Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global pyridine market is expected to reach a value of more than USD 727.77 Million in 2025. The industry is expected to grow at a CAGR of 4.50% during the forecast period of 2026-2035. Increasing demand for pyridine in the pharmaceutical and agrochemical industries is driving pyridine demand. Pyridine is crucial in synthesizing vitamins, pesticides, and herbicides, contributing to its rising adoption in these sectors. Additionally, its use in food additives and solvents further boosts demand globally, as it supports product formulations in multiple industries, thus aiding the market to attain a valuation of USD 1130.20 Million by 2035.

Base Year

Historical Period

Forecast Period

The United States Department of Agriculture projects that the global demand for pesticides, including pyridine-based chemicals, will grow at 4.6% annually through 2027. This growth is driven by the rising global population, increasing agricultural production needs, and the growing necessity for crop protection. Pyridine will be in high demand due to the need for farmers and agrochemical companies to develop more efficient and sustainable crop protection solutions for growing food demand, especially in the most difficult agricultural conditions, thereby propelling the growth of the Pyridine market.

The role of pyridine in agrochemical formulations has become crucial with the requirement to make pesticides and herbicides work better. With the increasing requirement for effective crop protection, pyridine-based chemicals are more commonly used in the manufacture of fungicides, insecticides, and herbicides. The increased dependency on pyridine in formulations raises demand in the market since it promotes better crop production and controls pests that undermine agricultural productivity. The manufacturing companies are answering by conducting more research into producing more pyridine-based solutions in response to the growing demand globally for the solution of pest control.

In developing countries, higher agricultural production is driving up the consumption of pesticides, which is thus driving up the demand for pyridine. As agriculture becomes more intensive to feed the ever-growing population, pesticides are used more to protect crops from pests and diseases. This increasing consumption, particularly in emerging economies with large-scale farming operations, is a huge demand for pyridine. Moreover, the requirement for effective pest control systems in these regions makes pyridine-based pesticides a significant solution, thereby supporting the growth of the pyridine market worldwide.

Compound Annual Growth Rate

4.5%

Value in USD Million

2026-2035

*this image is indicative*

The demand for pyridine is increasing globally due to its increased application in agrochemicals and pharmaceuticals. In agriculture, the demand for pyridine is fueled by the increasing need for effective crop protection, especially in pesticide formulations. As the agricultural sector increases food production, pyridine-based products are needed to protect crops from pests and diseases, thus driving the pyridine market growth.

This trend is more pronounced in regions with growing agricultural output. Another factor that increases demand is the growing reliance of the pharmaceutical industry on pyridine for the synthesis of essential drugs, including vitamins and antibiotics. As investment in healthcare increases worldwide, the role of pyridine in drug manufacturing becomes more critical, thereby increasing demand. All these factors are driving the expansion of the pyridine market across industries worldwide.

The growth in the market for pyridine is also driven by the factor of sustainability. Pyridine-based chemicals, especially in agrochemical formulations, are preferred because of lower environmental impact compared to the traditional chemical alternatives. The pressure to develop eco-friendly farming practices is on an increase as governments and industries focus on sustainable practices. Due to their efficiency in formulations of pesticides, reduced environmental footprint, and formation in meeting sustainability goals in agriculture globally, the demand for pyridine is boosted.

The global marketplace is being driven by increased demand in agrochemical manufacture, particularly for herbicides such as paraquat and pyrimethanil. The rise of the pharmaceutical industry, which uses pyridine derivatives for medication production, accelerates pyridine market growth. Furthermore, rising demand for bio-based chemicals is driving a shift toward more sustainable manufacturing processes, such as bio-catalytic synthesis. Companies such as Lonza and Vertellus are investing in sophisticated technologies to lower production costs and increase efficiency, hence driving the market's overall growth.

Synthetic flavors and fragrances in the production of flavoring agents are also an emerging niche driver for the pyridine industry. Pyridine derivatives are very important in producing a wide range of flavoring agents that are used in food and beverages, including nutty or smoky profiles. For instance, pyridine is used in the production of flavoring compounds in processed foods, which contributes to their unique taste. As the global food and beverage sector expands, especially in developing countries, the demand for these chemical components in flavor and fragrance production will continue to fuel pyridine market growth.

The pyridine industry is driven by agrochemicals, sustainability, pharmaceuticals, and food flavoring, with increasing demand across these sectors globally, particularly in emerging economies.

