Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global wireline services market was valued at USD 11.51 Billion in 2025. The industry is expected to grow at a CAGR of 3.30% during the forecast period of 2026-2035 to reach a value of USD 15.92 Billion by 2035. The market is undergoing a significant transformation driven by automation and advanced technologies, enhancing operational efficiency, accuracy, and safety in oil and gas operations.

Automation facilitates real-time monitoring, precise well interventions, and faster data acquisition, particularly in complex well environments. Halliburton's introduction of the Auto Pumpdown™ service in April 2023 exemplifies this transformation. This service automates wireline and pump operations during unconventional completions, controlling fluid pumps and wireline units as a single, fully automated, closed-loop system. By executing operations to plan and optimizing equipment operation, it enhances consistency and efficiency.

The Auto Pumpdown service reduces risks by providing prompt feedback to dynamic downhole conditions, helping prevent unplanned and costly interventions. It has demonstrated improved operating efficiencies, reduced fluid requirements, and minimized the risk of unnecessary well interventions. Multiple perforating crews in North America currently use the Auto Pumpdown service, and Halliburton plans to implement it across its North American fleet through 2023 and beyond.

These advancements underscore the commitment of the wireline services market in integrating automation and advanced technologies to improve operations, ensuring safer, more efficient, and cost-effective outcomes in oil and gas exploration and production.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

3.3%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Wireline Services Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 11.51 |

| Market Size 2035 | USD Billion | 15.92 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 3.30% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 3.9% |

| CAGR 2026-2035 - Market by Country | India | 4.2% |

| CAGR 2026-2035 - Market by Country | China | 3.7% |

| CAGR 2026-2035 - Market by Wireline Type | Electric Line | 3.8% |

| CAGR 2026-2035 - Market by Hole Type | Open Hole | 4.0% |

| Market Share by Country 2025 | Brazil | 2.7% |

The expansion of offshore oil and gas exploration is boosting the wireline services market growth, as these operations require precise well logging, perforation, and reservoir evaluation. Advanced wireline technologies enable operators to assess complex offshore reservoirs safely and efficiently. For instance, in India, the government approved three offshore blocks in the Kerala-Konkan Basin for exploration, with drilling operations set to begin in October 2025. Oil India Ltd (OIL) and ONGC are leading these projects, and a MoU with Cochin Port will establish shore base facilities to support offshore operations.

Strategic mergers and acquisitions in the oil and gas sector increase demand for wireline services, as expanded operations require more well evaluation, monitoring, and intervention support. In May 2024, ExxonMobil completed its acquisition of Pioneer Natural Resources, doubling its footprint in the Permian Basin. The acquisition aims to raise production capacity from 1.5 million to 2.3 million barrels per day by 2030, necessitating enhanced wireline operations for reservoir monitoring and well optimization. Such deals highlight wireline services’ critical role in supporting growing production volumes.

Collaborations between service providers and drilling companies are accelerating innovation in the global wireline services market, improving efficiency, accuracy, and safety in complex wells. Citing a prime instance, in June 2023, Halliburton and Nabors Industries partnered to develop automated well construction solutions, integrating RigCLOUD and Halliburton Well Construction 4.0. This collaboration enhances wireline operations in unconventional drilling environments by streamlining workflows and increasing precision. Such partnerships are key to improving performance, reducing operational downtime, and meeting the rising demand for wireline services in challenging oil and gas projects.

Private sector investment and joint ventures are critical for advancing wireline technologies, particularly for unconventional and complex oil and gas projects. In June 2025, Baker Hughes and Cactus formed a joint venture to develop surface pressure control equipment for unconventional completions. This collaboration aims to enhance well control, reservoir monitoring, and overall operational efficiency, strengthening wireline service capabilities in shale and other challenging formations. Private investments like this accelerate technology adoption and improve service quality across global wireline operations.

