Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global pyrethroids market reached a value of USD 3.91 Billion in 2025. The market is further expected to grow at a CAGR of 4.50% in the forecast period of 2026-2035 to reach a value of approximately USD 6.07 Billion by 2035.

Base Year

Historical Period

Forecast Period

The market for pyrethroids is being driven by rising global food demand, as managing pests effectively becomes crucial to boosting crop production.

Environmentally concerned consumers and regulators are drawn to pyrethroids due to their increased safety and efficacy as a result of recent developments in biopesticide formulations.

As agricultural methods change and pest management requirements increase, pyrethroid manufacturers have a tremendous opportunity to expand into emerging countries, thereby propelling the growth of the pyrethroids market.

Compound Annual Growth Rate

4.5%

Value in USD Billion

2026-2035

*this image is indicative*

Sustainable pest management practices are driving innovation in bio-based pyrethroid formulations.

The pyrethroids market shows a strong trend toward sustainable and environment-friendly pest control practices. As safety and environmental impact are more and more frequently in the mind of consumers and regulatory bodies, manufacturers strive to develop more bio-based formulations for pyrethroids and put them into broad pest management approaches. Growth in organic farming and urban gardening, where effective yet safer pest control solutions are often a must, encourages this trend of the pyrethroids market further. To address these shifting consumer preferences and regulatory requirements, companies are investing in innovative technologies and partnerships.

April 2024

Bayer announced an agreement signed with UK-based AlphaBio Control to gain an exclusive licence for new biological insecticide. This new product marks the entry of the first for arable crops, including oilseed rape and cereals.

March 2024

Insecticides (India) Limited (IIL) launched a patented insecticide called Turner with unique properties for residual control against white grub and termites on a variety of crops.

The pyrethroids industry faced increased governmental scrutiny and further pest resistance over the last five years. The leading companies responded with R&D investments in new formulations that were more potent and effective, plus in resistance management practice. This was accompanied by further enhancement in collaboration with the agricultural stakeholders on further promotion of integrated pest management practices, boosting the pyrethroids market growth. Hence, the entire emphasis was on transparency in terms of safety assessment and formulating eco-friendly alternatives, thereby enhancing product offerings to meet the demands of safer pest control solutions for consumers.

Opportunities include innovative formulations, emerging markets, integrated pest management, and urban pest control solutions.

Increasing demand in agriculture and residential sectors drives pyrethroids market growth, emphasising safety and effectiveness.

Market dynamics for pyrethroids are balanced with increased demand in the agriculture as well as the residential sector for effective pest control. Increasing population and decreasing accessible agricultural land forces farmers to adopt innovative techniques and use pyrethroids as a cheaper alternative in place of old-school pesticides. Regulatory trends favour safer formulations more, thus it further enables better production techniques, bolstering the pyrethroids market dynamics and trends. Pyrethroids are also less toxic to mammals and birds, which will make them more attractive compared to organophosphates. The market is further driven by some increasing applications in the control of mosquitoes and treatment of cloth, through integrated pest management practices for promoting sustainable agricultural practices.

Growing pyrethroid demand in agriculture and residential sectors drives market growth, replacing harmful insecticides.

The extensive use of the product across agriculture and residential sectors is a major driver for the pyrethroids market growth. With a rising population, as well as diminishing agricultural property, farmers around the world are introducing innovative farming practices to increase their yield. As a result, pyrethroids are commonly used in agriculture and allied industries. They serve as a cost-effective alternative to traditional insecticides, augmenting the growth of pyrethroids market. In addition, to cope with synthetic alternatives, manufacturers concentrate on improved production and more effective delivery of pyrethroids. In addition, because they are less harmful to mammals and birds, these insecticides actively substitute organophosphates, which are commonly used in plants, including carrots and lettuce. As a result, there is a growing demand for pyrethroids in cloth treatment as well as mosquito control across residential and industrial sectors, which is expected to boost the growth of the pyrethroids market further.

Market challenges include regulatory scrutiny, pest resistance, competition from biopesticides, and supply chain disruptions.

One of the significant pyrethroids market challenges is mounting regulatory pressure, which mandates higher safety analyses and labelling standards, thus impacting the lead time to manufacture. The other major issue relates to the development of resistance in pest populations that lowers the effectiveness of pyrethroids as well. The growing acceptance of biopesticides also adds competitive threat as consumers opt for "greenier" options. Disruptions in the supply chain-the sourcing of raw materials present efficiency challenges in the manufacturing process. Price fluctuations in agricultural commodities also bring uncertainties to the manufacturers, thus affecting their profitability and investment in innovation.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Pyrethroids Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:

