Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global welding consumables market attained a value of USD 18.26 Billion in 2025 and is projected to expand at a CAGR of 5.80% through 2035. The market is further expected to achieve USD 32.09 Billion by 2035. Rising refurbishment of aging industrial assets is lifting demand for consumables, with more repair welding taking place on pipelines, rail equipment, and heavy machinery.

The market is moving into a phase where productivity gains and data-ready consumables matter just as much as bead strength. In May 2022, Lincoln Electric announced the latest evolution of the HyperFill Twin-Wire Welding Solution with its expansion into FCAW-G applications, aiming to cut spatter and boost deposition uniformity on high-strength steels. This welding consumables market trend has become critical because robotic welding uptake keeps accelerating in automotive and general fabrication lines across the world, and manufacturers want wires that reduce rework time. These developments indicate a shift toward consumables designed not only for metallurgical performance but also for seamless integration with automated cells that run longer hours.

Producers are now connecting welding wire, flux, and electrodes with digital support tools that capture heat input windows, travel speeds, and moisture control notes. For example, in April 2023, Kemppi launched AX MIG Welder, a powerful robotic welder with seamless integration, an easy-to-use interface, and the latest welding technology. This gives fabricators clearer traceability when building critical components for infrastructure, renewables, and pressure vessels, driving the overall welding consumables market value. Low-hydrogen electrodes with stronger coating durability remain critical, especially in climate zones where moisture fluctuations can damage weld integrity.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

5.8%

Value in USD Billion

2026-2035

*this image is indicative*

Manufacturers are shifting towards welding consumables optimized for robotic and automated cells. Automotive and heavy fabrication facilities need wires that start cleaning, feed consistently, and reduce downtime between cycles. Governments in developed markets also back automation to boost competitiveness, offering incentives for smart factories, accelerating the welding consumables market growth. In December 2025, Spartan Robotics, a division of BlueBay Automation, unveiled a new cobot welding cell developed through international collaboration, by partnering with Kassow Robots, a subsidiary of Bosch Rexroth, and Fronius. Wires for robotic cells are expected to be increasingly specified in tenders, tied to higher output and quality compliance.

Low-hydrogen electrodes are trending because infrastructure projects require safer, crack-resistant welds. Major suppliers enhance coatings to resist moisture pickup and sustain arc stability, especially in variable climates. Government codes for bridges, pipelines, and offshore facilities emphasize toughness, making low hydrogen rods a crucial specification. Australia’s infrastructure pipeline including roads, ports, energy, raises the bar for weld quality and fatigue life. In December 2024, ESAB unveiled the OK Goldrox 7018, a premium low-hydrogen Stick electrode designed to make welding more accessible and efficient. This trend in the welding consumables market pushes procurement teams to select products that support certification and inspection ease.

Renewable energy builds, LNG facilities, and subsea structures push demand for nickel, duplex stainless, and other specialty welding wires and rods. Traditional mild steel supplies are no longer enough for corrosive, high-stress environments. Producers are tailoring consumables with precise alloy chemistry that matches base metals in wind towers, solar mounts, and pressure vessels, accelerating demand in the welding consumables market. In May 2025, Panasonic Smart Factory Solutions India introduced a new TIG welding power source and water-cooling unit, developed at its Jhajjar, Haryana facility for industrial use.

Sustainability is gaining traction in the welding consumables market dynamics. Manufacturers experiment with greener flux blends that reduce fume, lower slag mass, and cut hazardous by-products. This aligns with tightening regulations around workplace air quality and waste management. In July 2022, Vitesco Technologies, a leading international manufacturer of modern drive technologies and electrification solutions, announced that the company is using innovative laser systems from its long-standing production engineering partner TRUMPF. Fabricators see value in consumables that improve welder safety and reduce cleanup costs.

Traceability is now essential for critical fabrication work. Leading producers embed QR codes and digital IDs on welding wire spools, electrodes, and flux boxes. These codes link to batch chemistry, moisture history, heat numbers, and recommended parameters. Automotive and aerospace sub-tiers, and even pressure vessel shops, require this level of documentation for quality audits. In October 2024, Pandrol unveiled its revolutionary i+weld product range with the promise of transforming the process of track welding through automation and data. Welding teams use apps to log consumable usage by job, linking data to weld logs for compliance and warranty records. This welding consumables market trend pushes consumables from simple stock items to managed assets in digital workflows.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Welding Consumables Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

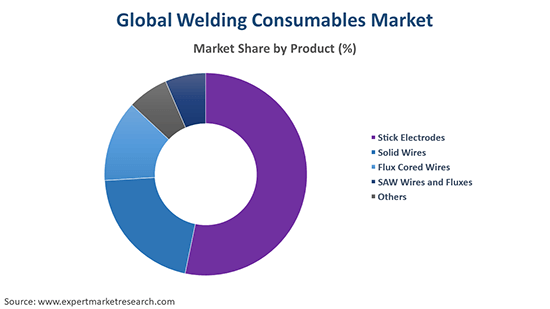

Market Breakup by Product

Key Insight: Solid wires anchor the majority of the application in automated and high-volume environments, valued for clean feed and broad steel applicability. Flux cored wires experience surging popularity owing to their structural strength and outdoor versatility. Stick electrodes stay relevant in repair and field maintenance, offering resilience where portability matters more than speed, driving the welding consumables market value. SAW wires and fluxes dominate heavy plate and long seam jobs, while other products including specialty fillers and niche alloys, support unique metallurgical and positional requirements.