Government initiatives in offshore oil and gas exploration stimulate demand for advanced wireline services, particularly in deepwater and complex fields contributing to the wireline services market expansion. Expert collaborations and investments ensure efficient development and monitoring of these resources. ONGC, for example, plans to involve BP experts in developing deepwater fields in the Krishna-Godavari Basin in 2024, enhancing exploration and production capabilities. These initiatives drive the need for wireline operations for formation evaluation, reservoir monitoring, and well intervention, highlighting the sector’s role in national energy expansion strategies.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Wireline Services Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Wireline Type

Key Insight: Electric line dominates the market due to its use in logging, perforation, and completion activities. Slick line is growing fastest as it supports cost-effective well maintenance and routine operations. Both benefit from digital logging, automation, and advanced tools, which enhance well evaluation, operational efficiency, and performance optimization across conventional and unconventional reservoirs in onshore and offshore fields, driving overall market growth.

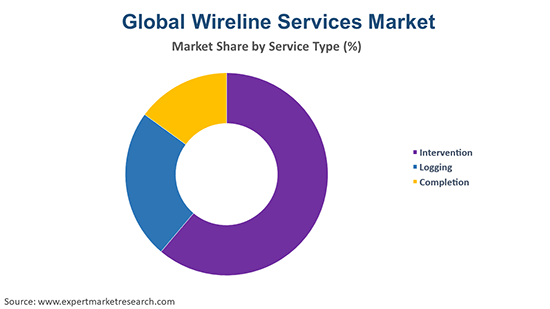

Market Breakup by Service Type

Key Insight: Logging leads the global wireline services market, providing essential subsurface data for reservoir evaluation and production planning. Intervention is expanding rapidly, driven by mature field maintenance and well performance optimization. Completion services support both logging and intervention activities. The adoption of automated tools, real-time monitoring, and digital data acquisition is fueling growth across all service types, improving efficiency, reliability, and operational performance in onshore and offshore exploration and production.

Market Breakup by Hole Type

Key Insight: Open hole holds the largest share, as it is used extensively during drilling, logging, and perforation for reservoir characterization. Cased hole is growing fastest due to its importance in well interventions, maintenance, and production optimization. Advanced wireline tools, digital logging, and automation are driving adoption across both types, improving operational efficiency, reducing downtime, and enabling precise monitoring and evaluation of conventional and unconventional wells in onshore and offshore fields.

Market Breakup by Location of Deployment

Key Insight: Onshore operations account for the largest portion of the global wireline services market because of mature land-based oil and gas fields. Offshore activities are growing fastest due to deepwater exploration and complex wells. Both onshore and offshore applications benefit from digital logging, automated interventions, and real-time monitoring, which improve production, optimize well performance, and enhance operational efficiency across conventional and unconventional reservoirs in multiple global locations.

Market Breakup by Region

Key Insight: Asia Pacific dominates the market, driven by rising energy demand and offshore development. North America is growing fastest, supported by shale exploration, mature fields, and technological adoption. Europe, Latin America, and the Middle East and Africa contribute steadily through conventional and unconventional exploration. Across all regions, government initiatives and advanced technologies are enabling efficient operations, production optimization, and extended well life, driving overall market growth.

By wireline type, electric line to represent the biggest market portion

Electric wireline services are witnessing notable growth in the global wireline services market as operators increasingly integrate digitalization and artificial intelligence into electric wireline logging. These technologies enhance reservoir evaluation by improving accuracy, reducing interpretation time, and supporting predictive decision-making. In July 2024, SLB partnered with TotalEnergies to co-develop next-generation reservoir engineering solutions on the Delfi™ digital platform, integrating AI and advanced geoscience modeling. This initiative is set to optimize subsurface data analysis, strengthening the role of electric wireline services in efficient and low-emission energy development.

