Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global positive displacement pumps market size reached around USD 14.57 Billion in 2025. The market is projected to grow at a CAGR of 4.80% between 2026 and 2035 to reach nearly USD 23.28 Billion by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

4.8%

Value in USD Billion

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

| Global Positive Displacement Pumps Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 14.57 |

| Market Size 2035 | USD Billion | 23.28 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 4.80% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 6.2% |

| CAGR 2026-2035 - Market by Country | Australia | 4.2% |

| CAGR 2026-2035 - Market by Country | China | 4.2% |

| CAGR 2026-2035 - Market by Product Type | Peristaltic | 5.3% |

| CAGR 2026-2035 - Market by Capacity | High Capacity Pumps | 5.4% |

| Market Share by Country 2025 | France | 2.4% |

The global market is being driven by the growing product utilisation in wastewater treatment facilities. The rising environmental concern and the growing need to recycle wastewater is supporting the industry's growth.

The growth of the positive displacement pumps market is driven by the growing demand for wastewater treatment in various industries like refining, chemical, and pharmaceuticals. The growing focus on sustainable development with rising environmental concerns is propelling the industry growth. The implementation of stringent government regulations across the globe, encouraging wastewater treatment, will significantly contribute to the growth of the global positive displacement pumps industry.

The rising demand for pump repair and remanufacturing from high-performance applications, such as chemical processing and offshore oil and gas production, is a crucial trend of positive displacement pumps market. The increased investment in research and development activities, coupled with rapid technological advancement, is expected to propel the global market growth over the forecast period.

As per the positive displacement pumps market dynamics and trends, Vogelsang announced the launch of the EP series, a range of positive displacement pumps, in July 2024, that can be readily used in industrial pumping applications, specifically in the oil and gas sector.

As per the positive displacement pumps industry analysis, the 2023 estimates of OPEC stated that around 79.1% of the world’s crude oil reserves are in the OPEC member countries, out of which the Middle East oil reserves account for around 67.3% of the total. Venezuela accounted for around 24.4% of crude oil reserves, followed by Saudi Arabia at 21.5%, and IR Iran at 16.8%. This positive trend can contribute to the demand for positive displacement pumps that are readily used for supplying crude oil from production sites to processing facilities. These pumps can transport viscous liquids at high pressures at a moderate rate which makes them preferable in the oil and gas sector.

Furthermore, the rising acquisition and partnerships between the market players to boost their market reach are expected to boost the growth of the positive displacement pumps industry. For instance, the Graham Corporation, a provider of mission-critical fluid, power, and heat transfer, announced the acquisition of P3 Technologies, LLC, an engineering, product development and manufacturing company in November 2023. This acquisition aimed to expand the turbomachinery solutions of Graham with the high-end diffuser technology that can enhance the efficiency of pumps and compressors for usage in various applications.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Positive displacement (PD) pump, also known as a constant flow machine, is a type of an industrial pump utilised to transfer fluid from the inlet pressure section into the discharge tube. They help in maintaining a constant flow of liquid irrespective of the backpressure. Positive displacement pumps, unlike the traditionally used centrifugal pumps, ensure the advancement of fluid at a constant speed irrespective of the pressure. Positive Displacement Pumps Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

On the basis of product type, the global positive displacement pumps industry is divided into:

Based on capacity, the industry is segmented into:

On the basis of pump characteristics, the industry is divided into:

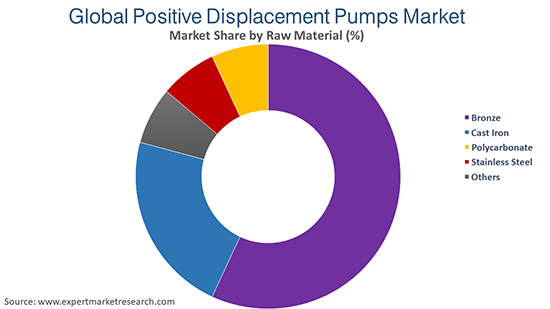

The various raw materials available in the positive displacement pumps industry are:

The product finds end use in various sectors like:

The report also covers the regional markets like:

| CAGR 2026-2035 - Market by | Country |

| Australia | 4.2% |

| China | 4.2% |

| Germany | 3.5% |

| France | 3.5% |

| Mexico | 3.1% |

| USA | XX% |

| Canada | XX% |

| UK | XX% |

| Italy | 2.7% |

| Japan | XX% |

| India | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

The Asia Pacific is expected to contribute significantly to the positive displacement pumps market value. With the growing urbanisation and rapid industrialisation, emerging economies are witnessing an increased installation of water treatment facilities, which is expected to provide various growth opportunities to the industry in the forecast period.

The report gives a detailed analysis of the following key players in the global market for positive displacement pumps, covering their competitive landscape, capacity, and latest developments like mergers and acquisitions, investments, capacity expansion and plant turnarounds:

The comprehensive EMR report provides an in-depth analysis of the global positive displacement pumps industry based on the Porter's five forces model along with giving a SWOT analysis.

The key players in the Global market include Grundfos, Xylem Inc., Flowserve Corporation, SPX FLOW, Inc., IDEX Corporation, Dover Corporation, Schlumberger Limited and ITT Inc.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market attained a value of nearly USD 14.57 Billion.

The market is assessed to grow at a CAGR of 4.80% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 23.28 Billion by 2035.

The major market drivers include increasing population, growing use of positive displacement pumps in wastewater treatment facilities, rising environmental concerns, and the growing focus on sustainable development.

Strict government regulation regarding the treatment of wastewater and the rising focus on sustainable development are the key trends expected to define the market growth in the coming years.

The major regions in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The leading product types in the market are rotary pumps, reciprocating pumps, and peristaltic, among others.

The major capacities considered in the market report include low capacity pumps, medium capacity pumps, and high capacity pumps.

Standard pumps, engineered pumps, and special purpose pumps are significant pump characteristics considered in the market report.

Bronze, cast iron, polycarbonate, and stainless steel are the dominant raw materials of positive displacement pumps in the market.

The various end-use industries of positive displacement pumps are oil and gas, water and wastewater, automotive, and chemicals and petrochemicals, among others.

The key market players include Flowserve Corporation, Grundfos Pumps Pty. Ltd, ITT Inc., KSB SE & Co. KGaA¸ ALFA Laval, and Schlumberger Limited., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Capacity |

|

| Breakup by Pump Characteristics |

|

| Breakup by Raw Material |

|

| Breakup by End Use Industry |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share