Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global thermal paper market reached a value of nearly USD 4.85 Billion in 2025. The market is assessed to grow at a CAGR of 5.80% during the forecast period of 2026-2035 to attain a value of around USD 8.52 Billion by 2035. The market growth can be attributed to the robust growth of the e-commerce sector, the rising adoption of Point of Sale (POS) systems, smart systems, and the Internet of things (IoT) devices, the growing demand for custom thermal papers, and the increasing emphasis on sustainability.

Base Year

Historical Period

Forecast Period

As online shopping is growing, the need for thermal paper in e-commerce packaging, particularly invoices and shipping labels, is increasing. Thermal paper is commonly used in the production of shipping documentation and barcode labels, which are integral to the logistics and shipping process. In 2023, 70% of citizens aged 16-74 years in the European Union bought or ordered goods or services online. The booming online retail sector relies on thermal paper for delivery slips, parcel tracking, and delivery slips.

Retailers actively rely on thermal paper for POS systems to print transaction details, receipts, and invoices for customers. As per the US Bureau of Labor Statistics, there were 1,045,422 retail establishments in the United States in Q3 2020. In the forecast period, the increasing adoption of digital kiosks, self-checkout stations, and automated POS systems by retailers is expected to bolster the use of thermal paper for printing coupons, receipts, and transaction records.

Standard thermal paper typically contains chemicals such as bisphenol S (BPS) and bisphenol A (BPA), which are associated with health and environmental concerns. In response, there is a growing demand for sustainable and BPA-free thermal paper that reduces chemical exposure and environmental harm. Reportedly, 79% of customers in Canada consider sustainability as an important metric while making purchases. Hence, retailers are favouring sustainable thermal paper as a part of their commitment to lower their carbon footprint and support eco-friendly practices and resonate with the eco-conscious consumer base.

Compound Annual Growth Rate

5.8%

Value in USD Billion

2026-2035

*this image is indicative*

The growth of the thermal paper market is being aided by the rising adoption of Point of Sale (POS) systems in sectors like transportation, retail, healthcare, and hospitality, among others. Reportedly, 73% of businesses planned to purchase new features or functionality for their POS system in 2023 whereas 43% planned to deploy POS software for use on a mobile device. This is boosting the demand for thermal paper rolls in printing receipts in POS systems. With the increasing trend towards faster transactions and improved customer experience in retail and service industries, thermal printing, due to its quick print speeds and low maintenance costs, is gaining popularity.

The growing focus of retailers to enhance customer loyalty and the rising demand for personalised transaction prints and customised receipts are surging the usage of thermal paper to print unique promotional content on receipts. Furthermore, the increasing popularity of custom thermal papers with personalised marketing messages, company logos, and eco-friendly packaging is aiding the thermal paper market expansion.

The increasing demand for mobile and portable thermal printers used by delivery drivers, field service professionals, and remote businesses is surging the adoption of portable and compact thermal paper rolls. Such printers allow on-the-go printing of invoices, receipts, and labels, improving convenience and mobility.

With businesses seeking new ways to engage customers, receipts printed on thermal paper are anticipated to serve as a platform for discount codes, advertisements, and loyalty programmes. To capitalise on this trend, thermal paper manufacturers are offering advertising-ready paper solutions that can support dynamic content, such as the capability to directly integrate discount codes, promotional offers, or QR codes on receipts.

The surging integration of blockchain technology to enhance transaction security is providing lucrative thermal paper market opportunities. Businesses are exploring new ways to use thermal paper in verifiable receipts and secure documentation to combat frauds and improve record-keeping in sectors like retail, finance, and government.

Flourishing e-commerce and logistics sectors; the rising trend of barcoding and inventory management in warehousing; technological advancements and innovations; and the growing emphasis on sustainability are driving the thermal paper market expansion.

