Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global running gear market was valued at USD 48.87 Billion in 2025. The market is expected to grow at a CAGR of 5.30% during the forecast period of 2026-2035 to reach a value of USD 81.91 Billion by 2035. Rising corporate wellness programs and employer-sponsored fitness incentives are expanding running participation, creating consistent demand for gear that supports both recreational and professional training, while strengthening brand loyalty across workforce communities.

The market is entering a phase of sustained growth, largely fueled by the surge in health awareness and organized sporting participation. According to the running gear market analysis, 247.1 million Americans engaged in at least physical activity in 2024, an increase of over 25 million participants since 2019. The rising appeal of marathons and community runs, most of them backed by municipal wellness initiatives, has accelerated the demand for high-performance running shoes, apparel, and wearables.

Technology is fast reshaping the running gear market dynamics, with innovations like Adidas’ Ultraboost 5 paired with STEPN GO’s NFT series bridging the gap between physical gear and digital assets. Similarly, Garmin’s launch of the Fēnix 8 GPS watch in August 2024, featuring solar charging and AI-driven navigation, reflects how data analytics and smart wearables are now embedded into core product lines.

Base Year

Historical Period

Forecast Period

There is a growing customer interest in performance-driven products and sports lifestyles, aided by rising health consciousness and the increasing desire for multifunctional and stylish running gear. Customers are also increasingly investing in high-quality running gear with advanced performance features such as breathability, energy return, and enhanced cushioning. This is prompting brands to innovate, driving the development of more efficient and specialised running gear. For instance, Nike Air Zoom Alphafly NEXT% features highly cushioned midsole, two ultra-responsive Zoom Air pods in the forefoot, an additional ZoomX foam in the heel, and lightweight materials for enhanced speed and comfortability.

The growing popularity of athleisure and lifestyle products, the rising emphasis on fitness, health, and comfort in daily life, and an increasing number of individuals embracing running and fitness activities are boosting the running gear market revenue. For instance, ASICS recorded its first year that exceeded category profit of 10 billion yen for all of its Core Performance Sports, Sports Style and Onitsuka Tiger categories in 2023. The increasing profitability of leading companies is pushing them to invest in research and development activities and create advanced running shoe technologies, more stylish options, and better performance-oriented gear.

Companies in the running gear market are expanding their distribution centres in strategic locations to enhance the accessibility of running gear, improve their supply chain, and reduce logistical and operational costs by reducing transportation distances and improving inventory management. During the last quarter of 2023, Skechers USA, Inc. opened new distribution centres in Canada, Chile, and India, which helped develop sales, shorten delivery times and distances, and lower costs in these markets.

Compound Annual Growth Rate

5.3%

Value in USD Billion

2026-2035

*this image is indicative*

The growing wave of organized marathons, community races, and trail runs is boosting demand in the running gear market. The United States alone hosts around 1,100 marathons annually, attracting more than 200,000 runners for scheduled November 2025 race. Globally, industry estimates suggest over 10 million participants across 2,500–4,000 marathon events every year. Europe is seeing increasing government support, such as France’s investments in promoting the Paris Marathon, which welcomed more than 54,000 finishers in 2024.

Eco-friendly design is rapidly transforming the running gear market trends. Consumers now prioritize recyclable shoes, biodegradable packaging, and apparel crafted from organic fibers. On’s Cyclon subscription program offers recyclable gear, while Humans Being incorporates Ynviron recycled yarn and plastic bottle fibers into activewear. In Europe, EU-funded programs are incentivizing brands to reduce textile waste through circular production cycles, making sustainable gear a commercial advantage rather than a niche category.

Wearable technology is boosting the demand for running gear by embedding advanced sensors into shoes, apparel, and watches. Garmin’s Fēnix 8 multisport GPS watch, for example, integrates solar charging, AI navigation, and health metrics, appealing to data-driven runners. Sensor-based footwear with real-time gait analysis is also gaining adoption. Governments and fitness bodies are supporting digital health through funding of connected devices for wellness monitoring, further expanding adoption. These smart solutions allow athletes and casual runners alike to optimize performance, prevent injuries, and personalize training, ensuring strong long-term demand in the running gear industry.

Digital retail expansion is fundamentally changing distribution. In December 2024, Seddiqi Holding’s Mizzen launched On’s first direct-to-consumer platform in the UAE, introducing exclusive releases and same-day shipping. Across North America and Europe, e-commerce platforms are investing in virtual try-ons, AI recommendations, and dynamic pricing to personalize the shopping journey. Governments in Asia are also upgrading digital payment infrastructure, making premium gear more accessible. These innovations widen the scope for the running gear market expansion, boost consumer engagement, and reduce reliance on traditional retail channels.