As the global population grows, and food security becomes an increasingly important issue, there is a growing demand for agrochemicals, particularly pesticides, in which pyridine is a crucial intermediate. Pyridine intermediates are used in the manufacturing of herbicides, insecticides, and fungicides, which will protect crops from pests and diseases. As agricultural intensification continues to meet the demands of growing populations, the pyridine market is expected to grow. Companies like BASF and Syngenta, who rely on pyridine for formulating crop protection products, are seeing rising demand, further bolstering the market, thus augmenting the pyridine demand growth.

As the focus on sustainability in agriculture intensifies, pyridine is increasingly being used in eco-friendly farming solutions. Pyridine derivatives in pesticides represent a more environment-friendly choice than traditional chemicals and can be supportive of sustainable agriculture. For instance, the pyridine formulations help reduce the ecological footprint of pesticides because they tend to target pests without causing damage to beneficial insects. With tightened chemical regulations and increasing eco-awareness globally, the need for pyridine-based agrochemicals will continue to increase with high sustainability-oriented regions.

Pyridine is an essential intermediate in the pharmaceutical industry, particularly for the synthesis of different vitamins, including Vitamin B6, and drugs. Increasing health supplement demand and investment in healthcare is also driving the demand for pyridine. In countries where the healthcare market is growing, such as India and China, the importance of pyridine in pharmaceutical production is rising. Global awareness of health and wellness is likely to continue propelling demand for pyridine during the production of medicinal compounds, thus boosting the pyridine market revenue.

Pyridine derivatives find vast applications in food and beverages. They are mainly used in creating smoky, nutty, and roasted flavor profiles which are very common in the production of processed foods. Among the companies manufacturing foodstuff is Nestlé and Coca-Cola who also apply this product for developing unique flavor profiles of the products which they manufacture including snacks and drinks. With the expansion of the global food and beverage market, especially in emerging economies, pyridine's food flavoring will propel market growth and fuel the expansion of the pyridine market.

Pyridine-based agrochemicals, especially in herbicide and pesticide formulation, is bolstering increased demand for pyridine. As the global population increases, more effective means of crop protection are required for higher agricultural productivity. Thus, pyridine demand increases as it is a primary intermediate in paraquat and other herbicides. For example, companies like Lonza Group focus on pyridine derivatives to meet the increasing requirements for sustainable agriculture and crop protection.

A niche trend in the pyridine industry is its increasing use in the manufacture of animal feed additives, especially to improve the nutrient uptake of livestock. Pyridine derivatives, such as niacin (vitamin B3), are used to enhance the health and productivity of animals. As demand for high-quality animal feed increases, the role of pyridine in maximizing livestock growth and health is becoming more important. This is a growing phenomenon in the emerging markets, driven by expanding populations and a booming demand for animal-based products. The agriculture sector, therefore, expands fast.

The application of bio-based synthesis techniques is a novel technology that is gaining popularity in the pyridine ecosystem and hence augments pyridine market dynamics and trends. Conventional pyridine production techniques depend on petrochemical reactions, however innovative bio-based technologies are producing pyridine from renewable resources such as biomass or agricultural waste. This change tackles sustainability issues, decreases production costs, and lessens the impact on the environment. In order to create pyridine more effectively and provide an environmentally responsible substitute for traditional methods while preserving product quality and production, businesses are investing in biocatalysis and fermentation approaches.

With increasing global demands for agrochemicals, especially herbicides and fungicides, pyridine is in higher demand. Pyridine derivatives are vital in making effective crop protection products with improved crop yields and pest management. As the world intensifies agriculture to satisfy food security needs, pyridine's role in agrochemical formulations becomes crucial. This growth in the agrochemical sector is going to significantly drive pyridine demand worldwide, particularly in areas with intensive agricultural activities.