The robust growth of the e-commerce and logistics sectors is creating lucrative thermal paper market opportunities. In FY 2022, the India logistics sector witnessed 14% growth to reach a value of USD 435 billion. Moreover, the US Department of Commerce estimated that US retail e-commerce sales in Q3 2024 reached USD 300.1 billion, a surge of 2.6% from the previous quarter. With the rising demand for high-quality and durable shipping and tracking labels in these sectors, the use of thermal paper for printing barcodes and QR codes that track packages throughout the supply chain is increasing. The rapid printing capabilities and cost-effectiveness of thermal paper make it ideal for manufacturing easy-to-apply, durable, and reliable shipping labels integral in e-commerce and logistics applications. Furthermore, the increasing trend of automation of warehouses and logistics centres and the growing implementation of automated sorting systems are boosting the demand for thermal paper to generate labels for products and packages.

As per the thermal paper market analysis, the growing trend of inventory management and barcoding in warehousing is increasing the demand for thermal paper in logistics and supply chain operations. With businesses seeking more ways to manage and track inventory, the use of thermal paper in barcodes and labels for accurate and quick scanning and sorting is increasing. Automation and RFID systems are significantly gaining traction in warehousing applications, surging the demand for high-quality and durable thermal paper capable of withstanding various warehouse conditions. In the forecast period, the development of premium thermal paper that offers resilience, clarity, and long-lasting prints to meet the growing demands of modern logistics operations is expected to aid the market.

The development of advanced coatings and formulations to improve the durability, resolution, and clarity of thermal prints amid the growing demand for high-quality prints in sectors like healthcare, retail, and logistics is boosting the thermal paper market revenue. There is a rising integration of radio-frequency identification (RFID) tags into thermal paper to enable advanced tracking and identification in the retail and logistics sectors. In addition, the development of portable thermal printers and mobile POS systems that enable businesses to print receipts, invoices, and labels on the go is revolutionising the market. Such printers boast improved efficiency and user-friendliness, surging their usage to print high-quality thermal paper labels and receipts with enhanced precision. In the forecast period, the growing trend of smart packaging and labelling is expected to bolster the integration of thermal papers with time-temperature indicators or sensors to provide real time insights regarding the condition of goods.

The growing focus on sustainability is shaping the thermal paper market trends and dynamics. Manufacturers are developing BPS-free and BPA-free coatings to develop thermal papers. There is also a rising focus on biodegradable, sustainable, and non-toxic coatings such as water-based or soy-based coatings that reduce the environmental impact of thermal paper and cater to growing consumer demand for eco-friendly products. With the growing focus on sustainability, manufacturers are increasingly developing recycled thermal paper products with post-consumer recycled materials. They are also attempting to lower the environmental impact of thermal paper production by minimising energy consumption, lowering water use, and decreasing waste.

The thermal paper market is benefiting from the robust growth of the e-commerce and logistics sectors. In FY 2022, India’s logistics sector grew by 14%, and U.S. e-commerce sales reached USD 300.1 billion in Q3 2024. The demand for durable shipping labels and tracking solutions in these industries is increasing, with thermal paper being ideal for printing barcodes and QR codes. Additionally, the trend of warehouse automation is driving further demand for thermal paper labels. Technological advancements are also shaping the market, with improvements in print durability, resolution, and the integration of RFID tags into thermal paper for better tracking and identification. Portable thermal printers and mobile POS systems are gaining popularity for their efficiency in printing receipts and labels on the go. Sustainability is a growing focus, with manufacturers developing BPA-free, biodegradable, and water-based coatings to reduce environmental impact. The demand for eco-friendly products has led to innovations in recycled thermal paper and sustainable production practices.

There is a rising usage of thermal paper in the healthcare sector for printing patient records, diagnostic reports, and medical prescriptions due to its reliability and high quality. The expansion of healthcare infrastructure, particularly in emerging economies, is providing lucrative opportunities for manufacturers to provide thermal paper rolls for medical applications.

Due to its versatility, thermal paper is increasingly used in emerging applications such as vending machines, event ticketing, parking tickets, airline boarding passes, and automated self-checkout systems. This is prompting manufacturers to diversify their offerings and create customised thermal paper solutions tailored to specific sectors such as entertainment, tourism, and public transport.