Meanwhile, slick wireline services demonstrate the fastest growth rate in the market, driven primarily by its cost-effectiveness in well intervention. Slick line operations provide a simple and economical solution for routine tasks such as setting plugs, gauges, and valves, helping operators maintain wells without the high expenses associated with complex intervention techniques. This affordability is particularly valuable in mature oilfields, where companies face constant pressure to maximize output while minimizing operational costs, making slick line an increasingly preferred choice for efficient field management.

By service type, logging to hold the largest share

The logging segment holds the largest wireline services market share, driven by its critical role in delivering accurate formation evaluation. Rising demand for reliable data is pushing operators to adopt advanced solutions that improve efficiency and safety. In August 2025, Schlumberger (SLB) launched the OnWave autonomous logging platform, which collects high-fidelity downhole measurements without cables and reduces deployment time by 70%. By ensuring faster, safer, and more reliable operations, such innovations reinforce logging as an indispensable service across exploration, production, and recovery.

Intervention services are the fastest-growing largely driven by the rising demand for well maintenance and productivity enhancement in aging oilfields. As reservoirs mature, maintaining output becomes a priority, and intervention provides an efficient solution to restore well integrity, remove obstructions, and optimize flow. Its ability to extend the productive life of wells while minimizing downtime has made it increasingly attractive to operators, fueling rapid adoption and positioning it as a key service within the industry.

By hole type, open hole to represent the biggest market portion

The open hole segment holds the largest portion of the global wireline services market due to its extensive use in initial well logging, formation evaluation, and reservoir characterization. Open hole wireline provides operators with detailed subsurface data before casing, allowing for more accurate decision-making on drilling, production strategies, and reservoir management. Its broad applicability across conventional and unconventional wells, combined with the ability to gather high-quality formation information, makes open hole the preferred choice for operators, thereby supporting market growth.

Cased hole, while smaller, is the fastest-growing segment in the market due to increasing demand for well interventions, production optimization, and integrity monitoring in completed wells. Cased hole operations enable perforations, logging, and maintenance in cased wells, boosting recovery and well life. Innovations in digital and electric wireline technologies enhance efficiency, accuracy, and safety. For example, in September 2025, Halliburton introduced the Turing® electro-hydraulic control system, enabling fast zonal optimization and precise flow management in cased wells, highlighting the impact of advanced technology adoption on this segment.

By location of deployment, onshore deployment to gain preference

Onshore wireline deployment records significant adoption in the global wireline services market attributed to the combination of lower operational costs and easy accessibility in land-based basins. Onshore wells allow operators to mobilize wireline units quickly, conduct frequent monitoring, and manage equipment and personnel with simpler logistics. These advantages reduce downtime and safety risks while enabling efficient well logging, formation evaluation, and interventions. The economic and operational benefits of onshore deployment make it the preferred choice for oil and gas operators aiming to optimize productivity and manage expenses effectively.

On the other hand, the offshore wireline deployment is picking up pace owing to the need for advanced technologies that enhance well performance, efficiency, and safety in deepwater operations. Offshore wells require precise logging, monitoring, and intervention tools to handle complex subsurface conditions and high operational risks. Companies are adopting AI-enabled solutions to streamline operations and optimize costs. For instance, in January 2025, SLB leveraged its AI-driven digital drilling and wireline capabilities across deepwater projects for Shell in the UK North Sea, Trinidad and Tobago, and the Gulf of Mexico, demonstrating how technology integration accelerates offshore wireline adoption.

By region, Asia Pacific to dominate the market

The Asia Pacific region leads the global wireline services market, primarily due to the surge in exploration and production across key countries like China, India, and Indonesia. Increasing investments in upstream infrastructure and frequent drilling activities in both onshore and offshore fields have fueled demand for well logging, formation evaluation, and intervention services. The combination of high activity levels and growing adoption of advanced wireline technologies positions Asia Pacific as the key destination for the market players globally.

