Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

C-MET is a subtype of non-small cell lung cancer (NSCLC). It is linked to changes in the MET gene, which codes for a receptor tyrosine kinase. Tumor growth, metastasis, and resistance to specific treatments can result from these alterations. To help patients with this aggressive type of lung cancer, targeted treatments including MET inhibitors are under development. The C Met non-small cell lung cancer pipeline analysis by Expert Market Research focuses on various treatment options for this disease.

Major companies involved in the C Met non-small cell lung cancer pipeline analysis include AbbVie, Janssen Research & Development, LLC and Beijing Pearl Biotechnology Limited Liability Company among others.

Leading drugs currently in the pipeline include telisotuzumab vedotin, and Amivantamab, among others.

Increased investment in research and development, along with regulatory support, is accelerating clinical trials and new treatment approvals.

The C Met Non-Small Cell Lung Cancer Pipeline Insight Report by Expert Market Research gives comprehensive insights into C Met non-small cell lung cancer currently undergoing clinical trials. It covers various aspects related to the details of each of these drugs under development for C Met Non-Small Cell Lung Cancer therapeutics. The C Met non-small cell lung cancer report assessment includes the analysis of over 15 pipeline drugs and 10+ companies. The C Met non-small cell lung cancer pipeline landscape will include an analysis based on efficacy and safety measure outcomes published for the trials, including their adverse effects on patients suffering from the condition, and alignment with C Met non-small cell lung cancer treatment guidelines to ensure optimal care practices.

The assessment part will include a detailed analysis of each drug, drug class, clinical studies, phase type, drug type, route of administration, and ongoing product development activities related to C Met non-small cell lung cancer.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

In c-MET non-small cell lung cancer (NSCLC), the MET signaling system, which typically controls cell proliferation, survival, and motility, is dysregulated. Uncontrolled proliferation, invasion, angiogenesis, and metastasis result from aberrant activation caused by overexpression, amplification, or alterations such MET exon 14 skipping. Resistance to treatments that target other pathways, such as EGFR, may also be fueled by these changes. One important oncogenic factor in certain NSCLC subtypes is MET dysregulation.

Therapy for c-MET Tyrosine kinase inhibitors (TKIs), such as tepotinib, capmatinib, and savolitinib, are effective against MET exon 14 skipping mutations, and are used to treat MET changes in non-small cell lung cancer (NSCLC). Even in cases when there are brain metastases, these medications improve outcomes, such as tumor response and disease control rates. Antibody-drug conjugates and monoclonal antibodies are further strategies. Research on combination treatments and methods for overcoming resistance is ongoing.

The overexpression of C-MET in non-small cell lung cancer (NSCLC) varies greatly among populations and detection techniques. According to studies, prevalence percentages vary from 15% to 70%, depending on thresholds and antibody assays. 68% of NSCLC patients in a sizable Chinese cohort had positive C-MET expression (IHC 2+ or 3+). Moreover, MET amplification is less frequent, happening in only 3.7% of cases. These results demonstrate how important MET changes are in NSCLC.

This section of the report covers the analysis of C Met non-small cell lung cancer drug candidates based on several segmentations, including:

By Phase

By Drug Class

By Route of Administration

The report covers phase I, phase II, phase III, phase IV, and early-phase drugs. The coverage includes an in-depth analysis of each drug across these phases. According to EMR analysis, phase II covers a major share of the total C Met non-small cell lung cancer clinical trials.

In the C Met non-small cell lung cancer pipeline, 75% of candidates are in Phase II with the largest share while the remaining 25% of the candidates are in Phase I. Thus, demonstrating division of candidates between the two phases and diverse progress toward potential treatments.