Continuous R&D investment is giving rise to high-performance running gear tailored to diverse terrains and conditions. For example, Arc’teryx launched the Sylan GTX trail shoe in July 2024, engineered with rocker geometry for propulsion and Vibram Megagrip outsoles for rugged terrain. Brands like Nike and ASICS are also experimenting with carbon-plated midsoles and responsive foams designed for speed optimization. Governments and sports medicine institutions are encouraging gear that reduces injury risks, supporting designs based on biomechanics and ergonomics, influencing market growth.

The EMR’s report titled “Global Running Gear Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

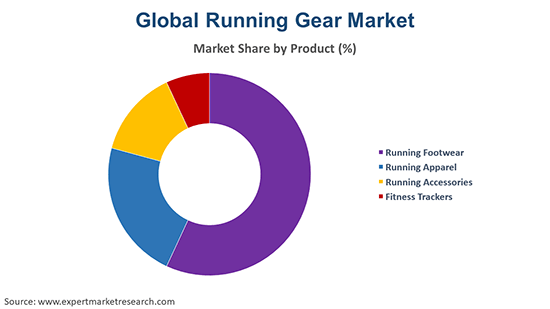

Market Breakup by Product

Key Insight: Across all the products considered in the market report, running footwear largely drives market growth, while fitness trackers are accelerating adoption through smart connectivity. Apparel continues to gain traction with moisture-wicking fabrics and ergonomic fits appealing to performance-focused users. Accessories, such as hydration packs and compression gear, are gaining visibility in communities.

Market Breakup by Gender

Key Insight: Men have contributed to the running gear market value by a significant margin, due to higher purchasing volumes, while women are driving future expansion with a shift toward inclusive and lifestyle-driven offerings. The unisex category is becoming increasingly important in youth and casual markets where functionality outweighs gender-specific design. Inclusive sizing, universal fits, and sustainable product lines are expanding appeal across all consumer groups.

Market Breakup by Distribution Channel

Key Insight: Distribution channels in the running gear market indicate that offline remains dominant due to experiential advantages, while e-commerce accelerates through technology-driven personalization. Emerging omnichannel strategies, like click-and-collect, bridge the gap, offering consumers the flexibility of online convenience with offline assurance. Direct-to-consumer websites from leading brands are also reshaping buying behaviors, reducing dependency on third-party retailers.

Market Breakup by Region

Key Insight: Regions like Europe, Latin America, and the Middle East & Africa are contributing to market growth through niche adoption, sustainable sportswear initiatives, and urban fitness programs. While North America dominates in value, Asia Pacific leads in growth velocity. Emerging running gear markets are increasingly prioritizing accessibility, technology integration, and lifestyle-focused innovations.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

By product, running footwear secures the largest market share driven by performance and innovation

Running footwear commands the largest revenue share of the market due to its essential role in enhancing performance and reducing injury risk. Leading brands like ASICS and Adidas are consistently advancing cushioning technologies, midsole responsiveness, and outsole traction to meet the evolving needs of runners. Recent innovations include Adidas’ Ultraboost 5, developed with STEPN GO, combining physical footwear with NFT-linked experiences, demonstrating how digital assets are entering sports retail.

As per the running gear industry report, fitness trackers are growing widely popular, driven by consumer demand for personalized data insights. Devices like Garmin’s Fēnix 8 watch, with solar charging and AI-powered navigation, reflect how technology integration is shaping buying preferences. Trackers now offer advanced biometrics such as VO2 max, cadence monitoring, and recovery analysis, making them essential tools for both professional and recreational runners.

By gender, men account for the dominant share of the market backed by endorsements and performance focus

The men’s category secures the largest market share, driven by growing investments in performance footwear and gear products. Sponsorship deals with elite athletes and marathon events reinforce brand loyalty among male consumers. Companies like Nike and Adidas release limited-edition men’s collections tied to global events such as the Olympics and World Championships, further impacting the running gear demand.

The women’s category is expanding at an accelerated rate, supported by growing participation in running communities and events tailored to female athletes. Brands are focusing on biomechanics-specific designs, ensuring footwear fits narrower heels and arch structures more effectively. Apparel innovations, such as adaptive sport t-shirts and leggings with built-in compression, are gaining traction.

By distribution channel, offline retail dominates the market with experiential shopping and expert guidance

Offline retail leads the market, as specialty sports stores, brand outlets, and multi-brand chains provide immersive experiences that online platforms cannot fully replicate. Consumers prefer trying footwear for fit and comfort before purchase, making in-store shopping crucial. Retailers like Dick’s Sporting Goods and Decathlon are enhancing stores with gait analysis stations and AR fitting rooms, helping buyers find customized solutions. Pop-up stores and brand-sponsored events also strengthen visibility, propelling the running gear market revenue growth.

