Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global textile dyes market attained a value of USD 10.75 Billion in 2025 and is projected to expand at a CAGR of 6.10% through 2035. The market is further expected to achieve USD 19.43 Billion by 2035. Rising adoption of digital textile printing is increasing demand for specialized dye formulations optimized for ink compatibility, faster fixation, and short production runs across customized fashion and promotional textile categories.

Capacity expansion in polyester fiber production and tighter effluent norms are jointly shaping demand in the textile dyes market. China and India continue adding PET spinning capacity, lifting disperse dye volumes. At the same time, stricter wastewater discharge thresholds in Bangladesh and Turkey are pushing mills toward high-exhaust and low-temperature dye systems, accelerating replacement cycles for legacy dye chemistries while favoring suppliers with proven compliance portfolios across export-oriented textile clusters.

Product repositioning and compliance-driven innovation are reshaping the textile dyes market dynamics as manufacturers move away from commodity dispersions toward higher-margin specialty chemistries. Urbanization-linked garment production in South and Southeast Asia continues to expand, while global brands increasingly specify low-salt, high-fixation dyes to reduce wastewater loads and processing costs. For instance, in October 2024, Archroma introduced its NTRX bio-based reactive dye range, targeting apparel brands seeking petroleum-free coloration without sacrificing shade consistency.

Sustainability-led product roadmaps are also directly influencing procurement contracts and long-term supplier selection. In March 2025, Huntsman Textile Effects expanded commercial availability of its AVITERA SE polyreactive dyes, which reportedly cut water usage by up to 50% during dyeing cycles. Parallel investments are visible in digital color management and regional technical centers. These developments in the textile dyes market indicate that suppliers are aligning R&D, service models, and regulatory readiness to lock in multi-year volumes from apparel, home textile, and industrial fabric producers.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

6.1%

Value in USD Billion

2026-2035

*this image is indicative*

Low-salt reactive and high-fixation dye systems are gaining traction as mills respond to tighter effluent rules. Governments around the world are enforcing zero liquid discharge mandates for export clusters. As a response, in September 2025, Benninger presented the Benninger-Küsters Cold Pad Batch dyeing center for knitwear and woven fabrics, the only salt-free cold dyeing process. Salt-free dyeing without the use of energy is only possible using the cold pad batch (CPB) dyeing process. Apparel exporters adopting these chemistries are reporting lower treatment costs and faster audit approvals. Dye producers are positioning low-salt platforms as premium compliance solutions rather than cost products, accelerating the textile dyes market value.

Digital textile printing is accelerating demand for specialized dye inks with controlled viscosity and fast fixation. Government-backed textile parks in China and Vietnam are subsidizing digital printing lines to reduce water usage. Leveraging this trend, in September 2025, MS Printing Solutions and JK Group announced the launch of five multi-pass (MP) printers designed to heighten performance standards in digital textile printing. Fashion brands are using digital printing to shorten sampling cycles and reduce inventory risk. This trend in the textile dyes market favors suppliers offering application support, printer compatibility testing, and regional ink production aligned with nearshoring textile strategies.

Bio-based and non-toxic dye development is moving from pilot to commercial scale. EU REACH updates and California Proposition 65 disclosures are pushing brands to demand safer colorants. Biotech startups like Tintte offer a ‘biobank’ of over 100 microorganisms to create bacteria-based color pigments for sustainable fabric dyeing, since November 2025. Governments are linking export incentives to chemical compliance in textile hubs. Dye companies are responding by reformulating legacy products rather than launching niche product lines, redefining the entire textile dyes market dynamics.

Growth in polyester and nylon fiber output is driving demand for disperse and acid dyes. Southeast Asian countries are also attracting fiber projects as brands diversify sourcing. Dye suppliers are aligning production footprints closer to fiber clusters. This reduces lead times, stabilizes pricing, and supports long-term supply agreements tied to fiber producers rather than garment converters serving export markets efficiently amid volatile trade conditions. For example, in September 2025, Shree Pushkar Chemicals & Fertilisers Ltd. launched Dyecol, a new range of reactive dyes for Bangladesh, boosting the textile dyes market penetration.

Digital color management systems are becoming central to dye supplier differentiation. Governments are promoting Industry 4.0 adoption through textile modernization grants. Dye companies are bundling software, lab services, and on-site training with products. This model locks in customers, reduces reprocessing losses, and strengthens recurring revenue streams beyond pure dye sales for large mills operating multi-country supply networks serving apparel home and industrial textile brands, thereby stabilizing growth in the textile dyes market over the forecast period. Companies like Sun Chemical are demonstrating their complete range of digital textile inks, suitable for printing any textile material.