Advances in bio-based production of pyridine present sustainable alternatives to traditional methods while reducing environmental impacts. Bio-based methods use renewable resources to reduce dependency on fossil fuels and lower carbon emissions. As the world continues to push for sustainability and eco-friendly productions, bio-based pyridine gains ground in agrochemical and pharmaceutical industries. These improvements will drive the adoption of pyridine across environmentally conscious markets, boosting demand overall.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Pyridine Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

On the basis of product type, the market can be divided into the following:

On the basis of application, the market can be divided into the following:

On the basis of end uses, the market can be divided into the following:

Based on region, the market can be segregated into:

By Product Type Analysis

The increasing demand of pyridine derivatives, such as Alpha Picoline, Beta Picoline, and Pyridine N-Oxide, is gaining growth in the market across agriculture, pharmaceutical, and chemical industries. Alpha and Beta Picolines are widely used as raw materials for herbicides, vitamins, and related nicotine compounds, whereas Pyridine N-Oxide is used to synthesise special chemicals and for different solvent applications in industries. As per pyridine market analysis, the demand of 2-Methyl-5-Ethylpyridine, popularly known as MEP, is also rising in the high-performance chemical processes.

Market Analysis by Application

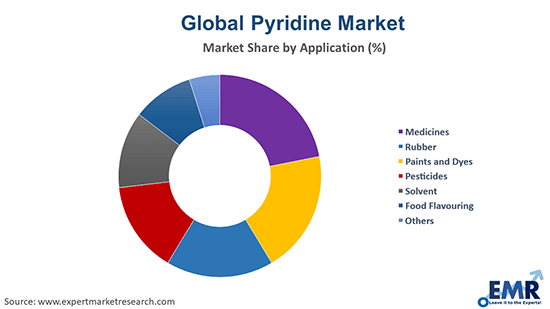

Applications of pyridine are continuously finding their way in different domains. In the medical field, it is used as an intermediate for compounds that produce vitamins and anti-inflammatory drugs. Pyridine facilitates vulcanization of rubber in the rubber manufacturing process. Pyridine is used in paints and dyes to increase colour stability and therefore performance. Pyridine is used in crop protection chemicals in the pesticide industry. It is also used as a solvent in various industrial processes, besides being an agent for flavouring food products, thereby increasing demand in the consumer market.

Analysis by End Uses

The rising demand for pyridine and its derivatives from the pharmaceutical and agrochemicals industries due to the product’s favourable chemical properties is anticipated to propel the market growth. In plastics, adhesives, and pharmaceutical products, pyridine is used as a solvent. As per pyridine market analysis, pyridine derivatives, on the other hand, are being used as a starting material for the production of agrochemicals, medicines, and food-flavouring additives, among others. Pyridine derivatives are often used as an anti-freeze mixture denaturant.

The growth of the global pyridine industry is driven by further developments in the processes of biocatalyst, increased demand for synthetic pyridines as well as the growing applications of pyridine in pesticides and herbicides. Companies are performing comprehensive research to enhance pyridine's applications in agrochemicals, including fungicides, insecticides, and herbicides. In the coming years, the market is expected to be further aided by the rising awareness of the product among farmers, catalysed by the increasing pest control activities.

North America Pyridine Market Opportunities

Demand for pesticides has encouraged the continuously growing agricultural sector in North America to make intensive use of pyridine. The United States government, under the framework of the 2023 Farm Bill, encourages the development of eco-friendly pesticide formulations and these are significantly increasing the demand for pyridine. Moreover, compounds based on pyridine have many applications in the pharmaceutical and rubber industries, which are expanding in North America. It is fueling the market steadily.

Europe Pyridine Market Dynamics

The pyridine market in Europe is projected to grow steadily, backed mainly by agricultural growth, especially in pesticides. The push for greener farming due to the European Union's Green Deal and the encouragement of sustainable farming have strengthened the demand for more environmentally friendly pesticides for which pyridine derivatives are the main choice of material. The pharmaceutical and chemical industries of Europe are also rapidly using pyridine for the preparation of medicines and specialty chemicals. Major countries in these trends are Germany, France, and the United Kingdom, as well as ensure market stability and growth.

Asia Pacific Pyridine Market Trends

Asia Pacific pyridine market share holds a significant share in the global pyridine market. This is mainly because of the growing market of the product in the region, owing to the rising demand in the countries of Bangladesh, China, Japan, India, South Korea, Vietnam, and Malaysia. The region's demand is increasing due to favourable government regulations, rising disposable incomes, and the readily available cheap labour, among other factors. The Asia Pacific market will further lead to growth in the pharmaceutical industry and will be even further driven by the huge increase in demand from the agrochemical sector.

