Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The thoracic surgery market was valued at USD 17.94 Billion in 2025 and is expected to grow at a CAGR of 4.70%, reaching USD 28.40 Billion by 2035. Growth is supported by rising incidence of thoracic disorders and advancements in minimally invasive surgery techniques.

Base Year

Historical Period

Forecast Period

Technological advancements in the minimally invasive thoracic surgery domain are expected to drive market growth resulting in improved outcomes and higher adoption rates.

The market is poised to be significantly driven by the rising global incidence of thoracic diseases like lung cancer, propelled to escalate demand for thoracic surgeries, and expanding market opportunities.

Increased specialisation and awareness in thoracic surgery are likely to enhance market value through better accessibility and patient outcomes.

Compound Annual Growth Rate

4.7%

Value in USD Billion

2026-2035

*this image is indicative*

A thoracic surgery involves any chest organ treatment or operation including the heart, lungs, oesophagus, as well as trachea. Thoracic surgery is also recognised as chest surgery. Thoracic surgery is conducted either by a minimally invasive procedure or by an open process. Thoracotomy requires a chest incision and is used to treat lung cancer.

Rising Prevalence Increasing the Rates of Thoracic Surgeries

The rising prevalence of lung cancer, chronic obstructive pulmonary disease (COPD), emphysema, and heart diseases are increasing the need for thoracic surgeries. The factors contributing to the rising prevalence include higher rates of smoking, air pollution, aging populations, and lifestyle changes, all of which heighten the risk of respiratory and cardiovascular issues that require surgical intervention. For instance, as per the fact sheet released by the American Heart Association in 2024, cardiovascular disease (CVD) accounted for 931,578 deaths in the United States in 2021. Additionally, an article published by the American Cancer Society announced that around 340 deaths happen daily due to lung cancer. Also, approximately 101,300 of the 125,070 lung cancer deaths (81%) in 2024 are highly expected to be caused by cigarette smoking directly, with an additional 3500 caused by second-hand smoke.

New Fixation System Drives Thoracic Surgery Market Growth

The rising prevalence of cardiothoracic surgeries and the need for efficient post-operative recovery solutions are driving innovation in thoracic surgery devices. For instance, in August 2024, DePuy Synthes, part of Johnson & Johnson MedTech, introduced the MatrixSTERNUM™ Fixation System, a plate and screw device specifically designed for securing and stabilising the chest wall following surgeries like open-heart and thoracic procedures. This system aims to improve patient outcomes with enhanced locking strength, quicker chest fixation, and slimmer, low-profile plates that reduce discomfort and healing time. This launch is expected to significantly impact the global thoracic surgery market by setting new standards for post-operative stability and recovery. As more healthcare providers adopt advanced fixation systems, the demand for thoracic surgeries is likely to rise due to improved patient outcomes and faster recovery. Additionally, DePuy Synthes’ focus on patient-specific solutions may encourage other companies to innovate, driving market growth through enhanced product development in the forecast period.

The market is witnessing several trends and developments to improve the current scenario. Some of the notable trends are as follows:

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Market Breakup by Product

Market Breakup by Application

Market Breakup by End User

Market Breakup by Region

Handheld Surgical Equipment Leads Thoracic Surgery Market Segment by Product

Handheld surgical equipment is likely to hold the largest market share within the thoracic surgery market’s product segment due to its versatility and essential role across various surgical procedures. These tools, including forceps, retractors, and scalpels, offer precision, ease of use, and are crucial in both open and minimally invasive surgeries, driving their high demand. The increasing adoption of minimally invasive techniques and advancements in equipment design have enhanced their effectiveness, further expanding the market. As healthcare providers seek high-quality tools that improve surgical outcomes, the segment is poised for strong growth, supporting the broader thoracic surgery market in the forecast period.

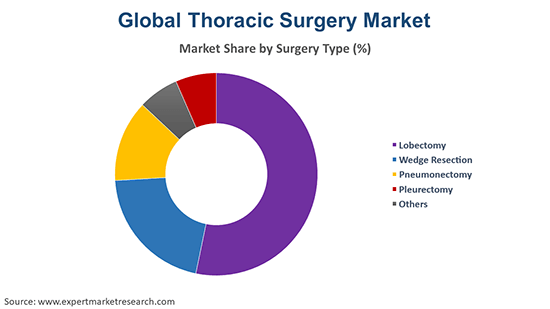

Lobectomy Segment to Lead the Thoracic Surgery Market Segmentation by Application

Lobectomy procedures are expected to hold the largest share within the application segment, driven by the high incidence of lung cancer and other respiratory conditions requiring lung tissue removal. As lobectomy is a common treatment for early-stage lung cancer, demand has surged with rising cases globally. The effectiveness of lobectomy in extending survival rates among patients further bolsters its popularity and market dominance. With continued advancements in surgical techniques, particularly minimally invasive lobectomy, the segment is poised to grow significantly, reinforcing its role in driving thoracic surgery market expansion over the coming years.