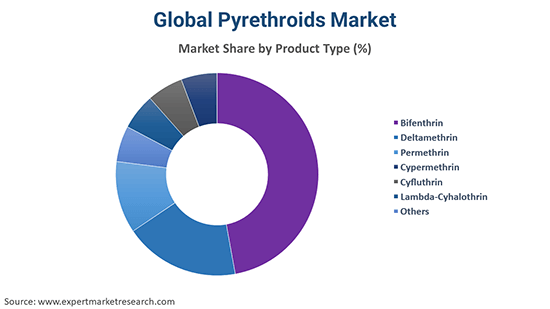

On the basis of product type, the market can be segmented into:

Based on crop type, the market can be divided into:

Based on pest type, the market can be segmented into:

Based on region, the market can be segregated into:

Bifenthrin, deltamethrin, and lambda-cyhalothrin gain traction for effectiveness in agriculture and pest control applications.

Bifenthrin is becoming popular owing to its wide-range efficiency in agriculture and residential sites. Deltamethrin is considered the strongest vector control agent, especially for mosquitoes. It is more largely employed for the purposes of home and garden applications because it has low toxicity for human beings. As per pyrethroids market analysis, cypermethrin is more preferred for agriculture pest control, particularly for the crop of cotton. Cyfluthrin Increasing in recognition in integrated pest management, cyfluthrin comes handy due to its versatility. Lambda-cyhalothrin It has been increasingly used in agriculture and public health because of its quick knockdown effect. Other: emerging formulation targeted to niche markets.

Pyrethroids are increasingly demanded in cereals, oilseeds, fruits, and specialty crops for effective pest control.

The demand for pyrethroids in cereals and grains is on the increase due to the rapid need to control pests effectively so that a maximum yield can be obtained in the face of ever-rising food demand. With oilseeds and pulses, the choice is pyrethroids due to their effective pest control of predominant pests and due to support of sustainable agriculture practices. As per pyrethroids industry analysis, in oilseeds and pulses, pyrethroids are favoured for their efficacy against common pests, supporting the growth of sustainable farming practices. In addition, specialty crops in the other category are employing pyrethroids for targeted pest management as well as improving crop quality and meeting consumer demands for safe produce.

Demand for pyrethroids is increasing for Lepidoptera, sucking pests, Coleoptera, Diptera, and mites management.

A high number of pests require pyrethroids. In the case of Lepidoptera, such as caterpillars, being effective against outbreaks in vegetables and fruits, makes it evident that they are working well. However, with sucking pests like aphids and whiteflies, knockdown and residual efficacy, for example, would be very important in keeping the plant healthy, thereby propelling the pyrethroids market revenues. In the Coleoptera segment, pyrethroids have been effective against beetles, which is important for grain and root crop protection. Pyrethroids are fundamental for Diptera, which comprises flies, both in agricultural and public health. The role of pyrethroids in managing infestation, particularly in fruit crops, improves general agricultural productivity for mites.

North America Pyrethroids Market Dynamics

Natural pest control alternatives are surging in popularity among the consumers of North America, thus boosting the demand for bio-based formulation in the North America Pyrethroids market. There is an increase in the spread of various pest species and thereby enhanced pest management strategies. Besides, advances in application technologies due to investments in agricultural research have increased the efficacy of pyrethroids and reduced their negative impacts on the environment. Furthermore, the rapid expansion of the e-commerce sector has opened avenues to commercial growers, and even home growers, thereby enhancing market penetration and consumer awareness.

Europe Pyrethroids Market Opportunities

Growing interest in urban gardening and home pest control solutions creates new opportunities for the Europe pyrethroids market. Household pesticide solutions are increasingly popular as sustainable practitioners create greater demand for their household pyrethroid products, although agricultural cooperatives and technology companies come together to form a portfolio of smart application systems that increase efficiency of pest management. The shift towards regenerative agriculture in countries like the Netherlands promotes the use of pyrethroids, encouraging holistic farming practice that spurs biodiversity while effectively controlling pest populations.

Asia Pacific Pyrethroids Market Insights

The Asia-Pacific region is thriving at a rapid growth pace in the horticulture sector of countries, like China and India. Pest management associated with crops of this category is crucial for sustaining their quality. Therefore, increased investments in agricultural technologies have augmented the effectiveness of pyrethroid application. The pyrethroids market share in Asia Pacific is driven by the higher incidence of diseases spread by vectors. The awareness about environmentally friendly products also acts as a thrust for consumers and manufacturers alike to create the eco-friendlier version of the pyrethroid formulations to serve both regulations from the environmental aspect and consumer expectations.

Latin America Pyrethroids Market Drivers

The Latin America pyrethroids market is being driven by agricultural output growth in countries like Brazil and Argentina, both of which use pyrethroids significantly in crop protection in crops like soy and coffee. An increasing farmer base being aware of sustainable farming is being driven towards safer insecticides, and urbanisation in Mexico and Colombia is a main factor driving pest control demand in residential areas. In respect to increases in the use of integrated pest management strategies, regulatory support extends the use of pyrethroids in many sectors of agriculture and its use in urban applications.

