Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Vietnam sanitary ware market was valued to reach a market size of USD 505.91 Million in 2025. The industry is expected to grow at a CAGR of 4.70% during the forecast period of 2026-2035. Rapid urbanisation, rising residential and commercial construction activities, and increasing consumer preference for modern bathroom aesthetics are aiding the market to attain a valuation of USD 800.83 Million by 2035.

Base Year

Historical Period

Forecast Period

The construction sector in Vietnam recorded a notable growth of 7.48% during the first nine months of 2024 compared to the same period in 2023. This upward trajectory in construction activity is directly influencing the sanitary ware market in Vietnam.

The anticipated addition of nearly 19,000 new housing units by 2025, fueled by urbanisation, industrial growth, a rising middle class, and regulatory reforms, is set to boost demand in Vietnam’s sanitary ware market.

Vietnam’s hotel construction pipeline, reaching 252 projects and 88,489 rooms as of Q3 2024, signals strong demand for sanitary ware products.

Compound Annual Growth Rate

4.7%

Value in USD Million

2026-2035

*this image is indicative*

|

Vietnam Sanitary Ware Market Report Summary |

Description |

Value |

|

Base Year |

USD Million |

2025 |

|

Historical Period |

USD Million |

2019-2025 |

|

Forecast Period |

USD Million |

2026-2035 |

|

Market Size 2025 |

USD Million |

505.91 |

|

Market Size 2035 |

USD Million |

800.83 |

|

CAGR 2019-2025 |

Percentage |

XX% |

|

CAGR 2026-2035 |

Percentage |

4.70% |

|

CAGR 2026-2035- Market by Region |

Southeast |

4.4% |

|

CAGR 2026-2035- Market by Region |

Red River Delta |

4.9% |

|

CAGR 2026-2035- Market by By Product Type |

Wash Basin |

4.9% |

|

CAGR 2026-2035- Market by By Material |

Ceramic |

4.8% |

Vietnam’s construction industry, valued at USD 95.8 billion in 2023 with a 5.4% growth rate, is projected to grow at 7% annually from 2024 to 2027, backed by a USD 30 billion national budget approved in 2023. This sustained investment positions Vietnam as one of the fastest-growing construction markets in Southeast Asia, directly supporting the Vietnam sanitary ware market across residential, commercial, and infrastructure projects.

Vietnam’s primary housing supply reached 86,971 units in 2024, an 84% increase over the previous year. This sharp rise in new residential units directly boosts demand for sanitary ware, as each development requires modern bathroom and kitchen fittings. The surge reflects strong construction momentum, reinforcing sanitary ware as an essential component of the country’s growing real estate sector.

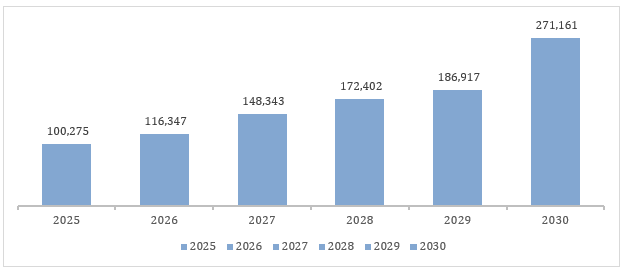

Figure: Vietnam’s Social Housing Targets (2025–2030)

Vietnam’s goal to complete 995,445 social housing apartments between 2025 and 2030 presents a major growth opportunity for the Vietnam sanitary ware market. As these large-scale residential projects roll out nationwide, the demand for cost-effective, durable, and standardised bathroom fittings & fixtures will surge.

The Vietnamese government’s plan to build one million social housing units by 2030, backed by VND849 trillion (USD 36.2 billion) in combined investment, is expected to significantly boost the sanitary ware market. This large-scale initiative will create consistent demand for affordable bathroom and kitchen fixtures, encouraging volume production and wider market reach for sanitary ware manufacturers.

Vietnam’s construction industry, projected to grow at 7% annually from 2024 to 2027 with a USD 30 billion national budget approved in 2023, positions the country as one of Southeast Asia’s fastest-growing construction markets. This growth directly supports the sanitary ware market, as large-scale residential, commercial, and infrastructure projects will drive sustained demand for bathroom fixtures, fittings, and modern sanitation solutions. Further, total apartment sales in Q3 2024 surged by 226 percent year-on-year, reaching 6,840 units, marking one of the strongest rebounds in Vietnam’s housing market.

Vietnam’s urbanisation rate is estimated to exceed 50% by 2030 and reach 70% by 2050 with 1,000–1,200 urban areas nationwide. As cities expand and new urban zones emerge, the demand for modern housing, commercial buildings, and public infrastructure will rise, driving consistent need for high-quality sanitary fittings.