Market Breakup by Welding Technique

Key Insight: Arc welding drives major demand in the welding consumables market through core steel fabrication and repair needs. Oxyfuel serves preparation tasks tied to heavy plate work. Resistance welding underpins automotive sheet assembly with fast cycle times. Ultrasonic solutions expand in precision components, altering joint strategies and material use. Other techniques plug niche gaps, from laser hybrid systems to brazing. Fabricators blend methods to match cost, geometry, metallurgical needs, and automation goals.

Market Breakup by End Use

Key Insight: Construction dominates through structural steel volume and site variability. Automobiles quickly expands its share in the welding consumables market with high automation and alloy evolution. Energy projects turn to specialty fillers for heat, corrosion, and fatigue demands. Shipbuilding leverages flux cored and SAW for thick section welding in marine environments. Aerospace favors precision wires and rigorous traceability. Industrial equipment depends on robust, repair-friendly consumables.

Market Breakup by Region

Key Insight: Asia Pacific anchors global volume through broad fabrication ecosystems. North America scales at a much faster pace owing to automation and energy builds. Europe balances automotive, offshore, and industrial machinery clusters, emphasizing process efficiency and qualification rigor. The welding consumables market in Latin America grows through construction and mining equipment builds, leaning on reliable core wires. Middle East and Africa boost demand via infrastructure and energy assets.

By product, solid wires record the largest share of the market due to automation readiness

Solid wires lead the market because automated and semi-automated weld cells depend on smooth feed, high deposition, and consistent bead appearance. Fabricators in automotive and general engineering lean heavily on MIG/MAG set-ups that pair well with solid wires, especially for thinner gauges and high output lines. These wires deliver lower spatter and stable arc control, reducing post-weld cleaning. Suppliers enhance copper coatings, spool winding, and surface finish to support digital parameters and robotic tip life, propelling the welding consumables market revenue.

Flux cored wires grow faster in terms of popularity because heavy fabrication, shipyards, and outdoor construction need higher deposition, strong vertical-up capability, and better tolerance to joint fit-up variation. Flux formulations improve arc stability and slag release, while metal-cored options support cleaner beads at speed. In September 2023, Castolin Eutectic launched the ultimate wear protection Flux Cored Wire for combined wear at extreme temperatures. Fabricators choose flux cored wires for thicker sections, achieving strong penetration and reduced porosity risk in variable conditions.

By welding technique, arc welding accounts for the dominant market share due to versatility across steels

Arc welding captures the dominant share within the welding consumables market dynamics because it spans SMAW, GMAW, FCAW, and SAW, covering light fabrication to deep-groove structural plates. Its flexibility lets workshops support urgent repairs and automated runs with the same core skill base. Arc processes also integrate with wire feeders, robots, and advanced power sources tuned for waveform control. Consumable demand stays strong because each arc variant leans on well-matched wires, rods, or fluxes.

Ultrasonic welding experiences rapid growth as electronics, EV battery packs, and lightweight assemblies need low heat input and tight dimensional control. While it is not a consumable-heavy field like arc, it influences welding consumables demand indirectly by shifting part design, joint prep, and hybrid process flows. In April 2025, Kulicke and Soffa Industries, Inc. announced the launch of Asterion-PW, extending its leadership in power device applications with a fast and precise ultrasonic pin welding solution. Manufacturers using ultrasonic welding often combine it with arc stages, especially around housing.

By end use, construction registers the largest share due to structural steel activity

Construction leads the market as bridges, towers, industrial sheds, and commercial frames depend on high-quality welds across thick plates and tubular steels. Fabricators rely on solid wire for shop welds and flux-cored solutions on site, balancing pace with structural integrity. Consumables must deliver toughness, reliable slag control, and low hydrogen potential. Strong alignment with codes and inspections keeps welding consumables central to construction requirements. Infrastructure upgrades, refits, and repair cycles sustain recurring demand in the welding consumables market.

