Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global high fructose corn syrup market size reached around USD 9.08 Billion in 2025. The market is projected to grow at a CAGR of 1.60% between 2026 and 2035 to reach nearly USD 10.64 Billion by 2035.

Base Year

Historical Period

Forecast Period

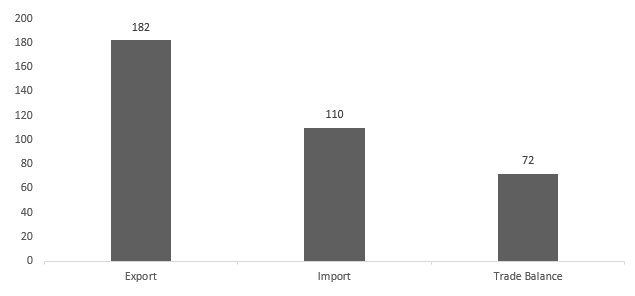

The 2023 "Data & Trends: EU Food and Drink Industry" reported a €1,112 billion turnover, positioning it as the EU's foremost manufacturing sector, consequently driving demand for the global high fructose corn syrup market.

Producing high-fructose corn syrup (HFCS) is 10-30% cheaper than manufacturing sucrose, offering comparable sweetness and flavour, thereby contributing to the growth of the HFSC market.

Coca-Cola states the North American region houses roughly 320 million consumers of its products, with an industry worth about USD 350 billion, which augments the global high fructose corn syrup market growth.

Compound Annual Growth Rate

1.6%

Value in USD Billion

2026-2035

*this image is indicative*

High fructose corn syrup is a sweetening agent derived from corn syrup that has been enzymatically modified to increase its fructose content by converting some of its glucose. It is frequently employed in the food and drink sector as a more economical substitute for sucrose (common sugar).

EXTERNAL TRADE IN EU FOOD AND DRINK INDUSTRY, 2023, IN € BILLION

As per the global high fructose corn syrup market report, HFCS is present in numerous items such as soft drinks, sweets, and processed foods, as it boosts sweetness levels and prolongs shelf life. As per the 2023 edition of "Data & Trends: EU Food and Drink Industry," the turnover amounted to €1,112 billion, marking it as the leading manufacturing sector in the EU. Moreover, it stands as the primary employer in the EU, providing jobs for approximately 4.6 million individuals, thus boosting the global high fructose corn syrup market.

The global high fructose corn syrup market is growing with an enhanced texture, extended shelf life, accessibility, and affordable, growing food and beverages industry.

High-fructose corn syrup's versatility among sweeteners appeals to food manufacturers due to its ability to enhance texture and prolong shelf life, making it a popular choice in baked goods and processed foods.

Easily obtained and derived from corn crops, high-fructose corn syrup reduces the need for imported sugar. Its convenience in transportation and storage makes it a preferred sweetening option for large-scale food producers.

Manufacturing high-fructose corn syrup (HFCS) costs 10-30% less than producing sucrose, with similar sweetness and taste. This affordability, combined with comparable flavour, makes HFCS an attractive alternative for various food and beverage applications.

HFCS, a prevalent sweetener and additive, is widely incorporated in processed foods and beverages, including soft drinks, yoghurts, and breads. Its numerous advantages over sucrose, like affordability and versatility, render it appealing to food manufacturers across various sectors.

The dynamic food industry's ongoing innovation creates avenues for high-fructose corn syrup (HFCS). It could find application in crafting unique packaged meals and beverages. While the future of the HFCS market is uncertain, demand is likely to persist due to its versatility and cost-effectiveness in the food sector.

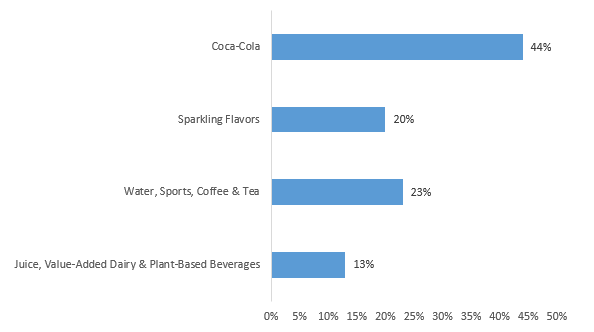

As per the global high fructose corn syrup market analysis, Coca-Cola's carbonated beverages predominantly rely on sugar for about 80% of their earnings, with HFCS accounting for approx. 20% of sweeteners.