Vietnam sanitary ware market is driven by surging infrastructural projects, a demand for smart sanitaryware, rising urbanisation, and government’s focus to enhance public sanitation facilities.

The growing construction and real estate sector is driving the Vietnam sanitary ware market expansion. In 2024, the construction industry recorded an impressive growth rate of approximately 8%, surpassing the annual target of 6.4% to 7.3%. This marks the highest growth rate since 2020, with the sector contributing an estimated 28.2 billion USD to the nation’s total GDP, equivalent to 6%. As infrastructure and urban development continue to surge, the demand for high-quality sanitary ware products is also increasing, making Vietnam a key market.

Expanding middle-class and urbanisation trends are driving the growth of the Vietnam sanitary ware market. Vietnam aspires to attain upper-middle-income status by 2030 and high-income status by 2050. The country’s middle class is expected to grow to 26% of the population by 2026, doubling from 13% (approximately 13 million people) in 2023. As income levels rise and urbanisation accelerates, demand for modern and high-quality sanitary ware products continues to increase.

The growing emphasis on sustainability and environmentally responsible manufacturing is contributing to the Vietnam sanitary ware market development. A notable example is Viglacera’s adoption of PVD (Physical Vapor Deposition) surface protection technology for faucets. This innovation aligns with the increasing consumer preference for eco-friendly products and reflects the industry's shift toward cleaner production methods. This method reduces environmental impact by eliminating harmful waste in manufacturing, while enhancing product quality.

The government is focusing on increasing toilet access for both residents and tourists. According to Decision 1978 / QD-TTg, by 2030, the government of Vietnam aims for 100% of rural households, schools, and health stations to have hygienic toilets that meet standards and regulations. In July 2023, the Ho Chi Minh City Department of Natural Resources and Environment submitted a plan to the municipal People’s Committee to increase the number of public restrooms and improve toilet service quality in the city. According to 2023 data, the city was home to 866 public toilets, including 491 owned by restaurants, eateries, and coffee shops.

The Vietnam sanitary ware industry is driven by residential, commercial, and infrastructural projects. According to the Ministry of Construction in 2024, 108 construction projects with a total of 47,532 social housing units were completed across the country. By 2025, it is expected that the country will have 135 projects, with nearly 101,900 units, an increase of 2.1 times.

In February 2024, Vietnam adopted a new Construction Industry Development Strategy for 2030 – 2045 to boost the construction market, especially in urban infrastructure and housing. The strategy prioritises housing construction, including doubling urban housing rates and building 1,000,000 housing units for low-income groups by 2030.

Vietnam also aims to develop and renovate 1.032 billion square metres, equivalent to 11.9 million homes, during the 2021-2030 period.

The rising smart home trend in Vietnam drives the demand for smart sanitaryware. By 2050, around 60% of the country’s population is expected to reside in cities with smart urban areas, making smart homes an inevitable choice. By introducing innovative technologies such as dual flush, aerators, and smart controls, players are strengthening their position in the Vietnam sanitary ware market. In February 2025, Arrow, a leading Chinese smart home brand, officially entered the Southeast Asian market, launching its flagship store in Ho Chi Minh City, covering over 1,000 square meters. The store showcases smart bathroom products in immersive settings, offering consumers intelligent home solutions.

As per Vietnam sanitary ware market analysis, a rise in office spaces in Vietnam, drives the market for sanitaryware products. A clean and hygienic restroom results into good health and well-being of employees, and clients. According to 2024 data, around 100,000 m2 of new Grade A offices will come online in Hanoi during the 2024-2027 period. In the next three years, Hanoi's total average supply is forecast to grow by 3.5% per year. In Ho Chi Minh City, the expected new Grade A supply in the city centre in 2024 - 2025 is 118,700 m2 of high-end office space and 81,000 m2 of Grade A from the non-CBD area in 2024 - 2026.

The influx of low-cost imported goods has exposed Vietnamese consumers to potential risks from substandard sanitaryware that fails to meet quality and inspection requirements. Homeowners who purchase counterfeit sanitary equipment often encounter difficulties with usage and warranty services, hindering the Vietnam sanitary ware market growth. Additionally, unverified sanitary products continue to be sold alongside reputable brands in various businesses across Hanoi, Ho Chi Minh City, and other provinces.

In July 2024, Market Management Team No. 8, in collaboration with Ward 2 Police in Tan Binh District, Ho Chi Minh City, conducted an inspection and seized approximately 5,275 units of undocumented sanitary equipment, valued at around USD 4.7 thousand.

The local manufacturers of sanitary equipment in Vietnam often relies heavily on imported raw materials, which can lead to price volatility and supply chain disruptions.

