Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global solar lighting system market attained a value of USD 9.91 Billion in 2025 and is projected to expand at a CAGR of 15.90% through 2035. The market is further expected to achieve USD 43.34 Billion by 2035. Increasing replacement of diesel-powered temporary lighting at mining, construction, and disaster relief sites is accelerating adoption of autonomous solar lighting systems with predictable costs and zero fuel dependency.

Rising public pressure to reduce grid congestion in urban expansion zones is supporting solar lighting adoption. At the same time, private infrastructure operators demand lighting systems that integrate with security and monitoring platforms. These buyers prioritize uptime guarantees and asset visibility, driving the overall solar lighting system market growth. As procurement shifts toward bundled solutions, suppliers offering hardware paired with digital controls are gaining stronger negotiating power. This convergence is also reshaping vendor selection criteria.

Moreover, governments are prioritizing lighting assets that reduce grid extension costs to a significant extent, while ensuring operational continuity. This shift has accelerated the procurement of intelligent solar lighting systems across highways, logistics parks, and industrial corridors. As a response, in September 2025, Signify Holding expanded its Philips SunStay portfolio with Gen3 solar luminaires featuring adaptive dimming firmware and modular lithium iron phosphate batteries for highway projects.

Product development trends in the solar lighting system market are shifting towards standalone luminaires and integrated energy assets. Manufacturers are integrating remote diagnostics, fault alerts, and performance analytics into controllers. For example, in June 2025, Sol by Sunna Design announced the launch of the EverGen 3, its most advanced solar-powered outdoor lighting system. Consumers are now considering lifecycle expenses over initial installment prices. Buyers are increasingly favoring vendors who provide modular battery changes and standard pole designs in their tenders.

Supplier positioning across different regions is being transformed through strategic investments. For example, the solar outdoor lighting roadmap of Eaton Corporation plc has been synchronized with the federal infrastructure-funding initiatives in North America with a focus on the industrial and transportation hubs, since June 2024. Concurrently, Asian manufacturers are localizing assembly lines to meet local demands. These systems are currently considered as distributed power infrastructure. This rebranding trend in the solar lighting system market is compelling firms to emphasize battery life, hybrid grid integration, and software-led assets management.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

15.9%

Value in USD Billion

2026-2035

*this image is indicative*

Hybrid forms of solar light systems which integrate photovoltaic generation with grid or back-up supply are becoming common in transportation corridors. Highways and border roads have become subject to uninterrupted lighting by governments, accelerating the solar lighting system market value. As a result, manufacturers are introducing intelligent controllers which automatically change power sources. Suppliers of certified hybrid solutions are securing long-term contracts. In January 2026, Edinburgh became the first city in the United Kingdom to implement this type of connected solar hybrid lighting in parks. The lighting, installed by Signify, is designed to improve safety and sustainability in Edinburgh’s parks while supporting the Scottish city’s climate goals.

Solar lighting is becoming software-defined infrastructure. Vendors are integrating cloud-based dashboards that track battery health, lumen output, and fault events. Governments funding smart city programs increasingly require centralized lighting control. Municipal projects in India and Southeast Asia also include clauses of monitoring. Software-enabled systems also lower maintenance costs by reducing manual inspections. Firms that are offering analytics on a service subscription basis are increasing their profit margins. This solar lighting system market trend is in favor of manufacturers that have an in-house software capability, with long term service strategies. In January 2026, Enact Solar announced its acquisition of PVComplete to create the industry’s first comprehensive platform that seamlessly connects solar project conception, powered by artificial intelligence.

Battery reliability remains a decisive purchasing factor. Manufacturers are shifting toward lithium iron phosphate chemistries, optimized for high-temperature operation. Public agencies in Africa and the Middle East now specify minimum battery cycle life in tenders. Poor thermal performance has previously caused project failures. Suppliers are redesigning enclosures with passive cooling and modular replacements. Battery innovation is directly influencing supplier credibility, creating new solar lighting system market opportunities. Companies investing in climate-resilient storage are gaining repeat contracts in harsh deployment regions. For example, in July 2025, Solex Energy launched two new advanced high-performance solar products in Rajasthan, India, bringing climate-resilient solar technology to support the region’s growing renewable energy demand.

