Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The United States personal finance software market size reached around USD 300.42 Million in 2025. The market is projected to grow at a CAGR of 5.50% between 2026 and 2035 to reach nearly USD 513.16 Million by 2035.

Base Year

Historical Period

Forecast Period

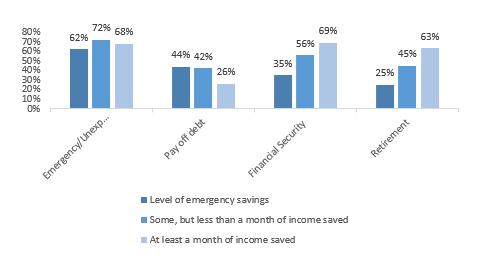

According to the Consumer Financial Protection Bureau, 35% of individuals without emergency savings prioritise financial security for saving, whereas 69% with at least one month's worth of emergency funds prioritise financial security.

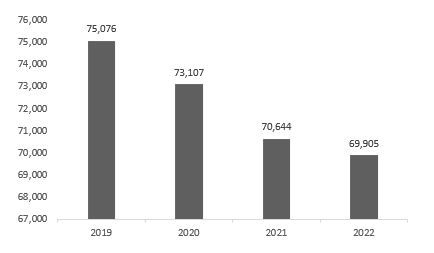

In 2022, the Federal Deposit Insurance Corporation recorded 69,905 US bank branches.

An increasing number of states in America are enforcing the inclusion of personal finance education in high school curricula as a graduation prerequisite, thus boosting the United States personal finance software market.

Compound Annual Growth Rate

5.5%

Value in USD Million

2026-2035

*this image is indicative*

Personal finance software is a tool crafted to arrange and evaluate an individual's financial data, thereby assisting in enhanced financial planning. It amalgamates diverse financial information to offer insights into expenditure patterns, budgeting, monitoring investments, and managing portfolios.

Additionally, it aids in tasks like overseeing bank records and monitoring financial transactions. Variations among different software options may encompass differences in features, transparency in coding, mobile application functionalities, methods for importing data, models for monetisation, and privacy protocols.

As per the United States personal finance market analysis, users can effortlessly connect bank accounts and cards to auto-import transactions, sparing manual entry. Analysing spending, identifying savings, tracking goals, bill reminders, and investment monitoring aid in informed financial decisions, enhancing planning and net worth evaluation. In 2022, the Federal Deposit Insurance Corporation reported a total of 69,905 bank branches in the United States, contributing to the expansion of the personal finance software market in the United States.

TOTAL BANK BRANCHES IN THE UNITED STATES

The United States personal finance software market growth is driven by ease of management of income, budget-oriented lifestyle, and integration of IoT.

| Date | Company/Entity | Event |

| December 2023 | Quicken | Unveiled Quicken Classic Business & Personal for Mac, merging business and personal finance tracking |

| November 2023 | MoolahMate Ventures Inc. | Introduced an innovative personal finance platform, streamlining the management of personal finances for users |

| October 2023 | American states | Mandating personal finance education for high school students as a graduation requirement |

| April 2023 | P&N Group's BCU Bank | Released a personal finance management application to offer its customers enhanced control and visibility over their finances |

| Trends | Impact |

| Managing income | Users can effortlessly sync bank accounts and cards to automate transaction categorisation, eliminating manual entry. Analysing spending patterns, identifying savings, and tracking goals aid informed decisions. It offers insights into income, expenses, net worth, investment performance, and cash flow, facilitating financial planning. |

| Budget-oriented lifestyle | The heightened emphasis of companies on digitising financial services, along with the expanding internet user base, is creating a promising market landscape. Moreover, the increasing preference for budget-conscious living is fuelling the United States personal finance software market. |

| Digital services and applications | The wide availability of digital services and mobile apps for personal finance management, along with advances in telecom infrastructure, offers promising opportunities for industry players. Moreover, the growing adoption of mobile banking, supported by real-time assistance and intuitive interfaces, fuels United States personal finance software market growth. |

| Integration of the internet of things (IoT) | Incorporating IoT technology into personal finance software, which collects and analyses client data for valuable insights, accelerates decision-making, fostering market expansion. IoT payment platforms enable versatile invoice payment methods, enhancing customer experiences and streamlining transactions, driving market growth. |

As per the United States personal finance software market report, this software enables users to monitor expenditures, establish budgets, and anticipate future costs. Variation exists among software concerning feature support, code transparency, mobile app capabilities, data import methods, monetisation models, and privacy measures.