Middle East and Africa Pyrethroids Market Trends

The adoption of integrated pest management (IPM) practices is increasingly driving demand in the Middle East and Africa pyrethroids market. Countries like South Africa and Kenya are at the forefront of this trend due to the growing popularity of sustainable agriculture. There is an increasing need for the use of pyrethroids in urban pest control in these areas. This, along with some changes in regulation, has gone a long way in forcing manufacturers to produce safer formulations such as bio-based pyrethroids. Advances in precision agriculture technologies also have the additional effects of improving efficiency in the application and efficacy of those applications in pest control strategies.

Pyrethroids startups in this market are venturing to create newer and friendlier ecological formulations and variety-based integrated pest management solutions. They achieve this by playing the greatest advantage of technology for precision agriculture while ensuring efficiency with minimal environmental impact. Many also target niche markets such as organic farming and use digital marketing strategies to reach those consumers that care more about their eco-friendly products, thereby increasing brand visibility and market penetration.

Syngenta AG

The company is based in Basel, Switzerland and was founded in the year 2000. Syngenta AG produces agricultural chemicals, including pyrethroid insecticides like Karate. Its formulation controls a wide range of pests and ensures efficient pest control for various crops.

Corteva Agriscience

Founded in 2018, the firm is headquartered in Wilmington, Delaware, and represents a range of agricultural products, including pyrethroid pesticides like Transform. Innovation and sustainability must feature high on this company's agenda under which nice, effective pest control methods can be offered for a range of contemporary farming models.

Pyrethroids market players are focusing on profits through investments in R&D and innovation with improved product formulation that increases their effectiveness and safety. Portfolio extensions include a broader choice of pest control solutions. Strategic partnerships with agricultural companies and distributors increase access to the market for the pyrethroids companies. A rise in focus on sustainable practices and integrated pest management solutions attracts the conscience of the environment-conscious consumer, further catapulting sales and profitability.

BASF SE is a chemical manufacturing company that is credited to originate in Germany and was founded in 1865. Its headquarters are located in Ludwigshafen, Germany. The pyrethroid insecticides developed by this company for commercial use are Fastac and Killing, which are used for agricultural and pest control purposes and have many considerations for efficacy and environmental safety.

FMC Corporation is a Philadelphia, Pennsylvania-based company founded in 1884, which provides agricultural solutions. Their list of pyrethroids includes Talon and Hero among others used for pest control that can be found both on crops and homes and, while potent, have the least harm to beneficial insects.

Bayer CropScience Limited is a firm that originated in 1863, with its head office located at Leverkusen, Germany. The chemical pyrethroid insecticides produced by them include Deltra, which assists people in giving the possibility of an effective pest management solution with sustainable farm and crop handling and integrated pest management strategies.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other market players in the pyrethroids industry include Syngenta, among others.

May 2024

BASF launched its Professional & Specialty Solutions business unit's division Agricultural Solutions's household pesticide spray-SUWEIDA natural pyrethrin pesticide aerosol. This could be a solution at least for several household pest problems. The SUWEIDA® pesticide aerosol is friendly to humans and pets alike because it contains pyrethrin, the natural pyrethrin.

November 2023

FMC launched Ethos Elite LFR Insecticide/Biofungicide premix crop protection product. This solution combines an established and science-proven pyrethroid insecticide, bifenthrin, with two biological strains proprietary to FMC, Bacillus velezensis strain RTI301 and Bacillus subtilis strain RTI477, for a broad spectrum of control against early-season diseases and soilborne pests.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The global pyrethroids market reached a value of USD 3.91 Billion in 2025.

The market is projected to grow at a CAGR of nearly 4.50% in the forecast period of 2026-2035.

The market is estimated to reach a value of about USD 6.07 Billion by 2035.

The major drivers of the market include rising disposable incomes, increasing population, rising food demand, favourable properties of the product, and the growing agriculture sector.

The introduction of innovative farming practices, the improved production and enhanced efficient delivery of pyrethroids, and the growing demand for pyrethroids in cloth treatment and mosquito control are the key trends guiding the market development.

North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa are the leading regions in the market.

The major product types in the market are Bifenthrin, Deltamethrin, Permethrin, Cypermethrin, Cyfluthrin, and Lambda-Cyhalothrin, among others.

The leading crop types in the market are cereals and grains, oilseeds and pulses, and fruits and vegetables, among others.

Lepidoptera, sucking pests, Coleoptera, Diptera, and mites, among others, are the major pest types in the market.

The leading players in the market are BASF SE, FMC Corporation, Bayer CropSciene Limited, and Syngenta, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Crop Type |

|

| Breakup by Pest Type |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share