Automobile end use grows faster as OEMs and tier suppliers automate MIG/MAG and resistance weld cells for thin-gauge steels and evolving EV platforms. Solid wires with consistent feed and lower spatter are key to cycle-times and repeatability. In September 2025, Miller Electric Mfg. LLC partnered with Gullco International to introduce Hercules, a high-deposition welding automation system engineered for high-efficiency MIG welding. Light alloy and high-strength steel adoption widens consumable needs, pushing specialty filler metals in certain sub-systems.

Asia Pacific captures the leading position in the market due to strong fabrication output

Asia Pacific leads the global market owing to its strong manufacturing base in automotive, construction equipment, shipbuilding, and infrastructure. The region’s supply chains support steel production, filler metal manufacturing, and large fabrication hubs that consume solid and flux cored wires at scale. Industrial expansions in India and Southeast Asia add recurring shop-floor demand, while China and Japan advance automation in automotive and robotics.

The welding consumables market in North America is strengthening rapidly, with reshoring, robotics, and energy projects. Automotive and heavy equipment makers modernize weld bays, adopting metal-cored wires for higher output and arc stability. Offshore wind, LNG terminals, and pipeline refurbishments raise alloy filler demand. Aerospace and defense add requirements for traceability and specialty wire consistency. Distributors offer technical support and welding procedure guidance, improving consumable performance.

Welding consumables companies compete on deposition quality, wire feed stability, and coatings that reduce fume and spatter. Metal-cored wires designed for automated bays are gaining traction, especially in automotive and heavy fabrication lines where cycle time matters. Low-hydrogen electrodes remain critical for structural and energy projects, pushing makers to upgrade moisture barriers and packaging.

Specialty nickel and duplex fillers are another focus area of welding consumables market players as offshore wind and LNG assets expand and need tighter metallurgy. The biggest opportunity lies in helping fabricators shorten qualification cycles through data-rich consumables that pair with weld parameter libraries and procedure tools. The market also notices momentum in vacuum-sealed bulk packaging, warehouse-ready keg formats, and easier weldability in out-of-position joints.

Voestalpine Böhler Welding GmbH, established in 1870 and headquartered in Düsseldorf, Germany, focuses on high-alloy filler metals and low-hydrogen electrodes for demanding jobs. The company emphasizes metallurgical expertise and strong procedure guidance for offshore, power, and pressure vessel fabrication. Its portfolio of nickel, duplex, and stainless fillers meets rigorous inspection and code requirements, helping customers reduce rework and enhance service life in corrosive environments.

Founded in 1860 and headquartered in Delaware, United States, Colfax Corporation drives innovation in welding automation and digital welding platforms under its ESAB brand. Its consumables cover solid wires, flux-cored wires, and SAW solutions for shipyards, automotive plants, and structural steel. The company supports customers with process intelligence tools that improve deposition tracking and weld quality.

Air Liquide, founded in 1902 and headquartered in France, combines shielding gas leadership with a selective filler metal offering. The company integrates gas-wire synergy charts and process guidance to boost arc stability and bead shape. Its solutions support MIG/MAG automation, high-strength steel welding, and precision work across aerospace and energy.

The Lincoln Electric Company, established in 1895 and headquartered in Ohio, United States, leads in welding wire R&D, metal-cored innovations, and robotic compatibility. Its consumables power automotive, pipeline, and heavy equipment fabrication. Lincoln Electric supports digital parameter libraries, robotic cell integration, and alloy-matched wires that reduce rework.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include Hyundai Welding Co., Ltd., Obara Corp, and Panasonic Corporation, among others.

Unlock the latest insights with our welding consumables market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 18.26 Billion.

The market is projected to grow at a CAGR of 5.80% between 2026 and 2035.

The market is estimated to observe a healthy growth in the forecast period of 2026-2035 to reach a value of about USD 32.09 Billion by 2035.

Expanding alloy ranges, improving robotic feed stability, enhancing moisture protection, scaling digital parameter support, and strengthening regional training networks are helping suppliers deepen customer value and reduce conversion friction.

Innovations and advancements in welding technology and increasing automobiles sales are expected to be key trends guiding the growth of the market.

North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa are the leading regions in the market.

Stick electrodes, solid wires, flux cored wires, and SAW wires and fluxes, among others are the various products in the market.

Arc welding, resistance welding, oxyfuel welding, and ultrasonic welding, among others, are the leading welding techniques in the market.

The various end uses in the market are construction, automobile, energy, shipbuilding, aerospace, and industrial equipment, among others.

The key players in the market include Voestalpine Böhler Welding GmbH, Colfax Corporation, Air Liquide, The Lincoln Electric Company, Hyundai Welding Co., Ltd., Obara Corp, and Panasonic Corporation, among others.

Companies must manage alloy complexity, coil-to-coil consistency, moisture control, and global logistics while balancing price pressure, rapid automation shifts, and stringent codes across infrastructure and energy projects.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Welding Technique |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share