growth of Physical Security Services in Asia Pacific and the Middle East & Africa

Asia Pacific physical security services market is projected to witness the fastest growth rate due to the rapid industrialisation and economic development in countries, such as China, India, Japan, and Australia. The rising security threats, such as terrorism, cyberattacks, and civil unrest, in this region are also boosting the demand for physical security services. Additionally, the growing investments in smart city projects, infrastructure development, and public safety initiatives in this region are creating lucrative opportunities for the market players.

Additionally, the demand for security may rise in Middle East and Africa due to the increasing geopolitical instability, civil wars, and terrorist activities in countries, such as Iraq, Syria, Yemen, and Libya. The need for securing critical infrastructure, such as oil and gas pipelines, airports, and power plants, in this region is also propelling the physical security services market growth.

Key players in the physical security services market are increasingly integrating advanced technologies to enhance service offerings. They are adopting cloud-based platforms, AI-driven analytics, and biometric authentication to provide scalable, real-time, and data-driven security solutions. This technological integration aims to streamline operations, improve threat detection, and offer more personalized security measures to clients across various sectors.

Additionally, these companies are expanding their global presence through strategic acquisitions and partnerships. By acquiring specialized firms and collaborating with technology providers, they aim to diversify their service portfolios and enter new markets. This approach allows them to leverage local expertise and address region-specific security challenges effectively. Such strategic moves are designed to strengthen their competitive position and meet the evolving demands of the physical security landscape.

Securitas AB, headquartered in Sweden, is a leading global security services provider, offering a range of solutions including on-site guarding, remote monitoring, and electronic security systems. The company operates across various sectors such as banking, retail, and industrial, focusing on customized security services to address the unique needs of its clients. Securitas is known for its strong technological integration in security services.

GardaWorld Security Corporation, headquartered in Canada, is one of the world’s largest privately owned security companies, providing services like risk management, armored transportation, and security personnel services. With operations in over 45 countries, GardaWorld focuses on delivering tailored security solutions for businesses, government organizations, and NGOs, leveraging both human expertise and advanced technology for comprehensive protection.

Brinks Security Services Limited, a subsidiary of the Brinks Company, is renowned for its secure logistics and cash management solutions. Headquartered in the United States, the company specializes in armored transportation, secure vaulting, and cash-in-transit services. It serves industries such as banking, retail, and government, offering both physical and digital security systems, and is recognized for its global reach and innovation in financial security solutions.

Agile Security Force, with its headquarters in India, is a security services provider focused on delivering highly trained personnel and advanced technology solutions for both private and public sector clients. The company specializes in security consultancy, physical guarding, and integrated security systems. Agile is known for its flexible approach and responsiveness to clients' changing security needs, emphasizing proactive risk management and operational efficiency.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the physical security services market report are Securiguard Services Ltd., Allied Universal Security Services, and The Brink’s Company, among others.

Stay ahead of the curve with the latest insights into the Global Physical Security Services Market Trends for 2026. Download a free sample report to explore key market dynamics, growth forecasts, and strategic recommendations. For tailored advice and more detailed insights, contact us today to gain a competitive edge in this rapidly evolving sector.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 378.74 Billion.

The market is projected to grow at a CAGR of 6.00% between 2026 and 2035.

Key strategies driving the market include integrating AI and IoT for real-time monitoring, expanding remote surveillance capabilities, transitioning to cloud-based systems, offering bundled security-as-a-service models, and complying with stricter regulatory standards. Additionally, partnerships, acquisitions, and regional expansions are enhancing service coverage and technological competitiveness across global markets.

Key trends aiding security market expansion include the advent of smart technology, real time incident reporting, and GPS tracking for managing and monitoring security workforces.

Physical security involves protecting people, assets, and data from physical actions and events that could lead to significant loss or damage at a site.

Physical security systems can integrate technologies such as access control, video surveillance, intrusion detection, visitor management, managed access control, managed video, and situational awareness technologies.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The various services in the market are manned guarding, electronic security, and cash solution, among others.

The significant end uses of physical security services include industrial, energy utility, commercial, retail, government, BFSI, and airports, among others.

The key players in the market report include Securitas AB, GardaWorld Security Corporation, Brinks Security Services Limited, Agile Security Force, Securiguard Services Ltd., Allied Universal Security Services, and The Brink’s Company, among others.

The manned guarding segment is dominating the industry as it involves deploying security personnel to monitor premises, control access, and respond to incidents.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Services |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share