Latin America Pyridine Market Insights

Latin America pyridine market is growing as there is a boom in demand for agricultural products, especially pesticides and herbicides. The companies like Arkema are in a good position to leverage this opportunity and rise in productions of pyridine derivatives used in agrochemicals. The company in Arkema has focused on region-specific production mechanisms, mainly eco-friendly and sustainable, to cater to the burgeoning demand for environmentally friendly agricultural solutions. This allows the company to achieve the regional regulatory requirements and enhance market reachability in the Latin American countries where sustainable farming techniques are experiencing a surge.

Middle East and Africa Pyridine Market Drivers

The Middle East and Africa pyridine market is expanding due to increased demand for agrochemicals, notably pesticides and herbicides, as agriculture is an important aspect of the region's economy. As stated by the Food and Agriculture Organization (FAO), the growing need for crop protection chemicals in countries such as Egypt, South Africa, and Morocco is driving pyridine use. Furthermore, the rise of the oil and gas sector is increasing demand for pyridine-based chemicals in rubber and solvents, which is driving regional market growth.

The pyridine market players are focusing on product innovation, developing derivative products for niche applications such as agrochemicals and pharmaceuticals. They are following sustainable production processes and green chemistry initiatives, with respect to environmental regulation. Pyridine companies further strengthen regional presence through expansion of manufacturing capacities and vertical integration to improve cost efficiency, reduce carbon footprint, and better serve growing demand globally for quality pyridine products.

Incorporated in 2006, with headquarters in Indianapolis, IN, Vertellus is an agrochemical and pharmaceutical manufacturer for pyridine and its derivatives. Their product line includes picolines among other quality pyridine-based products utilized in solvents and catalysts.

Lonza was incorporated in 1897, and it has its head office in Basel, Switzerland. This company provides a variety of pyridine compounds for pharmaceutical and agrochemical industries. It offers sustainable chemical production processes combined with specific solutions in biologics manufacturing and pyridine derivatives to create safe products and the environment.

Novasyn Organics Company was incorporated in 1998 at Mumbai, India. The company manufactures chemicals based on pyridine, including picolines and pyridine N-oxide. Its products are targeted at agriculture, chemical, and pharmaceuticals industries, focusing on custom synthesis and high-quality chemical intermediates.

In 1949, Koei Chemical Co., Ltd. was founded as a leader in pyridine and its derivatives. This firm is at Tokyo, Japan, with the production of pyridine for fields within the agrochemical, pharmaceutical, and food flavouring industries.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the global pyridine market are ProChem, Inc., Shangdong Luba Chemical Co. Ltd, and Resonance Specialties Limited, among others.

Startups in the pyridine market are targeting eco-friendly production methods, particularly bio-based pyridine, for reduced environmental impact. Additionally, they are finding innovative uses of pyridine in pharmaceuticals and agrochemicals. The start-ups are developing environment-friendly solutions and targeting emerging markets in order to capitalize on the growth in demand for sustainable and efficient chemical production, particularly in regions with growing agricultural and industrial sectors.

Startups like GreenPyridine focus on bio-based pyridine production with the aim of reducing the environmental impact of traditional fossil fuel-based methods, promoting sustainable agricultural and pharmaceutical products.

Companies like AgroChem Innovations are expanding pyridine applications in emerging markets, particularly in Asia-Pacific, developing eco-friendly agrochemical solutions to meet growing agricultural demands.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 727.77 Million.

The pyridine market is assessed to grow at a CAGR of 4.50% between 2026 and 2035.

The growth of the market is driven by factors like the rising manufacturing of herbicides, pesticides, and insecticides, growing research to improve pyridine's and its derivatives’ chemical properties, rising demand from the pharmaceuticals industry, and growing agrochemicals sectors.

The growing awareness regarding the benefits of pyridine among farmers and the rising pest control activities are the key trends fuellling the market.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The leading product types in the market are pyridine n-oxide, alpha picoline, beta picoline, gamma picoline, and 2-methyl-5-ethylpyridine (MEP), among others.

Medicines, rubber, paints and dyes, pesticides, solvent, and food flavouring, among others, are the major applications of pyridine.

Pharmaceuticals, agrochemicals, food, and chemicals, among others, are the significant end uses of pyridine.

The major players in the pyridine market are Vertellus Holdings LLC, Lonza Group Ltd., Novasyn Organics Pvt. Ltd., Koei Chemical Co., Ltd., ProChem, Inc., Shangdong Luba Chemical Co. Ltd, and Resonance Specialties Limited, among others.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 1130.20 Million by 2035.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Application |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share