Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The United States generic injectables market size reached a value of almost USD 16.12 Billion in 2025. The industry is further expected to grow at a CAGR of 7.00% between 2026 and 2035 to reach a value of almost USD 31.71 Billion by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

7%

Value in USD Billion

2026-2035

*this image is indicative*

The United States generic injectables market is driven by the extensive use of the product owing to an increase in the lifestyle ailments caused by non-nutritive diet, sedentary lifestyles, and ageing population. The market significantly contributes to the growth of the overall North America generic injectables market, which is the leading regional market on a global scale.

On account of several benefits offered by generic injectables, the government is supporting its manufacturers in the United States. In addition to this, several factors, such as an increase in the drug shortage in the United States, ageing population, rising prevalence of chronic and lifestyle diseases, and patent expiry of a number of blockbuster drugs, are significantly contributing to the market growth.

Generic injectables are bioequivalent of branded drugs that are not covered by patents. Their purpose is to rapidly transport the drug into the body, bypassing the first-pass metabolism. On account of their similar quality, strength, effect, dosage, and active ingredient, generic injectables are as effective and safe as innovator injectables. They are used in the treatment of diseases like cancer, diabetes, rheumatoid arthritis, osteoporosis, osteoarthritis, respiratory, and cardiovascular disorders.

The market is segmented on the basis of the therapeutic area into:

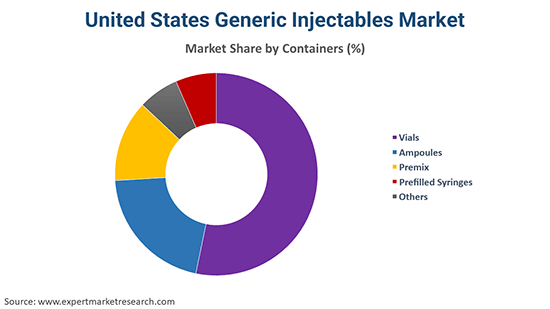

On the basis of containers, the industry is divided into:

On the basis of the distribution channel, the market is segregated into:

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The generic injectables industry in the United States is driven by the increase in the demand for the product owing to increasing investment for the development of generic drugs by the United States government. This will help promote the market and decrease the expenditure on healthcare in the United States. Moreover, shortages of drugs, along with quick approvals by the USFDA, will fuel the manufacturing of these drugs, thereby increasing the market growth. Further, many of the branded injectables firms are expected to lose their patent protection in the coming years, as a result offering enormous lucrative opportunities to the manufacturers of generic injectables.

The report gives a detailed analysis of the following key players in the United States generic injectables market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

The comprehensive EMR report provides an in-depth assessment of the market based on the Porter's five forces model along with giving a SWOT analysis.

Japan Generic Injectables Market

Latin America Generic Injectables Market

Middle East and Africa Generic Injectables Market

North America Generic Injectables Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market in the United States attained a value of nearly USD 16.12 Billion.

The market is expected to grow at a CAGR of 7.00% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach around USD 31.71 Billion by 2035.

The major drivers of the market are increasing investments into the development of generic drugs by the government and expiration of patent protection in the coming years.

The key trends guiding the growth of the generic injectables market include growing geriatric population and the fast-track approvals by the United States FDA.

The major therapeutic areas of generic injectables in the market are oncology, anaesthesia, anti-infectives, parenteral nutrition, and cardiovascular.

Vials, ampoules, premix, and prefilled syringes, among others, are the various containers of generic injectables in the market.

Retail pharmacies and hospital pharmacies are the leading distribution channels of generic injectables.

The major players in the United States generic injectables market are Pfizer Inc., Hikma Pharmaceuticals PLC, Sandoz International GmbH, and Teligent, Inc, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Therapeutic Area |

|

| Breakup by Containers |

|

| Breakup by Distribution Channel |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 1,999

USD 1,799

tax inclusive*

Single User License

One User

USD 3,099

USD 2,789

tax inclusive*

Five User License

Five User

USD 4,599

USD 3,909

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share