Hospitals and Clinics Segment Holds Largest Thoracic Surgery Market Share in End User Segment

Hospitals and clinics are poised to dominate the end user segment due to their capacity to perform complex surgical procedures and house specialised surgical teams. The availability of advanced technologies and a higher volume of surgeries performed at these facilities further boost the segment market share. As patient demand for quality healthcare services rises, hospitals and clinics continue to invest in cutting-edge thoracic surgery equipment and skilled professionals. This trend is expected to drive further growth, with hospitals and clinics strengthening their role as primary end users in the thoracic surgery market during the forecast period.

North America is projected to lead the market due to its advanced healthcare infrastructure, strong presence of specialised surgical centres, and high adoption of cutting-edge surgical technologies. The region has a significant number of thoracic surgeons and specialised care facilities, enabling complex procedures with greater frequency and precision. Additionally, the rising prevalence of lung cancer and other thoracic diseases, combined with proactive screening initiatives, drives substantial demand for thoracic surgeries. North America’s commitment to research and innovation also fuels continuous advancements in surgical techniques, ensuring the region’s strong market position and growth potential in the thoracic surgery sector.

The key features of the market report comprise patent analysis, grants analysis, funding and investment analysis, and strategic initiatives by the leading players. The major companies in the market are as follows:

Headquartered in Marlborough, Massachusetts, Boston Scientific Corporation was established in 1979 and is a global leader in medical devices, particularly for cardiovascular, endoscopy, and urology. The company’s portfolio includes innovative thoracic and minimally invasive surgical devices. Recently, it has focused on expanding its portfolio with new products and acquisitions to strengthen its market presence.

Founded in 1949, Medtronic plc is headquartered in Dublin, Ireland, and is one of the largest medical device companies globally. Its portfolio spans cardiovascular, surgical, and neurological devices, with a strong presence in thoracic surgery solutions. Medtronic recently announced advancements in minimally invasive technologies, reinforcing its commitment to improving patient outcomes in thoracic care.

AtriCure, Inc., based in Mason, Ohio, was founded in 2000 and specialises in treatments for atrial fibrillation and thoracic surgery. Its product range includes ablation devices and advanced surgical solutions for treating thoracic conditions. The company has been expanding its clinical trial initiatives, supporting innovative solutions and boosting its market footprint in thoracic and cardiac care.

Abbott Laboratories, headquartered in Abbott Park, Illinois, was established in 1888. It provides a wide range of healthcare products, including thoracic and cardiovascular devices, diagnostics, and nutritional products. Abbott has recently focused on enhancing its diagnostic and surgical devices portfolio, particularly for minimally invasive procedures, to meet growing healthcare demands. In January 2023, Abbott received approval from the U.S. Food and Drug Administration (FDA) for its latest-generation transcatheter aortic valve implantation (TAVI) system, Navitor™, for patients with severe aortic stenosis, allowing for valve replacement without open-heart surgery. It is the latest addition to the company's comprehensive transcatheter structural heart portfolio that offers less invasive treatment options to physicians and patients for some of the most common and serious heart diseases.

BioVentrix, Inc., headquartered in San Ramon, California, was founded in 2003 and focuses on advanced heart failure and thoracic solutions. Its portfolio includes minimally invasive therapies for ventricular reduction, enhancing outcomes for thoracic surgery patients. The company recently gained significant attention for its novel Revivent TC System, which addresses heart failure with a less invasive approach.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include Becton, Dickinson and Company, Teleflex Incorporated, Terumo Corporation, Zimmer Biomet Holdings, Inc., and Edwards Lifesciences Corporation.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Application |

|

| Breakup by End User |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Supplier Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 3,299

USD 2,969

tax inclusive*

Single User License

One User

USD 5,499

USD 4,949

tax inclusive*

Five User License

Five User

USD 6,999

USD 5,949

tax inclusive*

Corporate License

Unlimited Users

USD 8,199

USD 6,969

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share