Private industrial parks and logistics hubs are emerging as strong demand growth factors. Operators deploy solar lighting to reduce peak grid loads and improve ESG reporting. Lighting systems integrated with cameras and sensors gain consumer preference. This bundled approach strengthens supplier relationships with enterprise buyers seeking long-term operational efficiency, sustaining the overall demand in the solar lighting system market. For example, Schneider Electric inaugurated a 500,000 sq. ft. facility in Hosur, Tamil Nadu, India, featuring rooftop solar panels integrated with energy-efficient infrastructure to support sustainable production in June 2025, by partnering with Horizontal Industrial Parks.

Governments are adopting annuity and performance-linked financing models for solar lighting projects. Vendors install and maintain systems while authorities pay service fees. This reduces upfront capital pressure. Countries across Latin America are piloting such frameworks for roadway lighting, widening the solar lighting system market scope. Suppliers with financing partners and balance sheet strength gain advantage. These models favor companies offering guaranteed uptime and energy savings. In November 2025, DW Windsor launched Sierra Solaflex, a milestone innovation in solar street lighting that combines the simplicity of an all-in-one luminaire with the performance and adaptability of an adjustable solar panel.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Solar Lighting System Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Offering

Key Insight: Hardware anchors the majority of the solar lighting system market revenue due to physical asset requirements and long replacement cycles. Software and services accelerate growth by enabling monitoring and service assurance. Buyers increasingly favor bundled solutions combining durable hardware with digital oversight. In August 2025, Waaree Energies Ltd. launched Flexible Light-Weight (FLW) solar modules. These flexible panels are designed for surfaces where traditional glass panels cannot be installed. Suppliers balancing both offerings are gaining stronger contract visibility. Procurement trends now reward integrated capabilities rather than standalone components.

Market Breakup by Light Source

Key Insight: As per the solar lighting system market report, LED dominates light source selection due to efficiency, reliability, and proven compliance across infrastructure projects. Buyers trust LEDs for consistent illumination, predictable maintenance, and thermal stability. Other light sources remain limited to experimental or specialized environments. In March 2025, Atlas Copco launched the second generation of solar powered light towers called the HiLight MS 4 and MS 5. These alternatives attract innovation-focused buyers but face certification and cost barriers.

Market Breakup by Grid Type

Key Insight: Off-grid systems dominate deployments where grid access is limited or unreliable. These solutions enable rapid installation and predictable operating costs. Hybrid systems are gaining momentum within the solar lighting system market dynamics, powered by urban and critical locations requiring uninterrupted lighting. Buyers evaluate grid configurations based on risk exposure, climate conditions, and service continuity. Vendors respond by diversifying portfolios and controller capabilities. Grid strategy selection increasingly influences system design, battery sizing, and contract structure. Flexibility across grid options strengthens supplier competitiveness and expands addressable project scope.

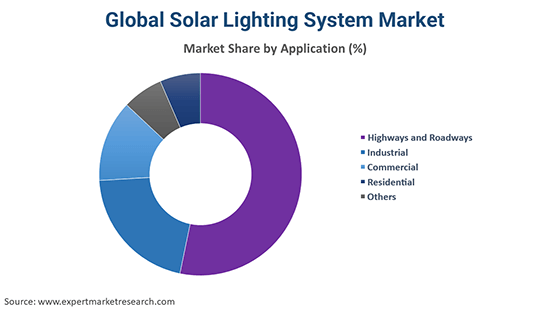

Market Breakup by Application

Key Insight: Roadway projects continuously boost demand in the solar lighting system market due to safety mandates and government funding. Industrial applications are growing their market shares as private operators invest in energy efficiency and ESG goals. Commercial, residential, and other segments remain selective and project-driven. Each application requires different illumination standards, layouts, and control features. Vendors tailor solutions to operational needs rather than one size offerings. Application diversity encourages modular designs and configurable systems.

Market Breakup by Region

Key Insight: The solar lighting system market in Asia Pacific boasts its dominance due to scale, infrastructure expansion, and manufacturing depth. North America drives growth through modernization and retrofit-focused projects. Europe emphasizes compliance, efficiency standards, and sustainability alignment. Latin America and the Middle East and Africa adopt selectively based on funding and electrification priorities. Regional differences influence product specifications, sourcing strategies, and service models. Vendors must align offerings with local regulations and procurement practices.