Global High Fructose Corn Syrup Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Application

Market Breakup by Region

HFCS 42 is the leading product in the global high fructose corn syrup market since it's a first-generation high fructose syrup

HFCS 42 is a sweetener with low viscosity and high fermentability, suitable for existing liquid sweetener facilities. With a fructose content of 42%, it is utilized in various products like beverages and baked goods beyond its primary use.

HFCS-55, with 55% fructose, is mainly employed in carbonated beverages, such as soft drinks, as its primary application. It has been instrumental in holding a prominent position in the global high fructose corn syrup market.

Based on application, the global high fructose corn syrup market share is dominated by the food and beverage sector

The rising adoption of high fructose corn syrup in carbonated beverages, bakeries, confectionery, condiments, yoghurt, and sweetened foods is propelling segment growth. It enhances browning, moisture, and texture in bakery goods and acts as a preservative in jams, and candies, boosting demand.

North America possesses a considerable portion of the global high fructose corn syrup market. The United States, being a leading corn producer, supports significant production capacity for high fructose corn syrup.

According to Coca-Cola, the region has approximately 320 million consumers of Coca-Cola products and possesses an industry value of around USD 350 billion, thus further boosting the global high fructose corn syrup market development.

CATEGORY'S CASE VOLUME BREAKDOWN, 2022

Asia Pacific presents promising prospects due to the increasing adoption of convenient and cost-effective ingredients by processed food manufacturers. Additionally, the presence of a substantial consumer base for processed and sweetened foods in emerging economies is expected to drive the global high fructose syrup market growth.

The global high fructose corn syrup market competitiveness is improved texture, longer durability, availability, cost-effectiveness, and expanding food and beverage sector.

Cargill, Incorporated, a private multinational food company founded in 1865 and headquartered in the United States, provides diverse products and services encompassing agriculture, animal nutrition, beauty, bio-industrial components, food service, pharmaceuticals, meat and poultry, and transportation, among other sectors. Its primary focus lies in linking grain and oilseed producers with consumers.

Ingredion Incorporated a multinational food enterprise established in 1906 and headquartered in the United States, supplies an extensive array of ingredients like encapsulants, emulsifiers, extracts, fibres, flours, plant proteins, and starch. It stands as one of the leading manufacturers of sweeteners, nutritional components, and biomaterials, serving diverse sectors including food and beverage, paper, and pharmaceuticals.

Tate & Lyle Plc is an international provider of ingredients for the food and beverage industry, as well as various industrial sectors. Established in 1921 and headquartered in London, UK, the company offers a wide range of products including sweeteners, textures, fibre enrichment, crystalline fructose, sucralose, corn syrup, glucose, and dextrose.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other global high fructose corn syrup market key players are AGRANA Beteiligungs-AG, Roquette Frères S.A., Showa Sangyo Co. Ltd, Tereos Group, Daesang Corporation, and Guangzhou Shuangqiao Company LTD, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market attained a value of nearly USD 9.08 Billion.

The market is assessed to grow at a CAGR of 1.60% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 10.64 Billion by 2035.

The market is growing due to its enhanced texture, extended shelf life, accessibility, and affordable, growing food and beverages industry.

Based on the type, the market is divided into HFCS 42, HFCS 55, and others.

Key players in the industry are Cargill Incorporated, Ingredion Incorporated, Tate & LylePlc , AGRANA Beteiligungs-AG, Roquette Frères S.A., Showa Sangyo Co Ltd, Tereos Group, Daesang Corporation, and Guangzhou Shuangqiao Company LTD, among others.

Based on application, the high fructose corn syrup market is divided into food and beverages, pharmaceuticals, animal feed, and others.

The market is broken down into North America, Europe, Asia Pacific, Latin America, Middle East, and Africa.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share