The rising adoption of smart systems and the Internet of things (IoT) devices is aiding the market. With businesses and customers increasingly relying on self-checkout kiosks, smart POS terminals, and automated ticketing systems, the usage of thermal paper for automatically printing receipts, tickets, and labels is growing.

Traditionally, thermal paper used BPA as a developer to facilitate the printing of images using heat. Various pharmacological studies have outlined the negative health effects of BPA through skin absorption, such as disruption of endocrine systems and lowered fertility rates.

Due to its coating, thermal paper is not recyclable, which complicates its disposal and contributes to landfill waste. The introduction of stringent environmental regulations and the shift towards recyclable and sustainable alternatives can limit the growth of the thermal paper industry. Moreover, the growing trend of digital receipts, e-invoicing, and paperless transactions in sectors like hospitality, retail, and transportation can also challenge the market.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR's report titled "Global Thermal Paper Market Report and Forecast 2026-2035" offers a detailed analysis of the market based on the following segments:

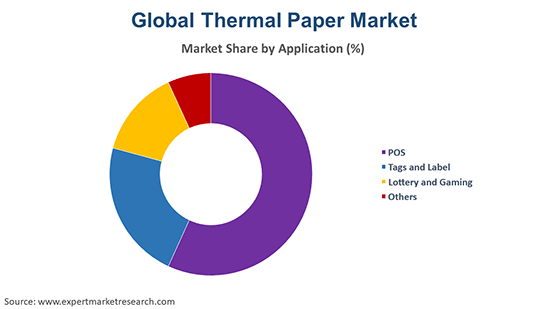

Market Breakup by Application

Market Breakup by Technology

Market Breakup by Region

By Application Insights

Due to its cost-effectiveness and efficient and rapid printing speed, thermal paper is extensively used to print invoices, receipts, and transaction records at checkout counters in the hospitality, retail, and service sectors.

In the logistics, healthcare, manufacturing, and retail sectors, thermal paper is used to print high-resolution tags and labels such as shipping tags, product labels, inventory control labels, and barcodes. The flexibility benefits of thermal printers make it ideal for printing different shapes and sizes of tags and labels. Factors such as the robust growth of the e-commerce sector and stringent labelling regulations in sectors like food and beverage and pharmaceuticals are driving the thermal paper demand growth.

Meanwhile, thermal paper incorporating security features such as barcodes, holograms, and special inks, is used for gaming receipts and lottery tickets. With scratch cards, lottery tickets, and gaming receipts requiring detailed and high-quality prints, the use of thermal paper is rising.

By Technology Insights

Thermal transfer technology utilises a ribbon, typically made of wax, resin, or a combination of both, to transfer the ink onto the paper. More resistant and durable to fading than their counterparts, thermal transfer prints are ideal for applications where longevity and resistance to environmental factors are essential. As thermal transfer technology can create crisp and high-quality images, its utilisation for producing graphics, logos, and barcodes is increasing. The rising demand for technologies compatible with different label materials, including synthetic labels, plastics, and coated papers, is boosting the thermal paper market value.

Meanwhile, direct thermal printing does not require ink, ribbons, or toner, making it more affordable than thermal transfer technology. Fast printing, low maintenance, and compact and lightweight designs of direct thermal printing also boost its appeal.

North America Thermal Paper Market Trends

The growing emphasis on sustainability in the region is surging the demand for BPA-free, water-based and eco-friendly thermal paper products. As per a 2021 Gallup survey, 43% of surveyors in the United States expressed concern about global warming. In addition, the increasing focus on smart labels and smart packaging in sectors like pharmaceuticals, logistics, and food and beverages is boosting the use of thermal paper RFID tags, QR codes, and time-temperature labels. The thermal paper market development in the region is further being fuelled by the growing adoption of portable thermal printers and mobile POS systems.

Europe Thermal Paper Market Outlook

The rise of contactless transactions and smart payment systems is surging the demand for high-quality thermal paper that is capable of supporting digital receipts and QR codes. Rapid digital transformation across various sectors is boosting the demand for thermal paper. With sustainability becoming a critical consideration for European businesses, the demand for eco-friendly, BPA-free, and biodegradable thermal paper is increasing. In addition, the growing trend of personalised marketing and smart retail solutions is surging the usage of thermal paper in receipts containing QR codes for loyalty programmes, personalised promotions, and product recommendations.