Leading personal finance software streamlines income and expense management, facilitating improved financial balance. It simplifies personal financial management by minimising reliance on traditional methods like receipts and spreadsheets.

The United States Personal Finance Software Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Breakup by Product Type

Breakup by End Use

Breakup by Region

Based on product type, United States personal finance software market share is led by mobile-based product

Mobile apps incorporating personal finance software ensure streamlined performance, offering advantages over web-based counterparts such as immediate online/offline accessibility, push notifications, productivity boosts, and cost-effectiveness, driving market expansion in this sector.

The increasing popularity of web-based software is attributed to its robust security features, integrating anti-virus and anti-malware solutions. Additionally, these programs allow users to input financial details like bank accounts, credit cards, loans, and debts, facilitating real-time transaction tracking. This is further driving the United States personal finance software market.

The ability of these software to amalgamate and segregate financial data for enhanced planning among the small business users is pushing the United States personal software market growth

It aids in recognising spending trends, facilitating debt management, and monitoring financial goals to empower business users in making informed decisions. It streamlines money management, aiding small business operators in overseeing operations and finances. Furthermore, it generates reports and invoices based on data.

Individual consumers utilise personal finance software to monitor income, expenses, credit cards, investments, and bank accounts via smartphones or computers. It efficiently manages financial transactions, helping individuals track monthly expenses.

The growing demand for finance and saving in the Southwest due to future goals is pushing the United States personal finance software market development.

"Attaining financial security" stands out as a key motivation for saving, particularly among consumers with ample emergency funds, especially prevalent in the Far West region.

The Consumer Financial Protection Bureau reported that 35% of people who don't have emergency savings see financial security as vital for saving, while 69% of those with at least one month's worth of emergency funds prioritize financial security.

SHARE OF RESPONDENTS WHO REPORTED EMERGENCIES, PAYING OFF DEBT, FINANCIAL SECURITY, AND RETIREMENT AS REASONS FOR SAVING

Market players are integrating IoT and keeping up with rapid digitisation to stay ahead in the market.

| Company | Year Founded | Headquarters | Specialisation |

| Microsoft Corporation | 1975 | Washington, United States | Developing and marketing software, services, and hardware aimed at providing innovative solutions, improved convenience, and enriched experiences for individuals worldwide. |

| Quicken | 1984 | California, United States | Offers a personal finance solution. Quicken Home and Business provides users with a consolidated view of their finances, requiring them to label business-related accounts and expenses to monitor profits, losses, tax deductions, and cash flow projections. |

| Buxfer, Inc. | 2006 | California, United States | Offers online money management software tailored for personal finance needs, including account aggregation, budgeting, bill reminders, and financial forecasting. |

| CountAbout | 2012 | Wisconsin, United States | Specialises in creating and enhancing online personal financial management solutions. Its platform facilitates banking, credit card, and financial transaction management services. |

Other United States personal finance software market key players are Igg Software, Inc., Moneyspire Inc., PocketSmith Ltd, Doxo, Inc., You Need A Budget LLC among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market attained a value of nearly USD 300.42 Million.

The market is assessed to grow at a CAGR of 5.50% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 513.16 Million by 2035.

The personal finance software market is growing with ease of management of income, budget-oriented lifestyle, growing demand for digital services and apps and integration of IoT.

Based on the product type, the market is bifurcated into app-based and web based.

Key players in the industry are Microsoft Corporation, Quicken, Buxfer, Inc., CountAbout, Igg Software, Inc., Moneyspire Inc., PocketSmith Ltd, Doxo, Inc., and You Need A Budget LLC, among others.

Based on end use, the market is divided into commercial and individual consumers.

The major market areas include New England, Mideast, Great Lakes, Plains, Southeast, Southwest, Rocky Mountain, and Far West.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share