The EMR’s report titled “Global Textile Dyes Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Dye Type

Key Insight: Direct dyes retain relevance for cost-sensitive applications requiring simple processing, opening up new textile dyes market opportunities. Reactive dyes lead the market due to cotton dominance and fixation reliability. On the other hand, vat dyes serve niche durability-driven uses and basic dyes remain limited to acrylics. Acid dyes support wool and nylon coloration. Disperse dyes grow fastest with polyester expansion. Companies like Jay Chemical Industries offer the Jaylene range of dispersed dyes, since June 2023, recognizing the rising need for high-quality dyes for superior color fastness and performance.

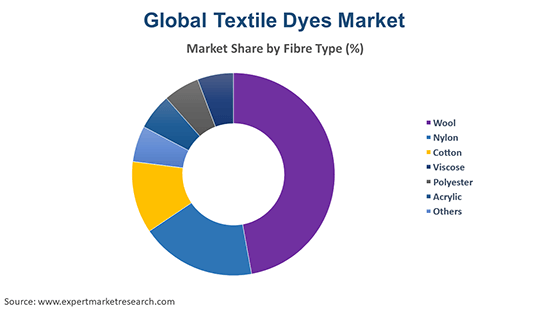

Market Breakup by Fibre Type

Key Insight: Wool remains tied to premium dye systems where deep shades, softness, and finish matter most for luxury textiles. Polyester continues to capture the dominant textile dyes market share because large-scale apparel manufacturing depends on its durability, speed, and consistent dye uptake. Acrylic is expanding as a cost-efficient substitute for wool in blankets and winterwear. Other fibers, including blends and specialty yarns, sustain niche dye demand shaped by texture needs, pricing sensitivity, and functional performance requirements across apparel, home furnishings, and industrial textile applications.

Market Breakup by Region

Key Insight: North America emphasizes specialty dye solutions aligned with regulatory compliance and performance standards. The textile dyes industry in Europe prioritizes sustainability-focused formulations, driven by environmental policies and brand commitments. Asia Pacific anchors global dye demand through large-scale textile manufacturing and export activity. Latin America supports steady consumption linked to regional apparel and home textile production. The Middle East and Africa continue expanding as governments promote industrialization, export-oriented textile projects, and local value chain development.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Reactive dyes register the largest market share due to cotton usage and fixation efficiency

Reactive dyes continue to dominate the textile dyes industry due to their strong bonding with cellulosic fibers and predictable shade reproducibility. Apparel exporters producing cotton garments rely on reactive dyes to meet wash fastness benchmarks demanded by global retailers. Suppliers such as DyStar and Archroma focus on high-fixation reactive systems that reduce reprocessing risks for large mills. Reactive dyes also allow controlled color depth across mass production lines, which supports volume-driven manufacturing contracts. Their compatibility with continuous dyeing processes improves output efficiency. In June 2025, DYECOL launched its latest innovation called the DYECOL CARE ESN series, a 4th-generation range of reactive dyes.

Disperse dyes are registering the fastest growth as polyester fiber usage expands across apparel and industrial textiles. Sportswear brands increasingly favor synthetic fabrics for durability and performance, accelerating disperse dye consumption. Manufacturers like Atul and Kiri Industries are expanding disperse dye portfolios to support low-temperature dyeing and energy-efficient processes. Disperse dyes offer better color uniformity on synthetic fibers and allow high-speed production cycles. Growth in this category is further supported by the shift toward recycled polyester, which requires optimized disperse formulations.

By fiber type, polyester fibers lead demand growth as synthetic apparel volumes increased globally

Polyester remains the dominant fiber category, boosting consistent textile dye demand toward disperse and specialty synthetic-compatible chemistries. Apparel brands favor polyester for durability, wrinkle resistance, and cost stability. Textile mills aligned with fast fashion and sportswear production depend heavily on polyester yarn. Dye suppliers tailor disperse dye systems to ensure shade consistency at scale. Exporters also value polyester’s lower water absorption, which reduces dyeing cycle times. Depending on this trend, Loop Industries, Inc. announced the launch of Twist, a branded circular polyester resin made entirely from textile waste in July 2025.