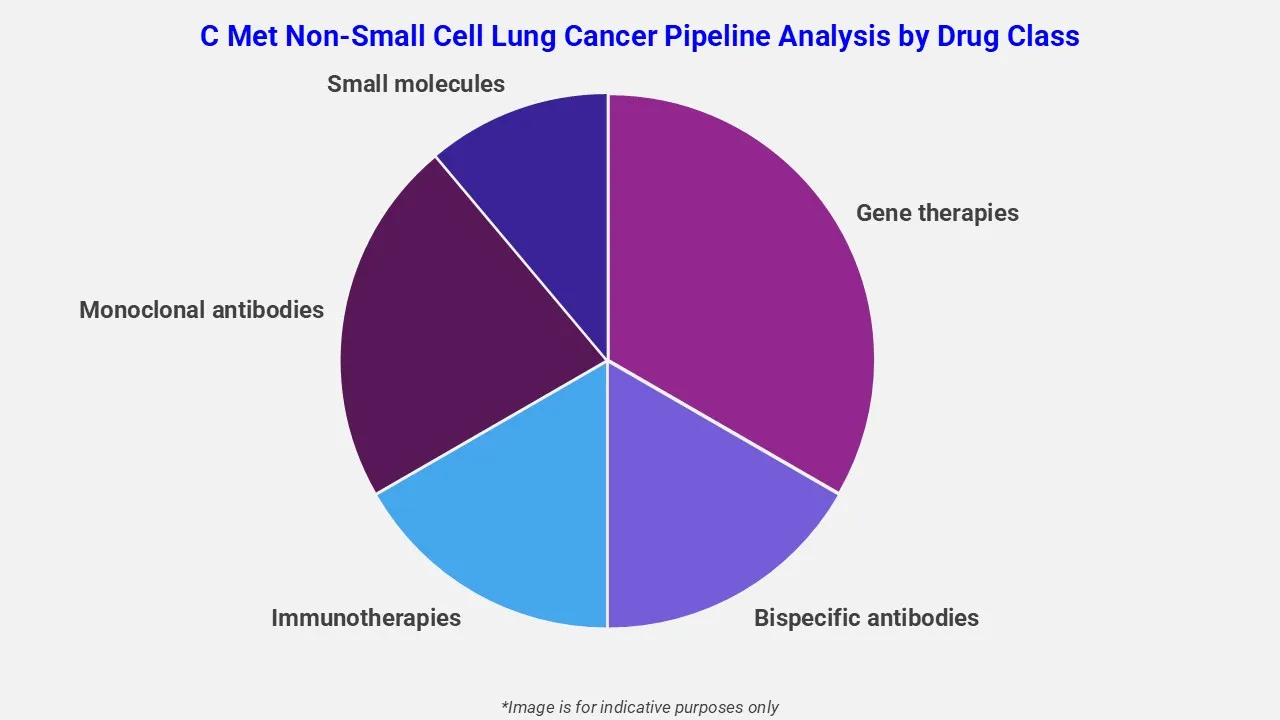

The drug molecule categories covered under the C Met non-small cell lung cancer pipeline analysis include gene therapies, bispecific antibodies, immunotherapies, monoclonal antibodies and small molecules. The C Met non-small cell lung cancer report provides a comparative analysis of the drug classes for each drug in various phases of clinical trials for C Met non-small cell lung cancer.

The EMR report for the C Met non-small cell lung cancer pipeline analysis covers the profile of key companies involved in clinical trials and their drugs under development. Below is the list of a few players involved in C Met non-small cell lung cancer clinical trials:

This section covers the detailed analysis of each drug under multiple phases, including phase I, phase II, phase III, phase IV, and emerging drugs for C Met non-small cell lung cancer. It includes product description, trial ID, study type, drug class, mode of administration, and recruitment status of C Met non-small cell lung cancer drug candidates.

AbbVie created the experimental antibody-drug combination, known as Telisotuzumab Vedotin (Teliso-V) to treat non-small cell lung cancer (NSCLC) that overexpresses the c-Met protein. Teliso-V showed an overall response rate of 35% in patients with c-Met High and 23% in individuals with c-Met intermediate in the Phase 2 LUMINOSITY trial. In January 2022, the U.S. FDA designated it as a Breakthrough Therapy, and in September 2024, AbbVie filed a Biologics License Application for the drug.

Janssen Research & Development, LLC created the bispecific antibody amivantamab, which targets both the EGFR and MET receptors. It prevents downstream signaling pathways and receptor activation brought on by ligands. In May 2021, the U.S. FDA gave it expedited approval to treat advanced non-small cell lung cancer (NSCLC) with EGFR exon 20 insertion mutations. Phase 1 of the ongoing clinical trial is assessing the medication's safety, effectiveness, and ideal dosage.

*Please note that this is only a partial list; the complete list of drugs will be available in the full report.*

Small Cell Lung Cancer (SCLC) Market Report

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

|

Scope of the Report |

Details |

|

Drug Pipeline by Clinical Trial Phase |

|

|

Route of Administration |

|

|

Drug Classes |

|

|

Leading Sponsors Covered |

|

|

Geographies Covered |

|

Mini Report

One User

USD 1,999

USD 1,799

tax inclusive*

Single User License

One User

USD 3,099

USD 2,789

tax inclusive*

Five User License

Five User

USD 4,599

USD 3,909

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share