“Vietnam Sanitary Ware Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

On the basis of product type, the market can be divided into the following:

On the basis of material, the market is segmented into the following:

By application, the market is bifurcated into the following:

By end use, the market is segmented into the following:

Based on region, the market can be segregated into:

Market Analysis by Product Type

Rising urbanisation rate is driving the need for multifunctional and compact bathroom products like toilet sinks, which combine a sink and toilet into one unit. In urban areas, where living spaces tend to be smaller and more confined, consumers are increasingly opting for compact toilet sinks that enhance functionality without sacrificing design. Toilet sinks provide an ideal solution for urban households, especially in apartments or smaller homes, by optimising space and efficiency. Vietnam’s urbanization rate is expected to surpass 50% by 2030, as outlined in the urban and rural system planning for the 2021-2030 period, with a vision extending to 2050.

The development of commercial, residential, and infrastructure construction projects is boosting the demand of wash basins in Vietnam. As Vietnam aims to build 100,000 social houses by 2025, the demand for space-efficient bathroom solutions like wash basins is expected to grow in the coming years, driven by the need for practical and compact designs in affordable housing, there by supporting the Vietnam sanitary ware market. Vietnam’s construction sector grew by 7.48% in the first nine months of 2024, boosting demand for sanitary ware products in both residential and commercial projects.

Market Analysis by Material

The growth of Vietnam's real estate market, particularly in the commercial sector, is set to increase demand for ceramic sanitaryware. The 32% rise in FDI to USD 37 billion in 2023, against the previous year, is expected to fuel the commercial construction market, further driving demand of Vietnam sanitary ware market. Ceramic materials are favoured for their durability, aesthetic appeal, and cost-effectiveness, making them ideal for toilets, washbasins, and other bathroom fixtures. Based on 2023 data, on an average, the ceramic manufacturing industry contributes more than 3 billion USD/year to Vietnam's GDP.

Rising incomes and changing customer preferences for high-quality fixtures are driving market growth, with metal products like faucets and shower systems in demand for their durability. The growing middle-class population in Vietnam is yet another factor leading to increase in the spending on premium metallic sanitaryware products in Vietnam, thus contributing to the Vietnam sanitary ware market growth. Vietnam aims to reach upper-middle-income status by 2030 and become a high-income country by 2050. By 2026, the country's middle class is projected to grow to 26 % of the population from 13% (~13 million people) in 2023.

Market Analysis by Application

Rising urbanisation and improved public hygiene initiatives are driving demand in Vietnam's bathroom sanitary ware segment. As per the Vietnam sanitary ware market analysis, in Ho Chi Minh City alone, the number of public toilets increased to around 2,165 in 2024 up by 2,022 units since 2018, reflecting growing investment in bathroom infrastructure and sanitary installations.

Rising urban development and shifting consumer preferences toward modern living spaces are driving growth in Vietnam’s kitchen sanitary ware segment. In line with this trend, in 2023, Yoshimoto Sangyo partnered with Vinh An Interior & Decor to enter Vietnam’s market through the “KITCHEN TOWN” brand, offering high-end kitchen and water-related products. Their Hanoi showroom showcases Japan-made kitchen sinks and washbowls tailored to Vietnamese lifestyles, supporting the segment’s upward momentum.

Market Analysis by End Use

As per the Vietnam sanitary ware market report, the increasing construction of homes, particularly in social housing projects, is anticipated to fuel the demand for sanitary ware in Vietnam. In Q1 2024, Vietnam reported 13 social housing projects across 42 localities, resulting in 16,008 new units, with 2,016 units already completed. This surge in affordable housing development is expected to drive the demand in the market. With an estimated 1,062,200 dwellings expected to be completed by 2030, including 428,000 by 2025, the growing housing sector in Vietnam will significantly drive the demand for sanitary ware.

The growth in commercial construction projects is driving the Vietnam sanitary ware market. Notable hotel brands such as IHG Hotels & Resorts and Marriott are expected to set up new hotels in Vietnam. As the demand for new office buildings, hotels, and shopping centers is bound to increase in the coming years, the need for high-quality bathroom fixtures is expected to drive market growth. The projected addition of 100,000 sq.m of Grade A office space in Hanoi (2024-2027) and 118,700 sq.m in Ho Chi Minh City (2024-2025) is expected to drive demand for high-quality sanitary ware.

Ho Chi Minh City in Southeast Vietnam is dominated by high-end housing projects. In 2025, the city is expected to witness the launch of around 6,500-7,000 new high-end apartments. This surge in construction activity drives the demand for sanitary ware products, as new residential developments require modern bathroom fixtures and fittings. Advancements in large-scale urban projects aid the Vietnam sanitary ware market. In March 2025, Dong Nai authorities approved a 1:500 detailed planning scheme for the over USD 2.82 billion Hiep Hoa Urban Area project, the largest in the southern Vietnam province.