Acrylic fiber is emerging as a key contributor to the growth in the textile dyes market due to demand for wool-like alternatives at lower cost. Home textiles, blankets, and winter apparel increasingly incorporate acrylic blends. Basic dyes dominate this segment because of strong affinity and vibrant shades. Dye manufacturers are refining basic dye stability to improve lightfastness. Acrylic fiber demand rises in price-sensitive regions where natural fibers remain expensive. Mills favor acrylic for thermal properties and lightweight construction.

Asia Pacific secures the leading market position due to manufacturing scale advantages

The continuous dominance of the Asia Pacific textile dyes industry is due to concentrated garment and fabric manufacturing capacity. Countries such as China, India, and Vietnam host large export-oriented mills. Dye suppliers prioritize this region for volume contracts and technical service centers. Government-backed textile parks improve infrastructure reliability and chemical sourcing efficiency. Regional players focus on cost-optimized formulations while maintaining compliance requirements to gain traction from international buyers. Firms like Clariant are offering new pigment dispersions called Permajet IN-C and Flexonyl WF in India.

The Middle East and Africa textile dyes market growth is led by emerging textile hubs and localization strategies. Governments are promoting domestic textile manufacturing to reduce import reliance. Countries such as Egypt and Ethiopia are attracting spinning and weaving investments. Dye suppliers see opportunities in early-stage capacity building and technical partnerships. Demand focuses on foundational dye categories with gradual upgrades toward compliant formulations. Regional market growth is also supported by trade access to Europe and cost-competitive labor.

The competitive landscape of the market is shifting toward performance-led differentiation rather than price competition. Major textile dye companies are prioritizing low-impact chemistries, digital shade control, and application-specific dye systems to secure long-term mill partnerships. Investments are increasing in high-fixation reactive dyes, low-temperature disperse dyes, and digital printing inks that reduce processing risk for exporters.

Textile dyes market players are also expanding regional technical centers to support faster approvals and shade matching. Suppliers offering measurable water, energy, and audit savings are gaining stronger bargaining power. Strategic collaborations with fiber producers and machinery OEMs are also emerging, helping dye manufacturers integrate deeper into textile value chains and stabilize recurring volumes across apparel, home textile, and industrial fabric segments globally.

Huntsman Corporation was established in 1970 and is headquartered in Texas, United States. Through Huntsman Textile Effects, the company focuses on high-performance dyes and digital color solutions. It serves large export-oriented mills by integrating dyes with digital shade libraries and process control tools. Huntsman emphasizes polyreactive dyes that reduce reprocessing losses.

Established in 1998 and headquartered in Gujarat, India, Kiri Industries Ltd. specializes in reactive and disperse dyes, catering to cotton and polyester textile producers. Kiri focuses on scale-driven manufacturing supported by backward integration. It supplies cost-competitive dye solutions while gradually upgrading formulations to meet export compliance needs.

Atul Ltd., established in 1947 and is headquartered in Gujarat, India, has a strong presence in disperse and reactive dyes, supporting synthetic and blended textile segments. Atul emphasizes process efficiency and energy-optimized dyeing systems. It aligns dye development with polyester fiber expansion and technical textile applications.

LANXESS AG was established in 2004 and is headquartered in Cologne, Germany. The company focuses on specialty dyes and pigments for technical textiles and industrial applications. LANXESS prioritizes regulatory-aligned formulations and high-purity dye systems. Its offerings cater to automotive, protective textiles, and performance fabrics.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include Colorant Limited, among others.

Unlock the latest insights with our textile dyes market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 10.75 Billion.

The market is projected to grow at a CAGR of 6.10% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 19.43 Billion by 2035.

Stakeholders are investing in compliance-ready formulations, expanding regional technical services, integrating digital tools, aligning with fiber producers, and restructuring portfolios toward high-margin, application-specific dye systems.

The key trends guiding the growth of the market include the significant investments in plant-based textile dye research and development and low costs of manufacturing.

The market is broken down into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

By dye type, the market is divided into direct, reactive, vat, basic, acid, disperse, and others.

Based on fibre type, the market is segmented into wool, polyester, acrylic, and others.

The key players in the market include Huntsman Corporation, Kiri Industries Ltd., Atul Ltd., LANXESS AG, and Colorant Limited, among others.

Companies face rising compliance costs, volatile raw material prices, wastewater regulations, and pressure from brands demanding faster approvals, traceable chemistry, and consistent batch performance across multiple sourcing regions.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Dye Type |

|

| Breakup by Fibre Type |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share