Navigating Sustainable, Profitable Growth in a Rapidly Changing World

Supply chain finance has evolved into a technology-driven solution, where a third party facilitates secure business transactions through flexible payment options for buyers. Supply chain finance helps mitigate the risk by optimising the working capital of both suppliers and buyers. The digitisation of supply chain finance solutions is a significant technological development, enabling secure transactions, improving visibility, expediting transactions, and enhancing overall efficiency.

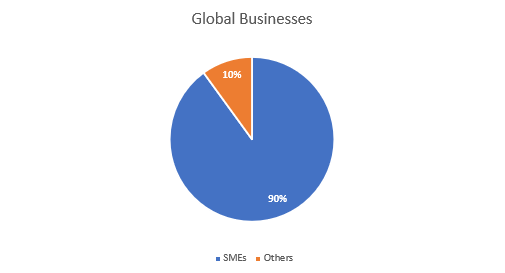

The increasing number of start-ups and small and medium-sized enterprises (SMEs) is a key factors aiding the supply chain finance market. Supply chain finance helps small businesses and start-ups to manage their working capital. As of July 2023, there were 1,200 Unicorn startup companies globally. According to the International Labour Organization, SMEs represent 90% of global businesses.

Further, the integration of artificial intelligence in supply chain finance notably enhances the decision-making process. AI, particularly through machine learning algorithms, empowers the decision-making process by efficiently analysing vast amounts of data. This capability enables accurate and rapid assessments of potential risks, leading to faster and more informed financing decisions.

Furthermore, banks are increasingly investing towards upgrading their technological infrastructure to improve supply chain finance offerings, providing innovative solutions to support MSMEs. For instance, in January 2024, Yes Bank launched SmartFin, a supply chain finance platform, powered by a digital solutions provider Veefin Solutions, to drive operational and financial efficiencies and enhance its digital offerings in the space.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Market Breakup by Provider, Offering, Application, End User, and Region:

- The market is segmented based on provider into banks, trade finance house, and others.

- Based on offering, the market is segmented into letter of credit, export and import bills, performance bonds, shipping guarantees, and others.

- Based on application, the market can be bifurcated into domestic and international.

- The market is segmented based on end-user into large enterprises and small and medium-sized enterprises.

- Region-wise, the global market for supply chain finance can be divided into North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

Key Findings of the Report:

- Growing start-up culture and the increasing number of small and medium-sized enterprises are supporting the global supply chain finance market. Supply chain financing or SCF as a model helps improve liquidity and reduce financing costs, mitigating the working capital risks.

- The market for supply chain finance is being supported by growing technological advancements and the development of the fintech sector.

- The increasing use of AI in supply chain financing models is opening new avenues of growth, predicting future risks and enabling users to make informed decisions.

- Fintech companies and financial institutions are increasingly investing in the development of user-friendly solutions to meet the requirements of diverse customer base.

Key Offerings of the Report:

- The EMR report gives an overview of the global supply chain finance market for the periods (2019-2025) and (2026-2035).

- The report also offers historical (2019-2025) and forecast (2026-2035) markets for the provider, offering, application, end user, and major regions of supply chain finance.

- The report analyses the market dynamics, covering the key demand and price indicators in the market, along with providing an assessment of the SWOT and Porter’s Five Forces models.

Top Players:

The major players in the supply chain finance market are:

- Asian Development Bank

- HSBC Group

- Standard Chartered Holdings Limited

- JPMorgan Chase & Co.

- Citigroup, Inc.

- DBS Bank Limited

- Bank of America Corporation

- Orbian

- BNP Paribas

- NatWest Group

- Mitsubishi UFJ Financial Group

- Others

The comprehensive report by EMR looks into the market share, capacity, and latest developments like mergers and acquisitions, plant turnarounds, and capacity expansions of the major players.

About Us

Expert Market Research (EMR) is a leading market research and business intelligence company, ensuring its clients remain at the vanguard of their industries by providing them with exhaustive and actionable market data through its syndicated and custom market reports, covering over 15 major industry domains. The company's expansive and ever-growing database of reports, which are constantly updated, includes reports from industry verticals like chemicals and materials, food and beverages, energy and mining, technology and media, consumer goods, pharmaceuticals, agriculture, and packaging.

EMR leverages its state-of-the-art technological and analytical tools, along with the expertise of its highly skilled team of over a 100 analysts and more than 3000 consultants, to help its clients, ranging from Fortune 1000 companies to small and medium sized enterprises, easily grasp the expansive industry data and help them in formulating market and business strategies, which ensure that they remain ahead of the curve.

