Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The United Kingdom dairy market size is projected to grow at a CAGR of 0.90% between 2026 and 2035, reaching a value of USD 18.92 Billion by 2035.

Base Year

Historical Period

Forecast Period

Based on product type, the United Kingdom dairy market share is dominated by cow milk.

12,000 active dairy farmers yield nearly 15 billion liters of milk annually, contributing to £9.2 bn wholesale value of dairy products, according to dairy UK.

The varied cheese production offers individuals the opportunity to savor more than 700 distinct British cheese varieties.

Compound Annual Growth Rate

0.9%

2026-2035

*this image is indicative*

The United Kingdom dairy market consists of the processing of milk and milk products in dairy facilities as well as the production of milk on dairy farms. The industry produces ice cream, butter, cheese, yoghurt, and many types of milk such as whole milk, semi-skimmed milk, skimmed milk, flavored milk, powdered milk, and condensed milk.

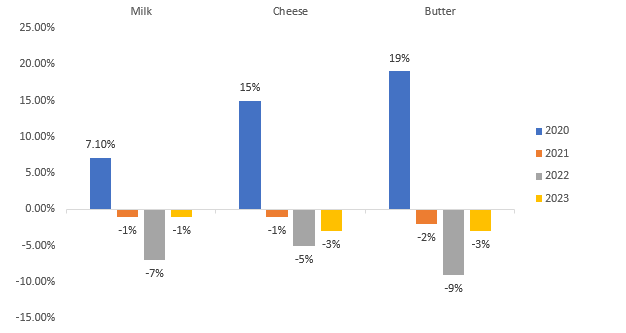

DAIRY RETAIL VOLUME CHANGE

The market is routed through hypermarkets, supermarkets, convenience stores, internet merchants, dollar stores, variety stores, specialty food and beverage outlets, cash and carry businesses, and warehouse clubs.

Changing lifestyle of individuals, increasing presence of e-commerce platforms, boosting employment, and government initiatives are increasing the United Kingdom dairy market growth.

Growing awareness of health and well-being is fueling the demand for dairy products. Informed consumers recognise dairy as a vital nutritional component due to its protein, calcium, and probiotic content, supporting digestive health and providing essential nutrients in a healthy diet.

The extensive availability of dairy products in retail has streamlined the purchasing process, aiding the United Kingdom dairy market development. Consumers can effortlessly order their preferred dairy items, with swift doorstep delivery. Online delivery services like Milk & More and Getir ensure one-hour delivery of dairy products such as yogurt, cheese, butter, and milk.

Dairy UK emphasises the pivotal role in improving the product demand, highlighting the essential contributions of processing members who employ 24,000 individuals across the nation. Furthermore, dairy farms significantly contribute to employment, engaging 50,000 people directly and in associated industries.

Government efforts to boost dairy product usage have strengthened the United Kingdom dairy market growth. Advocacy campaigns position the dairy market as a remedy for health issues and nutritional deficiencies, cultivating a positive atmosphere and consequently boosting demand for dairy products.

The UK government launched the Dairy Export Program to strengthen the dairy market and improve its outlook. New regulations aim to bring increased fairness and transparency to the sector, allowing farmers to challenge prices and express concerns in supply contracts to ensure fair compensation.

"United Kingdom Dairy Market Report and Forecast 2026-2035" offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type

Market Breakup by End Use

Market Breakup by Region

Varied flavors, nutritional advantages, and convenience are propelling the dairy market in the United Kingdom

Health-conscious consumers increasingly choose flavored milk over sugary drinks, as it provides the goodness of dairy with diverse flavors such as caramel, coffee, vanilla, mango, and others, essential nutrients, and dietary options like low-fat. They offer convenience for on-the-go consumption providing swift means to access the nutritional advantage of milk.

Whey protein, derived from the liquid residue of milk curdling during cheese production, is a favored supplement for individuals seeking a convenient means to boost daily protein intake. It comprises various proteins and all essential amino acids, offering diverse flavors like chocolate, vanilla, coffee, strawberry, and mango.

Cheese is a concentrated dairy product, made by coagulating milk proteins with rennet or other agents, partially draining the resulting whey. It includes various types such as Parmesan, Mozzarella, and Cream Cheese, each with distinct physical, chemical, and sensory attributes. The diverse cheese manufacturing sector, which adds an extra 3 billion liters of milk, provides people with the chance to enjoy over 700 different types of British cheeses.