E-commerce emerges to be the fastest-growing distribution channel, benefiting from the rise of digital-native consumers and advanced retail technologies. Platforms like Amazon, Zalando, and Nike’s own app are using AI-driven personalization to recommend products based on running style, purchase history, and fitness goals. Virtual try-on features and size prediction tools are improving customer confidence in online purchases.

North America secures the leading position in the market with its advanced fitness culture

North America holds the largest share of the global market. Growth in this region is influenced by a strong fitness culture, high disposable incomes, and widespread participation in marathons, trail runs, and urban fitness events. The United States and Canada lead the adoption of innovative products, including smart footwear and performance wearables.

Asia Pacific, fueled by rapid urbanization, a rising middle class, and increasing health consciousness, boosts considerable running gear market opportunities for growth. Countries like China, India, and Japan are witnessing a surge in running event participation, from city marathons to trail running communities. Expanding e-commerce platforms and growing retail networks are enhancing accessibility to premium gear.

Most of the running gear companies are focusing on advanced product development, incorporating smart wearables, AI-driven analytics, and sustainable materials to meet evolving consumer demands. Partnerships with marathons, tech startups, and fitness apps are creating new avenues for brand engagement. Market growth is also fueled by urbanization, rising health consciousness, and increasing participation in recreational and competitive running events across global regions.

Running gear market players leverage omnichannel strategies, influencer collaborations, and direct-to-consumer e-commerce to build loyalty. Opportunities lie in smart connected gear, personalized footwear, and eco-friendly product lines, while smaller players differentiate through niche innovations and targeted regional campaigns. Additionally, emerging trends such as virtual fitness coaching, integration of biometric tracking, and collaboration with health and wellness platforms are enhancing customer experience. Continuous R&D, sustainability initiatives, and digital marketing are driving competition and shaping the future of the market.

Adidas AG, a German multinational corporation founded in 1949, primarily focuses on running gear, including shoes, apparel, and accessories. Adidas specializes in providing customers with the best cushioning through its Boost technology and performance and style through Ultraboost. The brand engages itself with sustainability and innovation for its running products.

ASICS is a high-performance running gear firm of Japan founded in 1949 based out of Kobe. Their main focus lies on high-tech running shoes featuring biomechanics and comfort. Gel technology is one specialty of ASICS where they excel in shock absorption; serious runners go for the GEL-Nimbus and GEL-Kayano lines. The priority of ASICS has always been to research and develop to meet the needs of runners.

Nike was founded in 1964 and is headquartered in Beaverton, Oregon. It provides comprehensive running gear like ZoomX and React and Flyknit technology with an air focus for the lightest possible running clogs. The brand is applying both performance and style to cater to casual and competitive runners.

Skechers USA, Inc., headquartered in California, United States, is a company that is engaged in the development, design, and marketing of over 3,000 styles for men, women and children. Founded in 1992, the company offers two distinct footwear categories- performance footwear and a lifestyle division. It also provides branded apparel, eyewear, accessories, and scrubs, among others through licensing agreements.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Another key player in the market is Columbia Sportswear Company, among others.

Explore the latest trends shaping the global running gear market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on running gear market trends 2026.

Latin America Running Gear Market

Brazil Running Gear Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 5.30% between 2026 and 2035.

Key strategies driving the market include continuous innovation in smart and sustainable products, direct-to-consumer e-commerce, personalized offerings, and partnerships with marathons, fitness apps, and tech startups to enhance brand engagement and loyalty.

The growing adoption of smart technology in running gears, which helps the consumer track their progress and health, is expected to be a major trend informing the growth of the market.

The major regions in the markets are North America, the Asia Pacific, Europe, Latin America, and the Middle East and Africa.

The leading products in the market are running footwear, apparel, and accessories, along with fitness trackers.

The significant gender segments in the market are male, female, and unisex.

The major distribution channels in the market are speciality and sports shops, supermarkets and hypermarkets, department and discount stores, and online, among others.

The key players in the market include Adidas AG, ASICS, Nike, Skechers USA, Inc., and Columbia Sportswear Company, among others.

In 2025, the running gear market reached an approximate value of USD 48.87 Billion.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 81.91 Billion by 2035.

The key challenges are intense competition, rapidly changing consumer preferences, high production costs for advanced technology and sustainable materials, and supply chain disruptions.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Gender |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share