Asia Pacific Thermal Paper Market Overview

As per the thermal paper market regional analysis, the robust growth of the e-commerce sector and the increasing demand for shipping labels, barcode printing, and tracking solutions are aiding the market. In FY 2023, e-commerce platforms in India reached a GMV of USD 60 billion, marking a y-o-y increase of 22%. The expansion of sectors like hospitality and retail sectors and the rising adoption of POS systems are driving the demand for thermal paper rolls for printing receipts and invoices, particularly in small businesses and restaurants.

Latin America Thermal Paper Market Drivers

The robust growth of the foodservice sector, especially takeout services and quick-service restaurants (QSRs), is increasing the demand for thermal paper for receipts, order tickets, and food labelling. In 2022, consumer foodservice sales in Mexico reached USD 50.3 billion, representing nearly 70% in food and 30% in drink sales. In addition, the Latin America thermal paper market expansion is being aided by digitisation of government services, such as issuing permits, licenses, and other official documents. Thermal paper is increasingly used in official receipts and documentation.

Opportunities in the Middle East and Africa Thermal Paper Market

The expansion of shopping malls and retail chains is boosting the adoption of point-of-sale (POS) systems, surging the usage of thermal paper for printing receipts, invoices, and transaction records. In June 2024, Emaar Properties announced a monumental expansion of Dubai Mall, including 240 new food and beverage outlets and luxury stores. Moreover, the robust growth of the hospitality sector, especially in countries like the UAE and South Africa, is increasing the demand for thermal paper receipts for hotel check-ins and ticketing for food service operations and events. Furthermore, the expansion of transportation infrastructure, such as railway, metro, and aviation systems, is propelling the thermal paper market growth.

Key thermal paper market players are developing advanced coatings to improve the clarity, durability, and performance of thermal papers. They are also investing in research and development (R&D) activities for creating new and advanced thermal papers that can withstand various environmental conditions.

Ricoh Company Ltd., founded in 1927, is a prominent technology company that is headquartered in Tokyo, Japan. Its key areas of operations include digital imaging, printing solutions, thermal printing solutions, and document management solutions, among others. Some of its product offerings include multifunction printers (MFPs), POS systems, and cloud-based document management systems.

Oji Holdings Corporation, headquartered in 1873, is a prominent player in the paper and pulp sector. Headquartered in Tokyo, Japan, the company is one of the largest paper manufacturers in the world. The company is focused on enhancing its sustainability efforts by producing eco-friendly products and investing in energy-efficient technologies and green manufacturing practices.

Koehler Paper, established in 1807 and headquartered in Oberkirch, Germany, is a leading producer of high-quality paper products. Its expansive product portfolio includes premium paper products, thermal paper, and label paper, among others. The company heavily invests in research and development activities to improve the functionality and quality of paper.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Key players in the thermal paper market are Appvion Operations, Inc., Mitsubishi Paper Mills Limited, and Hansol Paper Co. Ltd, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 4.85 Billion.

The thermal paper market is assessed to grow at a CAGR of 5.80% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 8.52 Billion by 2035.

The major drivers of the industry, such as the rapidly rising food and beverage market, increasing need for POS systems with the advent of digitalisation, and the increasing significance of product labelling, are expected to aid the market growth.

The key market trend guiding the industry growth includes the increasing demand worldwide for the product for manufacturing and shipping.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The major applications of the product in the industry are POS terminals, tags and labels, and lotteries and gaming, among others.

The significant technologies in the industry are direct thermal and thermal transfer, among others.

The major players in the industry are Ricoh Company, Ltd., Oji Holdings Corporation, Appvion Incorporated, Koehler Paper, Mitsubishi Paper Mills (MPM) Limited, Hansol Paper Co. Ltd, and Siam Paper, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Application |

|

| Breakup by Technology |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share