Rapid urbanisation in Red River Delta, particularly in cities like Hanoi, is driving demand for Vietnam sanitary ware market. As part of the adjusted Hanoi Master Plan 2045-2065 approved in 2025, the government aims to increase construction land, with urban land expanding to 125,000 hectares by 2045. Market players are investing in new plants to strengthen their position in the market. In March 2024, Japanese sanitaryware firm TOTO opened a faucet factory in Vietnam’s Vinh Phuc province with an investment of USD 67.7 million.

The development of large-scale social housing projects in the Mekong River Delta region presents an opportunity for affordable sanitaryware products. In March 2025, Long An authorities announced the implementation of the Social Housing Development Project, approved by the Provincial People's Committee under Decision No. 13213/QD-UBND in December 2024. As part of this initiative, Long An plan to complete five projects in 2025, covering a total area of 2.13 hectares and delivering 774 apartments. Additionally, the province aims to launch 21 projects spanning 129.33 hectares, providing 32,977 apartments in 2025.

|

CAGR 2026-2035 - Market by |

Region |

|

Southeast |

4.4% |

|

Red River Delta |

4.9% |

|

Mekong River Delta |

XX% |

|

South Central Coast |

XX% |

|

Others |

XX% |

The Vietnam sanitary ware market is highly competitive owing to the presence of large, medium, and small-sized enterprises. Key competitive factors include price, product, and service quality. Competition is not only present at the production level but also at dealer level. Smart advertising through channels such as Google and Facebook are used to attract and retain customers.

Founded in 2005, JOMOO Vietnam, a subsidiary of the globally recognised ‘JOMOO Group’, specialises in smart bathroom solutions. The company has established itself as a leader in the bathroom industry by developing the world’s first 5G-powered, light-free smart factory. The company achieves a quality rate of 99.6%, delivers products 25% faster, and operates with 35% higher production efficiency. The factory has reduced energy use by 7% annually and has cut operating costs by 8%. Further, the company is committed to achieving carbon neutrality by 2058.

Founded in 2002, TOTO Vietnam Co., Ltd., a subsidiary of TOTO Ltd., is a leading manufacturer of high-quality sanitary ware for luxury hotels, residential and commercial restrooms, and major airports worldwide. The TOTO Information Center, operated by TOTO Vietnam Co., Ltd., serves as a hub that connects and inspires professionals and enthusiasts in architecture and art through collaborative events. TIC operates in both Hanoi and Ho Chi Minh City.

INAX is a leading brand of sanitary ware and architectural tiles, which operates under ‘LIXIL Corporation’, a global leader in innovative water and housing solutions. The company combines the traditional Japanese Water Ritual with human-centered technologies and appropriate designs. Further, the company creates exquisite tiles featuring refined textures and colors inspired by the four seasons, reflecting the Japanese culture and tradition.

Established in 1996, Caesar Vietnam Sanitary Equipment Joint Stock Company is a subsidiary of ‘SANITAR Co., Ltd.’ which is a 100% Taiwanese-owned company. The company has developed various technologies which includes Magic Power Technology, Aqua Jet Technology, Massage lamp bathtub, Super anti-fouling enamel and others. Further, the company grinds and mixes kaolin with various raw materials. The final mixture, so/so becomes the basic material for their porcelain products.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the Vietnam sanitary ware market are Siam Sanitary Ware Industry Co., Ltd. (Cotto), Hao Canh Porcelain Production and Trading Co., Ltd., Viglacera Corporation, Toko Vietnam Co. Ltd, and Thien Thanh Ceramics Company Limited, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the Vietnam sanitary ware market reached an approximate value of USD 505.91 Million.

The market is projected to grow at a CAGR of 4.70% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 800.83 Million by 2035.

The major drivers of the market are developments in residential and commercial sectors, booming tourism sector, and burgeoning urban middle-class population.

The key trends of the market include urbanization, smart technology, eco-friendly products, premium design quality, and e-commerce growth.

The major regions in the market are Southeast, Red River Delta, Great Lakes, Mekong River Delta, South Central Coast, and others.

The various product types considered in the market report are toilet sink/water closet, wash basin, pedestal, cistern, and others.

The various materials considered in the market report are ceramic, metal, and plastic.

The applications considered in the market report are kitchen and bathroom.

The major players in the market are Viglacera Corporation, TOTO Vietnam Company, LIXIL Vietnam Corporation, Vietnam Caesar Sanitary Equipment Joint Stock Company, Hao Canh Porcelain Production and Trading Co., Ltd., Siam Sanitary Ware Industry Co., Ltd., Jomoo Vietnam, Toko Vietnam Co. Ltd, Thien Thanh Ceramics Company Limited, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Material |

|

| Breakup by Application |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 3,499

USD 3,149

tax inclusive*

Single User License

One User

USD 5,499

USD 4,949

tax inclusive*

Five User License

Five User

USD 6,999

USD 5,949

tax inclusive*

Corporate License

Unlimited Users

USD 8,324

USD 7,075

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share