Yogurt offers protein and calcium, supports beneficial probiotic gut bacteria, and is available in various flavors and varieties. In contrast, ice cream is a frozen dairy treat composed of cream or butterfat, milk, sugar, and flavorings. According to the Companies House register, as of 2022, there are 701 companies in the UK involved in the manufacturing of ice cream.

Powdered milk is made by spray drying milk and removing water. Cream is derived from the high-fat layer atop milk before homogenization. Butter is produced by separating milk or cream into fat and buttermilk, condensing the fat into solid blocks.

The United Kingdom dairy market, based on end-use, is witnessing moderate growth within the commercial sector

Quick service restaurants (QSRs), and food and beverage outlets are seeing an increase in demand for dairy products including milk, cheese, whey protein, and yoghurt in the commercial sector. The creation of different foods and drinks such as milkshakes, coffee, ice cream, sandwiches, pizzas, and burgers.

Dairy products, including milk, butter, cheese, cream, and milk powder, are commonly utilized in households across various age demographics for their nutritional benefits and versatile use in cooking.

Dairy companies are focusing on introducing healthy consumables to enhance daily nutrition for customers and treading new avenues to boost their position in the dairy market in United Kingdom.

Arla Foods was founded in 2000 and is headquartered in Denmark. It produces a diverse range of products for bakery, beverages, dairy, medical, infant, and sports nutrition. Their offerings include cheese, ice cream, and high-protein dairy drinks like Nutrilac® and Lacprodan®.

Danone SA was founded in 1919 and is headquartered in France. It is a world-leading food company pioneered in innovative food, drinks & specialized nutrition that has a positive impact on health. It makes flavoured milk, yoghurt, ice cream, and others.

Unilever PLC was founded in 1929 and is headquartered in the United Kingdom. Unilever is a creator of renowned brands and is committed to reducing environmental impact and amplifying positive influence. Responding to growing demand, it is further diversifying its ice cream range with non-dairy and vegan alternatives. It has many brands of dairy products such as Ben & Jerry's, Magnum, and Wall’s for Ice cream.

Glanbia PLC was founded in 1997 and is headquartered in Ireland. It is a leading nutrition enterprise, offering consumer brands and ingredients worldwide, empowering individuals to thrive, stay nourished, and excel at any life stage. Their products involve cheese, nutritional and functional nutrition solutions, and dairy and non-dairy flavourings.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the United Kingdom dairy market report are Royal Friesland Campina N.V., Lactalis Group, Saputo Inc., Nestlé S.A, Unternehmensgruppe Theo Müller, Country Milk Products Limited, and others.

England plays a crucial role in market growth due to its significant population of dairy cows.

Based on statistics, in 2019, the United Kingdom ranked as the 13th leading global producer of milk. In 2020, milk constituted 16.4% of the overall agricultural output in the UK, valued at £4.4 billion based on market prices. The United Kingdom dairy market growth is further fueled by the presence of 1,850,000 dairy cows.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The dairy market in United Kingdom is projected to grow at a CAGR of 0.90% between 2026 and 2035.

The dairy market is expected to reach USD 18.92 billion in 2035.

Based on the product type, the market has been categorised into flavoured milk, whey, cheese, milk powder, yoghurt, and others.

Based on the end-use, the dairy market is bifurcated into residential and commercial.

Advancements in changes in the lifestyle of individuals, increasing presence of E-commerce platforms, boosting employment, and government initiatives are boosting United Kingdom dairy market growth.

Some of the major players in the industry are Arla Foods, Danone SA, Unilever PLC, Glanbia PLC, Royal Friesland Campina N.V., Lactalis Group, Saputo Inc, Nestlé S.A, Unternehmensgruppe Theo Müller, Country Milk Products Limited, and others.

Yogurt has been consumed by humans for millennia, though its exact beginnings remain uncertain. Presently, it holds significant popularity, with 78% of UK adults consuming yogurt or fromage frais, and 51% indulging in it at least twice a week.

UK dairy processors ship their products to more than 135 nations. In the past few years, yearly exports have surpassed one million tonnes, with milk and cream constituting the largest portion.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share