Hardware dominates the offerings category due to asset-heavy procurement and lifecycle-driven public infrastructure tenders

Hardware remains the dominant offering across the solar lighting system market dynamics as solar lighting projects are capital-intensive and asset-driven. Public authorities and industrial buyers prioritize luminaires, poles, batteries, and controllers that guarantee long operational life. Manufacturers are focusing on corrosion resistant poles, modular battery enclosures, and tamper-proof designs to reduce maintenance exposure. Companies with standardized hardware platforms benefit from faster certifications and volume manufacturing. In highway and industrial projects, buyers prefer proven physical reliability over experimental designs. This keeps hardware central to procurement decisions despite increasing digital layers.

Software and services are rapidly expanding their share in the solar lighting system market as buyers demand operational visibility and accountability. Vendors are embedding cloud platforms for battery diagnostics, lumen tracking, and outage alerts. Municipal buyers increasingly seek dashboards for centralized monitoring across zones. Service contracts now include uptime guarantees and predictive maintenance to reduce manual inspections and truck deployments. In August 2024, Array Technologies announced the launch of SkyLink, a revolutionary PV-powered wireless tracker system that builds on the capabilities of DuraTrack and OmniTrack offerings. Suppliers monetizing software through annual subscriptions improve margin quality.

By light source, the LED category registers the largest market share due to efficiency, thermal resilience, and standardized roadway specifications

LED lighting dominates the market due to high luminous efficiency and low energy consumption. Solar lighting systems depend on LEDs to maximize battery autonomy and minimize system sizing. Manufacturers refine optical designs to ensure uniform illumination while limiting glare. Public agencies favor LEDs due to predictable maintenance cycles and long operating life. Mature supply chains enable large scale deployments. In October 2024, Nessa Illumination Technologies Private Limited announced the launch of its Smart Light and Hybrid Solar High Mast at the Renewable Energy India (REI) Expo, Noida, contributing to the overall solar lighting system market penetration.

Other light sources are growing selectively within niche environments. These include experimental optical systems for specialized industrial or security applications. Adoption is driven by pilot projects and research-oriented deployments. Manufacturers are testing advanced materials to enhance spectral performance. Higher costs and certification complexity restrict wider adoption. Buyers exploring innovation-driven use cases remain cautious.

Off-grid solar lighting systems are gaining rapid popularity due to rural electrification and highway expansion projects

Off-grid solar lighting accounts for a substantial share of the market as it eliminates grid extension costs and deployment delays. Highways, rural roads, and industrial perimeters rely on standalone systems for rapid installation. Governments favor off-grid solutions within electrification programs. Manufacturers design higher capacity batteries and efficient controllers to ensure extended autonomy. Off-grid systems reduce dependence on unstable utility networks. This segment aligns with safety and infrastructure expansion objectives. For example, in May 2025, Landscape Forms debuted 360 Solar, an off-grid lighting solution with cylindrical solar panels and smart controls. Suppliers offering robust off-grid designs secure repeat public sector contracts.

Hybrid systems are also contributing to the solar lighting system market revenue due to increasing reliability expectations. These solutions combine solar generation with grid or backup input. Urban and critical infrastructure deployments favor hybrid configurations. Manufacturers introduce intelligent controllers that switch power sources automatically. Hybrid systems reduce outage risks during prolonged low irradiance periods. Buyers value uninterrupted lighting for safety sensitive locations. This subsegment commands higher margins due to technical complexity and reliability assurance.

By application, highways and roadways dominate the market due to government-funded safety and connectivity programs

Highways and roadways dominate applications due to public safety mandates. Governments fund large scale solar lighting installations across national and regional corridors. These projects emphasize consistent illumination and operational uptime. Vendors supply integrated pole mounted systems engineered for wind load and vandal resistance. This application benefits from predictable funding cycles and standardized technical specifications, broadening the solar lighting system market scope. In January 2026, Lord's Mark Industries secured NHAI solar lighting contract, leveraging advanced technology for road safety amidst growing market trends.

Industrial applications are expanding rapidly across logistics parks and manufacturing facilities. Operators deploy solar lighting to reduce grid load and support ESG objectives. Systems often integrate with security cameras and sensors. Buyers prefer scalable designs supported by performance guarantees, while vendors offer customized layouts for perimeter and yard lighting. Private infrastructure investment is driving growth in this category. This application prioritizes reliability, visibility, and long-term operational savings.