Contact Us

Expert Market Research

Website: www.expertmarketresearch.com

Email: [email protected]

US & Canada Phone no: +1-415-325-5166

UK Phone no: +44-702-402-5790

Report Summary

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Provider |

|

| Breakup by Offering |

|

| Breakup by Application |

|

| Breakup by End User |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

How To Order

Our step-by-step guide will help you select, purchase, and access your reports swiftly, ensuring you get the information that drives your decisions, right when you need it.

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Single User License

USD 3,999

USD 3,599

tax inclusive*

- All Segments

- Printing Restrictions

- PDF Delivered via Email

- Custom Report Layout

- Post Sales Analysts Support

- Periodic Updates

- Unlimited Prints

Datasheet

USD 2,499

USD 2,249

tax inclusive*

- Selected Segments

- Printing Restrictions

- Excel Spreadsheet Delivered via Email

- Full Report

- Periodic Updates

- Post Sales Analysts Support

- Unlimited Prints

Five User License

USD 4,999

USD 4,249

tax inclusive*

- All Segments

- Five Prints Available

- PDF Delivered via Email

- Limited Free Customization

- Post Sales Analyst Support

- Custom Report Layout

- Periodic Updates

- Unlimited Prints

Corporate License

USD 5,999

USD 5,099

tax inclusive*

- All Segments

- Unlimited Prints Available

- PDF & Excel Delivery via Email

- Limited Free Customization

- Post Sales Analysts Support

- Discount On Next Update

- Custom Report Layout

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

- Life Time Access

- Analyst Support Related to Report

- PDF Version of the Report

- Complimentary Excel Data Set

- Free Analyst Hours

- Complimentary Free 1 Month Subscription to Trade Data Base

- Complimentary One Month Subscription to Price Database (Chemicals only)

- Complimentary PPT Version of the Report

- Complimentary License Upgrade

- Complimentary Power BI Dashboards

- Life Time Access

- Analyst Support Related to Report

- PDF Version of the Report

- Complimentary Excel Data Set

- Free Analyst Hours - 50 Hours

- Complimentary Free 1 Month Subscription to Trade Data Base

- Complimentary One Month Subscription to Price Database (Chemicals only)

- Complimentary PPT Version of the Report

- Complimentary License Upgrade

- Complimentary Power BI Dashboards

- Life Time Access

- Analyst Support Related to Report

- PDF Version of the Report

- Complimentary Excel Data Set

- Free Analyst Hours - 80 Hours

- Complimentary Free 1 Month Subscription to Trade Data Base

- Complimentary One Month Subscription to Price Database (Chemicals only)

- Complimentary PPT Version of the Report

- Complimentary License Upgrade

- Complimentary Power BI Dashboards

- Life Time Access

- Analyst Support Related to Report

- PDF Version of the Report

- Complimentary Excel Data Set

- Free Analyst Hours - 100 Hours

- Complimentary Free 1 Month Subscription to Trade Data Base

- Complimentary One Month Subscription to Price Database (Chemicals only)

- Complimentary PPT Version of the Report

- Complimentary License Upgrade

- Complimentary Power BI Dashboards

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

- 3 Reports Included

- Life Time Acess

- Analyst Support Related to Report

- PDF Version of the Report

- Free 1 Month Subscription to Trade Data Base

- 1 Month Subscription to Price Database (Chemicals only)

- Complimentary Excel Data Set

- PPT Version of the Report

- Power BI Dashboards

- License Upgrade

- Free Analyst Hours

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

- 5 Reports Included

- Life Time Acess

- Analyst Support Related to Report

- PDF Version of the Report

- Complimentary Excel Data Set

- Free Analyst Hours - 50 Hours

- Free 1 Month Subscription to Trade Data Base

- 1 Month Subscription to Price Database (Chemicals only)

- Complimentary Excel Data Set

- PPT Version of the Report

- Power BI Dashboards

- License Upgrade

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

- 8 Reports Included

- Life Time Acess

- Analyst Support Related to Report

- PDF Version of the Report

- Complimentary Excel Data Set

- Free Analyst Hours - 50 Hours

- Free 1 Month Subscription to Trade Data Base

- 1 Month Subscription to Price Database (Chemicals only)

- License Upgrade

- Free Analyst Hours - 80 Hours

- Power BI Dashboards

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

- 10 Reports Included

- Life Time Acess

- Analyst Support Related to Report

- PDF Version of the Report

- Complimentary Excel Data Set

- Free Analyst Hours - 50 Hours

- Free 1 Month Subscription to Trade Data Base

- 1 Month Subscription to Price Database (Chemicals only)

- License Upgrade

- Power BI Dashboards

- Free Analyst Hours - 100 Hours