Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global probiotics ingredients market is predicted to expand from USD 3.65 Billion in 2025 to USD 8.56 Billion by 2035 at a CAGR of 8.90% over the forecast period of 2026-2035.

Base Year

Historical Period

Forecast Period

The market in France was expected to account for around 3.6% of the global market share in 2023.

The demand for probiotic ingredients for human consumption is expected to witness a CAGR of 9.7% in the forecast period.

The Mexican market is expected to grow at a CAGR of 9.3% between 2024 and 2032.

Compound Annual Growth Rate

8.9%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Probiotics Ingredients Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 3.65 |

| Market Size 2035 | USD Billion | 8.56 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 8.90% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 9.8% |

| CAGR 2026-2035 - Market by Country | India | 10.2% |

| CAGR 2026-2035 - Market by Country | China | 9.4% |

| CAGR 2026-2035 - Market by Source | Bacteria | 9.5% |

| CAGR 2026-2035 - Market by End Use | Human Consumption | 9.7% |

| Market Share by Country 2025 | France | 3.6% |

The growth of the global probiotics ingredients market can be ascribed to the rising consumer awareness regarding preventive healthcare combined with the increased spending on probiotics by consumers. Furthermore, the accessibility to preventive healthcare data due to the availability of several online platforms is creating awareness among consumers regarding the product.

The increased focus on preventive healthcare by consumers, which is driving the demand of probiotics ingredients market, is the result of factors like rising disposable incomes, rising living standards, ageing populations, and changing attitudes towards healthcare, particularly in the developed and developing economies. Further, the growing demand for dietary supplements in the pharmaceutical, cosmetics, and personal care sectors is expected to drive the probiotics market, which in turn, is expected to drive the growth of the probiotics ingredients market.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Consumers are increasingly seeking foods and drinks fortified with probiotics to enhance digestive health. This trend of probiotics ingredients market has led to the incorporation of probiotic ingredients into a variety of products, including yogurts, kefir, and fermented beverages. Innovations in encapsulation and stabilisation techniques are enhancing the viability and shelf life of probiotic products. These advancements ensure that a higher number of live microorganisms reach the gut, improving efficacy.

Probiotic ingredients are being incorporated into animal feed to promote gut health and enhance immunity in livestock and pets. This application is gaining traction as a natural alternative to antibiotics.

Morinaga Milk Industry Co., Ltd., a prominent Japanese dairy manufacturer, has announced that its proprietary probiotic strain, Bifidobacterium infantis M-63, has received approval from the National Health Commission (NHC) of the People's Republic of China as a new food ingredient suitable for infant and children's products, which can contribute to the growth of the probiotics ingredients market. This approval represents a notable achievement for the company, positioning it as the sole Japanese company with three bifidobacteria strains registered for use in the infant and toddler food sector in China.

A Growing demand for Probiotic Ingredients in Food and Beverage and Animal Feed.

According to the FAO and WHO, the total imports of yeast globally increased from 2018 to 2021, with a consistent upward trend. In 2018, total imports amounted to USD 1,636.8 million, growing to $1,727.2 million by 2021. As per the probiotics ingredients industry analysis, Europe was the dominant importer throughout these years, accounting for a substantial share, from USD 561.4 million in 2018 to $568.9 million in 2021. Asia consistently ranked second, with imports ranging from $391.1 million in 2018 to $405.8 million in 2020 before declining to USD 375.9 million in 2021. North America saw modest growth, moving from USD 256.2 million in 2018 to USD 323.7 million in 2021.

Africa, South America, and Oceania maintained relatively smaller shares, although Africa showed a steady increase from USD 285.6 million in 2018 to USD 314.5 million in 2021, which contributed to the growth of the probiotics ingredients industry. This growth trajectory in yeast imports reflects the increasing demand for yeast-based products, which directly correlates with the rising popularity of probiotic ingredients. The surge in health-conscious consumers and the expansion of the functional food market are driving the demand for yeast in various food and beverage applications.

According to the 2023 Alltech Agri-Food Outlook, North America's compound feed production saw overall growth from 2021 to 2022, increasing by 0.88%, equivalent to 2.272 MMT. The broiler feed segment experienced the most significant rise, growing by 1.932 MMT, a 3.32% increase. Pet food production also saw substantial growth, increasing by 5.66%, with an additional 0.600 MMT produced, which increased probiotics ingredients industry revenue. Layer feed increased by 2.71%, with an added 0.410 MMT, while beef feed saw a modest growth of 0.64%. The increased emphasis on specialized feed for broilers and pets indicates a growing interest in optimizing animal health, which ties closely to the probiotic ingredients market.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