North America is witnessing significant market growth, driven by the integration of advanced technologies and automation in well operations. Shale oil and gas development, coupled with digital wireline solutions and real-time monitoring, enhances production efficiency and reduces operational risks. The region’s continuous investment in well intervention and completion services supports rapid adoption, making North America a key growth market for innovative wireline solutions.

| CAGR 2026-2035 - Market by | Country |

| India | 4.2% |

| China | 3.7% |

| Saudi Arabia | 3.7% |

| USA | 3.5% |

| Brazil | 3.4% |

| Canada | XX% |

| UK | XX% |

| France | XX% |

| Italy | XX% |

| Japan | XX% |

| Australia | XX% |

| Mexico | 2.9% |

| Germany | 2.7% |

Leading wireline services companies are prioritizing technology-driven solutions to stay competitive and meet rising operational demands. Firms are investing in automation, digital wireline tools, and AI-enabled platforms to enhance efficiency, accuracy, and safety in well interventions. For example, firms are developing autonomous logging systems and cable-free intervention tools to cut deployment time and operational risks. These strategies help operators optimize production, reduce costs, and strengthen long-term client relationships in the evolving market.

Besides this, providers are also expanding service portfolios and geographic presence to capture growth opportunities. Leading companies are forming strategic partnerships and offering integrated solutions that combine logging, cased hole, and intervention services under outcome-based models. This approach allows clients to achieve end-to-end operational efficiency while leveraging expert support. By focusing on digital transformation, advisory services, and tailored solutions, global wireline services market players are positioning themselves to drive growth in both mature and emerging oilfield regions.

Headquartered in Houston, the United States, and founded in 1907, Baker Hughes Company delivers comprehensive oilfield services and technology solutions worldwide. Its expertise spans drilling, formation evaluation, and production optimization. Through its global operations, the company enables operators to improve efficiency while minimizing operational risks.

Weatherford International, established in 1941 and based in Houston, the United States, provides extensive well construction, completion, and intervention services. The company aims to maximize hydrocarbon recovery and enhance operational performance. Serving both onshore and offshore markets globally, Weatherford supports diverse oil and gas projects with innovative solutions.

Founded in 1926 with headquarters in Houston, the United States, Schlumberger is recognized as the largest oilfield services provider globally. The company delivers advanced technologies for reservoir characterization, drilling, and production management. Operating in more than 85 countries, Schlumberger supports exploration and production activities across varied geographies and environments.

Based in Stavanger, Norway, and established in 1974, Archer Ltd offers specialized drilling, well, and intervention services. The company emphasizes both offshore and onshore operations, combining technical expertise with innovative solutions to manage complex oil and gas projects efficiently.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the wireline services market include Expro Group, and Pioneer Energy Services Corp., among others.

Explore the latest trends shaping the Global Wireline Services Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Get a free sample report or contact our team for customized consultation on global wireline services market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 11.51 Billion.

The market is projected to grow at a CAGR of 3.30% between 2026 and 2035.

Key strategies driving the market include adoption of advanced automation and digital technologies, strategic partnerships, mergers and acquisitions, research & development for innovative tools, and targeted deployment across onshore and offshore regions.

The key trends aiding the market growth include the increasing discoveries of new oilfields and increasing exploration activities by key players.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The various wireline types considered in the market report are electric line and slick line.

Intervention, logging, and completion are the several service types considered in the market report.

The major hole types considered in the market report are open hole and cased hole.

The significant locations of deployment considered in the market report are onshore and offshore.

The key players in the market include Baker Hughes Company, Weatherford International plc, Schlumberger Limited, Archer Ltd, Expro Group, Pioneer Energy Services Corp., and several other regional and emerging companies.

Asia Pacific holds the largest share of the global wireline services market, supported by extensive exploration and production activities, growing upstream investments, and widespread adoption of advanced wireline technologies.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Wireline Type |

|

| Breakup by Service Type |

|

| Breakup by Hole Type |

|

| Breakup by Location of Deployment |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share