Asia Pacific leads the global industry due to infrastructure scale, localization mandates, and cost efficiency

Asia Pacific leads the solar lighting system market due to extensive infrastructure expansion and electrification programs across developing and emerging economies. Governments are actively funding highways, rural roads, industrial corridors, and smart city zones to improve connectivity and safety. Localization mandates encourage domestic manufacturing and assembly, allowing vendors to optimize costs and meet public procurement requirements. High volume tenders support scale economics and long production runs. Diverse climate conditions across the region require durable system designs with strong thermal performance and battery resilience.

The solar lighting system market in North America is expanding through retrofit and infrastructure modernization initiatives rather than new building projects. Federal and state level funding supports solar lighting adoption across transportation corridors, industrial parks, and municipal assets. Buyers emphasize compliance aligned designs, safety standards, and smart control integration. Service contracts are increasingly prioritized to ensure uptime and performance accountability. In January 2026, PowerBank Corporation announced that it has executed a lease agreement on a 5 MW AC hybrid solar plus battery energy storage project known as the NY-Holland Glnwd project, in New York.

Competition in the market is increasingly defined by system reliability, digital integration, and financing capability. Leading solar lighting system market players are moving away from selling standalone luminaires toward bundled infrastructure solutions. Hybrid architectures, modular batteries, and remote monitoring platforms have become key investment priorities.

Solar lighting system companies are strengthening relationships with governments, utilities, and industrial developers to secure multi-year projects. Local manufacturing and assembly are being used to meet content requirements and shorten delivery cycles. Long term service contracts tied to uptime guarantees are improving revenue stability. Battery durability and controller intelligence remain critical differentiation areas. Financing partnerships enable vendors to participate in annuity based public projects. The competitive advantage is shifting from price competition toward lifecycle performance, operational transparency, and predictable asset management outcomes.

Founded in 2016 and headquartered in Eindhoven, Netherlands, Signify focuses on connected and solar lighting systems. The company targets municipal and smart city projects globally. Its portfolio emphasizes adaptive controls and modular designs. Signify leverages digital platforms to secure long-term infrastructure contracts and recurring service revenue.

Established in 1911 and headquartered in Ohio, United States, Eaton integrates solar lighting into energy management solutions. The company serves industrial and infrastructure buyers. Eaton focuses on hybrid architectures and compliance-driven deployments. Its strength lies in system integration and reliability positioning.

Founded in 2011 and headquartered in Toronto, Canada, Clear Blue specializes in smart off-grid solar lighting. The company offers cloud-based monitoring platforms. It targets roadway, telecom, and industrial applications in emerging markets. Clear Blue emphasizes analytics-driven performance assurance.

Established in 2006 and headquartered in Zhejiang, China, Jinhua SunMaster Solar Lighting Co., Ltd. specializes in large scale solar lighting manufacturing for infrastructure markets. The company supplies municipal projects globally, emphasizing cost efficiency, standardized hardware, and export growth strategies throughout the world.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include Solar Electric Power Company, ENF Ltd., and Best Solar Street Lights USA, among others.

Unlock the latest insights with our solar lighting system market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 9.91 Billion.

The market is projected to grow at a CAGR of 15.90% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 43.34 Billion by 2035.

Manufacturers are expanding software platforms, localizing production, strengthening financing partnerships, improving battery durability, and targeting long term infrastructure contracts while aligning product roadmaps with public procurement priorities.

The growing demand for energy-efficient solar lighting systems for highways and increased usage of renewable energy for lighting are the key trends driving the market growth.

The major regions in the market include North America, the Asia Pacific, Latin America, Europe, and the Middle East and Africa.

The major offerings considered in the market report include hardware and software and services.

The significant light sources of solar lighting system are LED and others.

Off-grid and hybrid are the major grid types in the market.

The several applications of solar lighting system include highways and roadways, industrial, commercial, and residential, among others.

The key players in the market include Signify Holding, Eaton Corporation plc, Clear Blue Technologies Inc., Jinhua SunMaster Solar Lighting Co., Ltd., Solar Electric Power Company, ENF Ltd., and Best Solar Street Lights USA, among others.

Battery degradation in extreme climates, financing complexity, fragmented standards, and limited skilled maintenance networks continue to pressure project reliability and margins for solar lighting system manufacturers.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Offering |

|

| Breakup by Light Source |

|

| Breakup by Grid Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share