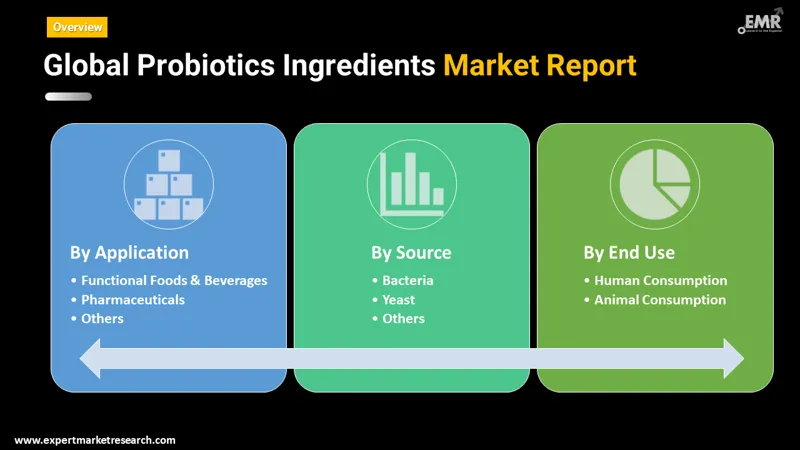

The probiotics ingredients market can be divided on the basis of segments like source, application, end-use and region.

The industry can be bifurcated on the basis of its source as:

Bacteria are subdivided into Lactobacillus, Bacillus, Enterococcus, Bifidobacterium, and Streptococcus. Yeast is further subdivided into Saccharomyces cerevisiae and saccharomyces boulardii.

The industry can be broadly categorised based on its application into:

The industry can be divided on the basis of its end use as:

Human consumption is subdivided into intestinal disorders, lactose intolerance, inflammatory bowel disorders, cardiovascular diseases, respiratory infections, obesity, urogenital infections, type-2 diabetes, and cancer.

The EMR report looks into the regional markets like:

The use of probiotic strains in the production of end products such as cheese, yoghurt, and other dairy products has stimulated this segment’s development. It is estimated that the bacterial segment will hold a major probiotics ingredients market share and is expected to grow at a CAGR of 9.5% in the forecast period as it provides different health advantages. Bacterial probiotics, particularly strains like Lactobacillus and Bifidobacterium, are widely recognised for their positive effects on digestive health, immune function, and overall well-being.

The report presents a detailed analysis of the following key players in the global probiotics ingredients industry, looking into their capacity, competitive landscape, and latest developments like capacity expansions, plant turnarounds, and mergers and acquisitions:

| CAGR 2026-2035 - Market by | Country |

| India | 10.2% |

| China | 9.4% |

| Mexico | 9.3% |

| USA | 9.2% |

| UK | 9.1% |

| Canada | XX% |

| France | XX% |

| Italy | XX% |

| Japan | XX% |

| Australia | XX% |

| Saudi Arabia | 8.6% |

| Brazil | XX% |

| Germany | 8.2% |

The Asia Pacific market is expected to grow at a CAGR of 9.8% in the forecast period. The markets in India and China are anticipated to witness a CAGR of 10.2% and 9.4% between 2026 and 2035. Rising health consciousness, increasing disposable incomes, and a growing demand for dietary supplements are fuelling probiotics ingredients market value. Moreover, a strong emphasis on preventive healthcare, favourable regulatory support, and a high demand for functional foods and beverages are also key factors boosting the market growth.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The global probiotics ingredients market reached a value of USD 3.65 Billion in 2025.

The market is projected to grow at a CAGR of 8.90% in the forecast period of 2026 and 2035.

The major drivers of the market include the increased consumer spending on probiotics, rising disposable incomes, rising living standards, ageing populations, changing attitudes towards healthcare, use of probiotic strains in the production of end products such as cheese, yoghurt, and other dairy products, and rising consumer awareness regarding preventive healthcare.

The increased focus on preventive healthcare by consumers and the growing demand for dietary supplements in the pharmaceutical, cosmetics, and personal care sectors are the key trends propelling the market growth.

The major regions in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The major applications of probiotic ingredients are functional foods and beverages and pharmaceuticals, among others.

The various sources of probiotics ingredients include bacteria and yeast, among others.

Probiotic ingredients find significant end uses in human consumption and animal consumption.

The key players in the market are CHR Hansen Holding A/S, Danisco A/S (DuPont), Lallemand, Inc., Novozymes A/S, Kerry Group Plc (Ganeden, Inc.), Archer Daniels Midland Company (Probiotics International Ltd.), and Bifodan A/S, among others.

The market is expected to reach a value of USD 8.56 Billion in 2035.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment

|

| Breakup by Application |

|

| Breakup by Source |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share