Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The router and switch market attained a value of USD 59.19 Billion in 2025. The market is expected to grow at a CAGR of 5.30% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 99.20 Billion.

Enterprises and cloud providers are pushing for ever higher port speeds like 100 Gbps, 400 Gbps, even 800 Gbps ports, especially in aggregation, leaf spine fabrics, and data centers. This is driven by AI/ML workloads, video streaming, and big data. Edgecore Networks released the DCS511 in August 2024, a spine switch featuring 32 × 400G ports and 12.8 Tbps switching capacity, powered by Broadcom’s Tomahawk 4 ASIC. These advancements enable faster data processing and lower latency, crucial for supporting the exponential growth of cloud services and real-time applications.

Routers and switches are increasingly embedding machine learning (ML)/artificial intelligence (AI) for self healing, traffic prediction, anomaly detection, and dynamic resource allocation. For instance, Huawei's CloudEngine 16800 series exemplifies the integration of AI into networking hardware. This reduces manual work and improves uptime. For instance, some new switches are promoted as self healing and AI adaptive, optimizing power consumption and routing paths based on observed usage.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

5.3%

Value in USD Billion

2026-2035

*this image is indicative*

As more processing moves to the network edge, smart factories, real time analytics, IoT, surveillance, the router and switch market will need to handle decentralized traffic, low latency, and distributed security. Juniper's MX Series routers are optimized for metro and edge deployments, providing high-density, low-latency connectivity and support a wide range of interfaces. Smart city initiatives are particularly influential, requiring devices that can handle unpredictable, highly distributed traffic patterns.

With billions of connected devices like smart sensors, wearables, and industrial machines, the burden on network infrastructure keeps increasing. Routers and switches handle many simultaneous connections, various traffic types, and low power usage. In October 2024, Meta's deployment of the Arista 7700R4 series switches exemplify the integration of AI-optimized networking in edge computing. These routers were specifically designed to support massive numbers of connected devices and resilient network performance in demanding settings.

Enterprises increasingly deploy workloads across on premises, private cloud, and public cloud. This is adding to the router and switch industry value as they need to support efficient and secure connectivity across these environments. In September 2024, DE-CIX India launched Cloud Router Services to enhance multi-cloud connectivity, enabling seamless, secure, and scalable inter-cloud network integration. This drives demand for higher throughput, redundancy, VPN, and connectivity optimization to and between clouds.

Switches and routers with more ports per unit, modular chassis, hot-swappable line cards, and compact designs are increasingly popular, enabling operators to scale flexibly and reduce downtime. For example, Cisco’s Catalyst 9600 Series switches offer modularity and high port density with hot-swappable components, supporting seamless network expansion and maintenance without service interruption. Such instances are boosting the router and switch market trends.

Use cases like gaming, 8K/4K video streaming, AR/VR, remote surgery, and financial trading require ultra-low latency networks. Routers and switches are optimized for minimal delay, better jitter, and faster failover to ensure seamless real-time experiences. For instance, in June 2024, ASUS unveiled the ROG Rapture GT-BE19000, offering tri-band WiFi 7 and wired speeds up to 31 Gbps. These enhancements enable industries to leverage high-speed, reliable connections essential for mission-critical operations and immersive digital experiences.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Router and Switch Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

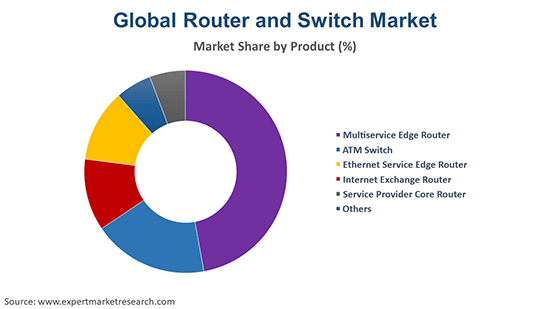

Market Breakup by Product

Key Insight: Service provider core routers are central to large-scale telecommunications networks, handling high-speed data traffic between different network segments. they are designed for scalability, reliability, and high throughput, supporting advanced features like MPLS, VPNs, and high-density 100G/400G interfaces. In January 2024, Zyxel Communications launched a pioneering 5G NR router powered by MediaTek's T830 and Filogic 680 chipsets. This device integrates advanced AI functionalities, including remote device management, real-time Wi-Fi analytics, and parental controls via cloud technology.

Market Breakup by Service

Key Insight: The ethernet aggregation segment of the router and switch industry involves combining multiple Ethernet links into a single high-capacity connection, enhancing bandwidth and redundancy. This segment is crucial for consolidating traffic from various access points into the core transport network, especially as bandwidth consumption grows. Their importance is rising with growing bandwidth consumption. For instance, Arista Networks 800G Core Router Platform launched in June 2024 is designed for hyperscale data centers and telco backhaul, this platform offers high-performance routing capabilities.

Market Breakup by Region

Key Insight: Asia Pacific leads the global router and switch market growth, driven by rapid urbanization, large-scale 5G deployments, and significant investments in digital infrastructure across China, India, and Japan. In July 2025, NTT SmartConnect launched Japan's first "MegaIX" service, establishing a connection point for Megaport's multi-cloud connectivity service at its Sonezaki Data Center. The region's burgeoning AI-startup ecosystem further stimulates purchases of 400G leaf-spine fabrics and lossless Ethernet clusters destined for computer-vision training workloads

Rising Demand for Multiservice Edge & Ethernet Service Edge Routers

Multiservice edge routers help connect enterprise networks to service provider networks, supporting a variety of services like voice, video, and data. They offer features such as QoS, security, and traffic management, enabling efficient delivery of multiple services over a single platform, driving innovations in the router and switch market. In February 2025, RtBrick introduced support for OpenZR+ coherent optics at 400Gbps, eliminating the need for separate transmission equipment between routers.

Ethernet service edge routers serve as the demarcation point between service providers' networks and customer premises equipment. They facilitate the delivery of Ethernet services, including VLANs, QoS, and traffic shaping, ensuring reliable and efficient data transmission. These routers are crucial for managing high bandwidth demands and supporting scalable, secure business connections in industries, such as finance, healthcare, and telecommunications.

Rising Router and Switch Use in Internet Data Center/Collocation/Hosting & Ethernet Access

The internet data center/collocation/hosting segment of the global router and switch industry encompasses data centers, colocation services, and hosting solutions, forming the backbone of cloud computing and digital infrastructure. Leading providers continually upgrade their network equipment to support increasing demand for cloud services, edge computing, and content delivery networks worldwide.

Ethernet Access refers to the delivery of Ethernet services from service providers to end-users, enabling high-speed internet and private network connectivity. Recent innovations focus on expanding fiber-to-the-premises deployments and enhancing broadband speeds to support bandwidth-intensive applications like video conferencing and cloud services. For instance, Verizon’s Fiber+ service launched in 2023 offers symmetrical gigabit speeds over Ethernet access, improving reliability and user experience for residential and commercial customers.

Thriving Router and Switch Usage in North America & Europe

North America holds a large router and switch market share, driven by advanced technological infrastructure and high adoption rates of networking solutions across various industries. Major companies in the telecommunications and technology sectors, including large enterprises and cloud service providers, drive significant demand for Ethernet switches and routers. Additionally, government initiatives aimed at enhancing digital connectivity and infrastructure investment further bolster market growth.

The market growth in Europe is supported by ongoing digitalization and government initiatives promoting smart cities and Industry 4.0. Germany, the United Kingdom, and France are leading in network modernization efforts. For instance, Germany’s Deutsche Telekom expanded its 5G network infrastructure with Nokia's AirScale portfolio in November 2024. These efforts collectively drive demand for sophisticated routing and switching equipment, supporting Europe's transition to more connected, efficient, and intelligent network ecosystems.

Major players in the router and switch market are focusing on innovation, strategic partnerships, and market diversification. Leading companies are heavily investing in research & development to develop next-generation routers and switches that support higher bandwidths, advanced security, and software-defined networking (SDN). The shift toward 5G and edge computing is pushing vendors to optimize for low-latency, high-throughput solutions compatible with hybrid and cloud-native environments. Strategic alliances with telecom operators, cloud service providers, and enterprise IT firms are enabling faster rollout of customized networking solutions.

Companies are also expanding their presence in emerging markets such as India, Southeast Asia, and Africa, where rising internet penetration and government-led digitization efforts are fueling demand for robust network infrastructure. Moreover, players are increasingly offering subscription-based models and integrated services like AI-driven network management, analytics, and cybersecurity to add value and enhance customer retention. Sustainability is also gaining attention, with vendors exploring energy-efficient chipsets and recyclable hardware designs. Mergers, acquisitions, and portfolio diversification remain key tactics to maintain competitive edge and adapt to rapidly evolving network demands.

Founded in 1984 and headquartered in San Jose, the United States, Cisco has pioneered the development of multiprotocol routers and is widely recognized for its innovations in cybersecurity, enterprise networking, and SDN. Cisco's solutions power infrastructure for enterprises, governments, and telecom operators worldwide.

Established in 1876 and based in Stockholm, Sweden, Ericsson is a telecommunications giant known for its key role in mobile network evolution. It has been instrumental in developing global 4G and 5G infrastructure. Ericsson leads in radio access network (RAN) technology and collaborates with operators on advanced wireless connectivity solutions.

Huawei, founded in 1987 and headquartered in Shenzhen, China, is a major global provider of ICT infrastructure and smart devices. Renowned for its high-performance routers and 5G innovations, Huawei has also expanded into AI-driven networking and cloud solutions, contributing significantly to digital transformation across multiple industries and regions.

Based in California, the United States, and founded in 1998, Actelis is known for extending broadband over existing copper and fiber infrastructure. Actelis’s innovations support secure, rapid connectivity in smart city deployments, transportation, and critical infrastructure, emphasizing both cost-efficiency and resilience.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the router and switch market are ALE International, and ZTE Corporation, among others.

Discover the latest router and switch market trends 2026 and beyond with our in-depth report. Download your free sample today to explore key drivers, technological innovations, and regional growth opportunities. Stay ahead in this rapidly evolving sector with expert insights designed to support your strategic decisions and business growth.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 59.19 Billion.

Key strategies driving the market include innovation in high-speed and AI-enabled devices, modular and scalable designs, enhanced security features, expansion into edge computing, strategic partnerships, and focusing on 5G and cloud integration. Emphasis on energy efficiency and customized solutions also fuels competitive advantage.

The key trends guiding the market growth are the growing emergence of work-from-home culture, the rising usage of video, carrier ethernet, and the convergence of residential and business networks, and the surging number of e-retailers.

The major regional markets of the router and switches are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The significant products of router and switch are multiservice edge router, ATM switch, ethernet service edge router, internet exchange router, and service provider core router, among others.

The major service segments in the market are ethernet aggregation, internet data center/collocation/hosting, ethernet access, and BRAS, among others.

The key players in the market report include Cisco Systems, Inc., Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., Actelis Systems, Inc., ALE International, and ZTE Corporation, among others.

The market is projected to grow at a CAGR of 5.30% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 99.20 Billion by 2035.

Asia Pacific dominates the market, driven by rapid industrialization, mining expansion, and large-scale infrastructure projects.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Service |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share